Understanding the intricacies of the BE-12A form is essential for businesses engaged in foreign direct investment in the United States. This document, part of the 2012 Benchmark Survey of Foreign Direct Investment, is regulated by the Bureau of Economic Analysis (BEA) of the U.S. Department of Commerce and is crucial for entities that meet specific financial thresholds. With a mandate rooted in the International Investment and Trade in Services Survey Act, the BE-12A form seeks detailed financial and operational information from majority-owned U.S. affiliates of foreign companies with assets, sales, or net income exceeding $300 million. This submission is not just a regulatory requirement but also a confidential avenue to contribute to a comprehensive statistical picture of international business dynamics within the U.S. The form touches on various aspects including the consolidation of financial reporting on a U.S. GAAP basis unless otherwise instructed, the specifics of reporting periods, and the involvement in contract manufacturing, among others. It underscores the importance of accurate and timely submission, due May 31, 2013, with severe penalties for non-compliance. Additionally, it offers guidance on various reporting scenarios, such as changes in fiscal year or the acquisition and establishment of business enterprises. Through electronic or traditional mailing options, the BE-12A form facilitates a systematic collection of data, asserting its mandatory nature while emphasizing confidentiality and the legal implications of submission.

| Question | Answer |

|---|---|

| Form Name | Form Be 12A |

| Form Length | 40 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 10 min |

| Other names | Dols, Alaska, ISI, BE-12A |

FORM |

OMB No. |

2012 BENCHMARK SURVEY OF FOREIGN DIRECT INVESTMENT IN THE UNITED STATES

MANDATORY — CONFIDENTIAL

FORM

Due date: May 31, 2013

Electronic filing:

www.bea.gov/efile

Mail reports to:

U.S. Department of Commerce

Bureau of Economic Analysis

Washington, DC 20230

Deliver reports to:

U.S. Department of Commerce

Bureau of Economic Analysis

Shipping and Receiving Section, M100

1441 L Street, NW

Washington, DC 20005

Fax reports to:

(202)

|

|

Name and address of U.S. business affiliate |

||||

1002 |

Name of U.S. affiliate |

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

1010 |

c/o (care of) |

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

1003 |

Street or P.O. Box |

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

1004 |

City |

|

|

0998 |

State |

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

1005 |

ZIP Code |

|

Foreign Postal Code |

|||

|

|

0 |

Or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assistance:

Telephone: (202)

Copies of blank forms: www.bea.gov/fdi

Include your

Who must file

Mandatory, Confidentiality, Penalties

This survey is being conducted under the International Investment and Trade in Services Survey Act (P.L.

Person to consult concerning questions about this report — Enter name and address

Certification — The undersigned official certifies that this report has been prepared in accordance with the applicable instructions, is

1000 |

Name |

|

|

|

complete, and is substantially accurate except that, in accordance with |

|

|||||

|

0 |

|

|

|

instruction III.C on page 34, estimates may have been provided. |

|

|||||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

1029 |

Address |

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

1030 |

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

Authorized official’s signature |

|

|

Date |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1031 |

0 |

|

|

|

0990 |

Print or type name |

0991 |

Print or type title |

|

||

|

|

|

|

|

|

|

0 |

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1001 |

Telephone number |

Area code |

Number |

Extension |

0992 |

Telephone number |

0993 |

Fax number |

|

||

|

0 |

|

|

|

|

|

0 |

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

May fax and/or

*Note — If you choose to communicate with BEA via fax or electronic mail, BEA cannot guarantee the security of the information during transmission, but will treat information we receive as confidential in accordance with Section 5(c) of the International Investment and Trade in Services Survey Act.

1027

1032

1 |

|

Yes (If yes, enter your |

|||

|

1 |

2 |

|

No |

0 |

|

|

|

|||

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

1028 |

Fax: |

1 |

1 |

|

Yes (If yes, enter your fax number) |

Fax number |

|

|||||

|

|

0 |

|||

|

|

|

|

|

|

1 |

2 |

No |

|

||

|

|

0999

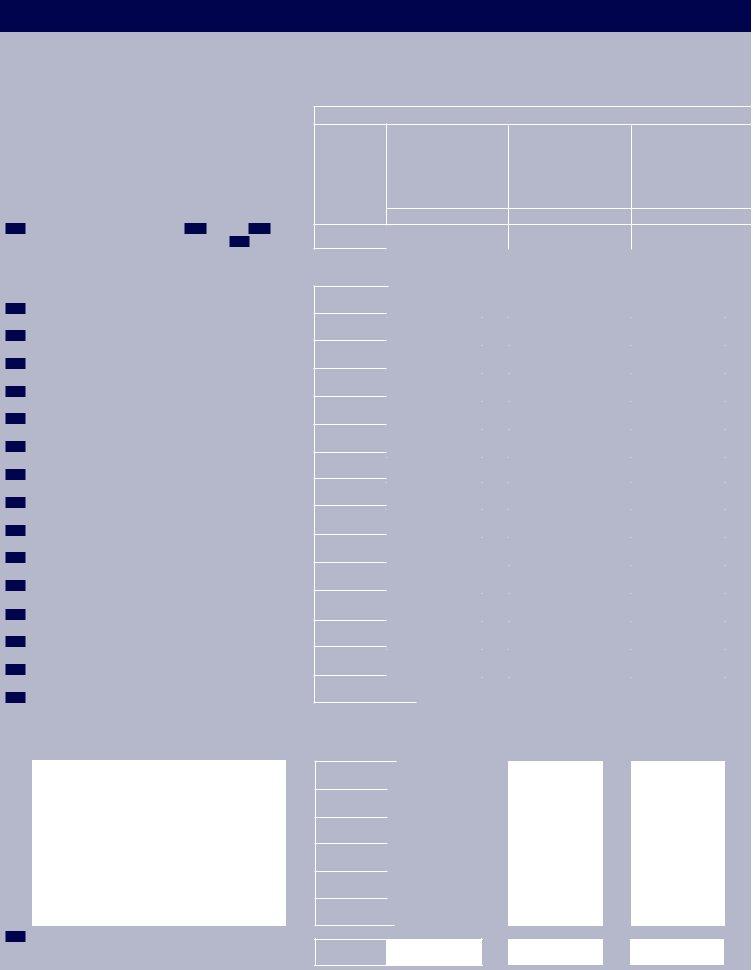

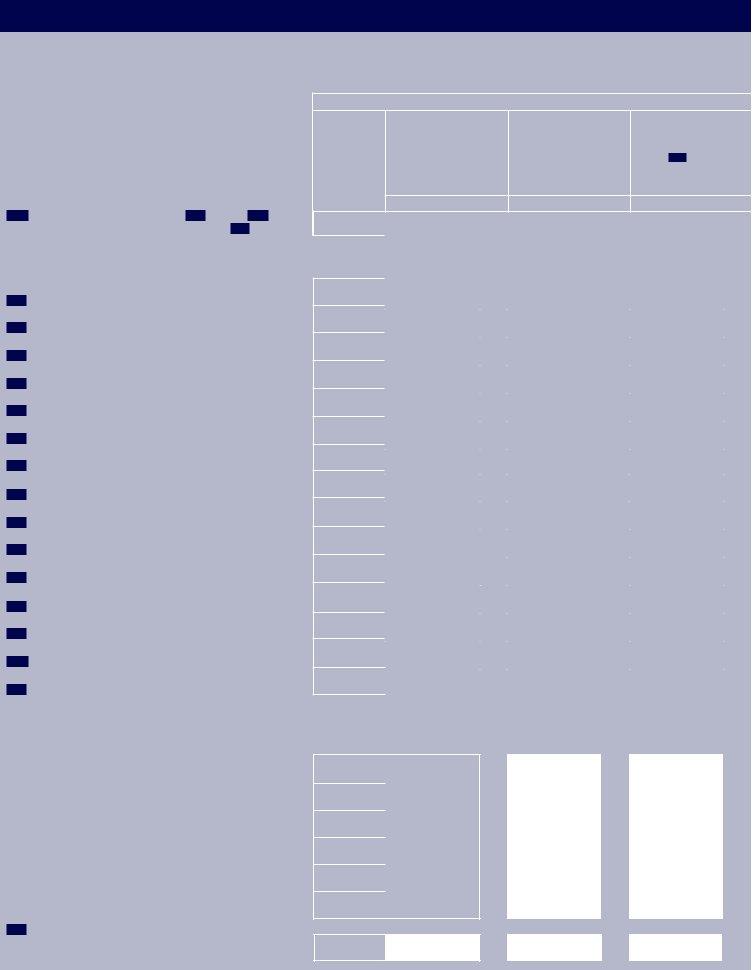

Part I - Identification of U.S. Affiliate

IMPORTANT

Review the instructions starting on page 31 before completing this form. Insurance and real estate companies see special instructions starting on page 38.

• Accounting principles — If feasible use U.S. Generally Accepted Accounting Principles to complete Form

• U.S. affiliate’s 2012 fiscal year — The affiliate’s financial reporting year that had an ending date in calendar year 2012.

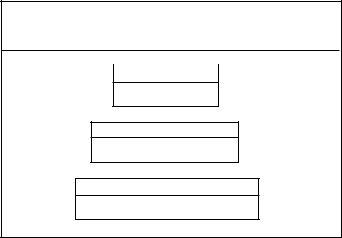

• Consolidated reporting — A U.S. affiliate must file on a fully consolidated domestic U.S. basis, including in the consolidation ALL U.S. business enterprises proceeding down each ownership chain whose voting securities are more than 50 percent owned by the U.S. business enterprise above. The consolidation rules are found in instruction IV.2 starting on page 34.

