Working with PDF forms online is always simple with our PDF editor. Anyone can fill in how to psers form here and use a number of other options we offer. To make our editor better and easier to use, we continuously design new features, taking into account feedback from our users. In case you are looking to get started, here's what you will need to do:

Step 1: Click the "Get Form" button above on this webpage to open our PDF editor.

Step 2: Using our advanced PDF editing tool, you may do more than merely fill in blanks. Edit away and make your docs look faultless with customized textual content added in, or optimize the original input to excellence - all comes along with the capability to incorporate just about any graphics and sign it off.

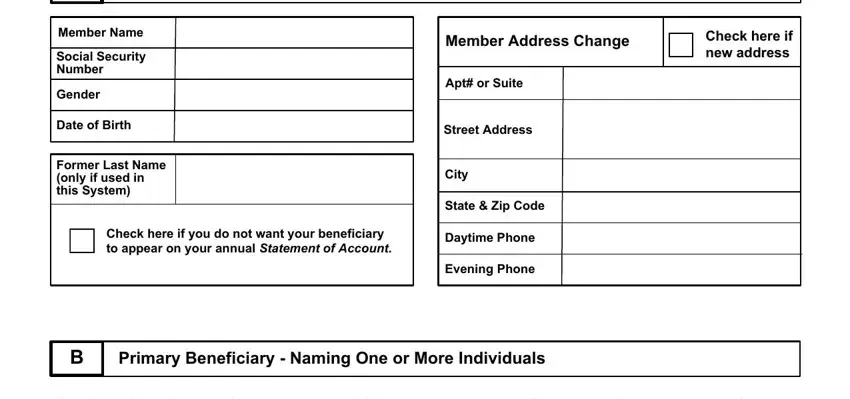

This PDF doc will need some specific details; to guarantee accuracy and reliability, take the time to bear in mind the recommendations below:

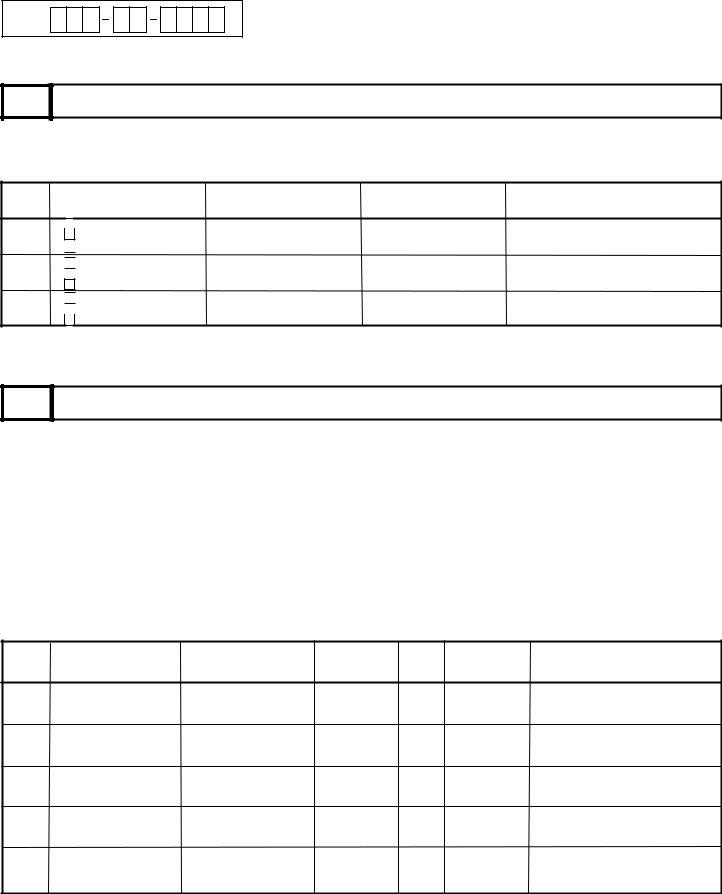

1. You should complete the how to psers form accurately, hence be careful when filling in the parts comprising all these blanks:

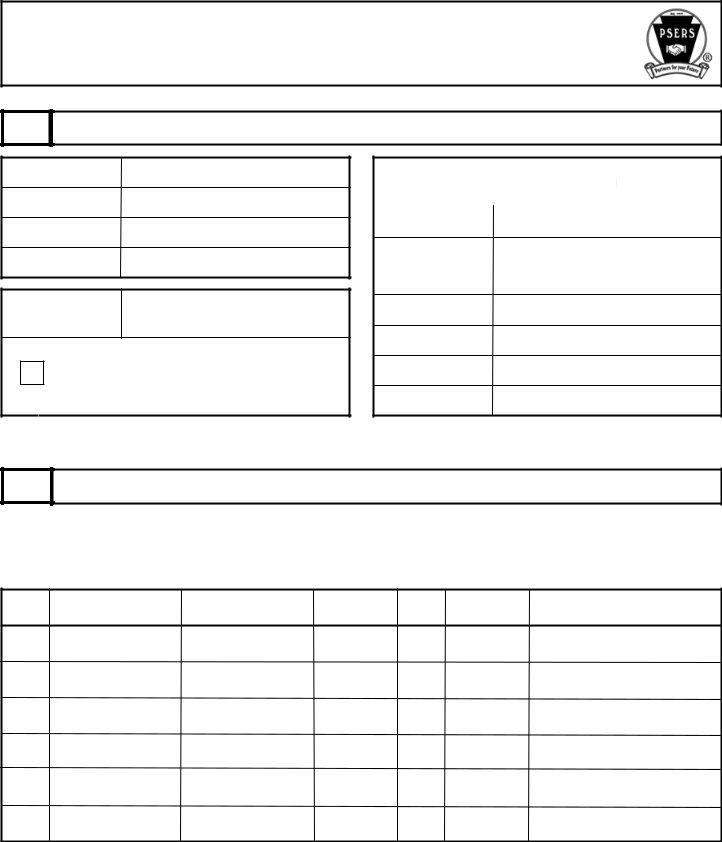

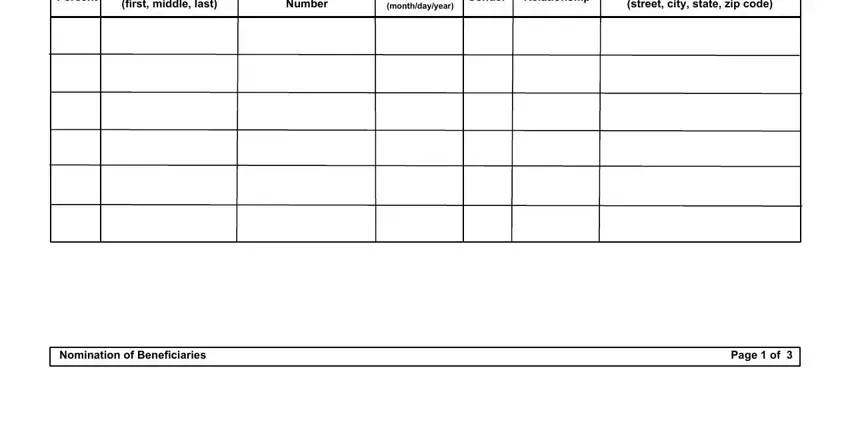

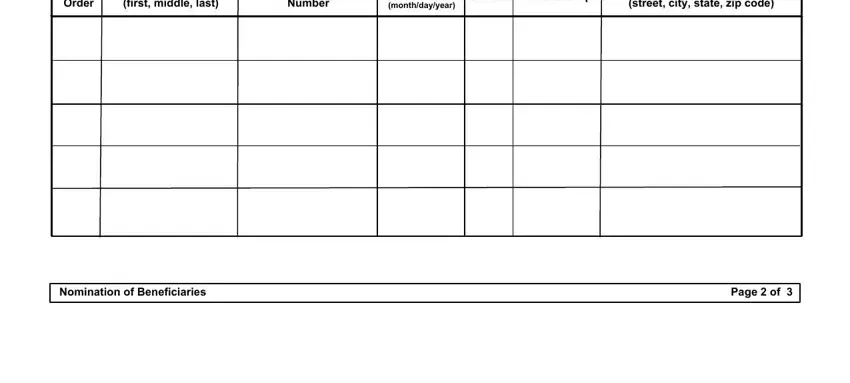

2. Once your current task is complete, take the next step – fill out all of these fields - Percent, first middle last, Number, Date of Birth monthdayyear, Gender, Relationship, street city state zip code, Nomination of Beneficiaries, and Page of with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

