You could complete Form Ap 102 3 instantly by using our online PDF editor. We are devoted to giving you the perfect experience with our editor by regularly releasing new capabilities and enhancements. Our editor is now much more user-friendly with the newest updates! So now, editing PDF forms is simpler and faster than before. To start your journey, go through these easy steps:

Step 1: Press the orange "Get Form" button above. It's going to open up our pdf tool so you could start filling out your form.

Step 2: With the help of this handy PDF editing tool, it's possible to accomplish more than simply fill out forms. Express yourself and make your documents seem faultless with custom textual content incorporated, or adjust the original input to perfection - all that comes with the capability to add just about any pictures and sign the document off.

This document will require particular details to be filled out, therefore make sure you take the time to enter what is required:

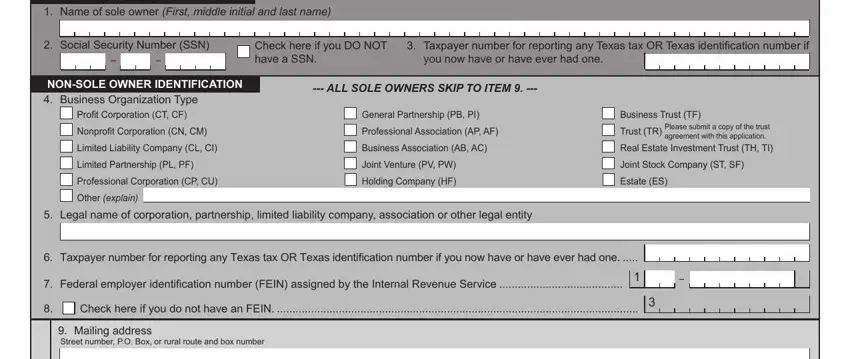

1. The Form Ap 102 3 involves certain details to be typed in. Be sure that the subsequent blank fields are finalized:

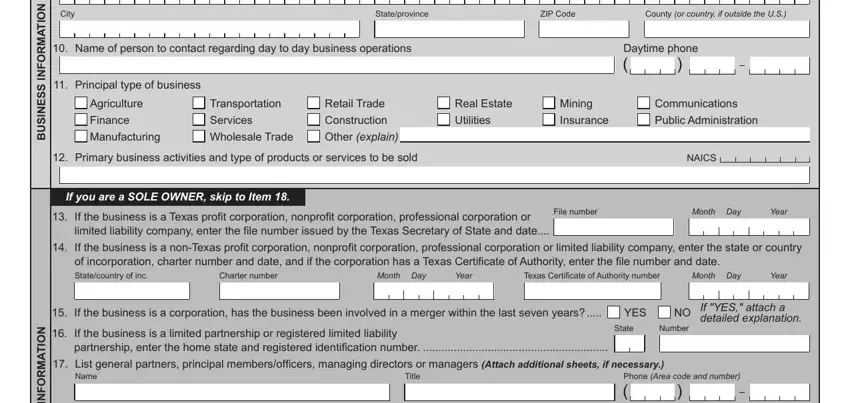

2. When this part is filled out, go to enter the applicable details in these - City, Stateprovince, ZIP Code, County or country if outside the US, Name of person to contact, Principal type of business, Agriculture, Finance Manufacturing, Transportation Services Wholesale, Retail Trade Construction Other, Primary business activities and, If you are a SOLE OWNER skip to, Daytime phone, Real Estate Utilities, and Mining Insurance.

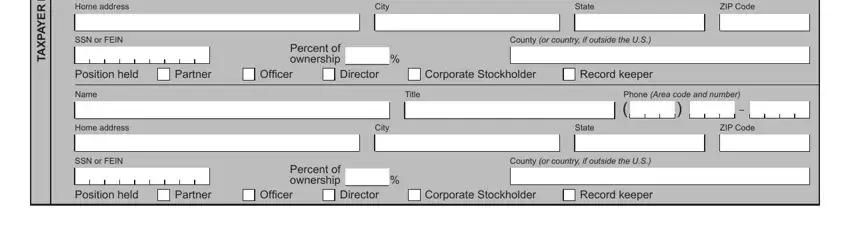

3. Your next stage is normally simple - fill in every one of the blanks in R E Y A P X A T, Home address, SSN or FEIN, Position held Name, Home address, SSN or FEIN, City, State, ZIP Code, Percent of ownership, County or country if outside the US, Partner, Oficer, Director, and Corporate Stockholder to conclude the current step.