• Rounding — Report currency amounts in U.S. dollars rounded to thousands (omitting 000). |

$ Bil. |

Mil. |

Thous. |

Dols. |

|

Do not enter amounts in the shaded portions of each item. |

|||||

|

1 |

335 |

000 |

||

Example — If amount is $1,334,891.00 report as: |

|

1Which financial reporting standards will you use to complete this

NOTE — The

1399 1

1

1

2

U.S. Generally Accepted Accounting Principles

International Financial Reporting Standards (as promulgated by, or adapted from, the International Accounting Standards Board) NOTE — Do not prepare your

1

3

Other reporting standards — Specify the reporting standards used

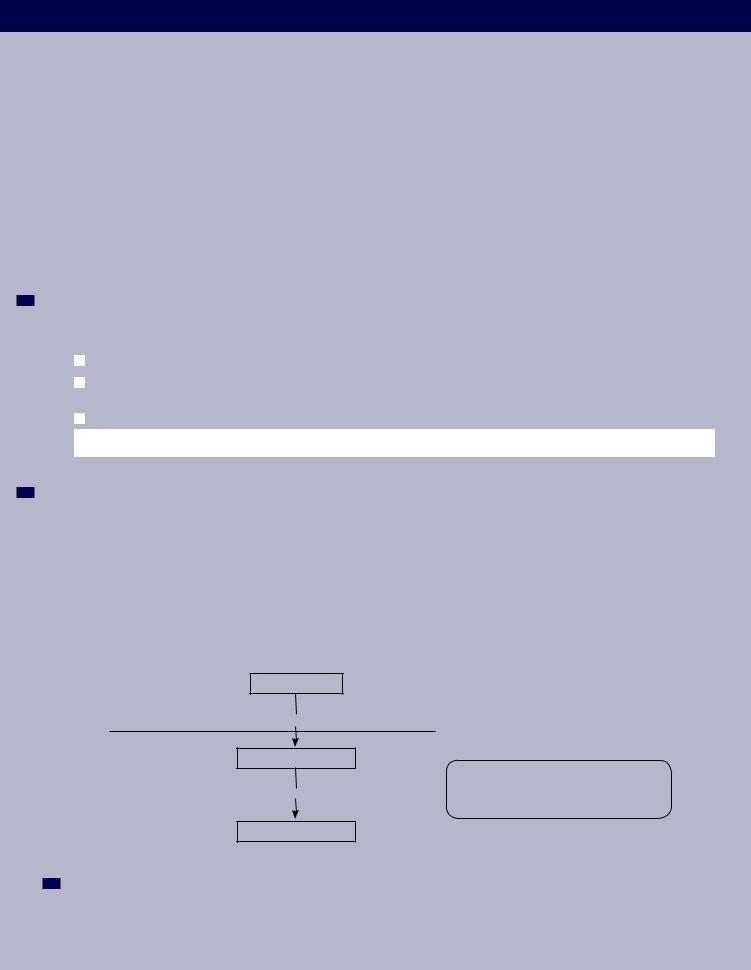

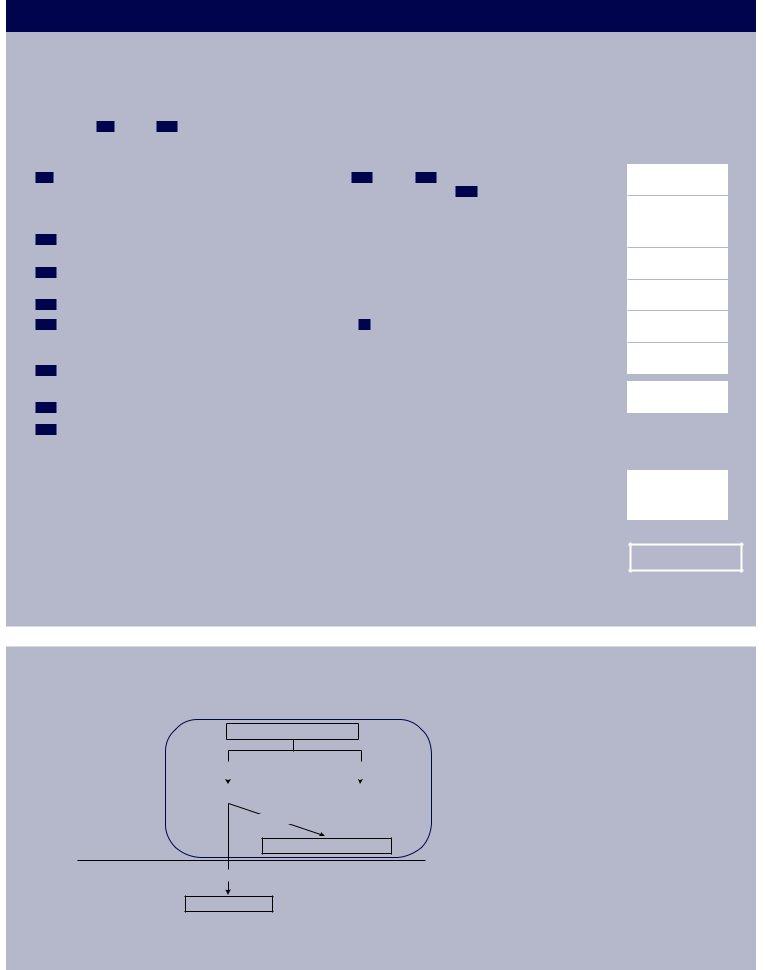

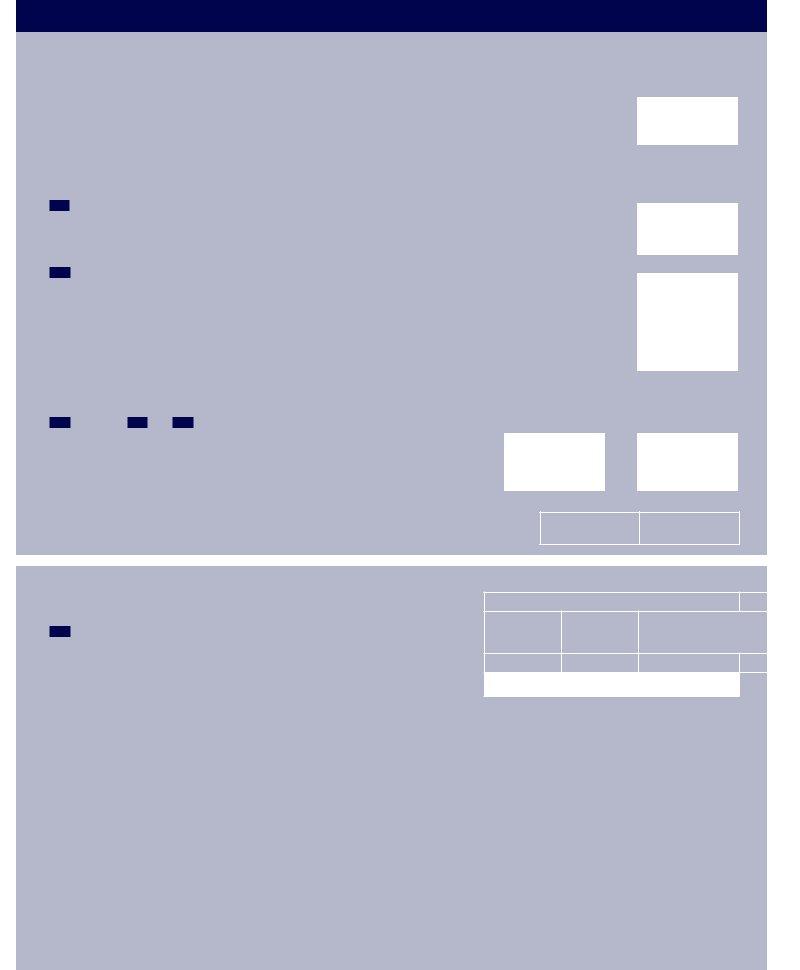

2Is more than 50 percent of the voting interest in this U.S. business enterprise owned by another U.S. affiliate of the foreign parent (see the diagram below)?

1400 |

1 |

1 |

|

Yes |

If “Yes” — Do not complete this report unless exception 2.c. described in the consolidation rules on page 35 |

|

|

|

|||

|

|

|

|

|

applies. If this exception does not apply, forward this |

|

|

|

|

|

your company more than 50 percent, and notify BEA of the action taken by filing |

|

|

|

|

|

item e completed on page 3 of that form. The |

|

|

|

|

|

at: www.bea.gov/fdi |

|

1 |

2 |

|

No |

If “No” — Complete this report in accordance with the consolidation rules starting on page 34. |

|

|

||||

|

|

|

CONSOLIDATION OF U.S. AFFILIATES

Foreign parent

Foreign |

10 to 100 percent |

United States

U.S. business enterprise A

> 50 percent

U.S. business enterprise B should be consolidated on the

U.S. business enterprise B

3Enter Employer Identification Number(s) used by the U.S. affiliate to file income and payroll taxes.

|

Primary |

|

Other |

1006 |

|

|

|

1 |

|

2 |

|

|

– |

|

– |

|

|

|

|

FORM |

Page 2 |

Part I - Identification of U.S. Affiliate – Continued

4Reporting period — Reporting period instructions are found in instruction 4 on page 35. If there was a change in fiscal year, review instruction 4.b. on page 35.

|

Month Day |

Year |

|

1 |

|

This U.S. affiliate’s fiscal year ended in calendar year 2012 on |

__ __ / __ __ / |

2 0 1 2 |

1007 |

|

|

Example — If the fiscal year ended on March 31, report for the |

|

|

NOTE — Affiliates with a fiscal year that ended within the first week of January 2013 are considered to have a 2012 fiscal year and should report December 31, 2012 as their 2012 fiscal year end.

5

6

7

Did the U.S. business enterprise become a U.S. affiliate during its fiscal year that ended in calendar year 2012?

|

|

|

|

|

|

Month Day |

Year |

1008 |

1 |

1 |

|

Yes If “Yes” — Enter the date the U.S. business enterprise became a U.S. affiliate and see |

|

1 |

|

|

|

|

|||||

|

|

|

|

|

|

||

|

|

|

|

instruction 5 on page 35 to determine how to report for the first time |

1009 |

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

||

|

1 |

|

|

|

|

|

|

2 |

No |

|

NOTE — For a U.S. business enterprise that became a U.S. affiliate during its fiscal year that ended in calendar year 2012, may leave the close FY 2011 data columns blank.

Form of organization of U.S. affiliate — Mark (X) one

1011 |

1 |

1 |

|

Incorporated in U.S. |

|

||||

|

|

|

||

|

|

|

|

Reporting rules for unincorporated affiliates are found in instruction 6 starting on page 35.

