Whenever you need to fill out Form Bt 199, you won't need to download and install any kind of programs - just try using our PDF tool. Our development team is always endeavoring to improve the tool and ensure it is even easier for users with its many features. Enjoy an ever-improving experience now! Here is what you'd want to do to get going:

Step 1: Simply press the "Get Form Button" at the top of this page to start up our pdf file editing tool. Here you will find all that is needed to work with your file.

Step 2: Using this handy PDF tool, you can do more than merely fill out blanks. Edit away and make your forms appear perfect with customized textual content incorporated, or optimize the file's original content to excellence - all that backed up by the capability to add any kind of graphics and sign the file off.

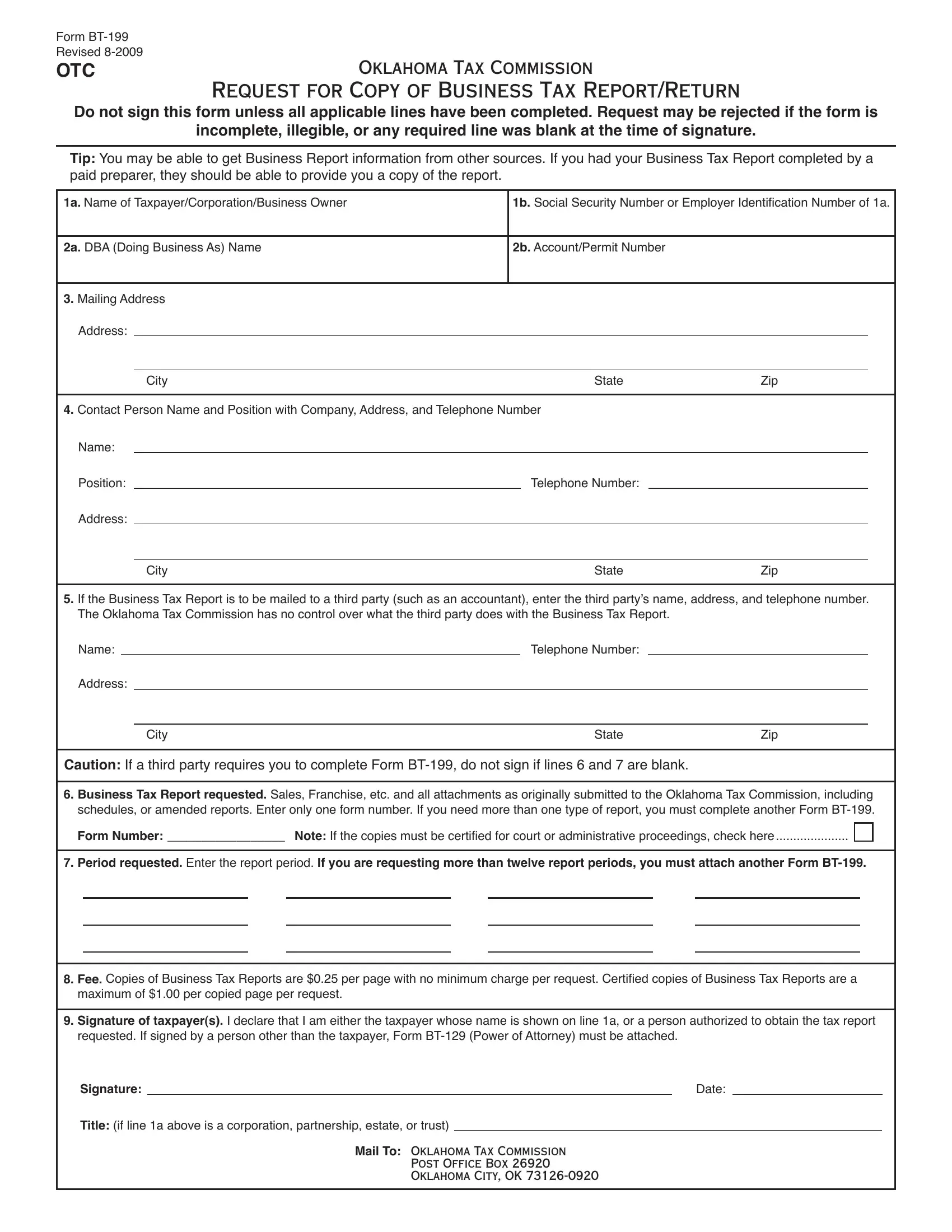

This PDF form requires specific details to be entered, thus ensure that you take your time to fill in precisely what is required:

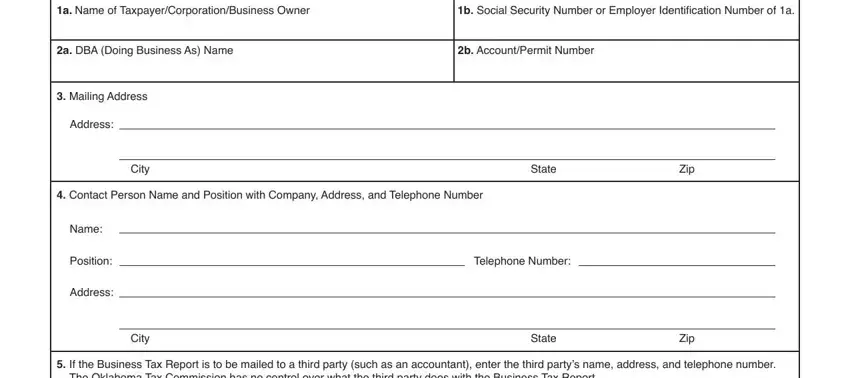

1. Whenever completing the Form Bt 199, be sure to complete all necessary blanks in their relevant section. This will help to expedite the work, allowing for your details to be handled promptly and appropriately.

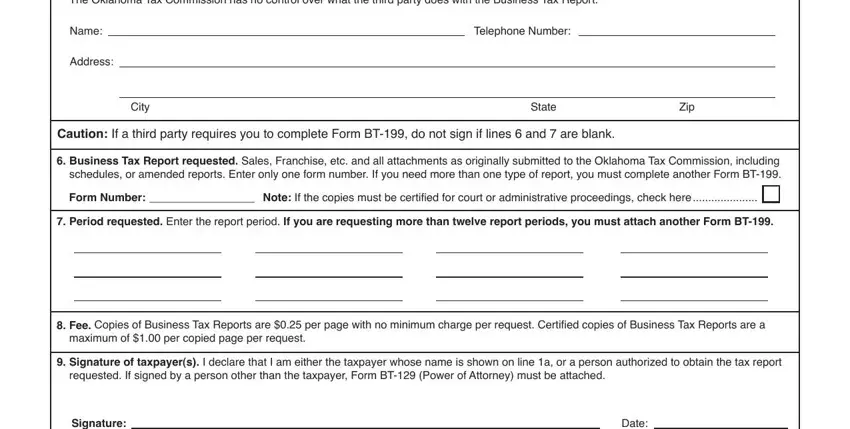

2. Your next stage is to fill out all of the following fields: If the Business Tax Report is to, Name, Address, Telephone Number, City, State, Zip, Caution If a third party requires, Business Tax Report requested, Form Number Note If the copies, Period requested Enter the report, Fee Copies of Business Tax, maximum of per copied page per, Signature of taxpayers I declare, and requested If signed by a person.

Always be really careful while filling in Signature of taxpayers I declare and City, since this is the section in which a lot of people make a few mistakes.

3. The third part is generally simple - complete every one of the form fields in Signature, Date, Title if line a above is a, Mail To Oklahoma Tax Commission, and Post Ofice Box Oklahoma City OK to complete this segment.

Step 3: Right after you have glanced through the information in the blanks, just click "Done" to complete your form. Sign up with us now and easily use Form Bt 199, prepared for download. All adjustments made by you are kept , which means you can change the file further when required. Here at FormsPal, we strive to guarantee that all your details are stored protected.