boe 502 d fillable can be filled in effortlessly. Just open FormsPal PDF editing tool to perform the job promptly. The editor is consistently updated by our team, getting handy features and becoming greater. With some simple steps, you are able to begin your PDF editing:

Step 1: Press the "Get Form" button at the top of this page to access our PDF editor.

Step 2: Once you open the tool, there'll be the document ready to be filled in. Apart from filling in different blanks, you could also do many other things with the form, that is writing your own text, changing the original text, adding illustrations or photos, affixing your signature to the PDF, and more.

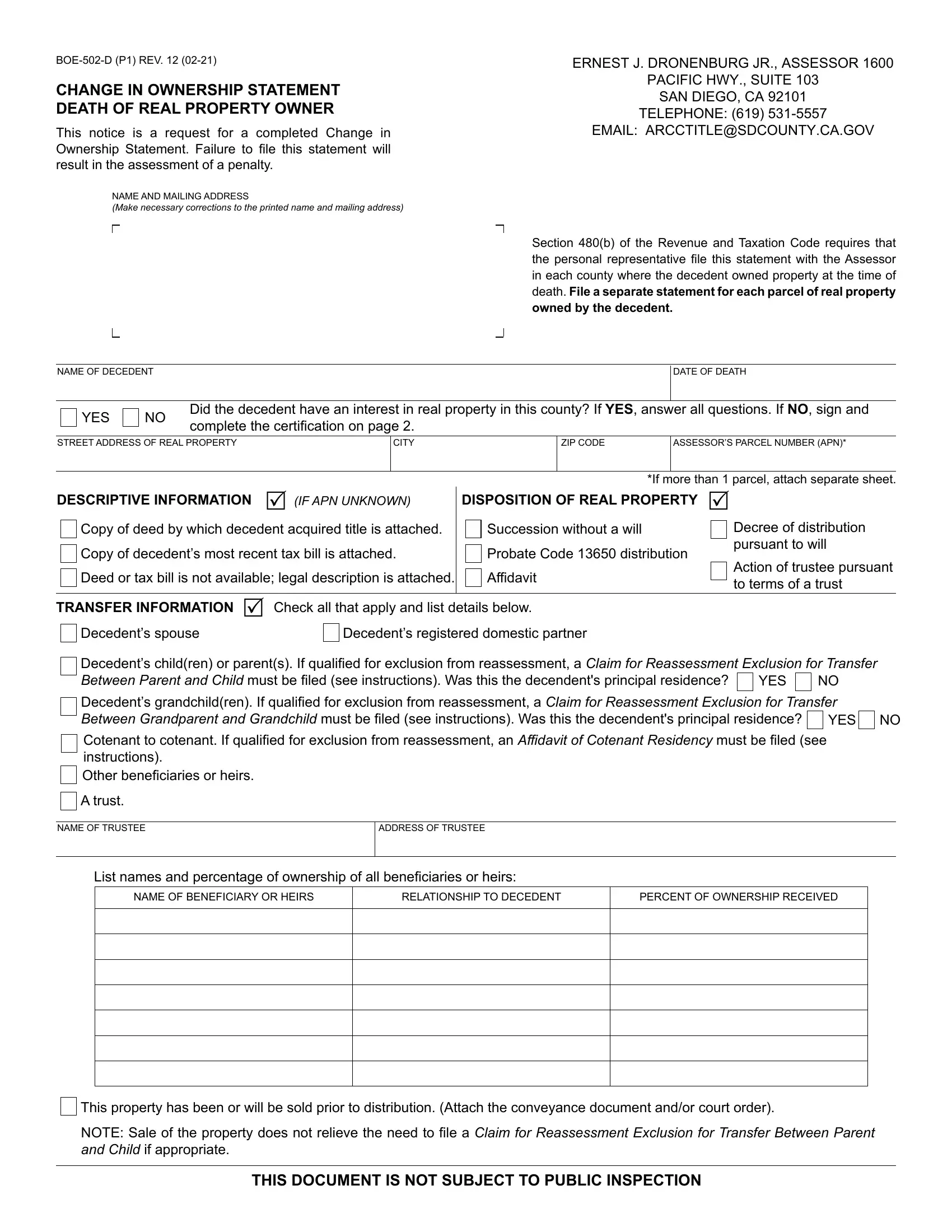

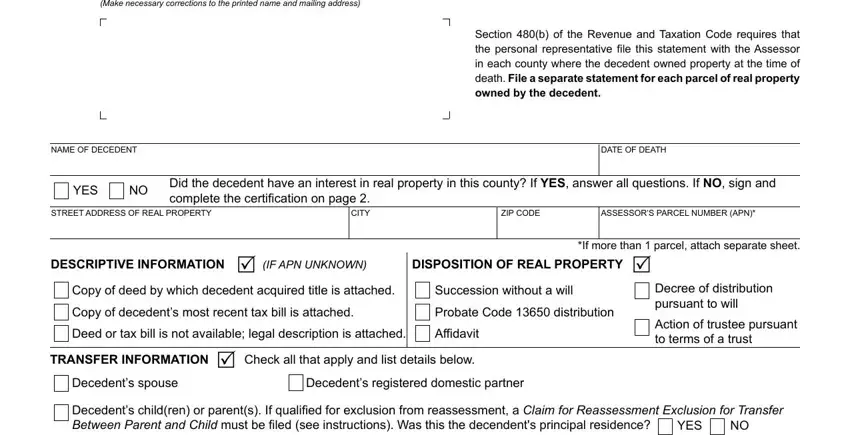