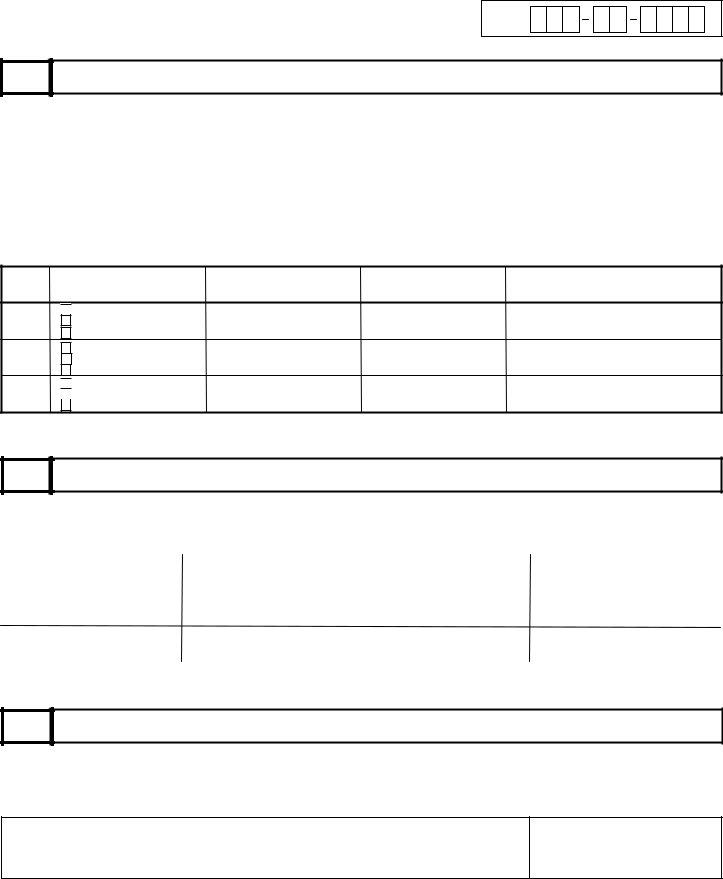

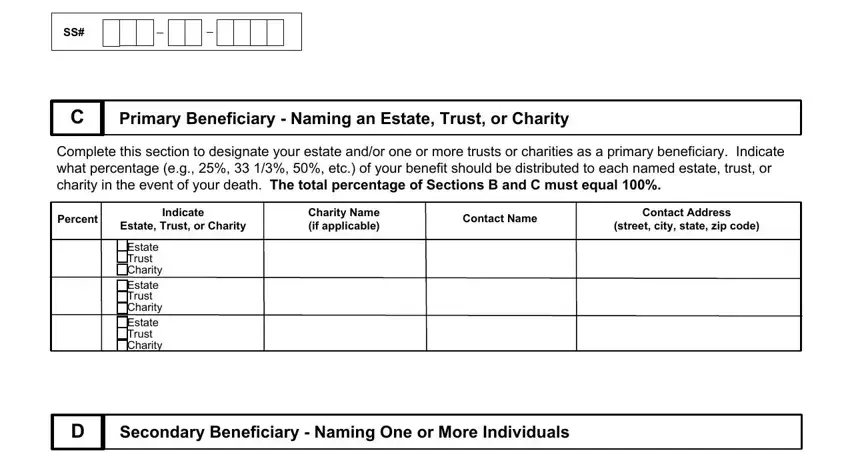

3. The next step is generally hassle-free - fill out every one of the form fields in Primary Beneficiary Naming an, Complete this section to designate, Charity Name if applicable, Contact Name, Contact Address, street city state zip code, Percent, Indicate, Estate Trust or Charity Estate, Secondary Beneficiary Naming One, and Complete this section to designate to conclude this part.

4. Filling in Percent Order, first middle last, Number, Date of Birth monthdayyear, Gender, Relationship, street city state zip code, Nomination of Beneficiaries, and Page of is vital in this next stage - make sure to devote some time and take a close look at every empty field!

Always be extremely attentive while filling in Number and street city state zip code, as this is where a lot of people make errors.

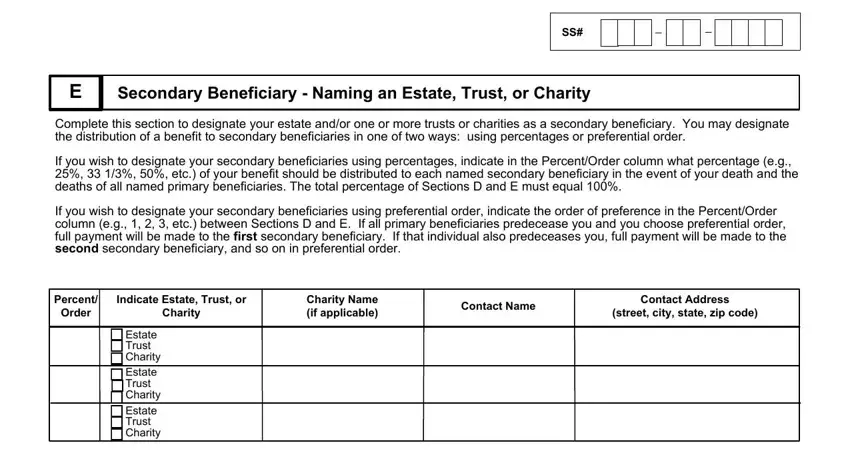

5. Because you come close to the end of this file, you'll notice several extra things to undertake. In particular, Secondary Beneficiary Naming an, Complete this section to designate, If you wish to designate your, If you wish to designate your, Percent Order, Indicate Estate Trust or, Charity, Charity Name if applicable, Contact Name, Contact Address, street city state zip code, and Estate Trust Charity Estate Trust should be filled in.

Step 3: When you have reviewed the details in the document, just click "Done" to finalize your form. Make a free trial subscription at FormsPal and gain direct access to how to psers form - downloadable, emailable, and editable in your personal cabinet. We do not share or sell the information that you type in while working with forms at FormsPal.