Using the online PDF tool by FormsPal, you are able to fill in or change Colorado here and now. Our team is devoted to providing you with the ideal experience with our editor by constantly releasing new capabilities and upgrades. With these updates, using our editor gets better than ever! If you're seeking to start, this is what it takes:

Step 1: Firstly, open the pdf tool by pressing the "Get Form Button" in the top section of this site.

Step 2: This tool allows you to change your PDF document in various ways. Change it with customized text, adjust existing content, and include a signature - all manageable within a few minutes!

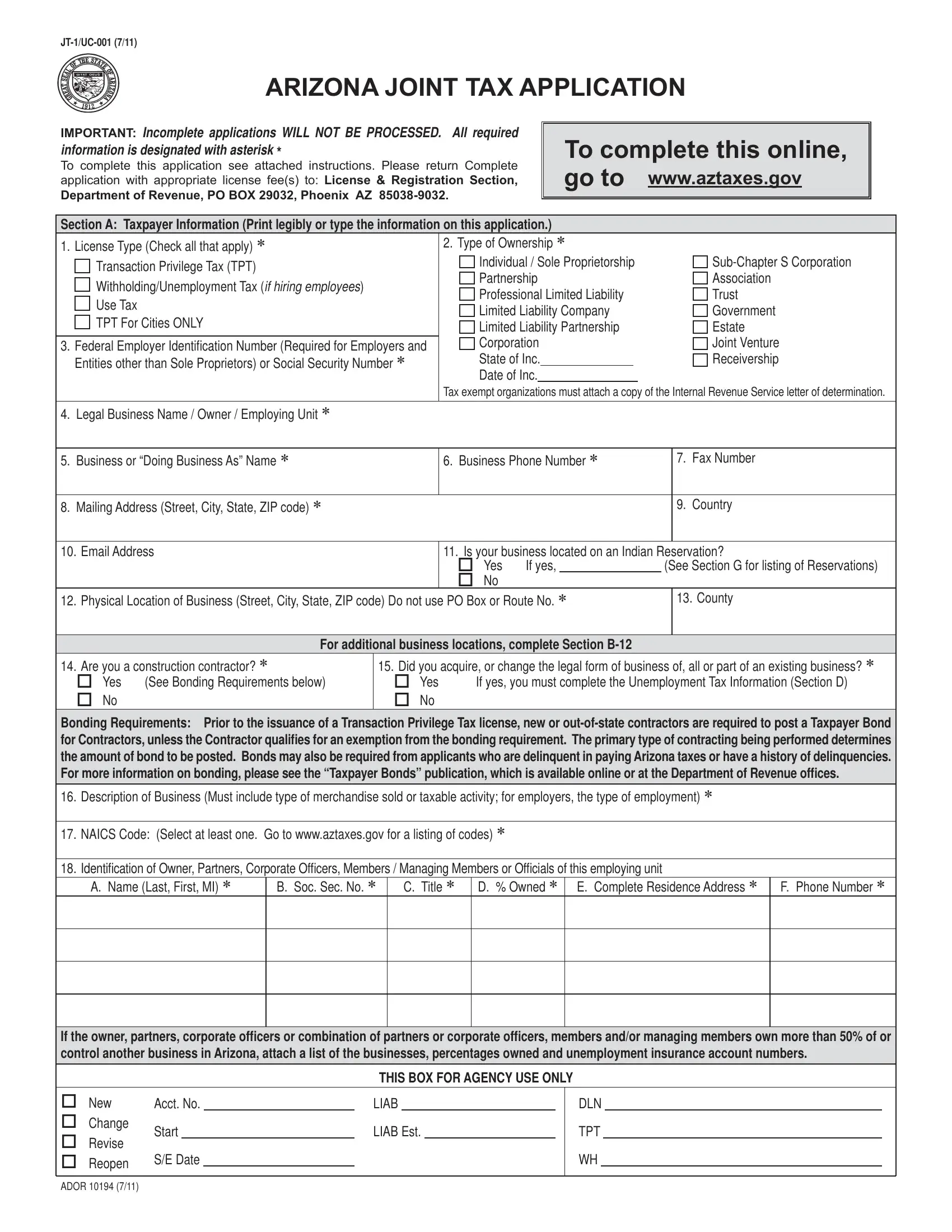

This form will require you to provide some specific information; to ensure accuracy, remember to pay attention to the next recommendations:

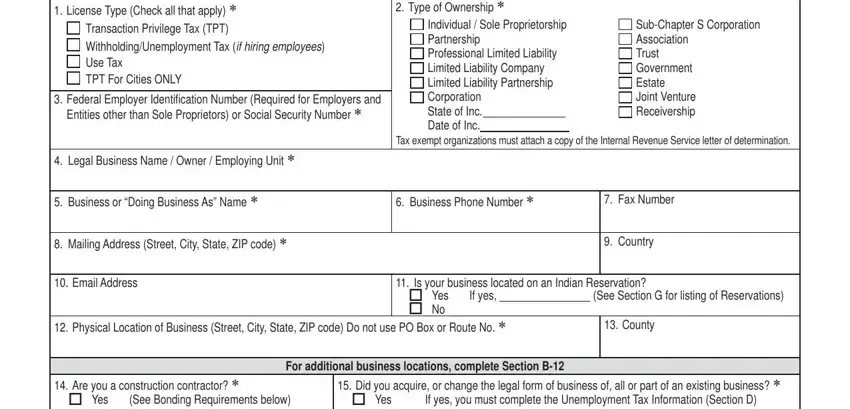

1. Complete the Colorado with a number of major blanks. Consider all the information you need and ensure not a single thing missed!

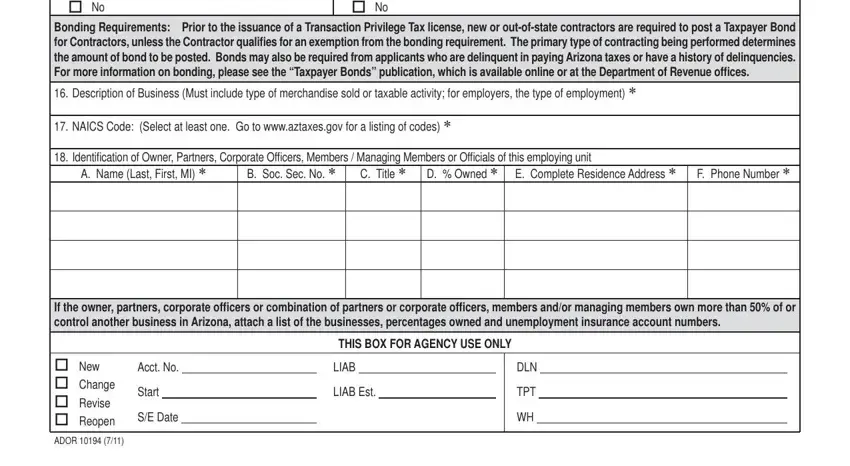

2. After the last part is finished, you're ready to insert the needed details in Yes No, Yes No, Bonding Requirements Prior to the, Description of Business Must, NAICS Code Select at least one Go, Identifi cation of Owner Partners, A Name Last First MI, B Soc Sec No, C Title, D Owned, E Complete Residence Address, F Phone Number, If the owner partners corporate, New Change Revise Reopen ADOR, and Acct No allowing you to proceed further.

