Navigating the process of closing a business involves multiple steps, one of which includes the proper filing of Form BN 6, as per the Registration of Business Names Act. This form serves as an official notice of cessation of a registered business, requiring comprehensive details of the business and the particulars relating to its closure. It is designed to be used by both individuals and corporations, aiming to streamline the process of communicating a business’ end to the relevant authorities. The form is divided into sections that capture everything from basic business information, reasons for the closure, to the final cessation date, alongside details of the individuals authorized to notify the closure. Additionally, instructions for completing the form emphasize the importance of providing clear, accurate information, adhering to presentation standards, and the necessity of including supporting documents upon submission. This attention to detail ensures a satisfactory completion of legal obligations towards the Registrar of Companies, facilitating a smoother transition during what can be a challenging period for business owners.

| Question | Answer |

|---|---|

| Form Name | Form Bn6 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | companies office of jamaica forms, amazon, business registration form jamaica pdf, bn6 form jamaica |

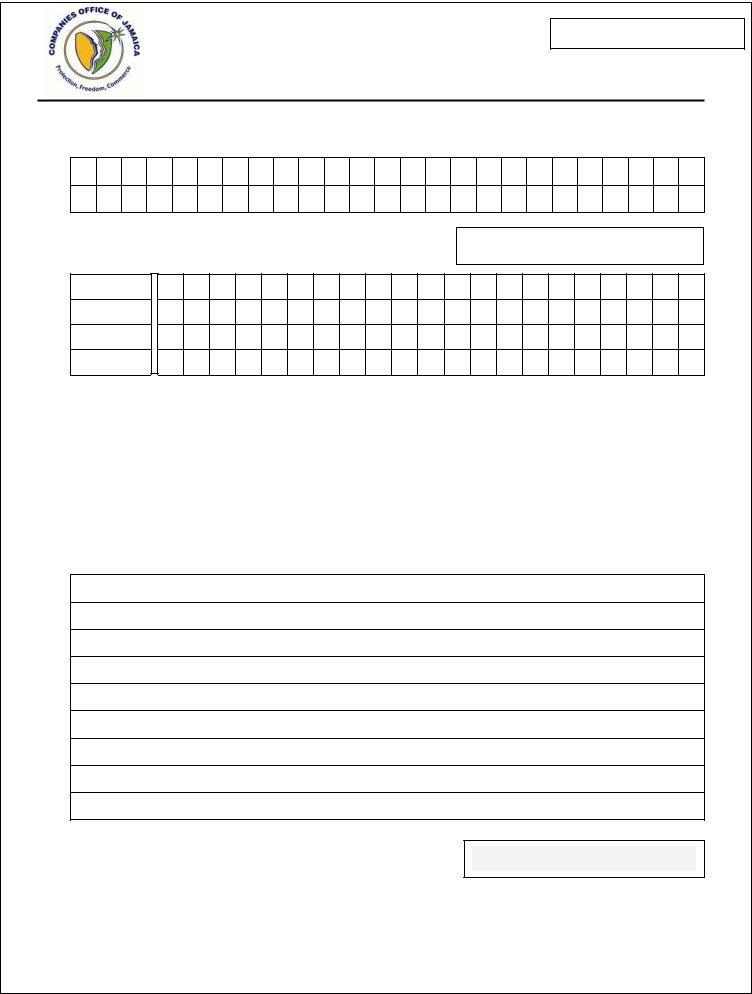

FORM BN 6 Rev 1.2011

REGISTRATION OF BUSINESS NAMES ACT

NOTICE OF CESSATION OF REGISTERED BUSINESS

(Pursuant to Section 15 of the Act)

SECTION A. BUSINESS INFORMATION

1. NAME OF BUSINESS

1A. BUSINESS REGISTRATION NUMBER:

2.PRINCIPAL ADDRESS Street/District

Post Office

Town

Parish

3. |

CONTACT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone |

|

|

|

_ |

|

|

|

|

|

|

|

|

Fax |

|

|

|

|

|

|

_ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

BUSINESS TAXPAYER REGISTRATION NUMBER (TRN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION B. PARTICULARS RELATIONG TO CLOSURE

=============================================================================================================

