With the online editor for PDFs by FormsPal, you may fill in or modify ct revenue services appeal right here and now. Our editor is constantly evolving to deliver the best user experience possible, and that is due to our dedication to continuous improvement and listening closely to customer feedback. Getting underway is simple! Everything you should do is follow the next basic steps below:

Step 1: First, open the pdf tool by pressing the "Get Form Button" in the top section of this page.

Step 2: When you start the editor, you will notice the form prepared to be filled out. Other than filling out different blanks, you could also perform several other actions with the form, including adding your own textual content, changing the original textual content, adding images, affixing your signature to the document, and more.

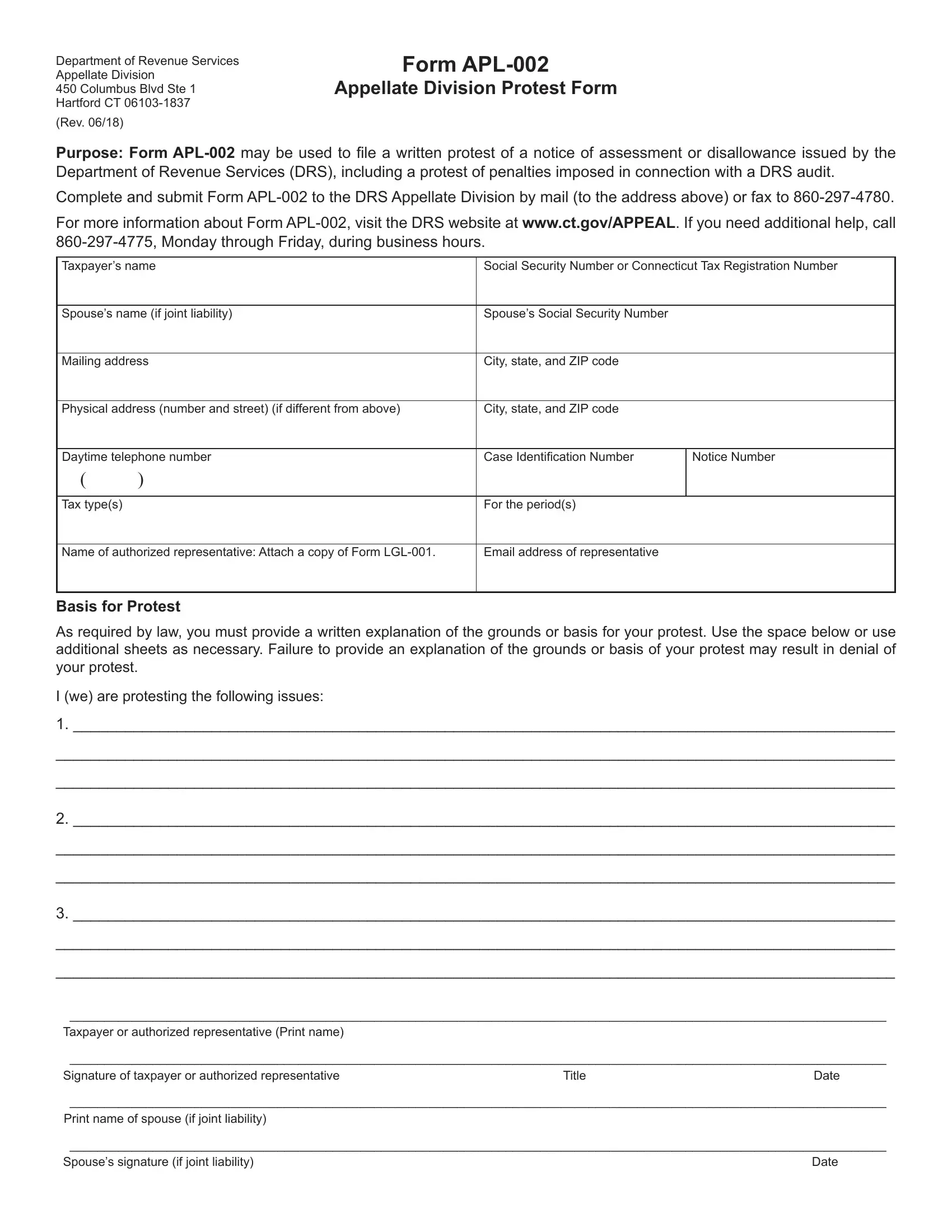

With regards to the blank fields of this particular document, here's what you need to know:

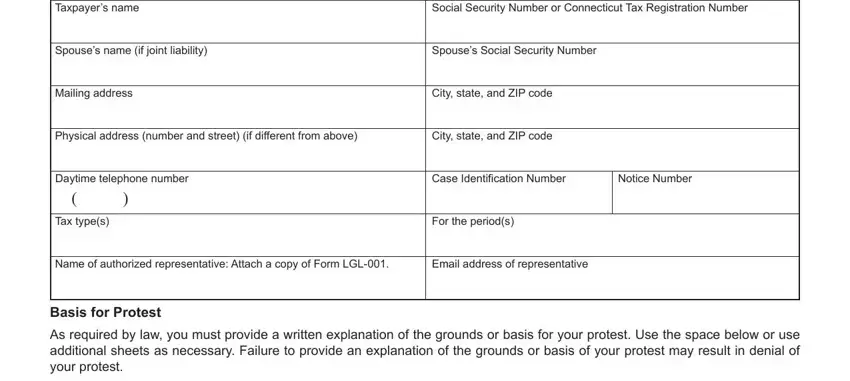

1. The ct revenue services appeal requires particular information to be inserted. Be sure the subsequent blanks are finalized:

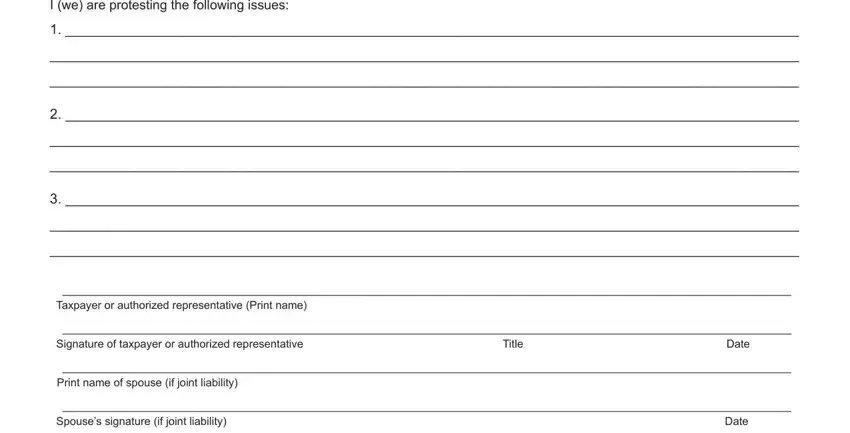

2. Given that the previous part is done, you have to include the required specifics in I we are protesting the following, Taxpayer or authorized, Signature of taxpayer or, Title, Date, Print name of spouse if joint, Spouses signature if joint, and Date in order to move forward further.

Always be extremely attentive when completing Taxpayer or authorized and Spouses signature if joint, because this is where a lot of people make errors.

Step 3: You should make sure your information is accurate and then just click "Done" to complete the project. Try a 7-day free trial subscription with us and obtain direct access to ct revenue services appeal - readily available inside your personal account page. We do not share or sell the details you provide when working with documents at our website.