Handling PDF forms online is actually a piece of cake with our PDF tool. You can fill out ar 1r ven here effortlessly. Our tool is constantly evolving to present the very best user experience achievable, and that is due to our resolve for continual development and listening closely to testimonials. With some simple steps, you may begin your PDF journey:

Step 1: Press the "Get Form" button in the top area of this page to get into our tool.

Step 2: When you launch the online editor, you'll see the document prepared to be completed. Other than filling out different fields, you could also perform various other actions with the Document, namely putting on any words, changing the original textual content, adding illustrations or photos, placing your signature to the document, and a lot more.

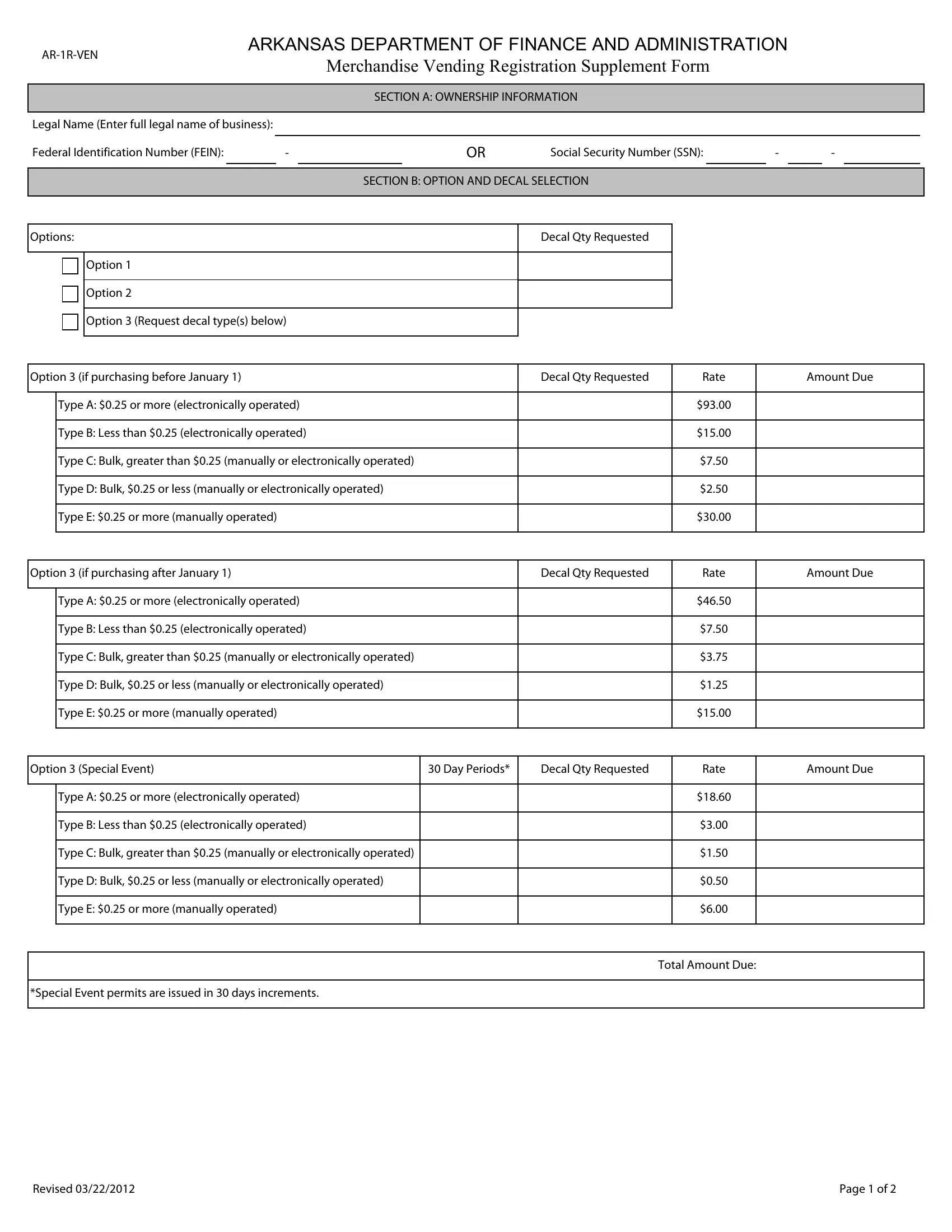

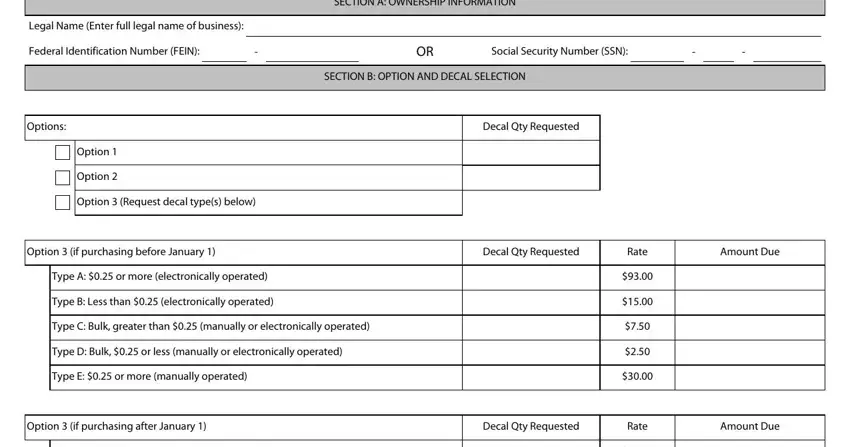

This document will need particular information to be entered, so make sure you take some time to type in what is requested:

1. The ar 1r ven needs particular information to be inserted. Make sure the subsequent blank fields are filled out:

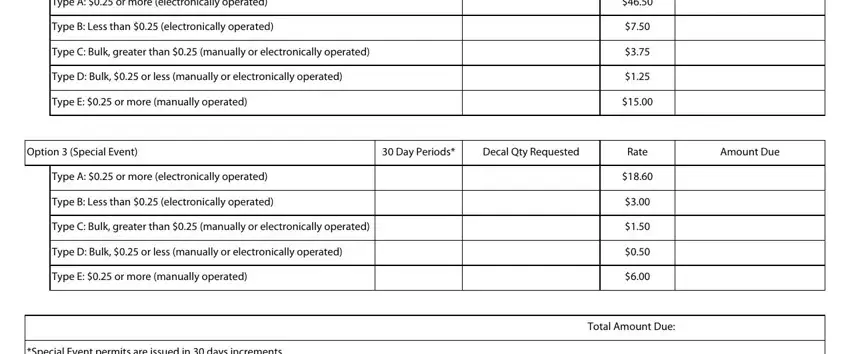

2. Once the previous section is completed, proceed to type in the relevant details in these - Type A or more electronically, Type B Less than electronically, Type C Bulk greater than manually, Type D Bulk or less manually or, Type E or more manually operated, Option Special Event, Day Periods, Decal Qty Requested, Rate, Amount Due, Type A or more electronically, Type B Less than electronically, Type C Bulk greater than manually, Type D Bulk or less manually or, and Type E or more manually operated.

In terms of Type D Bulk or less manually or and Type C Bulk greater than manually, be sure you double-check them in this section. The two of these are considered the most significant fields in the page.

Step 3: Always make sure that your details are correct and simply click "Done" to finish the task. After setting up afree trial account here, you will be able to download ar 1r ven or send it via email directly. The PDF file will also be readily accessible via your personal cabinet with your each modification. Here at FormsPal.com, we strive to guarantee that your information is stored secure.