When you want to fill out be 605 form, you don't need to download and install any software - just use our online tool. To keep our tool on the forefront of convenience, we strive to put into practice user-oriented capabilities and enhancements on a regular basis. We're at all times happy to receive feedback - play a pivotal part in revampimg how you work with PDF forms. For anyone who is looking to get going, this is what it takes:

Step 1: First, open the tool by clicking the "Get Form Button" at the top of this site.

Step 2: Using this state-of-the-art PDF editing tool, you could accomplish more than simply fill out blank form fields. Edit away and make your documents appear sublime with customized text added in, or optimize the file's original content to perfection - all that comes along with the capability to add stunning pictures and sign the PDF off.

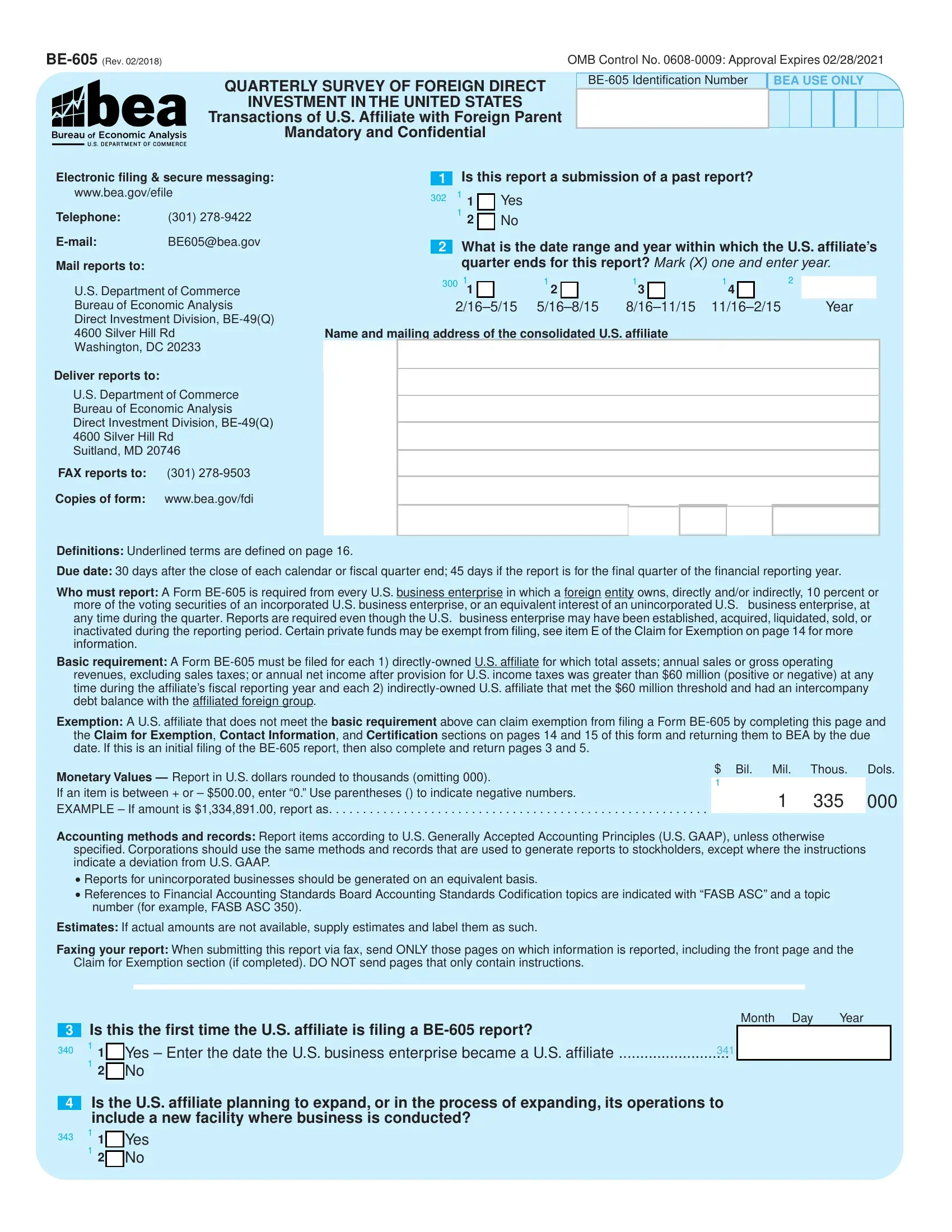

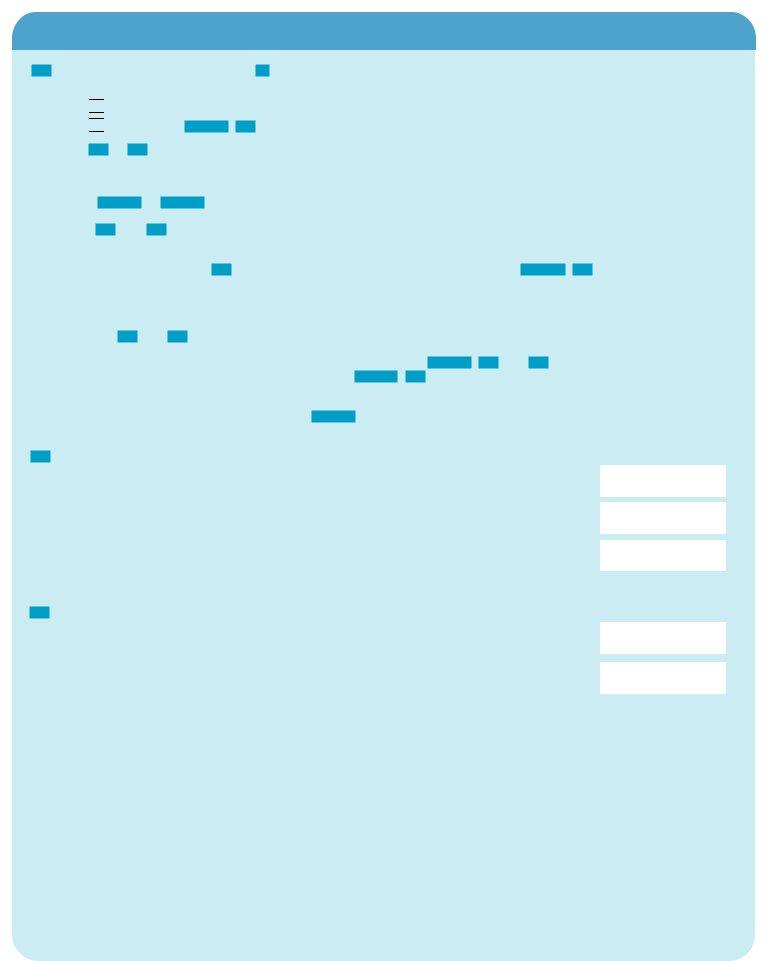

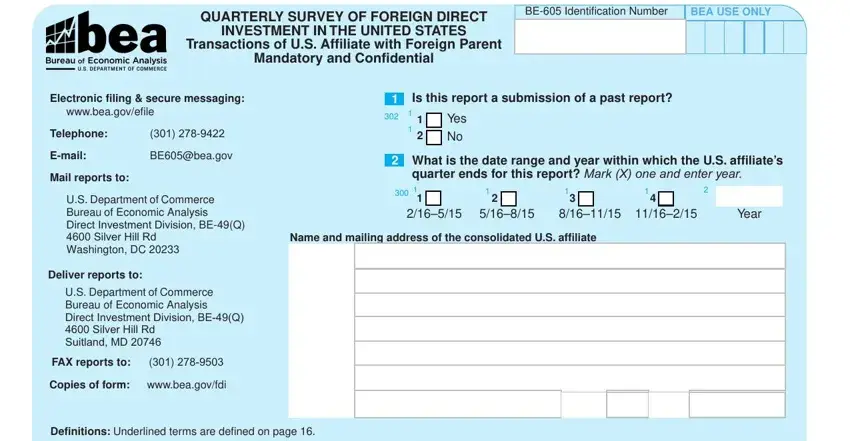

For you to finalize this PDF form, be sure you type in the necessary details in each area:

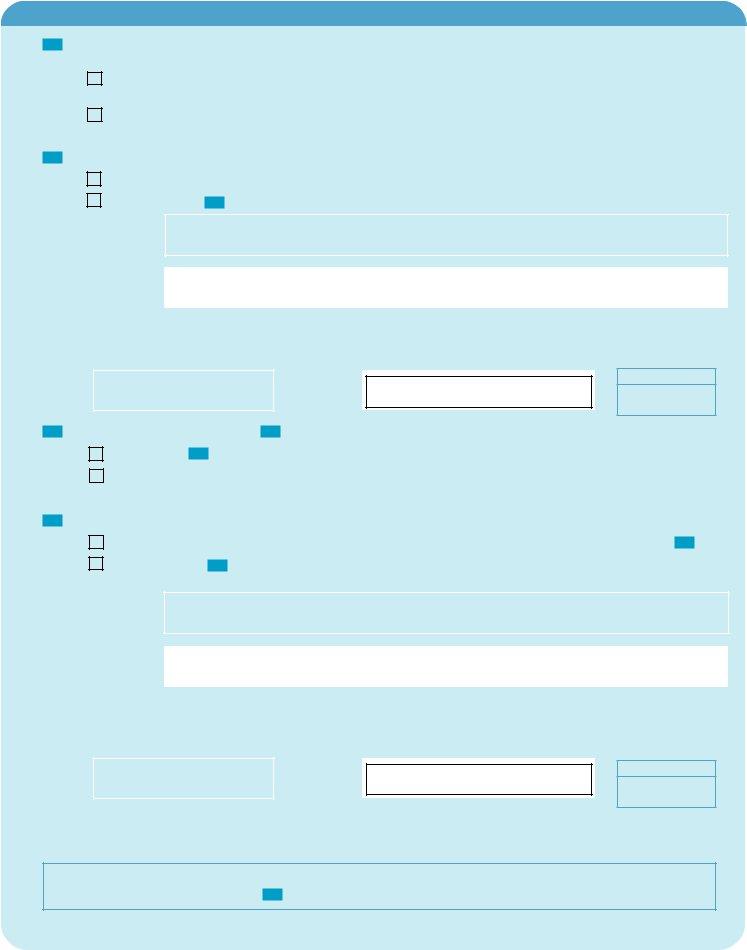

1. The be 605 form necessitates specific information to be typed in. Be sure that the following fields are completed:

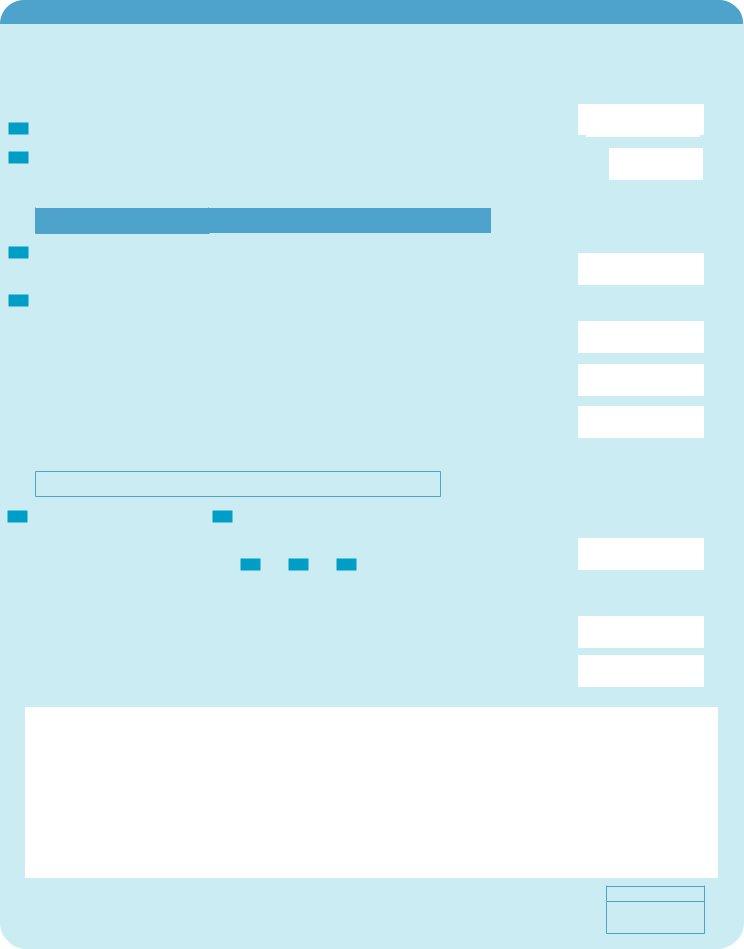

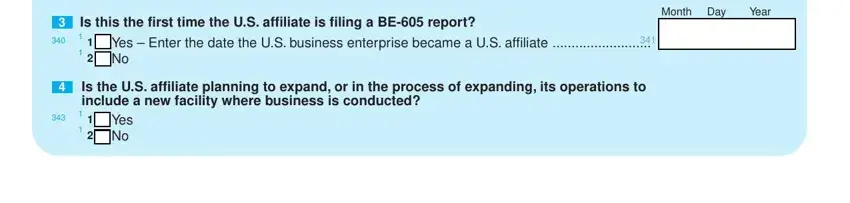

2. Now that the previous segment is finished, you have to put in the necessary particulars in Is this the first time the US, Yes Enter the date the US, Is the US affiliate planning to, Month Day Year, include a new facility where, and Yes No so you can progress to the next part.