1

2 U.S. partnership — Reporting rules for partnerships are found in instruction 6.b. on page 36.

1 |

3 |

|

U.S. branch of foreign person |

||

|

|||||

|

|

||||

1 |

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

Limited Liability Company (LLC) — Reporting rules for LLCs are found in instruction 6.c. on page 36. |

||

|

|

|

|||

1 |

5 |

|

Real property not in |

||

|

|||||

|

|

||||

|

|

|

|||

1 |

|

|

|

|

|

|

6 |

|

Business enterprise incorporated abroad, but whose head office is located in the United States and whose business activity is |

||

|

|

|

|||

|

|

|

conducted in, or from, the United States |

||

1 |

7 |

|

Other — Specify |

|

|

|

|

|

|||

|

|

|

|||

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

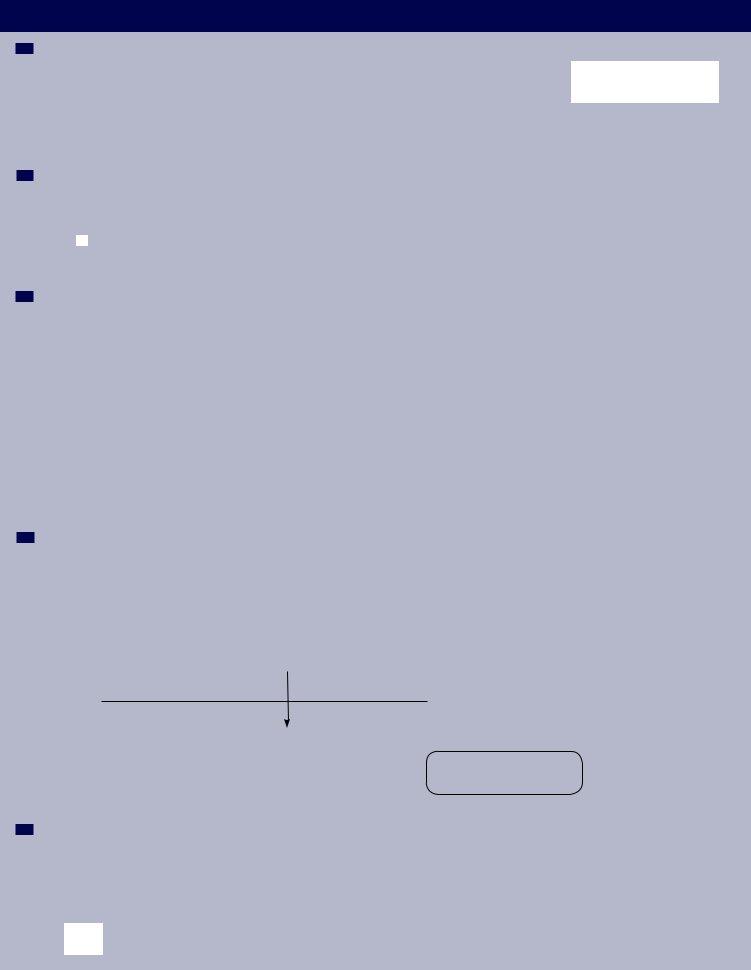

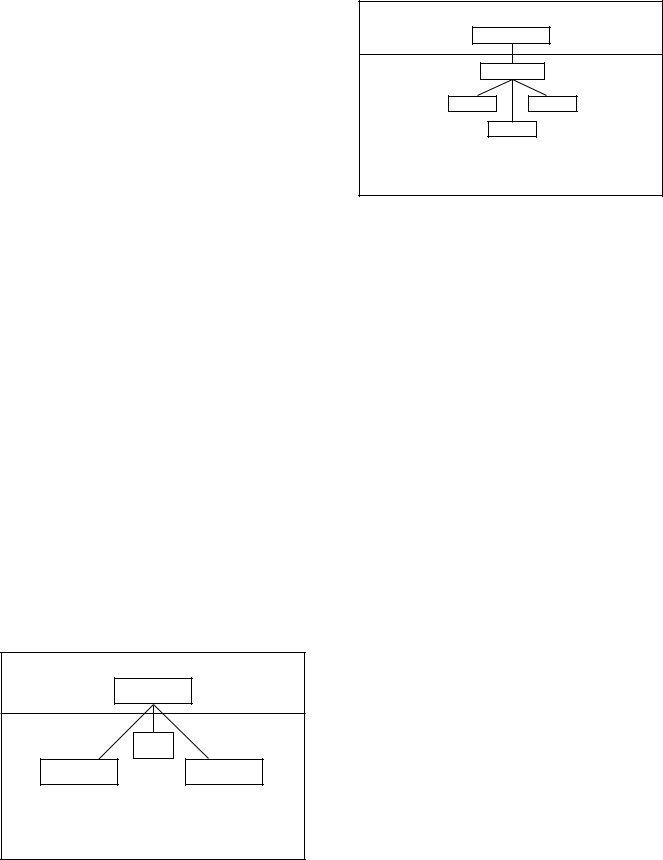

Does this U.S. affiliate own any foreign business enterprises or operations (see the diagram below)?

1014 |

1 |

1 |

|

Yes If “Yes” — DO NOT consolidate foreign business enterprises or operations. Foreign operations in which you own an interest of 20 |

||

|

|

|

||||

|

|

|

|

percent or more are to be deconsolidated and reported using the equity method of accounting. If your ownership interest is less |

||

|

|

|

|

than 20 percent, foreign operations are to be reported in accordance with FASB ASC 320 (formerly FAS 115). Reporting rules for |

||

|

|

|

|

foreign operations are found in the instruction IV.2.a. starting on page 34. |

||

|

|

|

|

NOTE — DO NOT eliminate intercompany accounts (e.g., receivables or liabilities) for holdings reported using the equity method. |

||

|

1 |

2 |

|

No |

|

|

|

|

|

|

|||

|

|

|

|

|

||

|

|

|

|

|

U.S. affiliate A |

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

|

|

|

|

|

Foreign |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign business |

|

|

|

|

|

|

enterprises or |

Do not consolidate foreign business |

|

|

|

|

|

operations |

|

|

|

|

|

|

enterprises or foreign operations |

|

|

|

|

|

|

owned by the |

|

|

|

|

|

|

owned by the U.S. affiliate |

|

|

|

|

|

|

U.S. affiliate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8U.S. business enterprises fully consolidated in this report — U.S. business enterprises that are more than

Enter the number of U.S. business enterprises consolidated in this report in the box below. Hereinafter they are considered to be one U.S. affiliate. If the report is for a single U.S. business enterprise, enter “1” in the box below. Exclude from the consolidation all foreign business enterprises or operations owned by this U.S. affiliate.

1012 1

If the number is greater than one, complete the Supplement A on page 27.

FORM |

Page 3 |

Part I - Identification of U.S. Affiliate – Continued

9U.S. affiliates NOT fully consolidated — See instruction 9 on page 36.

Number of U.S. affiliates, in which this U.S. affiliate has an ownership interest, that are NOT fully consolidated in this report.

1013 1If number is not zero, complete the Supplement B on page 29

The U.S. affiliate named on page 1 must include data for unconsolidated U.S. affiliates on an equity basis and must notify the unconsolidated U.S. affiliates of their obligation to file a Form

10Did this U.S. affiliate acquire or establish any U.S. business enterprises or segments during the reporting period that are now either

contained in this report on a fully consolidated basis, merged into this U.S. affiliate, reflected as an equity investment?

1015 |

1 1 |

Yes |

1 |

2 |

No |

|

|

|

|

11Did this U.S. affiliate sell, transfer ownership of, or liquidate any U.S. subsidiaries, operating divisions, segments, etc., during its fiscal year that ended in calendar year 2012?

1016 |

1 |

1 |

|

1 |

2 |

|

|

|

Yes |

No |

|||

|

|

|

||||

|

|

|

|

|

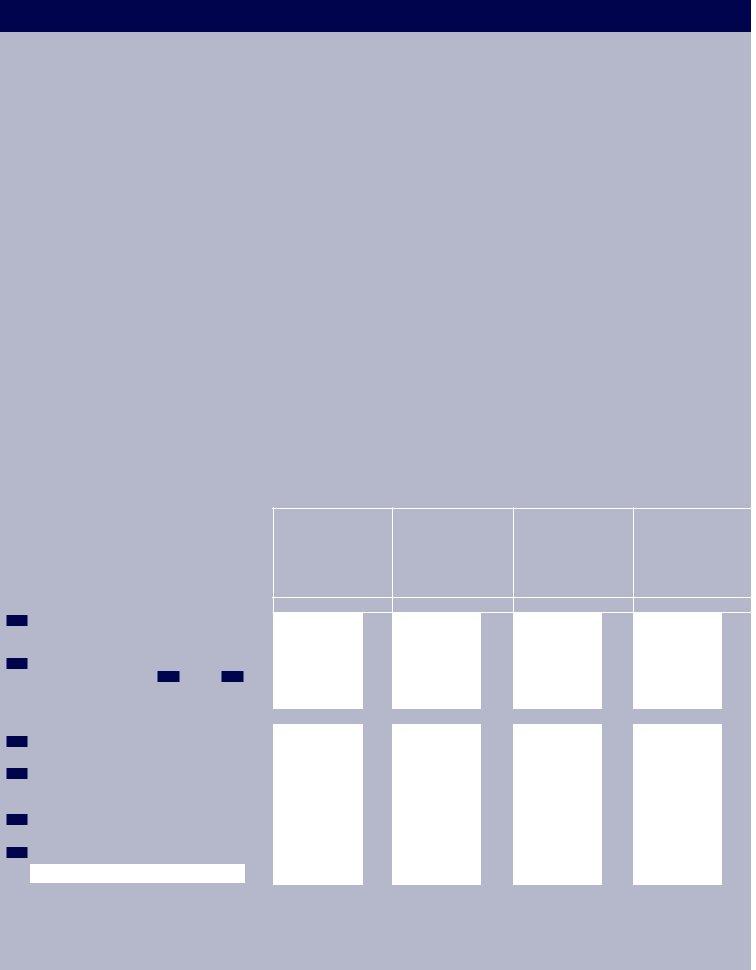

OWNERSHIP — Enter percent of ownership, in this U.S. affiliate, to a tenth of one percent, based on voting and equity interest if an incorporated affiliate (or an equivalent interest if any unincorporated affiliate). “Voting interest” and “equity interest” are defined in instructions

Foreign parent — A foreign parent is the FIRST person or entity outside the U.S. in a chain of ownership that has a 10 percent or more voting interest (direct or indirect) in this U.S. affiliate.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Voting interest |

|

Equity interest |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(If different from voting interest) |

|||||

|

12 |

|

Ownership held directly by foreign parent(s) of this affiliate — Give name |

|

|

|

|

|

||||||||||||||

|

|

|

of each foreign parent with direct ownership. If more than 4, continue on a |

|

Close FY 2012 |

|

Close FY 2011 |

|

Close FY 2012 |

|

Close FY 2011 |

|||||||||||

|

|

|

separate sheet. See example 1 on page 19. |

|

(1) |

(2) |

(3) |

(4) |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1017 |

1 |

|

2 |

|

3 |

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1018 |

1 |

|

2 |

|

3 |

|

4 |

|

b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1019 |

1 |

|

2 |

|

3 |

|

4 |

|

c. |

|

|

|

|

|

|

|

|

|

|

|

|

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1020 |

1 |

|

2 |

|

3 |

|

4 |

|

d. |

|

|

|

|

|

|

|

|

|

|

|

|

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

2 |

|

3 |

|

4 |

|

13 |

|

Ownership held directly by all U.S. affiliates of the foreign parent(s) — |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

The foreign parents of these other U.S. affiliates are indirect foreign parents |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

of this U.S. affiliate. If you put an entry in column 1 or 2, complete |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

items |

17 |

– |

21 |

below. See example 2 on page 20 |

1060 |

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

2 |

|

3 |

|

4 |

|

|

|

|

|

|

|

|

|

|

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|||||

|

14 |

|

Ownership held directly by all other U.S. persons or entities |

1061 |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

2 |

|

3 |

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

15 |

|

Ownership held directly by all other foreign persons or entities |

1062 |

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100% |

100% |

100% |

100% |

|||

|

16 |

|

TOTAL of ownership interests — Sum of items |

12 |

through |

15 |

|

|

|

|

||||||||||||

|

|

....................... |

|

|

|

|

|

|

|

|

|

|

||||||||||

NOTE: IF THERE IS AN ENTRY IN COLUMN 1 OR 2 OF ITEM 13 COMPLETE ITEMS 17 THROUGH 20 .