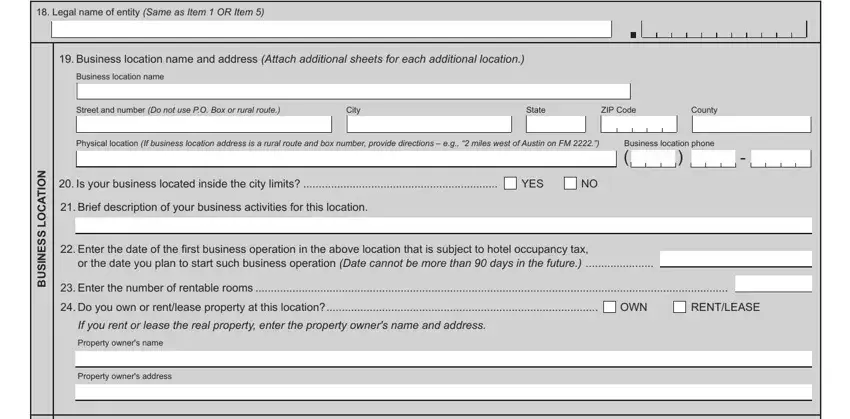

4. This particular section comes with these particular empty form fields to complete: Legal name of entity Same as Item, Business location name and, Business location name, Street and number Do not use PO, City, State, ZIP Code, County, Physical location If business, Business location phone, N O T A C O L S S E N S U B, Is your business located inside, YES, Brief description of your, and Enter the date of the irst.

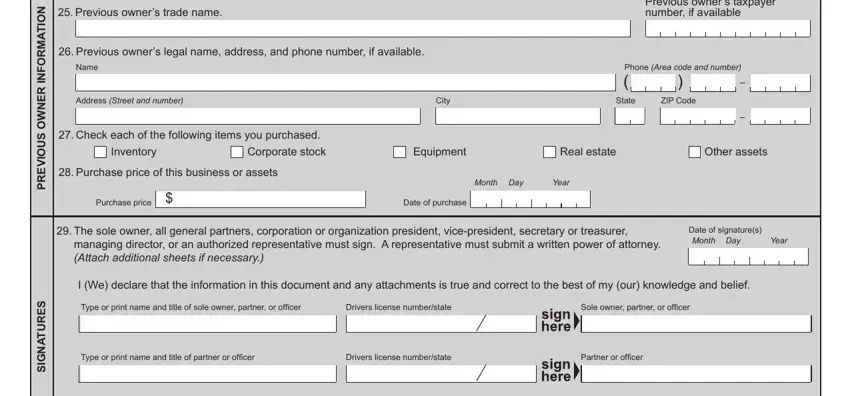

5. To wrap up your document, the final area includes several extra fields. Filling out N O T A M R O F N, R E N W O S U O V E R P, If you purchased an existing, Previous owners taxpayer number if, Previous owners legal name, Name, Phone Area code and number, Address Street and number, City, State, ZIP Code, Check each of the following items, Inventory, Corporate stock, and Purchase price is going to conclude the process and you're going to be done in a tick!

Regarding ZIP Code and Address Street and number, make sure that you get them right in this section. These two are certainly the most important ones in this PDF.

Step 3: Immediately after going through the entries, hit "Done" and you're all set! Create a 7-day free trial account with us and gain instant access to Form Ap 102 3 - readily available in your personal account. When using FormsPal, you can certainly complete forms without the need to worry about personal information breaches or records getting shared. Our secure platform helps to ensure that your private details are maintained safe.