4. REASON FOR CESSATION (CLOSURE)

5. DATE OF CESSATION (CLOSURE)

_______/__________________/______

Day |

Month |

Year |

1

FORM BN 6 Rev 1.2011

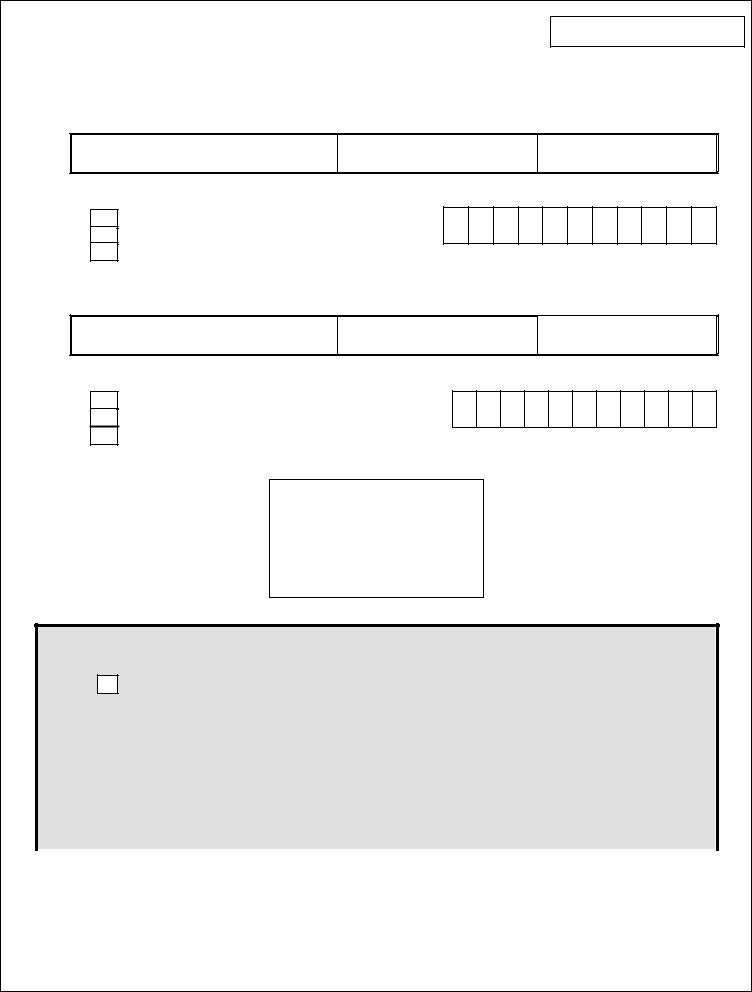

SECTION C. PARTICULARS OF INDIVIDUALS AUTHORIZED TO NOTIFY OF CLOSURE

=============================================================================================================

I, hereby declare all statement of particulars regarding the closure of the registered business furnished on this form to be true to the best of my (our) knowledge, information and belief.

1.NAME OF INDIVIDUAL #1:

SURNAME:

CHRISTIAN NAME:

MIDDLE NAME(S)

1A. INDICATE CAPACITY: |

1B. TAXPAYER REGISTRATION NUMBER (TRN) |

BUSINESS OWNER

DIRECTOR

SECRETARY

SIGNATURE __________________________________________

2.NAME OF INDIVIDUAL #2:

_

DATE_________________________________

SURNAME:

CHRISTIAN NAME:

MIDDLE NAME(S)

2A. INDICATE CAPACITY: |

2B. TAXPAYER REGISTRATION NUMBER (TRN) |

BUSINESS OWNER DIRECTOR SECRETARY

SIGNATURE __________________________________________

Affix company seal (where applicable)

_

DATE_________________________________

FOR OFFICIAL USE ONLY

Indicate the supporting documentation presented along with application by ticking relevant box (es):

VALID IDENTIFICATION. State Type ___________________________________________________

|

|

VERIFICATION OF ADDEESS |

|

VERIFICATION OF TRN |

|

|

|

||

|

|

|||

|

|

|

|

|

|

|

PROOF OF CERTIFICATION ATTACHED |

|

WORK PERMIT |

|

|

|

|

|

|

|

OTHER. Please certify ___________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_______/__________________/______ |