Give the name of each U.S. affiliate holding a direct ownership interest in this U.S. affiliate.

If more than 4, continue on a separate sheet.

See example 2 on page 19.

(1)

17

18

19

20

21Sum of items 17 through 20 . The sum of these percentages must equal item 13 columns 1 and 2.....

|

|

|

|

For the U.S. affiliate listed in column 1, |

|

|

Percent of direct voting interest |

give the name of the U.S. entity (U.S. |

BEA |

||

|

in this U.S. affiliate held by the |

affiliate) in its ownership chain that is |

|||

|

U.S. affiliate listed in column 1. |

directly owned by a foreign parent. |

USE |

||

|

|

|

|

If the U.S. affiliate listed in column 1 is |

ONLY |

|

|

|

|

directly owned by a foreign parent, also list |

|

|

Close FY 2012 |

|

Close FY 2011 |

that U.S. affiliate here. |

|

|

(2) |

(3) |

(4) |

|

|

1063 |

1 |

|

2 |

|

3 |

|

|

||||

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

|

1064 |

1 |

|

2 |

|

3 |

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

|

1065 |

1 |

|

2 |

|

3 |

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

|

1066 |

1 |

|

2 |

|

3 |

|

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

|

|

|

1 |

|

2 |

|

3 |

1071 |

___ ___ ___ . ___% |

|

___ ___ ___ . ___% |

BEA USE ONLY |

|

FORM |

Page 4 |

Part I - Identification of U.S. Affiliate – Continued

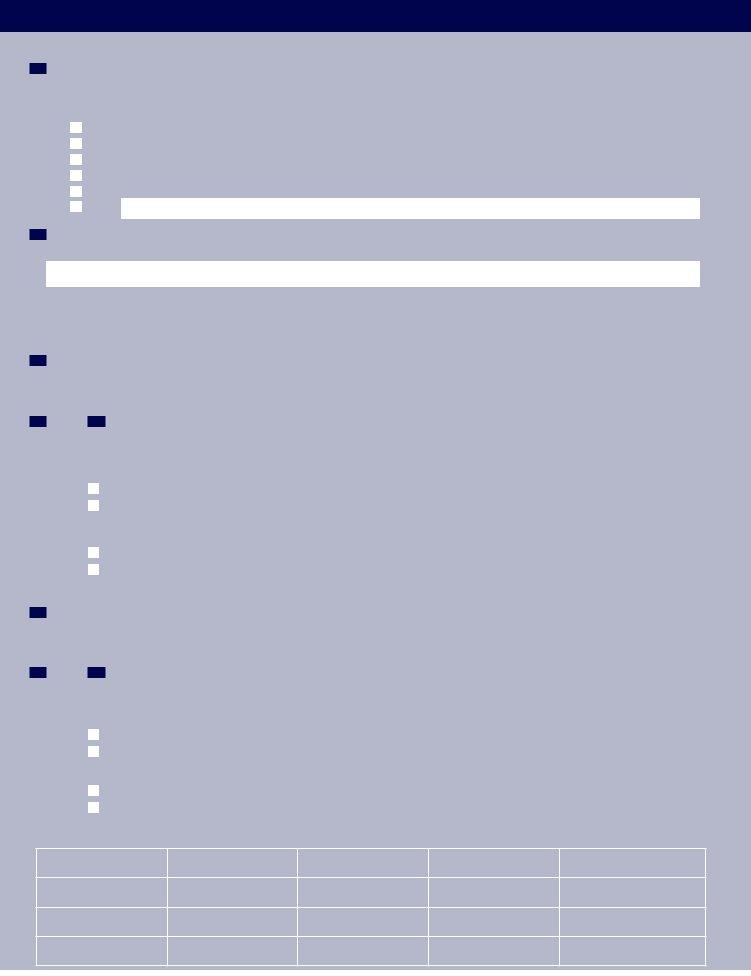

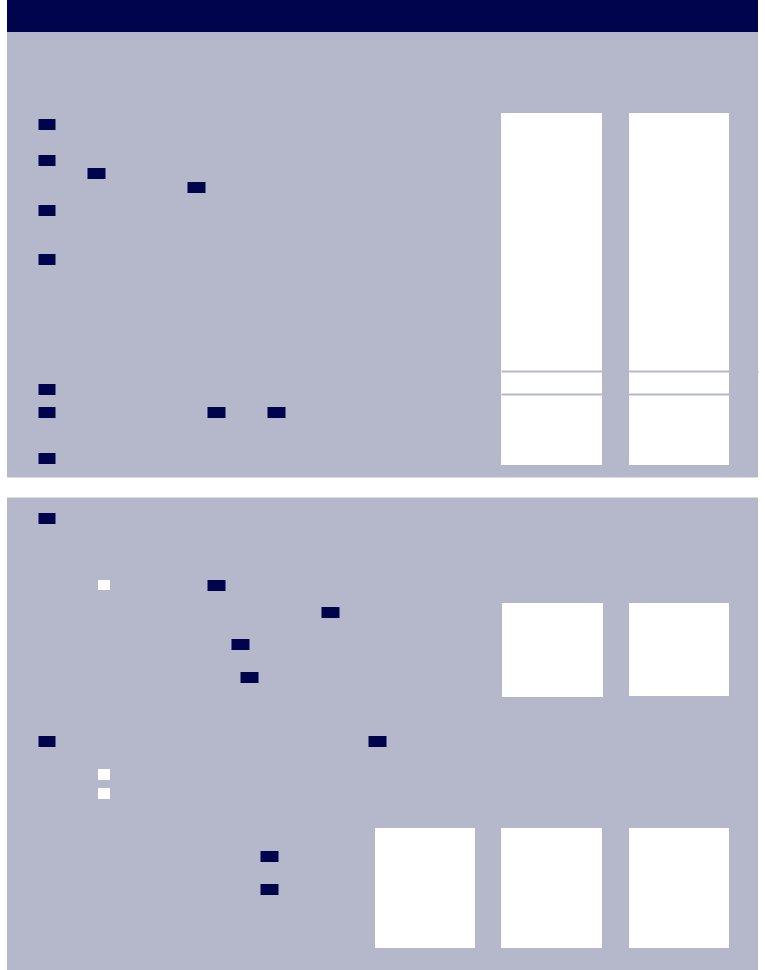

Section A — INDUSTRY CLASSIFICATION, TOTAL SALES, AND EMPLOYEES OF FULLY CONSOLIDATED U.S. AFFILIATE

22Major activities of fully consolidated U.S. affiliate — For an inactive affiliate, select the activities based on its last active period; for

Check all boxes that describe a major activity of the fully consolidated U.S. affiliate

1072 1

1

2

2

3

3

4

4

5

5

6

6

Producer of goods

Seller of goods the U.S. affiliate does not produce Producer or distributor of information

Provider of services Real estate

Other Specify

23What is (are) the major product(s) and/or service(s) resulting from this (these) activities? If a product, also state what is done to it, i.e., whether it is mined, manufactured, sold at wholesale, transported, packaged, etc. (For example, “manufactured widgets.”)

1163 0

CONTRACT MANUFACTURING SERVICES — Contracting with a firm to process materials and components, including payments for fabricating, assembling, labeling, and packaging materials and components.

Contract manufacturing services PURCHASED

24In FY 2012, did this U.S. affiliate purchase contract manufacturing services from others (including foreign affiliates)?

1073 |

1 |

1 |

|

Yes — Continue with item |

25 |

||

|

|

|

|

||||

|

1 |

|

|

|

|

|

|

|

|

2 |

|

No — Skip to item |

26 |

|

|

25If item 24 is answered “Yes,” indicate whether the U.S. affiliate owned the materials used by the contract manufacturers and whether the services were purchased from businesses inside or outside the U.S. (check all that apply).

The U.S. affiliate owned some or all of the materials used by the contract manufacturers and the companies providing the manufacturing services were:

1074 |

1 |

1 |

|

|

1

2

Located inside the U.S. Located outside the U.S.

The U.S. affiliate did not own the materials used by the contract manufacturers and the companies providing the manufacturing services were:

1075 |

1 |

1 |

Located inside the U.S. |

|

|

||

|

|

|

1 |

2 |

Located outside the U.S. |

|

||

|

|

Contract manufacturing services PERFORMED

26In FY 2012, did this U.S. affiliate perform contract manufacturing services for others (including foreign affiliates)?

1076 |

1 |

1 |

|

|

|

|

|

|

|

|

|

|

|||

|

Yes — Continue with item |

27 |

|||||

|

|

|

|||||

|

1 |

2 |

|

||||

|

|

||||||

|

|

|

|

|

|

||

|

|

No — Skip to item |

28 |

|

|

||

|

|

|

|

|

|||

|

|

|

|

|

|

||

27If item 26 is answered “Yes,” indicate whether the U.S. affiliate owned the materials used by the contract manufacturing and whether the services were performed for businesses inside or outside the U.S. (check all that apply).

