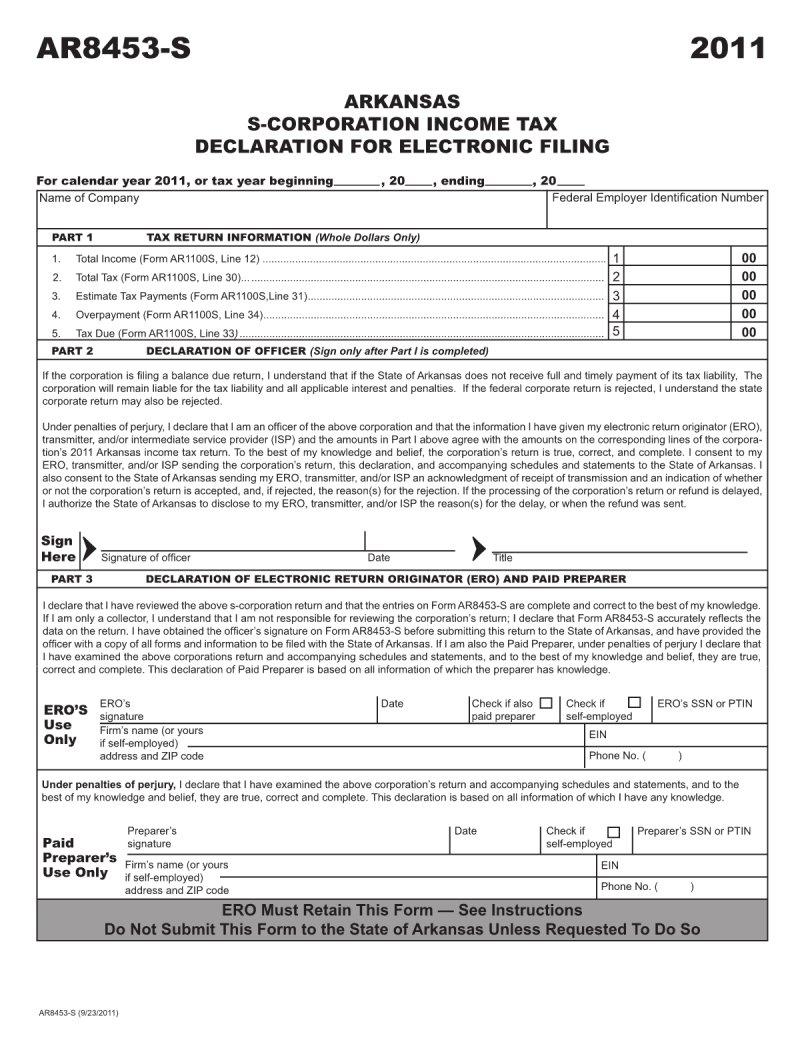

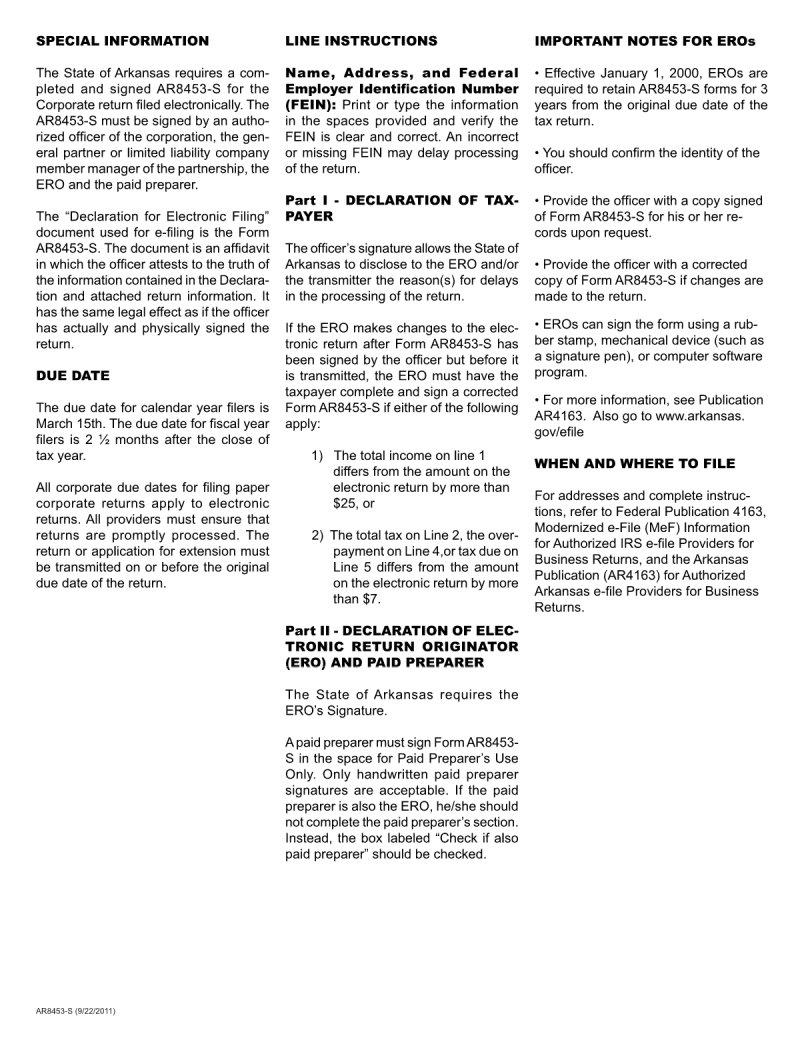

Understanding tax forms is crucial for taxpayers aiming to meet their obligations accurately and efficiently. Among the myriad of forms the IRS mandates, the AR8453 S form stands out for entities classified as S corporations. This specific document acts as an electronic filing declaration, a vital step for businesses opting to submit their tax returns digitally. It essentially serves as the tax preparer's or the taxpayer’s affirmation that the information supplied to the IRS electronically is true, correct, and complete to the best of their knowledge. This declaration also stipulates that the authorized IRS e-file provider has shared the correct tax return information with the taxpayer for review before transmission. Furthermore, the AR8453 S form allows for the direct deposit of any refund into a designated bank account, streamlining the process for efficient financial management. However, it is also the taxpayer's responsibility to retain a copy of this form and any related documents for a specified period, reinforcing the importance of diligent record-keeping in the complex landscape of tax compliance. Understanding the nuances and requirements of the AR8453 S form is essential for S corporations to ensure a smooth and compliant electronic filing process.

| Question | Answer |

|---|---|

| Form Name | Form Ar8453 S |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | e-File, AR1100S, ISP, ar8453 ol 2019 |