When you wish to fill out alberta return, you don't need to download and install any sort of applications - simply try using our PDF tool. The editor is continually maintained by our staff, receiving new awesome functions and becoming better. All it takes is several basic steps:

Step 1: Access the PDF file in our tool by clicking on the "Get Form Button" in the top section of this webpage.

Step 2: This editor enables you to modify PDF documents in various ways. Improve it by adding personalized text, correct original content, and put in a signature - all close at hand!

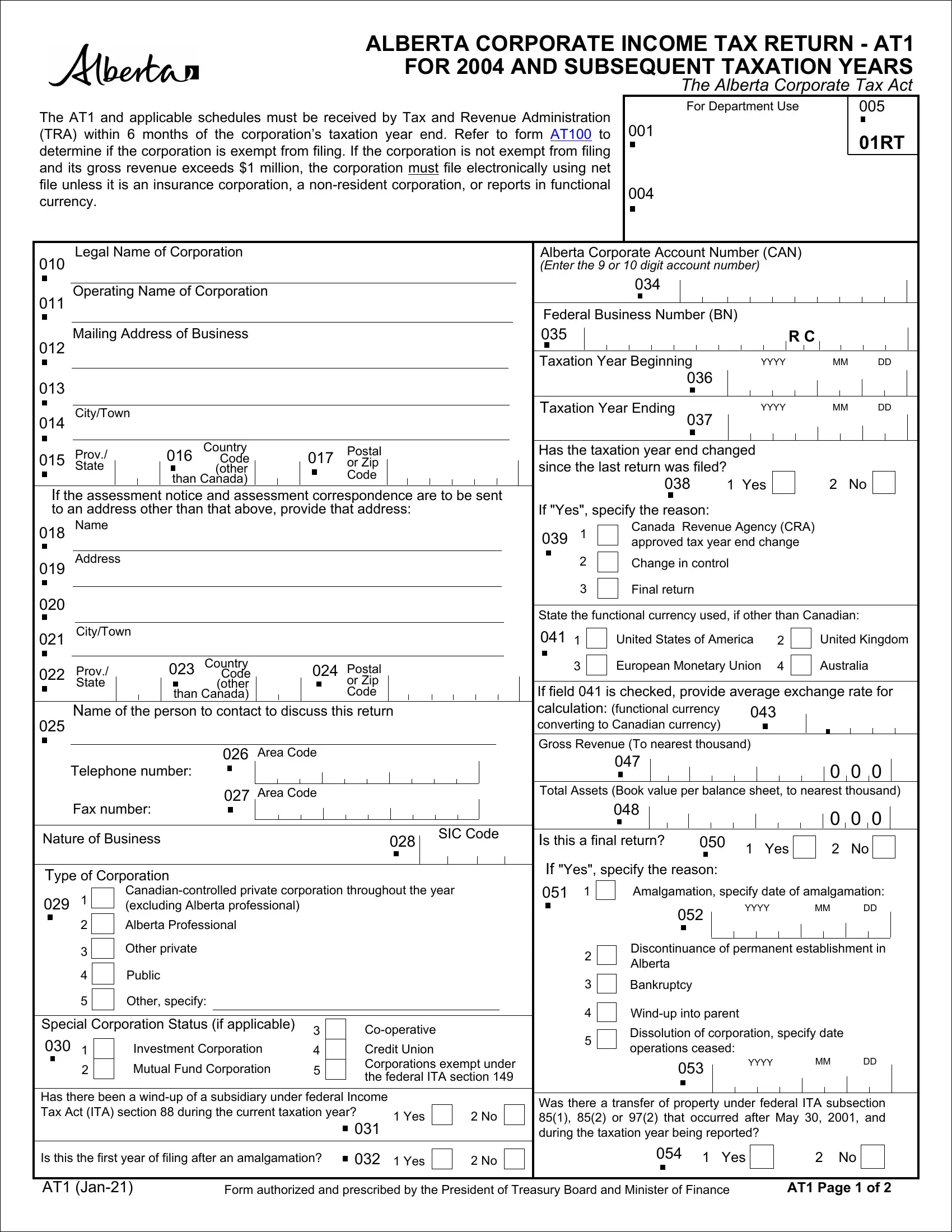

With regards to the blanks of this precise document, this is what you should do:

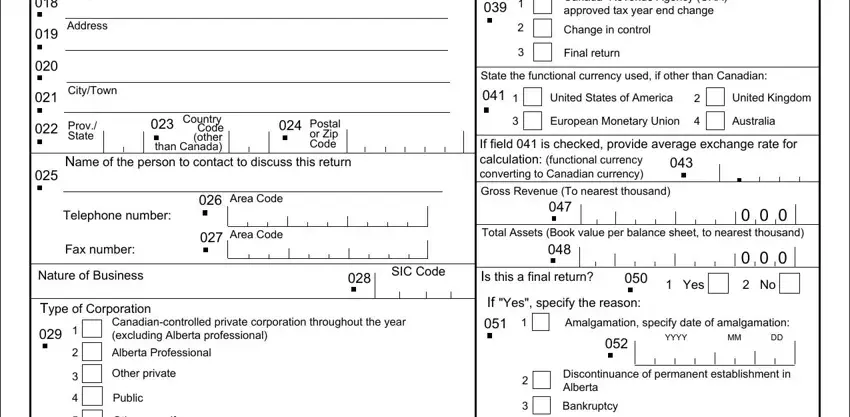

1. You will want to fill out the alberta return correctly, hence be mindful while filling out the areas that contain all of these blank fields:

2. Once your current task is complete, take the next step – fill out all of these fields - Name, Address, CityTown, Prov State, Country Code other than Canada, Postal or Zip Code, Name of the person to contact to, Area Code, Area Code, Telephone number, Fax number, Nature of Business, Type of Corporation, Canada Revenue Agency CRA approved, and Change in control with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

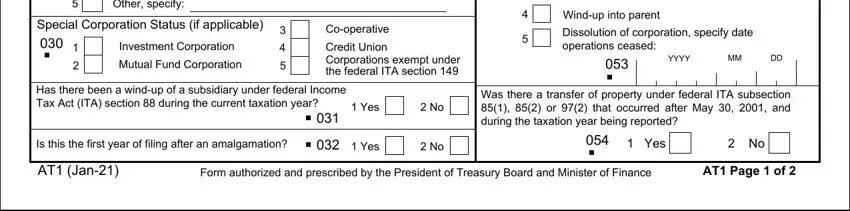

3. Your next part will be easy - fill out all the blanks in Other specify, Special Corporation Status if, Investment Corporation, Mutual Fund Corporation, Cooperative, Credit Union Corporations exempt, Windup into parent, Dissolution of corporation specify, YYYY, Has there been a windup of a, Yes, Was there a transfer of property, Is this the first year of filing, Yes, and Yes to complete this part.

It is easy to make an error while filling in the Yes, thus ensure that you go through it again prior to deciding to finalize the form.

