Handling PDF documents online is always a piece of cake using our PDF editor. You can fill in Form Ads 820 here with no trouble. The editor is constantly upgraded by us, receiving handy features and becoming greater. Here's what you will need to do to get started:

Step 1: Click the orange "Get Form" button above. It'll open our editor so you could begin filling in your form.

Step 2: This editor will give you the ability to work with your PDF in many different ways. Change it by writing personalized text, correct existing content, and put in a signature - all within a few clicks!

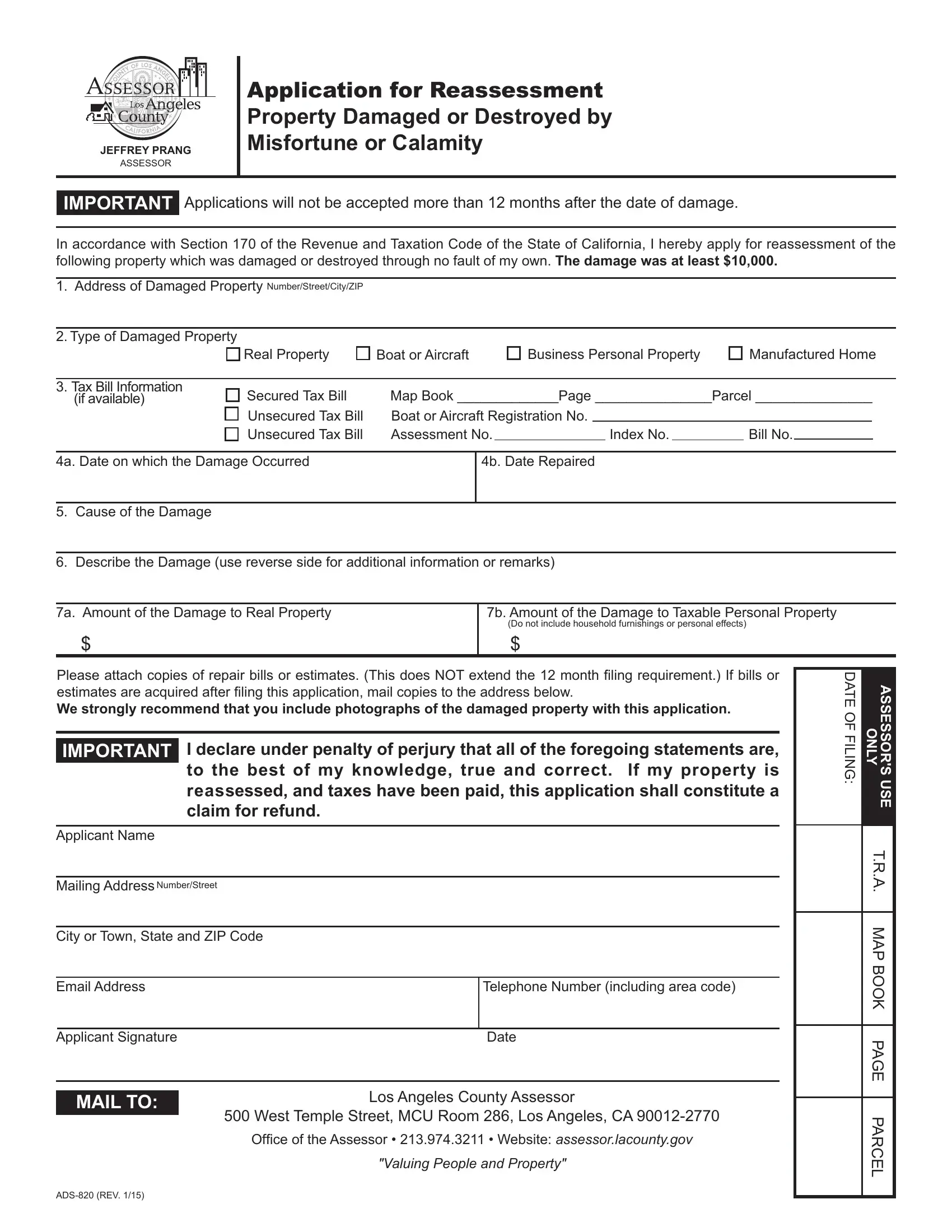

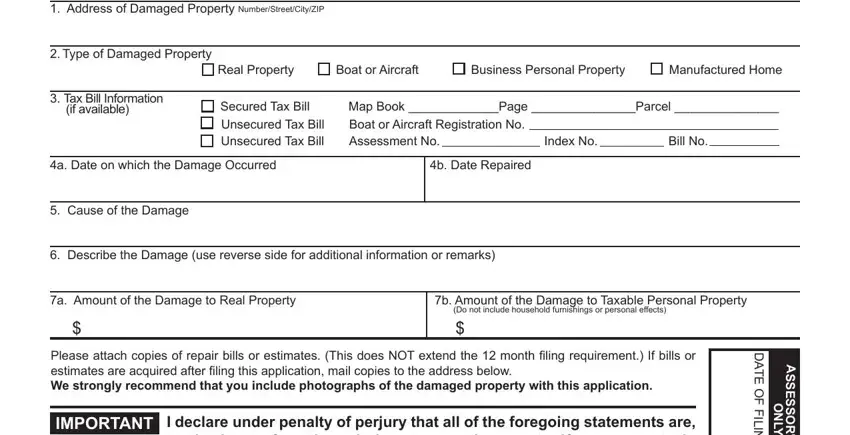

This document requires specific information to be typed in, hence you need to take the time to type in exactly what is requested:

1. You need to fill out the Form Ads 820 correctly, hence be mindful while working with the sections comprising all of these fields:

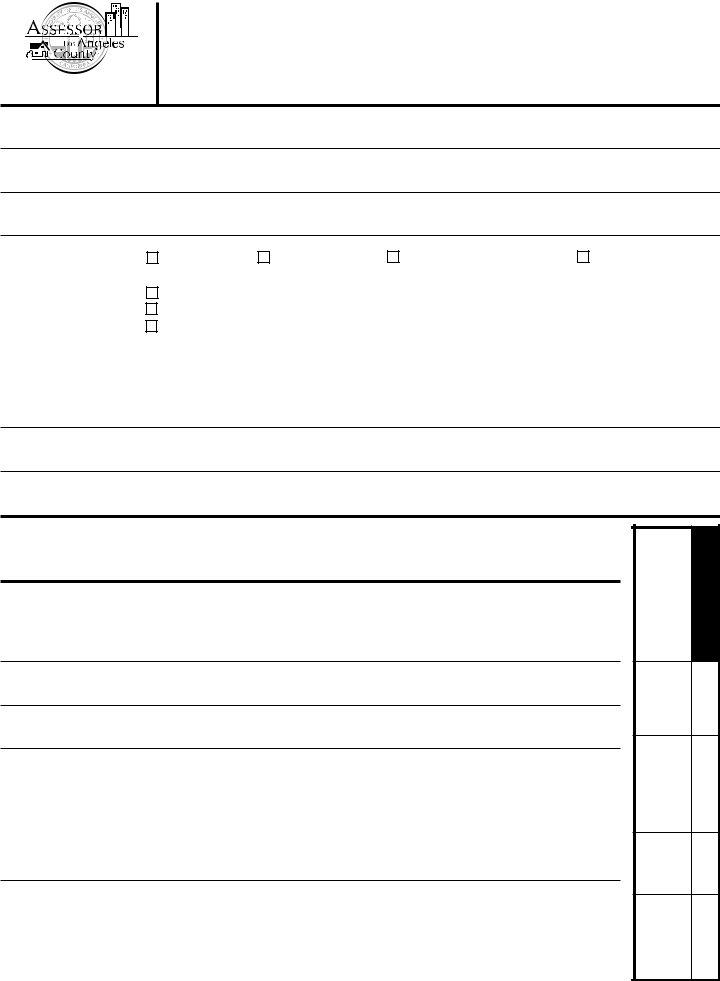

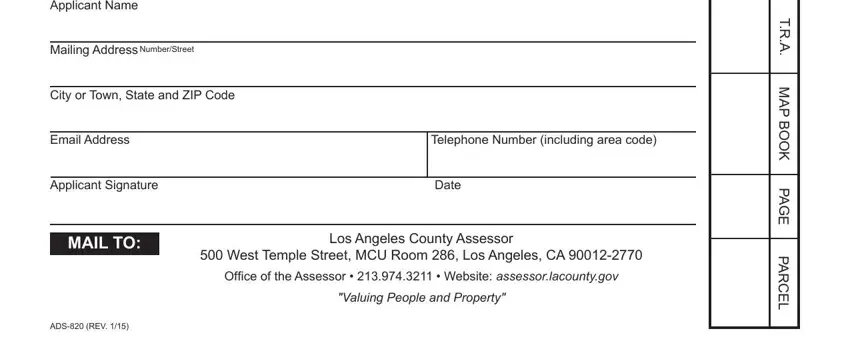

2. When the previous array of fields is finished, it's time to include the needed specifics in Applicant Name, Mailing Address, NumberStreet, City or Town State and ZIP Code, Email Address, Applicant Signature, Telephone Number including area, Date, MAIL TO, Los Angeles County Assessor, West Temple Street MCU Room Los, Ofice of the Assessor Website, Valuing People and Property, ADS REV, and M A P B O O K so you're able to progress to the third stage.

Concerning Date and Applicant Signature, make sure that you don't make any errors in this section. These two are viewed as the most significant fields in this document.

Step 3: Once you have reread the information you filled in, just click "Done" to finalize your document generation. Download your Form Ads 820 when you subscribe to a 7-day free trial. Immediately view the document in your personal account, with any modifications and adjustments being automatically kept! FormsPal is devoted to the personal privacy of all our users; we make certain that all information handled by our tool stays protected.