The U.S. affiliate owned some or all of the materials used in the contract manufacturing and the companies purchasing the manufacturing

services were:

1077 |

1 |

1 |

Located inside the U.S. |

|

|

||

|

|

|

1 |

2 |

Located outside the U.S. |

|

||

|

|

The U.S. affiliate did not own the materials used in the contract manufacturing and the companies purchasing the manufacturing services were:

1078 |

1 |

1 |

Located inside the U.S. |

|

|

||

|

|

|

1 |

2 |

Located outside the U.S |

|

||

|

|

|

|

|

BEA USE ONLY |

1200 1

2

3

4

5

1201 1

2

3

4

5

1202 1

2

3

4

5

1203 1

2

3

4

5

FORM |

Page 5 |

Part II - Financial and Operating Data of U.S. Affiliate

INDUSTRY CLASSIFICATION, TOTAL SALES, AND EMPLOYEES OF FULLY CONSOLIDATED U.S. AFFILIATE

Enter the

Book publishers, printers, and real estate investment trusts — See instructions for items 28 – 41 on page 37.

Holding company (ISI code 5512) is often an invalid industry classification for a conglomerate. A conglomerate must determine its industry code based on the activities of the fully consolidated domestic U.S. business enterprise.

Column 1 – ISI Code — See the Summary of Industry Classifications on page 30. For a full explanation of each code, see the Guide to Industry Classifications for International Surveys, 2012 located at www.bea.gov/naics2012. For an inactive affiliate, base the industry classification(s) on its last active period; for

Column 2 – Sales

INCLUDE

•Totalsalesorgrossoperatingrevenues,excludingsalestaxes, returns, allowances, and discounts.

•Feesandcommissions

•Revenuesgeneratedduringtheyearfromtheoperationsofa discontinued business segment.

•ONLYfinanceandinsurancecompaniesandunitsshouldreport dividends and interest. Companies involved with repos and reverse repos see instructions for items

•Totalincomeofholdingcompanies(ISIcode5512)asreportedin item 46 .

EXCLUDE

•Investmentgainsandlossesreportedinitem 44 .

•Salesorconsumptiontaxeslevieddirectlyontheconsumer.

•Excisetaxeslevieddirectlyonmanufacturers,wholesalers,and retailers.

•GainsorlossesfromDISPOSALSofdiscontinuedoperationsand gains and losses from derivative instruments (report as certain gains (losses) in item 44 ).

Column (3) – Number of employees — INCLUDE all

NOTE: For most U.S. reporters, the employment distribution in column 3 is |

|

|

|

Sales |

|

|

Number of employees |

|

|

|

|

|

|

associated with each ISI |

|||

|

not proportional to the sales distribution in column 2. Therefore, do |

|

|

|

(2) |

|

|

|

|

|

ISI code |

|

|

|

code in column 1 |

||

|

not distribute employment by industry in proportion to sales by industry. |

|

|

|

|

|

||

|

(1) |

$ Bil. |

Mil. |

Thous. Dols. |

(3) |

|||

|

|

1 |

2 |

|

|

|

3 |

|

|

|

|

|

|

|

|

000 |

|

28 |

Enter code of industry with largest sales |

1164 |

|

|

|

|

|

|

|

|

1 |

2 |

|

|

|

3 |

|

|

|

|

|

|

|

|

000 |

|

29 |

Enter code of industry with 2nd largest sales |

1165 |

|

|

|

|

|

|

|

|

1 |

2 |

|

|

|

3 |

|

|

|

|

|

|

|

|

000 |

|

30 |

Enter code of industry with 3rd largest sales |

1166 |

|

|

|

|

|

|

|

|

1 |

2 |

|

|

|

3 |

|

|

|

|

|

|

|

|

000 |

|

31 |

Enter code of industry with 4th largest sales |

1167 |

|

|

|

|

|

|

|

|

1 |

2 |

|

|

|

3 |

|

|

|

|

|

|

|

|

000 |

|

32 |

Enter code of industry with 5th largest sales |

1168 |

|

|

|

|

|

|

|

|

1 |

2 |

|

|

|

3 |

|

|

|

|

|

|

|

|

000 |

|

33 |

Enter code of industry with 6th largest sales |

1169 |

|

|

|

|

|

|

|

|

1 |

2 |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

34 |

Enter code of industry with 7th largest sales |

1170 |

|

|

|

|

000 |

|

|

|

1 |

2 |

|

|

|

3 |

|

|

|

|

|

|

|

|

000 |

|

35 |

Enter code of industry with 8th largest sales |

1171 |

|

|

|

|

|

|

|

|

1 |

2 |

|

|

|

3 |

|

|

|

|

|

|

|

|

000 |

|

36 |

Enter code of industry with 9th largest sales |

1176 |

|

|

|

|

|

|

|

|

1 |

2 |

|

|

|

3 |

|

|

|

|

|

|

|

000 |

|

|

37 |

Enter code of industry with 10th largest sales |

1177 |

|

|

|

|

||

|

|

|

|

|

|

|

|

3 |

38Number of employees of administrative offices and other auxiliary units — INCLUDE employees at corporate headquarters, central administrative, and regional offices, and operating units that provide administration and management or support services (such as accounting, data processing, legal, research and development and testing, and warehousing) to more than one U.S. operating unit. EXCLUDE employees that provide administration and management or support services for only one unit. Instead, report such employees in column 3 of items 28

|

through |

37 |

........................................................................................................................................................................... |

|

|

|

|

|

1178 |

|

|

|

|

|

|

|

|

|

|

2 |

3 |

||

|

|

|

|

|

|

|

|

|

|||

39 |

Sales and employees accounted for — Sum of items |

28 |

through |

38 |

............................. |

1172 |

|

000 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

3 |

||

40Sales and employees not accounted for above — Items 28 through 37 must all

|

have entries if amounts are entered in this item |

1173 |

|

000 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

2 |

3 |

||

41 |

TOTAL SALES OR GROSS OPERATING REVENUES (excluding sales |

|||||||||

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||

|

taxes) and employees — Sum of items |

39 |

and |

40 |

, columns 2 and 3 |

1174 |

|

|

000 |

|

FORM |

Page 6 |

Part II - Financial and Operating Data of U.S. Affiliate – Continued

Section B — INCOME STATEMENT |

|

INCOME |

|

42 Total sales or gross operating revenues, excluding sales taxes — Must equal item 41 column 2 |

2149 |

43Income from equity investments in unconsolidated U.S. affiliates and all foreign entities — INCLUDE here the equity in earnings, during the reporting period, for all U.S. and foreign investments that are unconsolidated and reported in item 66 . INCLUDE dividends received for investments that are owned less than 20 percent and not subject to FASB ASC 320 (formerly FAS 115). EXCLUDE fair value gains and losses for investments that would

otherwise be accounted for under the equity method. Report such fair value gains (losses) in item 44 |

2150 |

44Certain gains (losses) — READ INSTRUCTIONS CAREFULLY as this item is based on economic accounting concepts and may, in some cases, deviate from accounting principles.

Report gross amount before income tax effect. Include tax effect in item 48 . Report gains (losses) resulting from:

a.Extraordinary, unusual, or infrequently occurring items that are material. INCLUDE losses from accidental damage or disasters, after estimated insurance reimbursement. INCLUDE other material items, including

b.Restructuring. INCLUDE restructuring costs that reflect writedowns or writeoffs of assets or liabilities. EXCLUDE actual payments, or charges to establish reserves for future actual payments, such as for severance pay, and fees to accountants, lawyers, consultants, or other contractors. Report them in item 47 ;

c.Sales or disposition of land, other property, plant, and equipment, or other assets, and FASB ASC 360 (formerly FAS144) impairment losses. EXCLUDE gains (losses) from the sale of inventory assets in the ordinary course of trade or business. Real estate companies, see special instructions IV.44. on page 37;

d.Sales or other disposition of financial assets, including investment securities; gains (losses) related to fair value accounting; FASB ASC 320 (formerly FAS 115) holding gains (losses) on securities classified as trading securities; FASB ASC 320 impairment losses; and gains and losses derived from derivative instruments;

e.Goodwill impairment as defined by FASB ASC 350 (formerly FAS 142);

f.DISPOSALS of discontinued operations. EXCLUDE income (loss) from the operations of a discontinued segment. Report such income (loss) as part of your income from operations in items 28 through 41 ;

g.Remeasurement of the U.S. affiliate’s

h.The cumulative effect of a change in accounting principle; and

i.The cumulative effect of a change in the estimate of stock compensation forfeitures under FASB ASC 718

(formerly FAS 123(R)) |

2151 |

45Other income — Legal settlements in favor of the U.S. affiliate, dividends and interest earned by

|

2152 |

46 Total income — Sum of items 42 through 45 |

2153 |

COSTS AND EXPENSES |

|

47Cost of goods sold or services rendered, and selling, general, and administrative expenses — Operating expenses that relate to sales or gross operating revenues, item 42 , and selling, general, and administrative expenses. INCLUDE production royalty payments to governments, their subdivisions and agencies, and to other persons. INCLUDE legal judgments against the U.S. affiliate. INCLUDE depletion charges representing the amortization of the actual cost of capital assets, but EXCLUDE all other depletion charges. EXCLUDE goodwill impairment as defined by FASB ASC 350 (formerly FAS 142). Report such impairment losses in item 44 . For

guidance on restructuring costs, see item 44b |

2154 |

48Income taxes — Provision for U.S. Federal, state, and local income taxes. INCLUDE the income tax effect of certain

gain (losses) reported in item 44 . EXCLUDE production royalty payments |

2156 |

49Other costs and expenses not included above. Include noncontrolling interests in profits and losses (FASB ASC 810 (formerly FAS 160)). — Specify major items

|

|

2157 |

50 |

Total costs and expenses — Sum of items 47 through 49 |

2158 |

NET INCOME |

|

|

51 |

Net income (loss) after provision for U.S. Federal, state, and local income taxes — Item 46 minus item 50 |

2159 |

$ Bil. Mil. Thous. Dols.

1

000

1

000

1

000

1

000

1

000

1

000

1

000

1

000

1

000

1

000

FORM |

Page 7 |

Part II - Financial and Operating Data of U.S. Affiliate – Continued

Section C — DISTRIBUTION OF SALES OR GROSS OPERATING REVENUES

Distribute sales or gross operating revenues among three categories — sales of goods, sales of services, and investment income. For the purpose of this distribution, “goods” are normally outputs that are tangible and “services” are normally outputs that are intangible. When a sale consists of both goods and services and cannot be unbundled (i.e., the goods and services are not separately billed), distribute the sales as goods or services based on a best estimate of the value in each.

NOTE — Before completing this section, please see the instructions for item 52 through 57 starting on page 37. Insurance companies also see page 38, V.A. for special instructions.