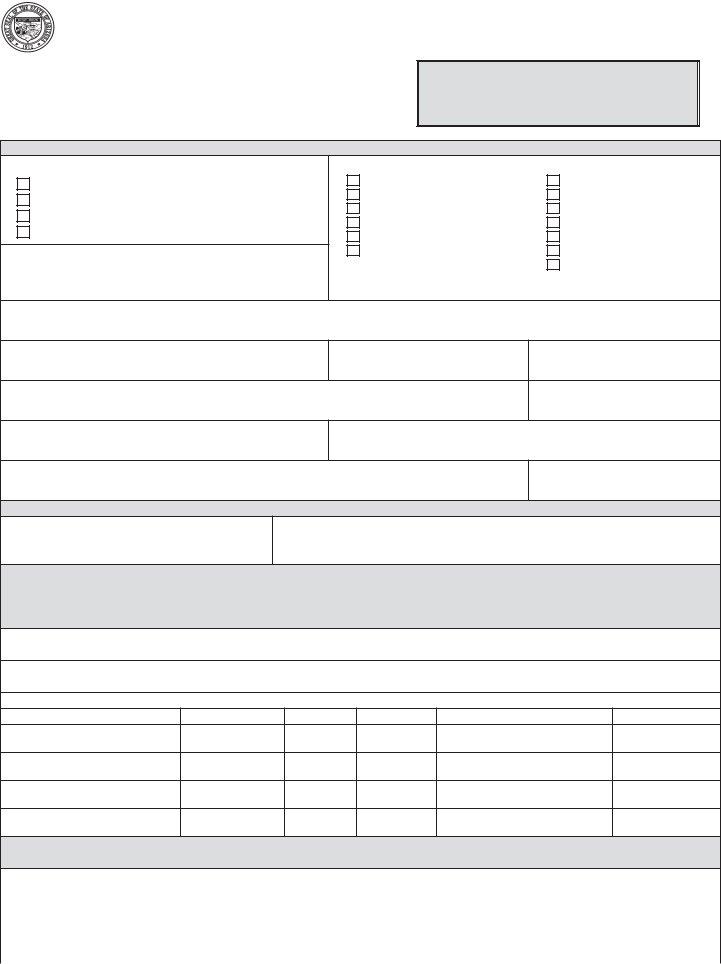

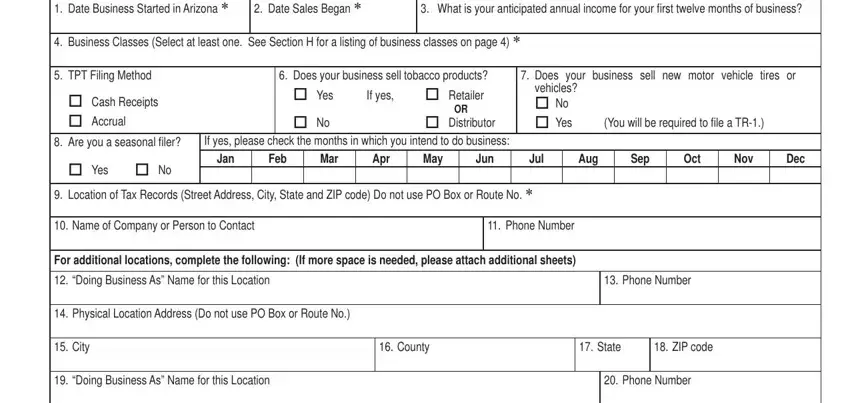

3. Completing JTUC Section B Transaction, Date Sales Began, What is your anticipated annual, Business Classes Select at least, TPT Filing Method, Does your business sell tobacco, Cash Receipts, Accrual, Yes, If yes, Retailer OR Distributor, Are you a seasonal fi ler, If yes please check the months in, vehicles, and Yes is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

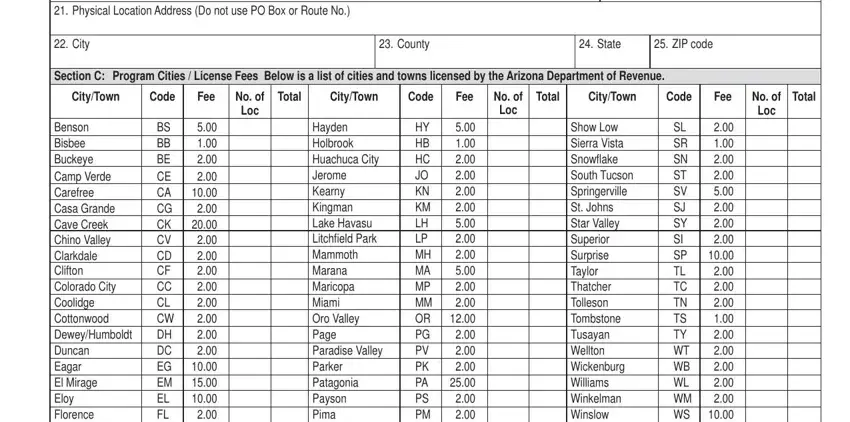

4. The following part comes next with all of the following blanks to focus on: Physical Location Address Do not, City, County, State, ZIP code, Section C Program Cities License, CityTown, Code, Fee, No of Loc, Total, CityTown, Code, Fee, and No of Loc.