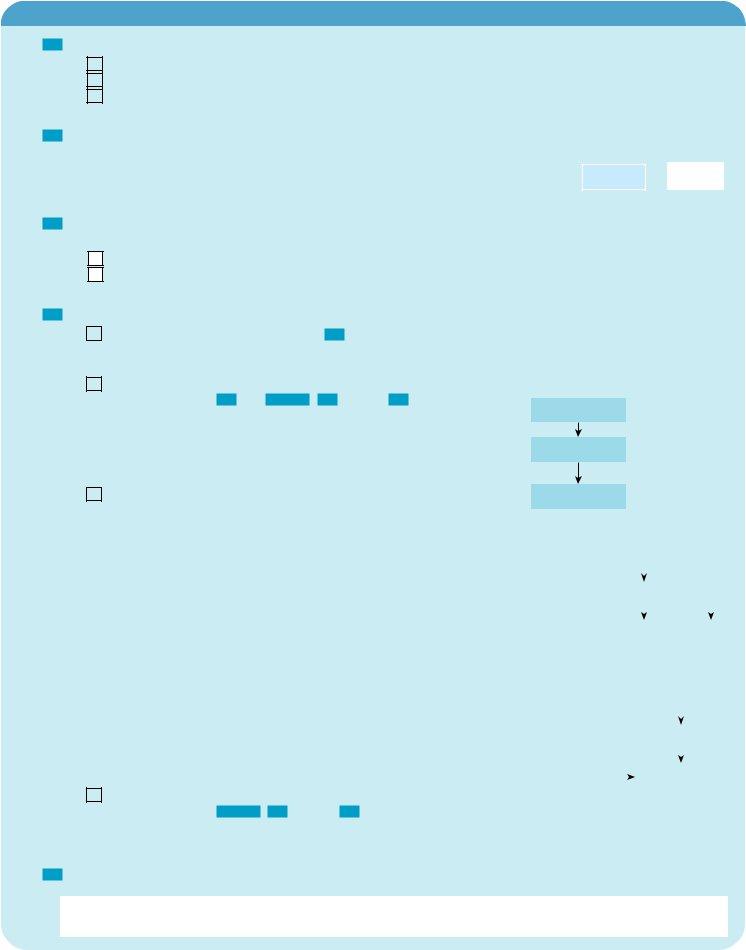

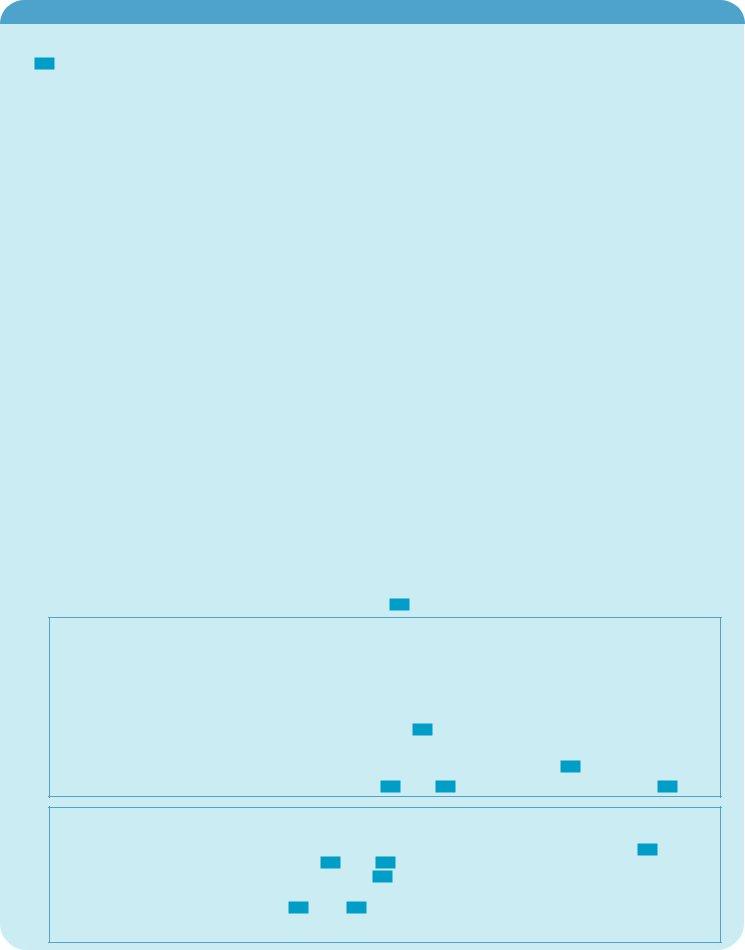

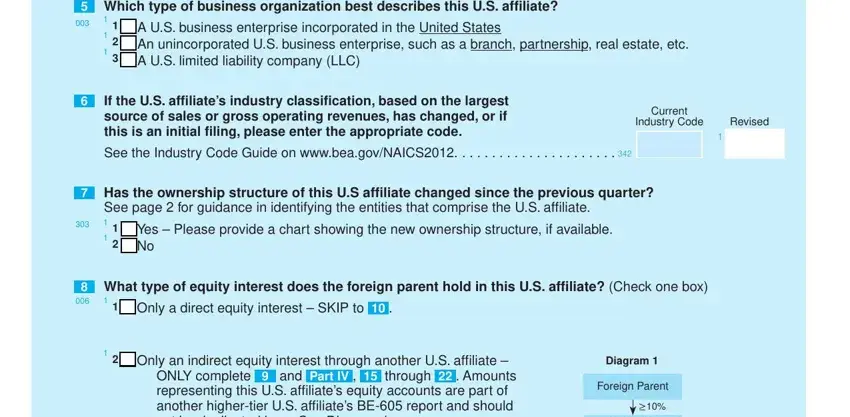

3. This step is generally hassle-free - fill in all of the form fields in Which type of business, A US business enterprise, If the US affiliates industry, See the Industry Code Guide on, Current, Industry Code, Revised, Has the ownership structure of, See page for guidance in, Yes Please provide a chart, What type of equity interest does, Only a direct equity interest, Only an indirect equity interest, Diagram, and ONLY complete and Part IV to complete this process.