Utilities and oil & gas producers and distributors — To the extent feasible, revenues are to be allocated between sales of goods and sales of services. Revenues earned from the sale of a product (e.g., electricity, natural gas, oil, water, etc.) are to be reported as sales of goods. Revenues earned from the distribution or transmission of a product (e.g., fees received for the use of transmission lines, pipelines, etc.) are to be reported as

sales of services. |

|

|

|

|

$ Bil. Mil. Thous. |

|

|

1 |

52 |

Total sales or gross operating revenues, excluding sales taxes — |

|

|

Equals sum of items 53 through 55 |

2243 |

|

|

1 |

53 |

Sales of goods |

2244 |

|

|

1 |

54Investment income included in gross operating revenues. Include ALL interest and dividends generated by

|

|

finance and insurance subsidiaries or units |

2245 |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

55 |

Sales of services, total — Sum of items |

56 |

and |

57 |

................................................................................................. |

2246 |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|||||||||||

|

56 |

To U.S. persons or entities |

2247 |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|||||||||||

|

57 |

To foreign persons or entities |

2257 |

|

||||||||||||

|

|

|||||||||||||||

|

|

Did this U.S. affiliate receive payments or credits from, or make payments or issue credits to, persons or entities located outside |

||||||||||||||

|

|

of the United States for any of the items listed below? |

|

|

||||||||||||

|

|

• Royalties,licensefees,andotherfeesfortheuseorsaleofintangibleproperty. |

|

|

||||||||||||

|

|

• Servicesincludingbutnotlimitedto:accounting,advertising,computer,constructionandrelatedservices,consulting, data base, |

||||||||||||||

|

|

|

financial, insurance, legal, management, operational leasing, public relations, and research and development services. |

|||||||||||||

|

|

1186 |

1 |

1 |

|

Yes |

1 |

2 |

|

No |

|

|

||||

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

Dols.

000

000

000

000

000

000

Section D — OTHER FINANCIAL AND OPERATING DATA

58Interest income from all sources (including foreign parents and affiliates), after deduction of taxes withheld

by the payer. Do not net against interest expense (item 59 ) |

2400 |

59Interest expenses plus interest capitalized, paid or due to all payees (including to foreign parents and

affiliates), before deduction of U.S. tax withheld by the affiliate. Do not net against interest income (item 58 ) .... |

2401 |

60Other taxes and

•Sales,consumption,andexcisetaxescollected by the affiliate on goods and services sold

•Premiumtaxespaidbyinsurancecompanies

•Propertyandothertaxesonthevalueofassetsandcapital

•Anyremainingtaxes(otherthanincomeandpayrolltaxes)

-Import and export duties

-Production royalties for natural resources

-License fees, fines, penalties, and similar items

NOTE: The amount reported in this item SHOULD NOT EQUAL the amount reported in item 48 |

2402 |

61Employee compensation — Base compensation on payroll records. Employee compensation must cover compensation charged as an expense on the income statement, charged to inventories, or capitalized during the reporting period. INCLUDE wages and salaries and employee benefit plans. EXCLUDE compensation related

to activities of a prior period, such as compensation capitalized or charged to inventories in prior periods. EXCLUDE compensation of contract workers and other workers not carried on the payroll of this U.S. affiliate. See instruction

for item 61 on page 38 |

2253 |

BEA USE ONLY

2404

$ Bil. Mil. Thous. Dols.

1

000

1

000

1

000

1

000

1

FORM |

Page 8 |

Part II – Financial and Operating Data of U.S. Affiliate – Continued

Section E – INDUSTRY ACTIVITIES

INSURANCE INDUSTRY ACTIVITIES

Insurance related activities are covered by industry codes 5243 (insurance carriers, except life insurance carriers) and 5249 (life insurance carriers).

62a

62b

62c

Of the total sales and gross operating revenues reported in item 41 , column 2, were any of the sales or revenues generated by insurance related activities?

1180 |

1 |

1 |

Yes — Answer items |

62b |

and |

62c |

|

|

||

|

|

|

|

|||||||

|

|

|

$ Bil. Mil. Thous. Dols. |

|||||||

|

1 2 |

No — Skip to item |

63a |

|

||||||

|

|

|

|

|

|

|

|

|

|

1 |

Premiums earned — Report premiums, gross of commissions, included in revenue during the reporting year. |

|

|||||||||

Calculate as direct premiums written (including renewals) net of cancellations, plus reinsurance premiums |

|

|||||||||

assumed, minus reinsurance premiums ceded, plus unearned premiums at the beginning of the year, minus |

|

|||||||||

unearned premiums at the end of the year. EXCLUDE all annuity premiums. Also EXCLUDE premiums and policy |

|

|||||||||

fees related to universal and adjustable life, variable and |

000 |

|||||||||

|

|

|

|

|

|

|

|

|

|

1 |

Losses incurred — Report losses incurred for the insurance products covered by item 62b . EXCLUDE

loss adjustment expenses and losses that related to annuities. Also EXCLUDE losses related to universal and adjustable life, variable and

For property and casualty insurance, calculate as net losses paid during the reporting year, minus net unpaid losses at the beginning of the year, plus net unpaid losses at the end of the year. In the calculation of net losses, INCLUDE losses on reinsurance assumed from other companies and EXCLUDE loses on reinsurance ceded to other companies. Unpaid losses include both case reserves and losses incurred but not reported.

For life insurance, losses reflect policy claims on reinsurance assumed or on primary insurance sold, minus losses |

|

|

recovered from reinsurance ceded, adjusted for changes in claims due, unpaid, and in course of settlement |

1182 |

000 |

WHOLESALE AND RETAIL TRADE INDUSTRY ACTIVITIES — Goods purchased for resale without further processing

Wholesale trade industry activities include the wholesaling of durable and nondurable goods.

These activities are covered by industry codes 4231 through 4251.

Retail trade industry activities are covered by industry codes 4410 through 4540.

63a Of the total sales and gross operating revenues reported in item 41 , column 2, were any of the sales or revenues generated by wholesale or retail trade activities?

1183 |

1 |

1 |

Yes — Answer items |

63b |

and |

63c |

|

|

|

|

|||

|

|

|

|

|

|

|

|||||||

|

|

|

2 |

|

|

|

|

||||||

|

|

1 |

No — Skip to item |

64 |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

$ Bil. Mil. Thous. Dols. |

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

63b |

Enter the cost of goods purchased for resale without further processing during the fiscal year that ended |

|

|||||||||||

|

|

|

|||||||||||

|

...................................................................................................................................................in calendar year 2012 |

|

000 |

||||||||||

|

|

Close FY 2012 |

|

Close FY 2011 |

|

|

|

|

|

(Unrestated) |

|

(1) |

|

(2) |

|

||

|

|

$ Bil. Mil. Thous. Dols. $ Bil. Mil. Thous. Dols. |

|||

|

|

|

|

|

|

|

1 |

|

2 |

|

|

|

|

|

|

|

|

63c |

Enter the closing balances at the end of fiscal years 2012 and 2011 |

|

|

|

|

|

of the inventory of goods purchased for resale without further processing ............... 1185 |

|

000 |

|

000 |

BEA USE ONLY

1

1189

FORM |

Page 9 |

Part II – Financial and Operating Data of U.S. Affiliate – Continued

Section F — BALANCE SHEET

NOTE — Disaggregate all balance sheet items in the detail shown. Insurance companies |

Close FY 2012 |

Close FY 2011 |

|

see page 38, V.A., for special instructions. |

|||

|

(Unrestated) |

||

|

|

||

|

(1) |

(2) |

ASSETS

64Cash items — Deposits in financial institutions and other cash items. Do NOT include overdrafts as negative cash.............................................................................................................

65Inventories — Land development companies, exclude land held for resale (include in item 68 ); finance and insurance companies, exclude inventories of marketable securities (include in item 68 ) ..........................................................................................

66Equity investment in unconsolidated U.S. and foreign business enterprises —

Include all ownership in unconsolidated business enterprises using the equity method. NOTE: Include ALL foreign affiliates using the equity method (even if majority owned)....

67Property, plant, and equipment, net — Include land, timber, mineral rights, structures, machinery, equipment, special tools, deposit containers, construction in progress, and capitalized tangible and intangible exploration and development costs of the affiliate, at historical cost net of accumulated depreciation, depletion, and amortization. Include items on capital leases from others, per FASB ASC 840 (formerly FAS 13), and property you own that you lease to others under operating leases. Exclude all other types of intangible assets, and land held for resale. (An unincorporated affiliate should include items owned by its foreign parent but which are in the affiliate’s possession in the United States whether or not carried on the affiliate’s own books or records.)............

68Other assets — Include all other assets not included above ...........................................

69Total assets — Sum of items 64 through 68 ..........................................................................

LIABILITIES

70 TOTAL LIABILITIES..........................................................................................................

$ Bil. Mil. Thous. Dols. $ Bil. Mil. Thous. Dols.

1 |

|

2 |

||

2101 |

|

|

000 |

000 |

1 |

|

2 |

||

2104 |

|

|

000 |

000 |

1 |

|

2 |

||

2106 |

|

|

000 |

000 |

1 |

|

2 |

||

2107 |

000 |

000 |

||

1 |

|

2 |

|

|

2110 |

000 |

000 |

||

1 |

|

2 |

|

|

2109 |

000 |

000 |

||

|

|

|

|

|

1 |

|

2 |

|

|

2114 |

000 |

000 |

||

71Has fair value accounting been applied to, or elected for, any asset or liability items included in the amounts reported on the balance sheet above?

2112 1 1 Yes — Report the total amount of the fair value assets

and liabilities in the space provided below.

1

2 No — Skip to item 72

Of the property, plant, and equipment reported in item 67 ,

what amount was reported using fair value accounting? ...................................................

Of the total assets reported in item 69 , what amount was

reported using fair value accounting?................................................................................

Of the total liabilities reported in item 70 , what amount was

reported using fair value accounting?................................................................................

BANKING INDUSTRY ACTIVITIES

Close FY 2012 |

Close FY 2011 |

|

(Unrestated) |

(1) |

(2) |

$ Bil. Mil. Thous. Dols. $ Bil. Mil. Thous. Dols. |

|

1 |

2 |

2115 |

000 |

000 |

|

1 |

2 |

2123 |

000 |

000 |

|

1 |

2 |

2597 |

000 |

000 |

72Of the total sales and gross operating revenues reported in item 41 , column 2, were any of the sales or revenues generated by depository or

2113 |

1 |

1 |

Yes — Report the U.S. affiliate’s values for the following |

|

Banking activities |

|

||

|

|

|

|

|||||

|

1 |

|

No — Skip to item |

|

|

|

in industry codes |

|

|

2 |

73 |

|

|

|

|||

|

|

Total |

5221 or 5229 |

All other |

||||

|

|

|

||||||

|

|

|

|

|

|

|||

|

|

|

|

|

|

(1) |

(2) |

(3) |

|

|

|

|

|

|

$ Bil. Mil. Thous. |

Dols. $ Bil. Mil. Thous. |

Dols. $ Bil. Mil. Thous. Dols. |

Assets: Total of all assets reported in the balance sheet

above (column 1 total equals item 69 column 1) .........

