Through the online PDF editor by FormsPal, you are able to fill out or modify wells fargo certificate right here and now. The editor is continually updated by our team, receiving powerful features and becoming greater. This is what you will want to do to start:

Step 1: Click on the "Get Form" button above on this webpage to get into our editor.

Step 2: This tool will allow you to work with your PDF document in many different ways. Change it with customized text, adjust original content, and place in a signature - all possible in minutes!

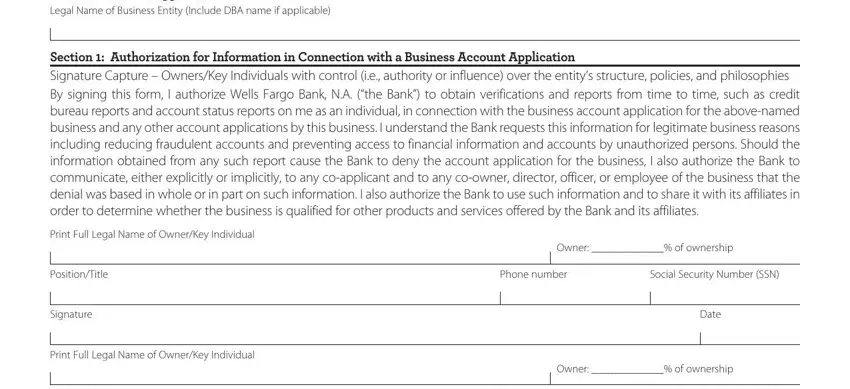

This PDF form will need specific information to be entered, therefore you should take whatever time to fill in precisely what is asked:

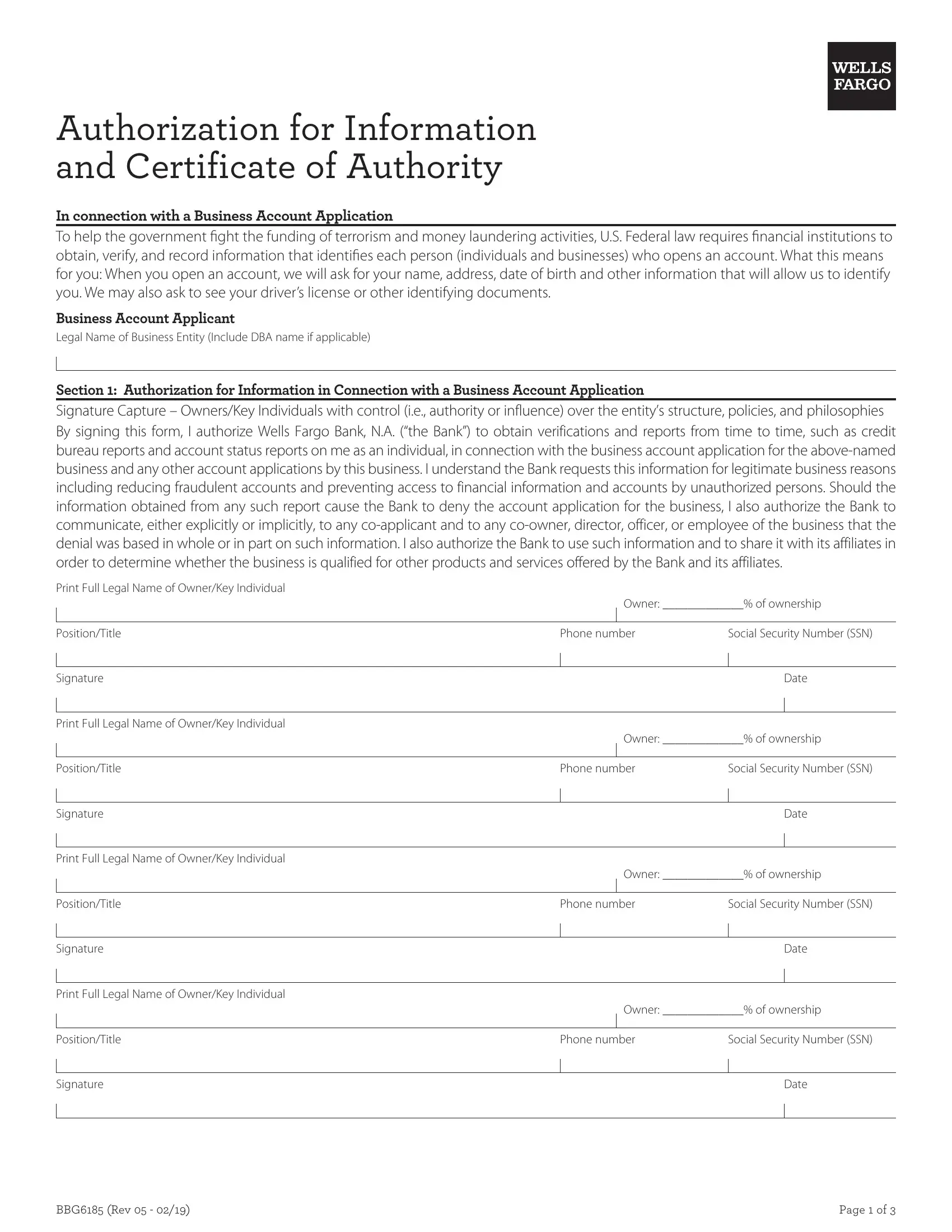

1. You will want to fill out the wells fargo certificate accurately, so take care while filling in the segments containing all these blank fields:

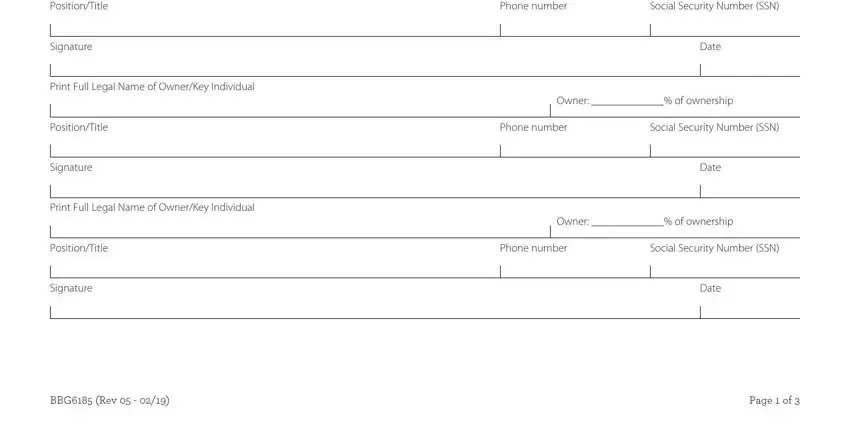

2. Just after filling out the last section, go on to the next part and enter the necessary details in these fields - PositionTitle, Signature, Print Full Legal Name of OwnerKey, PositionTitle, Signature, Print Full Legal Name of OwnerKey, PositionTitle, Signature, Phone number, Social Security Number SSN, Date, Owner of ownership, Phone number, Social Security Number SSN, and Date.

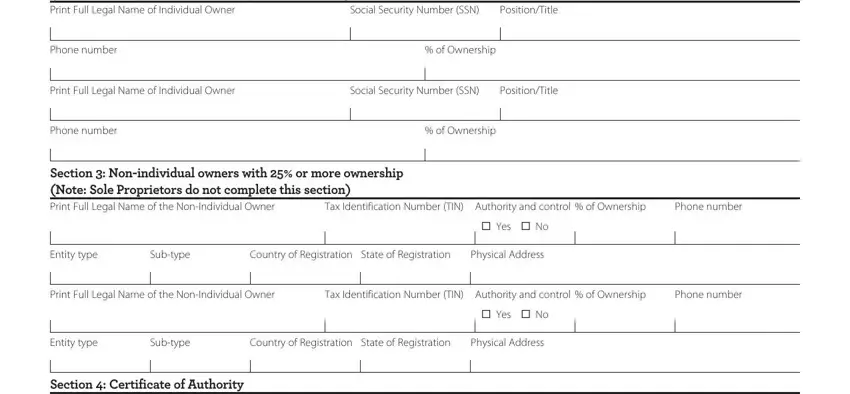

3. This next step is about Section Individual owners with, Social Security Number SSN, PositionTitle, Phone number, of Ownership, Print Full Legal Name of, Social Security Number SSN, PositionTitle, Phone number, of Ownership, Section Nonindividual owners with, Tax Identification Number TIN, Phone number, Yes No, and Entity type - fill out all of these blanks.

