Form C 4267 can be filled in without any problem. Just try FormsPal PDF editing tool to finish the job without delay. Our tool is constantly evolving to give the best user experience attainable, and that is thanks to our resolve for constant development and listening closely to user feedback. In case you are seeking to get started, this is what it's going to take:

Step 1: Press the orange "Get Form" button above. It will open our tool so you can begin filling in your form.

Step 2: This tool helps you modify PDF documents in a range of ways. Transform it with any text, adjust existing content, and put in a signature - all within a couple of clicks!

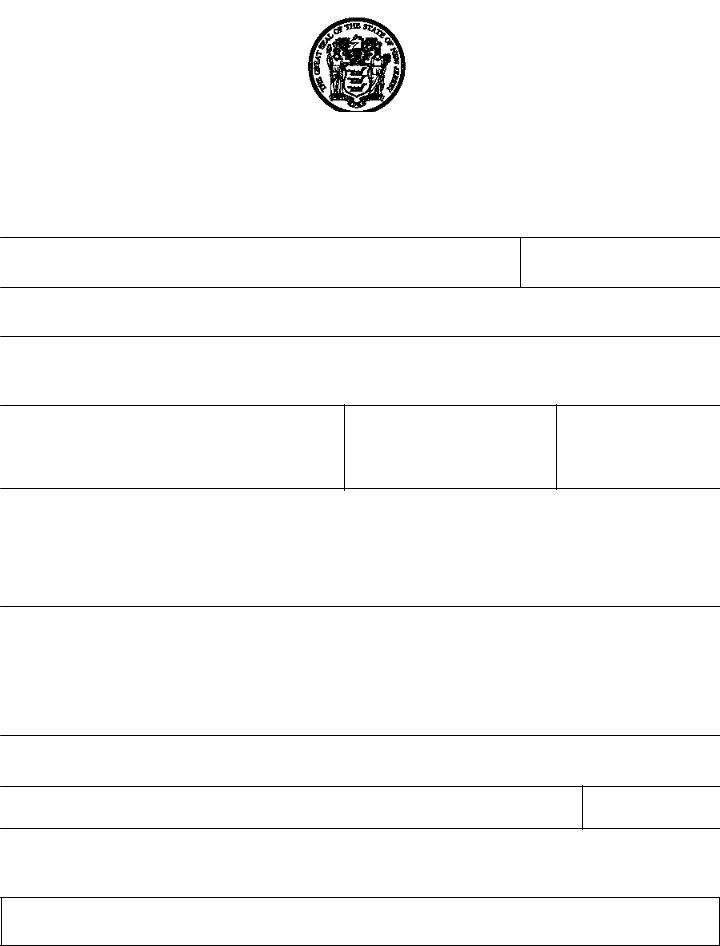

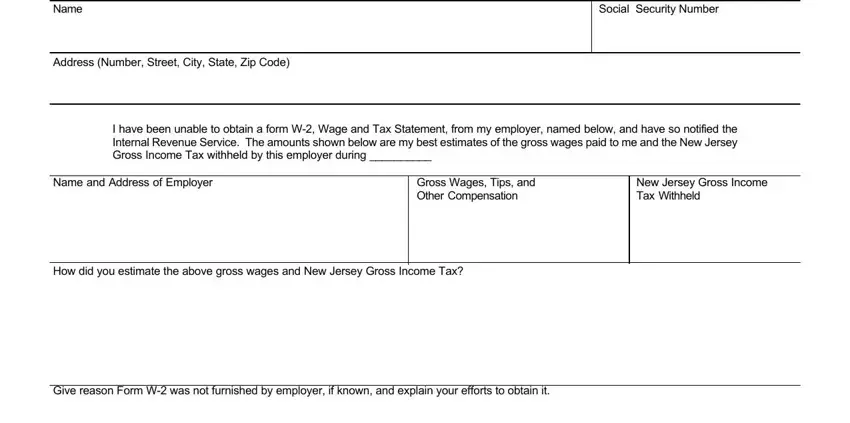

This PDF form requires specific data to be filled out, therefore be certain to take your time to type in exactly what is asked:

1. Fill out your Form C 4267 with a selection of essential fields. Note all of the required information and make sure absolutely nothing is forgotten!

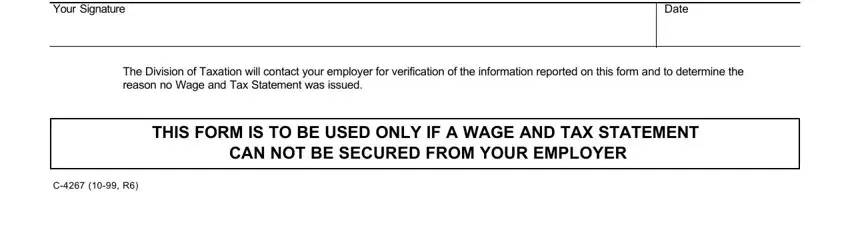

2. Right after completing the previous step, go on to the next part and complete the essential details in these blank fields - Your Signature, Date, The Division of Taxation will, THIS FORM IS TO BE USED ONLY IF A, CAN NOT BE SECURED FROM YOUR, and C R.

As to Date and CAN NOT BE SECURED FROM YOUR, make certain you get them right in this section. The two of these are considered the key fields in this document.

Step 3: Check the details you have typed into the form fields and press the "Done" button. Create a 7-day free trial option with us and acquire direct access to Form C 4267 - which you can then use as you wish from your FormsPal cabinet. FormsPal is dedicated to the confidentiality of our users; we make sure all information handled by our editor is confidential.