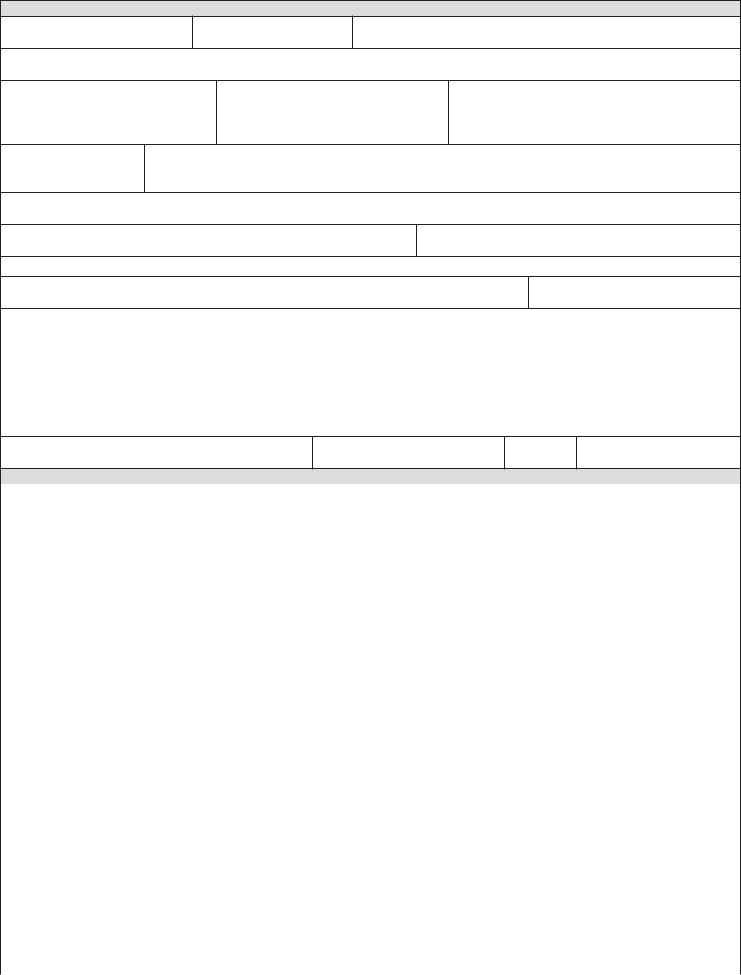

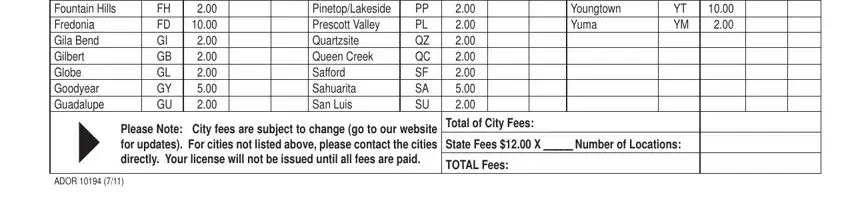

5. To wrap up your document, the last segment requires some extra blank fields. Filling out Benson Bisbee Buckeye Camp Verde, BS BB BE CE CA CG CK CV CD CF CC, ADOR, Hayden Holbrook Huachuca City, HY HB HC JO KN KM LH LP MH MA MP, Show Low Sierra Vista Snowfl ake, SL SR SN ST SV SJ SY SI SP TL TC, Please Note City fees are subject, Total of City Fees, State Fees X Number of Locations, and TOTAL Fees will certainly wrap up everything and you will be done before you know it!

Concerning SL SR SN ST SV SJ SY SI SP TL TC and State Fees X Number of Locations, be certain you do everything right in this section. These two are viewed as the most significant fields in the file.

Step 3: Go through the details you've typed into the form fields and press the "Done" button. Sign up with us now and instantly obtain Colorado, available for downloading. Every change you make is conveniently saved , allowing you to modify the pdf later as needed. Here at FormsPal, we strive to be certain that all of your information is stored private.