|

|

|

||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

Day |

Month |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Officer Signature |

Date |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

FORM BN 6 Rev 1.2011

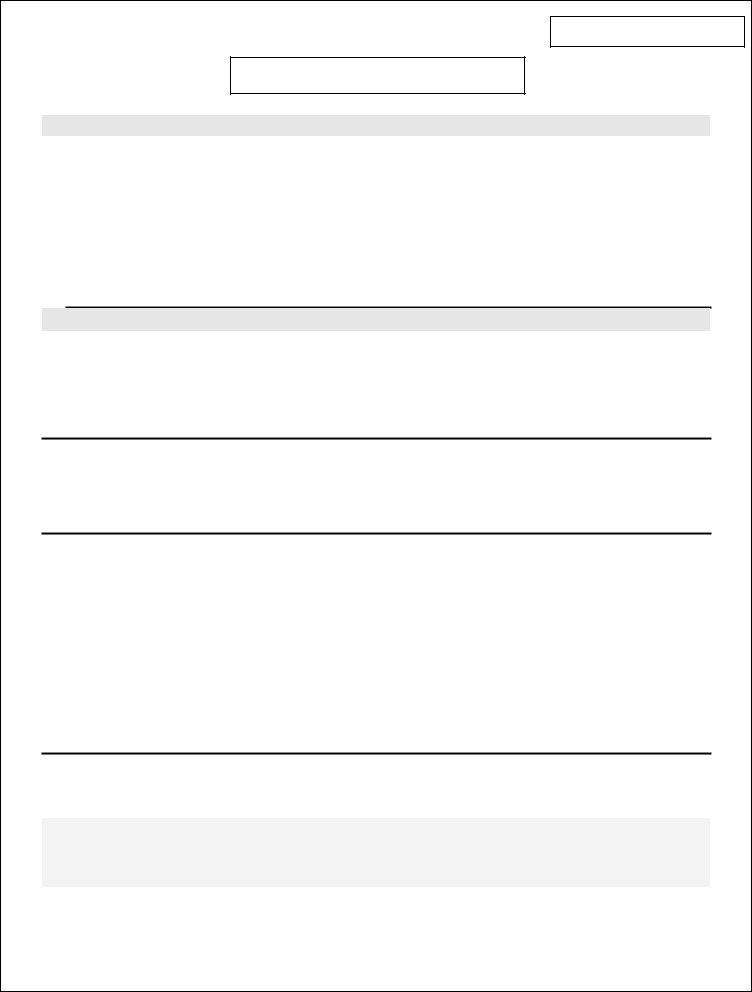

INSTRUCTIONS FOR COMPLETION OF BN 6

This form is to be used for giving notice to the Registrar of the cessation of registered business by individuals or corporation.

GENERAL INFORMATION

.All the fields on the form are to be filled out with the relevant information except where not applicable, the words “NONE” or N/A should be written. If the space provided is insufficient to contain all the required information, the remaining information must be set out in a schedule and annexed accordingly. Each schedule should be numbered sequentially

Any document lodged with the Registrar must:

•Be on clean, white, good quality letter size paper (8.5 in. x 11in) with 0.5 in. margins at the top, bottom and both sides

•Be typewritten in minimum font size 12 or handwritten clearly in block capital with black or blue permanent ink.

•Be fastened securely at the top left hand corner

•Free of correction fluid. Any errors should be struck through and initialled by the applicant.

SECTION A: PARTICULARS OF BUSINESS

In this section, set out particulars relating to business:

1.Registered Business Name: Name of the business as it appears on the certificate issued by Office of Registrar of Companies.

2.Business registration number: Number found at the top of the certificate issued by the Registrar of companies. e.g 1423/1994.

3.Principal Address: include street, district, town, post office and parish.

4.Taxpayer Registration Number for the business (TRN):

SECTION B: PARTICULARS OF CLOSURE

In this section, set out particulars relating to the closure and date of closure

5.Reason for closure: Describe clearly the reason for closure e.g death of individual, no longer trading, migrating etc.

6.Date of closure: Indicate the date the business ceased to carry on business.

Note also that you are required to present the existing certificate for a business name that has not expired.

SECTION C: PARTICULARS OF INDIVIDUAL (S) AUTHORIZED TO REGISTER THE CLOSURE OF BUSINESS

In this section, set out particulars relating to individual(s) authorized to register change in particulars of the business:

1.Applicant’s full name: include surname, Christian and middle name

2.Capacity: indicate whether business owner, secretary, director or other authorized persons. The statement must be signed by-

(a)Individuals in the case of particulars registered by an individual (sole trader) except in the case of the death of the individual when it is signed by the personal representative of the deceased

(b)All individuals who are partners at the time it ceased to carry on business, in the case of a partnership

(c)By director or secretary in the case of particulars registered by a corporation

3.Taxpayer Registration Number (TRN)

This Notice must in all cases be signed by the individual9s) giving notice of closure and must be sent by post, electronic means or delivered, within six months after the business has ceased to be carried on, along with supporting documents and prescribed fees to:

Companies Office of Jamaica

I Grenada Way

Kingston 5

3