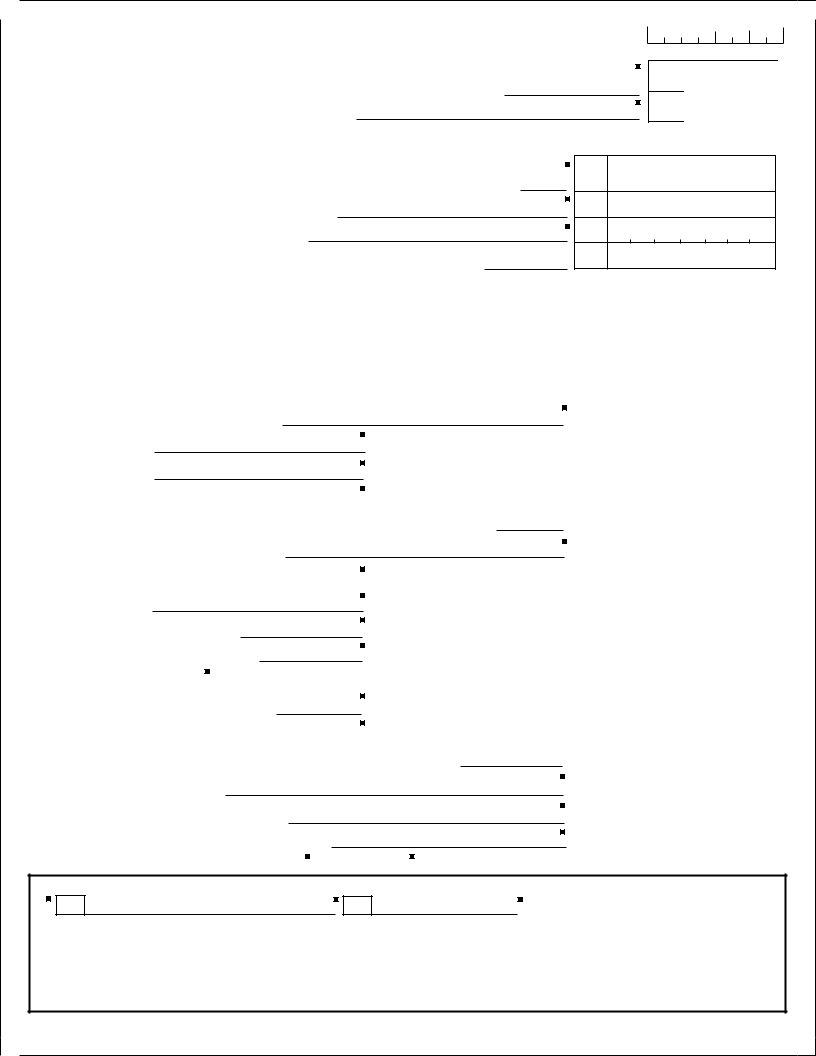

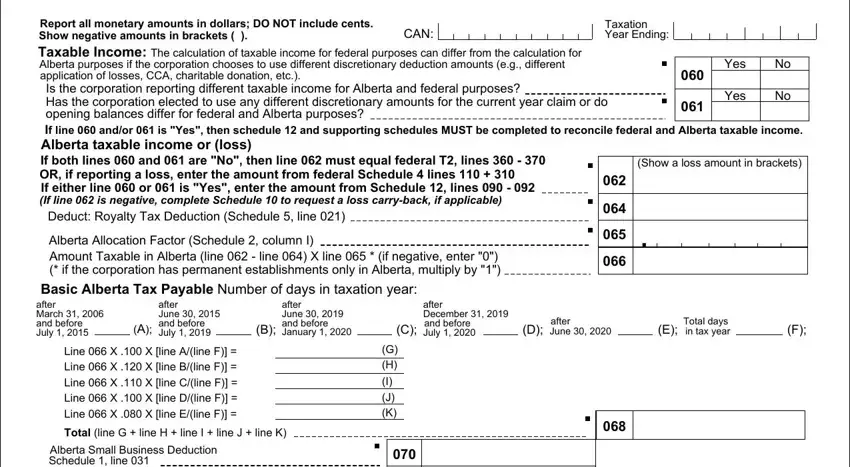

4. Completing CAN, Report all monetary amounts in, Show a loss amount in brackets, Taxation Year Ending, Yes, Yes, Deduct Royalty Tax Deduction, Alberta Allocation Factor Schedule, Basic Alberta Tax Payable Number, after June and before January, after June and before July, after December and before July, after June, Total days in tax year, and Line X X line Aline F Line X is essential in the fourth stage - be sure to devote some time and take a close look at every single blank area!

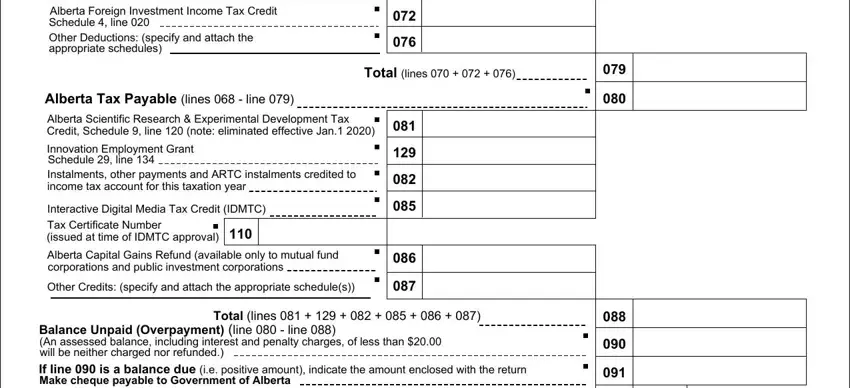

5. This form needs to be completed by filling out this section. Below you can see a detailed set of fields that require appropriate details to allow your document submission to be accomplished: Alberta Small Business Deduction, Alberta Foreign Investment Income, Total lines, Alberta Tax Payable lines line, Alberta Scientific Research, Innovation Employment Grant, Interactive Digital Media Tax, Alberta Capital Gains Refund, Other Credits specify and attach, Total lines, and Balance Unpaid Overpayment line.

Step 3: When you've glanced through the details you filled in, press "Done" to finalize your form. Join FormsPal now and instantly obtain alberta return, prepared for download. Every last modification made is conveniently preserved , helping you to customize the document later on when required. When using FormsPal, you can complete forms without stressing about personal data leaks or entries getting shared. Our secure software ensures that your private data is stored safely.