You are able to fill out Mtn instantly using our online editor for PDFs. The tool is continually upgraded by our staff, getting new features and growing to be greater. In case you are seeking to get started, here is what it will take:

Step 1: Hit the "Get Form" button above on this webpage to open our PDF editor.

Step 2: After you open the file editor, you will get the document made ready to be completed. Aside from filling in various blanks, you may also do several other actions with the Document, particularly putting on any text, changing the initial textual content, adding images, affixing your signature to the form, and more.

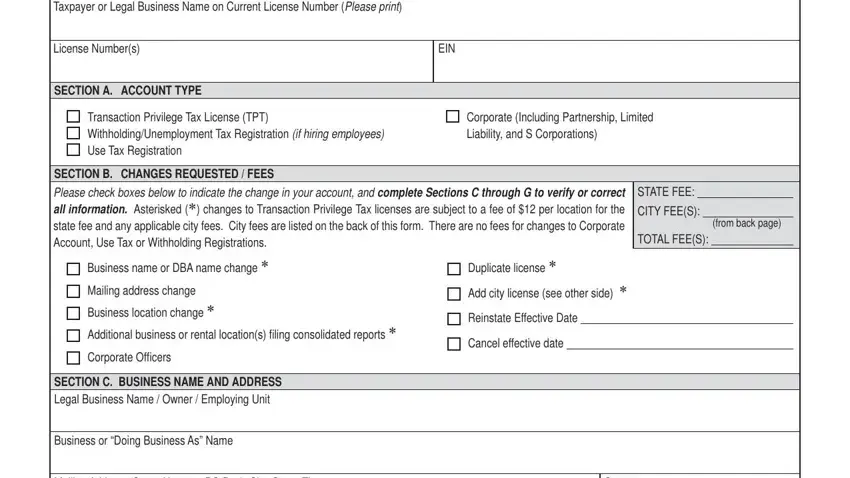

In order to fill out this document, be certain to type in the required details in each blank field:

1. For starters, once completing the Mtn, start with the page containing next blanks:

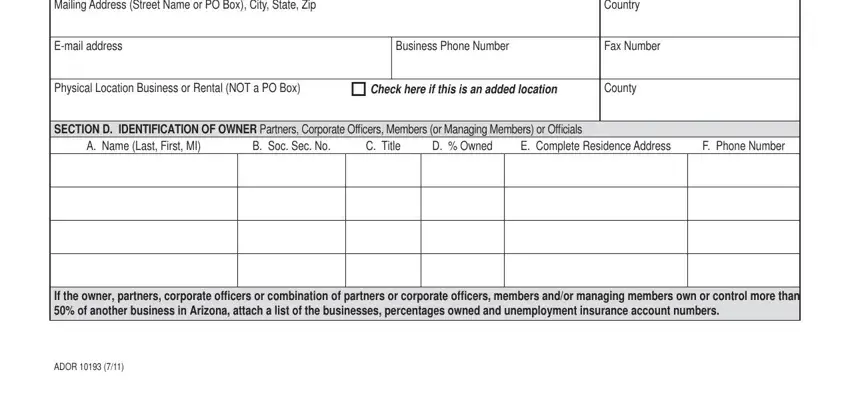

2. Right after this part is filled out, go to enter the applicable information in these: Mailing Address Street Name or PO, Country, Email address, Business Phone Number, Fax Number, Physical Location Business or, cid Check here if this is an added, County, SECTION D IDENTIFICATION OF OWNER, A Name Last First MI, B Soc Sec No, C Title, D Owned, E Complete Residence Address, and F Phone Number.

It is easy to get it wrong when filling out your Country, consequently make sure that you go through it again before you finalize the form.

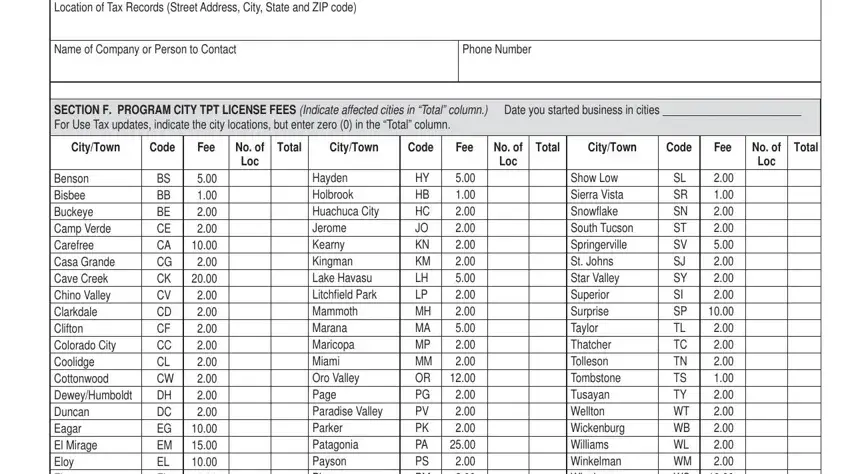

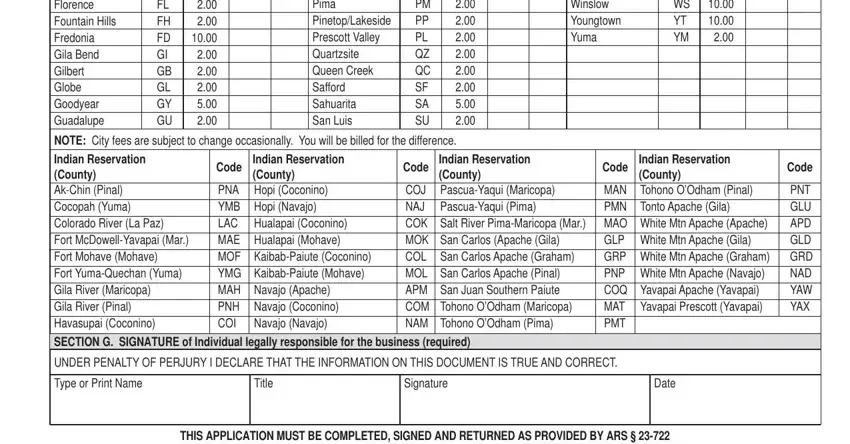

3. This third segment is typically relatively easy, Business Account Update SECTION E, Name of Company or Person to, Phone Number, SECTION F PROGRAM CITY TPT LICENSE, CityTown, Code, Fee, No of Loc, Total, CityTown, Code, Fee, No of Loc, Total, and CityTown - all these empty fields has to be filled out here.

4. Now complete this next segment! In this case you have all these Benson Bisbee Buckeye Camp Verde, BS BB BE CE CA CG CK CV CD CF CC, Hayden Holbrook Huachuca City, HY HB HC JO KN KM LH LP MH MA MP, NOTE City fees are subject to, Show Low Sierra Vista Snowfl ake, SL SR SN ST SV SJ SY SI SP TL TC, Indian Reservation County AkChin, Code, Indian Reservation County, Code, Indian Reservation County, Code, Indian Reservation County, and PNA Hopi Coconino YMB Hopi Navajo empty form fields to do.

Step 3: Prior to addressing the next step, you should make sure that all blanks were filled out the correct way. The moment you believe it's all good, click on “Done." After setting up a7-day free trial account with us, it will be possible to download Mtn or send it through email right away. The PDF will also be readily accessible in your personal account page with your every change. At FormsPal, we do everything we can to guarantee that all your information is stored protected.