This form requires specific details to be filled in, thus you must take some time to fill in what is expected:

1. To start with, once filling in the boe 502 d fillable, beging with the section containing subsequent blanks:

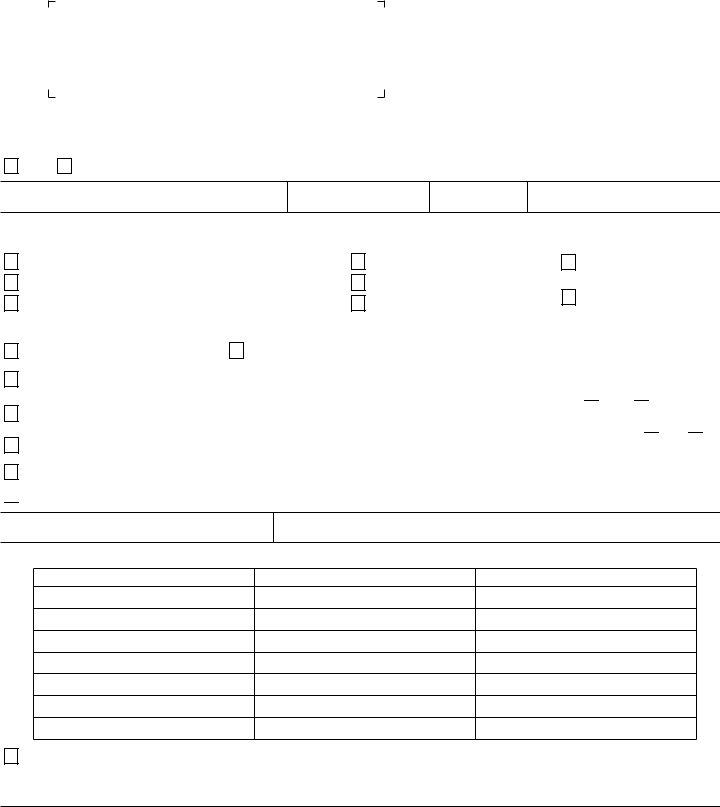

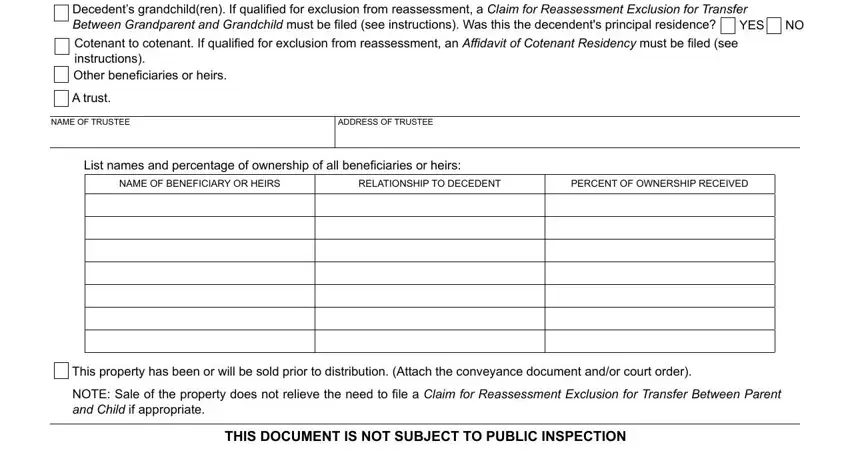

2. Once your current task is complete, take the next step – fill out all of these fields - Decedents children or parents If, YES, NAME OF TRUSTEE, ADDRESS OF TRUSTEE, List names and percentage of, NAME OF BENEFICIARY OR HEIRS, RELATIONSHIP TO DECEDENT, PERCENT OF OWNERSHIP RECEIVED, This property has been or will be, and THIS DOCUMENT IS NOT SUBJECT TO with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