Liabilities: Total of all liabilities reported in the balance sheet

above (column 1 total equals item 70 column 1) .........

|

1 |

2 |

3 |

|

2124 |

000 |

000 |

000 |

|

|

1 |

2 |

3 |

|

2125 |

|

000 |

000 |

000 |

|

1 |

2 |

3 |

|

Interest income: Column 1 total equals item |

58 |

............................. |

2126 |

000 |

000 |

000 |

|

|

|

|

|

|

1 |

2 |

3 |

|

|

000 |

000 |

000 |

|||

Interest expense: Column 1 total equals item |

59 |

........................... 2127 |

|||||

FORM |

Page 10 |

Part II – Financial and Operating Data of U.S. Affiliate – Continued

Section F — BALANCE SHEET — Continued

OWNERS’ EQUITY

73Capital stock and additional

74Retained earnings (deficit)..............................................................................................

75Treasury stock .................................................................................................................

|

Close FY 2012 |

|

|

|

Close FY 2011 |

|

|

|

|

|

|

(Unrestated) |

|

|

(1) |

|

|

|

(2) |

|

|

$ Bil. Mil. Thous. Dols. $ Bil. Mil. Thous. Dols. |

|||||

|

1 |

|

|

2 |

|

|

2116 |

|

|

000 |

|

|

000 |

|

1 |

|

|

2 |

|

|

2117 |

|

|

000 |

|

|

000 |

2118 |

1( |

) |

000 |

2( |

) |

000 |

|

Accumulated other |

|

Close FY 2012 |

Close FY 2011 |

|

|

|||||||

|

comprehensive income (loss) |

|

|

|

(Unrestated) |

|

|

||||||

|

|

(1) |

|

(2) |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

$ Bil. Mil. Thous. Dols. $ Bil. Mil. Thous. Dols. |

|

|

||||

|

|

|

|

|

|

|

1 |

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

000 |

|

|

|

76a |

Translation adjustment |

2122 |

|

000 |

|

|

|

||||||

|

|

|

|

|

|

|

1 |

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

000 |

|

|

|

76b |

All other components |

2128 |

|

000 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

2 |

||

|

|

|

|

|

|

|

|

|

|

||||

76c |

Total accumulated other comprehensive income (loss) — |

|

|||||||||||

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

000 |

|||

|

Equals sum of |

76a |

and |

76b |

............................................................................................... |

|

|

2129 |

|

000 |

|||

|

|

|

|

|

|

|

|

|

1 |

|

2 |

||

77Other — Include noncontrolling interest per FASB ASC 810 (formerly FAS 160). Specify major items

78Total owners’ equity — Sum of items 73 , 74 , 75 , 76c and 77 for incorporated U.S. affiliates and those unincorporated U.S. affiliates for which this breakdown is available. For those unincorporated U.S. affiliates that cannot provide a breakdown for items 73 through 77 , report total owners’ equity in this item. For both incorporated and unincorporated U.S. affiliates, total owners’ equity must equal item 69 (total assets) minus item 70 (total liabilities) .............................................................

2119 |

000 |

000 |

1 |

|

2 |

2120 |

000 |

000 |

Section G — CHANGE IN RETAINED EARNINGS (DEFICIT) — If retained earnings (deficit) is not shown as a separate account, show change in total owners’ equity.

79 |

Balance, close FY ended in 2011, before restatement due to a change in the entity (e.g., due to mergers, |

|

$ Bil. Mil. Thous. Dols. |

||

|

acquisitions, divestitures, etc.) or due to a change in accounting methods or principles, if any — Enter |

|

|||

|

|

|

|||

|

|

|

|

|

1 |

|

amount from item |

74 |

, column 2; if retained earnings (deficit) is not shown as a separate account, enter |

|

|

|

|

|

|||

|

|

|

|

000 |

|

|

amount from item |

78 |

, column 2 |

2211 |

|

|

|

|

|

|

1 |

80Increase (decrease) due to restatement of FY 2011 closing balance. — Specify reason(s) for change

81

82

83

84

FY 2011 closing balance as restated — Item 79 plus item 80 ............................................................................

Net income (loss) — Enter amount from item 51 ....................................................................................................

Dividends or earnings distributed — Incorporated affiliates, enter amount of dividends declared, inclusive of taxes withheld, out of current- or

Other increases (decreases) in retained earnings (deficit), including stock or liquidating dividends, or in total owners’ equity if retained earnings (deficit) is not shown as a separate account, including capital contributions (return of capital). — Specify

2212

1

2213

1

2214

1

2215

1

000

000

000

000

85FY 2012 closing balance — Sum of items 81 , 82 , and 84 minus item 83 ; also must equal item 74 , column 1, if retained earnings (deficit) is shown as a separate account, or item 78 , column 1, if retained earnings (deficit) is not shown as a separate account................................................................................................

2217

1

2218

000

000

FORM |

Page 11 |

Part II – Financial and Operating Data of U.S. Affiliate – Continued

Section H — LAND AND OTHER PROPERTY, PLANT, AND EQUIPMENT

Include all land and other property, plant, and equipment carried anywhere on the U.S. affiliate’s balance sheet, whether or not with the intent of holding and actively using the asset in the operating activity of the business. Land refers to any part of the earth’s surface, including land being leased from others under capital leases. Other property, plant, and equipment includes: timber, mineral and like rights owned; all structures, machinery, equipment, special tools, and other depreciable property; construction in progress; capitalized tangible and intangible exploration and development costs; and the capitalized value of timber, mineral, and like rights leased by the affiliate from others under capital leases. On the balance sheet these items may be carried in property, plant, and equipment (item 67 ) or in other assets (item 68 ).

Exclude items that the affiliate has sold on a capital lease basis.

CHANGE FROM FY 2011 CLOSING BALANCES TO FY 2012 CLOSING BALANCES |

$ Bil. Mil. Thous. Dols. |

|

1 |

86Net book value of all land and other property, plant, and equipment at close of FY 2011 wherever carried

on the balance sheet, before restatement due to a change in entity |

2386 |

000 |

CHANGES DURING FY 2012

|

|

|

|

|

|

1 |

87 |

Give amount by which the net book value in item |

86 |

would be restated due to: |

|

||

|

•Changeinentity(i.e., due to the acquisition of, or merger with, another company, or the divestiture of a |

|

||||

|

subsidiary, change in fiscal year, etc.) |

|

|

|

|

|

|

•Changeinaccountingmethodsorprinciples |

|

|

|

|

|

|

If a decrease, put amount in parentheses |

2387 |

000 |

|||

|

|

|

|

|

|

1 |

EXPENDITURES — Include all purchases by, or transfers to, the U.S. affiliate of land and other property, plant, and |

|

|||||

equipment. Exclude all changes caused by a change in the entity or by a change in accounting methods or |

|

|||||

principles during FY 2012 (include such changes in item |

|

|

|

|||

87 |

). |

|

|

|||

Expenditures by the U.S. affiliate for, or transfers into the U.S. affiliate of,

88Land — Report expenditures for land except land held for resale.

Report land held for sale in item |

93 |

...................................................................................................................... 2388 |

000 |

|

|

|

1 |

89Mineral rights, including timber — Report capitalized expenditures to acquire mineral and timber rights. Exclude capitalized expenditures for the exploration and development of natural resources. Include those

in item |

90 |

............................................................................................................................................................... 2389 |

000 |

|

|

|

1 |

90Property, plant, and equipment other than land and mineral rights (Exclude changes due to mergers and

|

|

000 |

||

acquisitions. Report them in item |

87 |

.) |

2390 |

|

|

|

|

|

1 |

91Depreciation

92Depletion .......................................................................................................................................................................................................................................................................................................................................

2392

1

2393

1

000

000

93Net book value of sales, retirements, impairments, or transfers out of assets defined for inclusion in this section, and other decreases (increases) — INCLUDE expenditures for land held for sale. EXCLUDE amounts

|

|

relating to the divestiture of U.S. affiliates. Report such amounts in item |

87 |

............................................................... |

2394 |

000 |

|||||||||

BALANCES AT CLOSE OF FY 2012 |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

94 |

Net book value of land and other property, plant, and equipment at close of FY 2012 — |

|

|

|||||||||||

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

000 |

|||||

|

|

Sum of items |

86 |

through |

90 |

, minus sum of items |

91 |

through |

93 |

.......................................................................... |

2395 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

000 |

||||||||||||

|

95 |

Accumulated depreciation and depletion |

2396 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

96Gross book value of all land and other property, plant, and equipment at close of FY 2012, wherever

carried on the balance sheet — Sum of items |

94 |

and |

95 |

.......................................................................................... 2397 |

000 |

ADDENDA

97Gross book value of land owned — The portion of item 96 that is the gross book value of land owned. Include undeveloped and agricultural land, and also the value of land you own that is located under developed properties such as office buildings, apartment buildings, retail buildings, etc. If your accounting and reporting systems do not separately account for land and building components when buildings sit upon land that you own, provide your best

estimate of the gross book value of the land owned |

2356 |

98Expensed petroleum and mining exploration and development expenditures — Include expensed expenditures to acquire or lease mineral rights. EXCLUDE expenditures that are capitalized and expenditures made in prior years that are reclassified in the current year; such expenditures are considered to be expenditures only in the year when

initially expended |

2398 |

BEA USE ONLY

2399

1

000

1

000

1

FORM |

Page 12 |

Part II – Financial and Operating Data of U.S. Affiliate – Continued

Section I — RESEARCH AND DEVELOPMENT

Research and development (R&D) expenditures – Include all costs incurred in performing R&D, including depreciation, amortization, wages and salaries, taxes, materials and supplies, overhead — whether or not allocated to others — and all other indirect costs.

See instructions 99

NOTE — Items 99 through 104 pertain to R&D performed by the U.S. affiliate, including R&D performed by the U.S. affiliate for others under contract.

$ Bil. Mil. Thous. Dols.