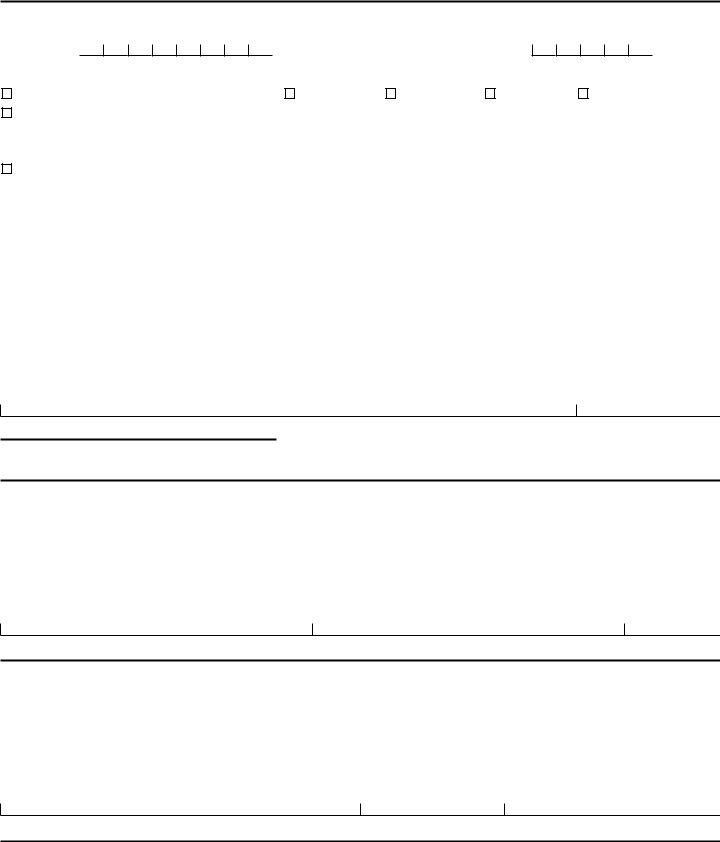

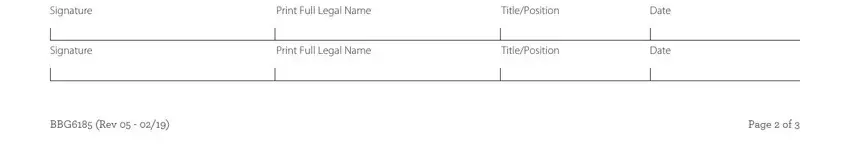

4. You're ready to start working on the next part! In this case you will get all of these Signature, Signature, Print Full Legal Name, TitlePosition, Print Full Legal Name, TitlePosition, Date, Date, BBG Rev, and Page of empty form fields to complete.

Always be really attentive while completing TitlePosition and Print Full Legal Name, because this is the section in which a lot of people make mistakes.

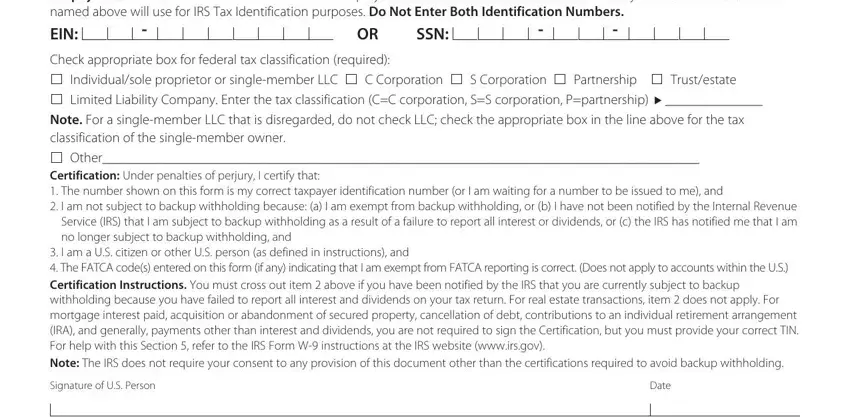

5. Since you approach the completion of this form, you'll find a couple more requirements that need to be fulfilled. Notably, Taxpayer Identification Number, EIN, OR SSN, Check appropriate box for federal, Individualsole proprietor or, C Corporation, S Corporation, Partnership, Trustestate, Note For a singlemember LLC that, Other, Certification Under penalties of, I am a US citizen or other US, Signature of US Person, and Date should be filled out.

Step 3: Ensure that the information is correct and then press "Done" to finish the task. Create a 7-day free trial plan at FormsPal and acquire instant access to wells fargo certificate - download, email, or change from your FormsPal account page. We don't share or sell any details that you use when dealing with forms at our website.