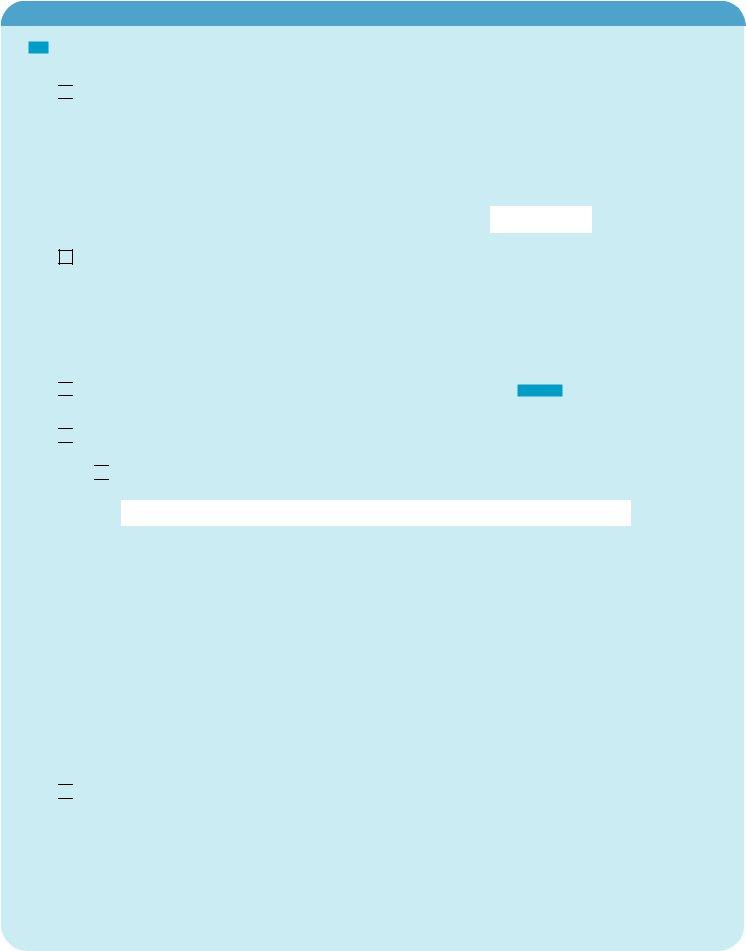

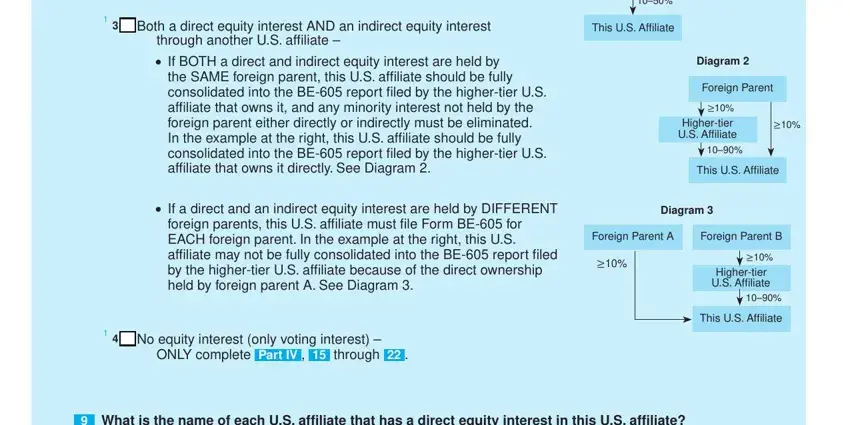

4. Filling in Both a direct equity interest AND, This US Affiliate, through another US affiliate If, the SAME foreign parent this US, If a direct and an indirect, foreign parents this US affiliate, No equity interest only voting, ONLY complete Part IV through, Diagram, Highertier US Affiliate, Foreign Parent, This US Affiliate, Diagram, Foreign Parent A, and Foreign Parent B is key in this section - be certain to be patient and be attentive with every empty field!

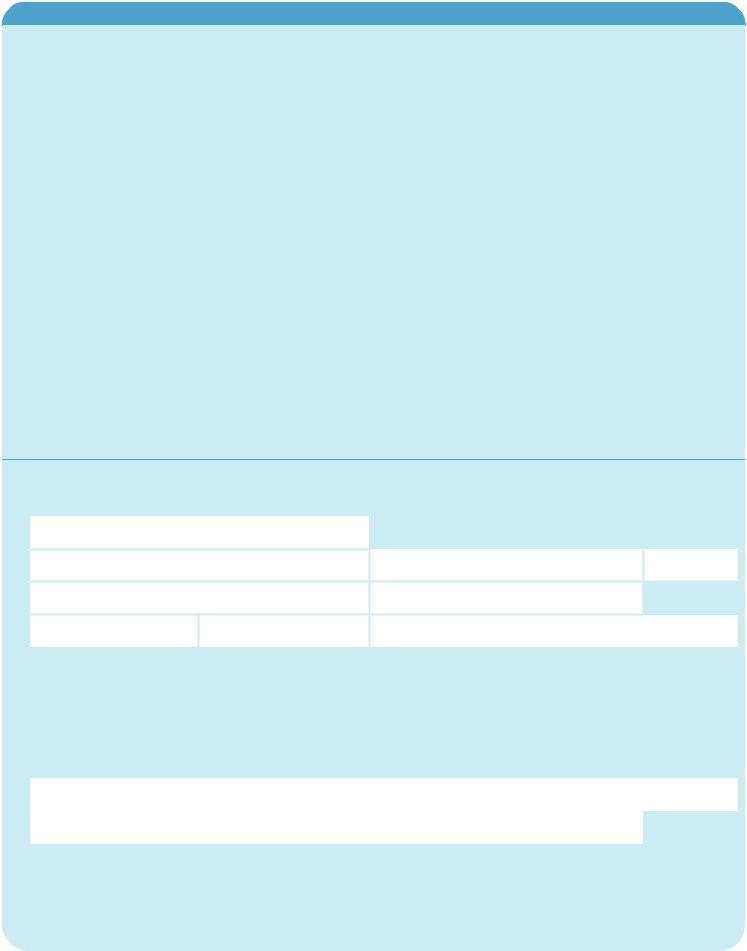

5. The final step to finalize this form is integral. Ensure to fill out the mandatory form fields, for example Page, What is the name of each US, and FORM BE Rev, prior to submitting. Otherwise, it could result in a flawed and potentially incorrect form!

It is possible to get it wrong when filling out your FORM BE Rev, consequently be sure to reread it before you'll send it in.

Step 3: Before moving forward, you should make sure that all form fields were filled in right. Once you believe it is all good, press “Done." Join FormsPal now and instantly get access to be 605 form, prepared for downloading. Every last change you make is handily saved , enabling you to modify the document at a later stage when necessary. FormsPal is devoted to the personal privacy of our users; we always make sure that all personal data going through our editor is kept protected.