99R&D performed BY the U.S. affiliate, total — Sum of items 100 through 104 . EXCLUDE the cost of R&D

|

funded by the U.S. affiliate but performed by others. Report such R&D costs in item 105 |

2403 |

|

Funded (or reimbursed) by: |

|

100 |

U.S. affiliate itself |

2405 |

101 |

Federal Government (i.e., federally financed R&D) |

2406 |

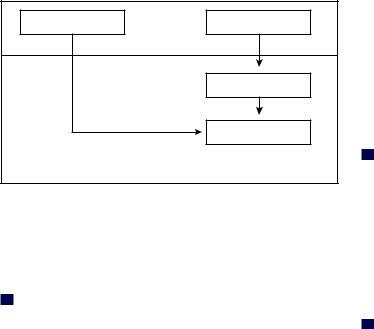

102 |

Affiliated foreign group. See the example below for an illustration of affiliated foreign group |

2411 |

103Foreign affiliates owned by this U.S. affiliate. See item 7 for a diagram that illustrates

|

foreign affiliates owned by this U.S. affiliate |

2412 |

104 |

Others under contract |

2407 |

105 |

R&D performed FOR the U.S. affiliate by others on a contractual basis |

2408 |

106R&D employees — Report the number of employees engaged in R&D in the United States (including the District of Columbia, Puerto Rico, and all territories and possessions of the United States) during the fiscal year that ended in calendar year 2012.

R&D employees are scientists, engineers, and other professional and technical employees, including managers, engaged in scientific or engineering R&D work, at a level that requires knowledge of physical, social, or life sciences, engineering, mathematics, statistics, or computer science at least equivalent to that acquired through completion

of a

1

000

1

000

1

000

1

000

1

000

1

000

1

000

Number of

R&D Employees

1

BEA USE ONLY

2410

1

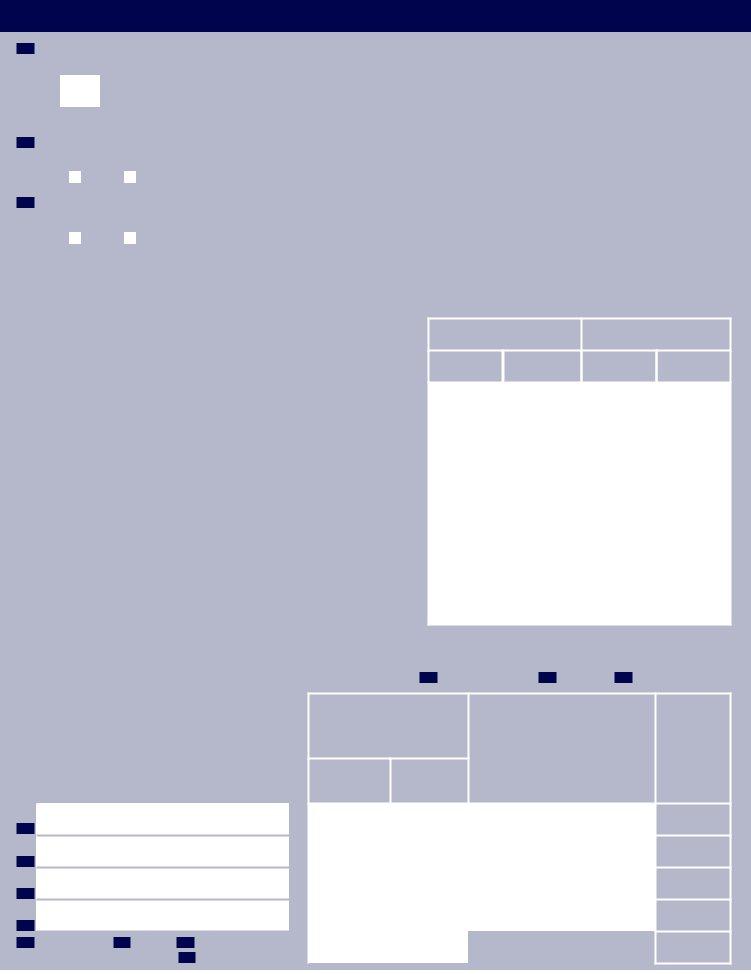

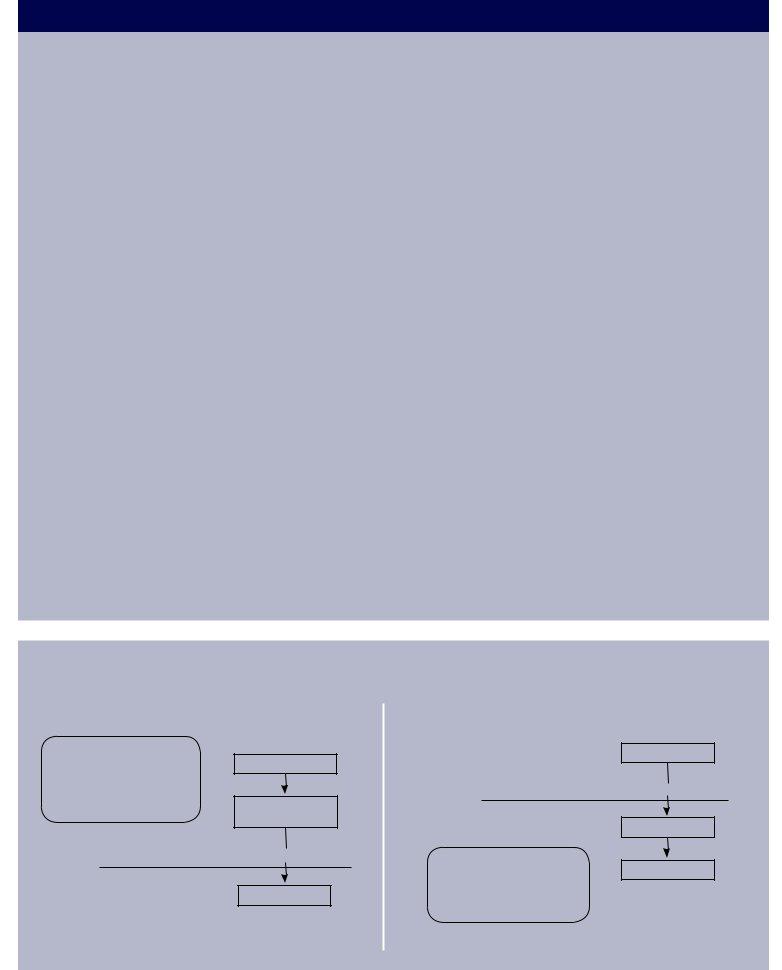

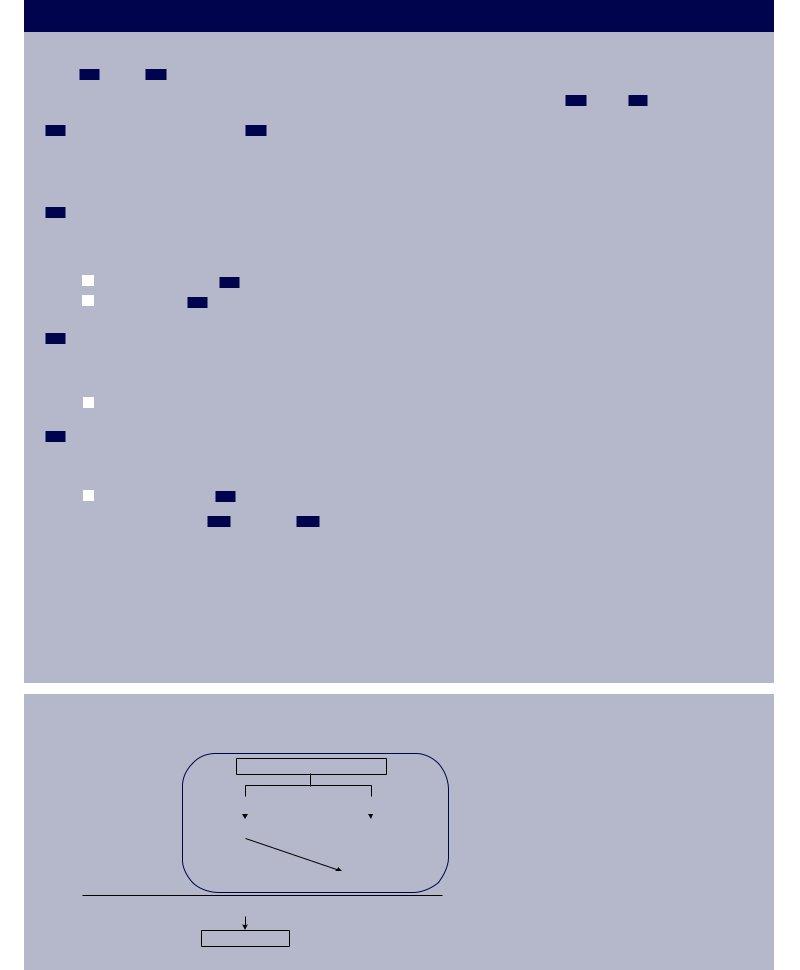

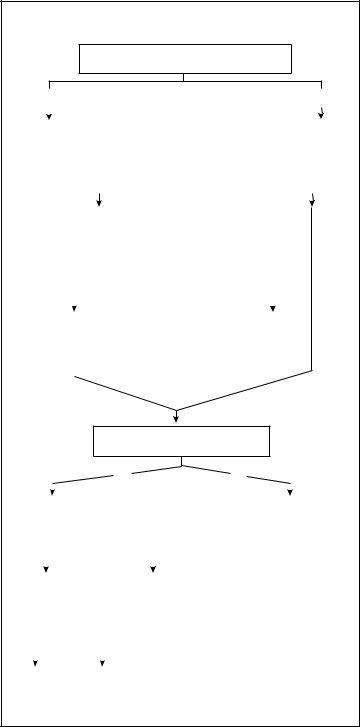

EXAMPLE OF AFFILIATED FOREIGN GROUP

Foreign United States

Affiliated foreign group

Foreign company X

>50 percent |

|

>50 percent |

||

|

|

|

|

|

|

|

|

||

Foreign parent |

|

Foreign company Y |

||

|

|

|

|

|

>50 percent

Foreign company Z

10 to 100 percent

U.S. affiliate

Affiliated foreign group means (i) the foreign parent, (ii) any foreign person, proceeding up the foreign parent’s ownership chain, which owns more than 50 percent of the person below it, up to and including that person which is not owned more than 50 percent by another foreign person, and (iii) any foreign person, proceeding down the ownership chain(s) of each of these members, which is owned more than 50 percent by the person above it. (“Person” is used in the broad legal sense and includes companies.)

FORM |

Page 13 |

Part II – Financial and Operating Data of U.S. Affiliate – Continued

Section J — U.S. TRADE IN GOODS BY U.S. AFFILIATE ON A SHIPPED BASIS

Report the value of goods exported and imported by the U.S. affiliate during the fiscal year that ended in calendar year 2012.