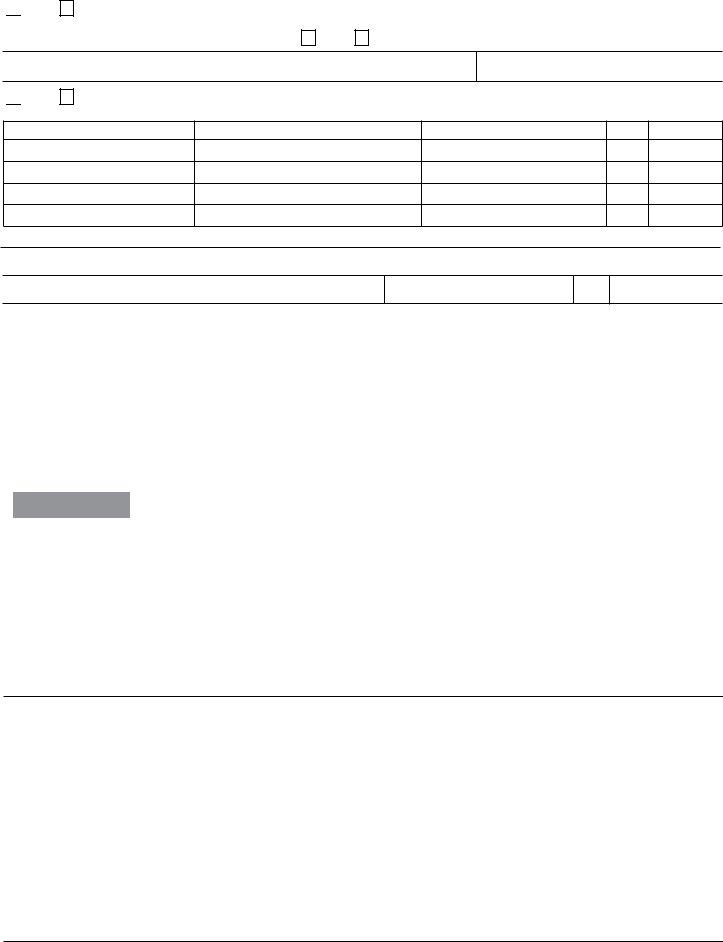

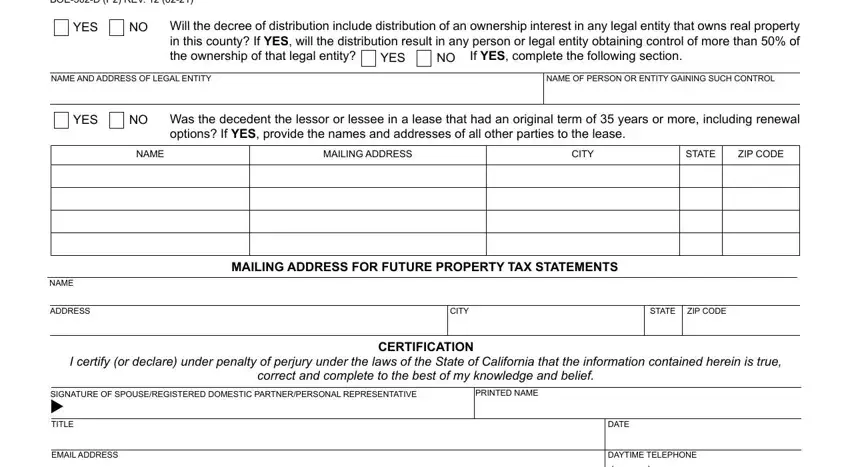

3. In this stage, review BOED P REV, YES, NO Will the decree of distribution, If YES complete the following, YES, NAME AND ADDRESS OF LEGAL ENTITY, NAME OF PERSON OR ENTITY GAINING, YES, NO Was the decedent the lessor or, options If YES provide the names, NAME, MAILING ADDRESS, CITY, STATE, and ZIP CODE. These will need to be filled out with utmost precision.

People frequently make mistakes while filling in NAME OF PERSON OR ENTITY GAINING in this part. Remember to reread what you enter right here.

Step 3: Be certain that the information is accurate and then simply click "Done" to progress further. Create a 7-day free trial account at FormsPal and acquire direct access to boe 502 d fillable - with all transformations saved and available in your FormsPal account. Whenever you work with FormsPal, you can easily fill out documents without the need to worry about personal data incidents or entries being distributed. Our protected software makes sure that your personal information is kept safe.