In an effort to streamline the understanding and handling of business taxation, the Michigan Department of Treasury provides a variety of forms, among which is the C-8020 form, specifically designed for the computation of penalties and interest due to underpaid estimated taxes by businesses. Issued under the authority of P.A. 228 of 1975, this form is central to ensuring that businesses meet their tax obligations in a timely and accurate manner. Essentially, it serves as a detailed guide for calculating what a business owes when it falls short of its estimated tax payments throughout the year. The C-8020 form highlights the necessity of not only making these payments but also doing so in a manner that aligns with the state’s fiscal regulations. The form itself is broken down into various parts, including the annual tax estimate required for the year, detailed computation sections for both the penalties and interest that may accrue due to untimely or insufficient quarterly tax payments, and specific schedules to assist businesses in accurately adjusting their payments should their liabilities fluctuate throughout the year. By dividing the estimated tax amount by the required quarterly returns or employing an annualization worksheet for businesses with uneven income distribution across the year, the C-8020 form encapsulates a comprehensive approach to managing and rectifying underpayments, thereby maintaining fiscal responsibility and legal compliance. Additionally, it includes provisions for adjustments and corrections to penalty assessments, offering a structured yet adaptable framework for businesses to navigate their tax responsibilities effectively.

| Question | Answer |

|---|---|

| Form Name | Form C 8020 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Michigan, 29A, Annualized, FEIN |

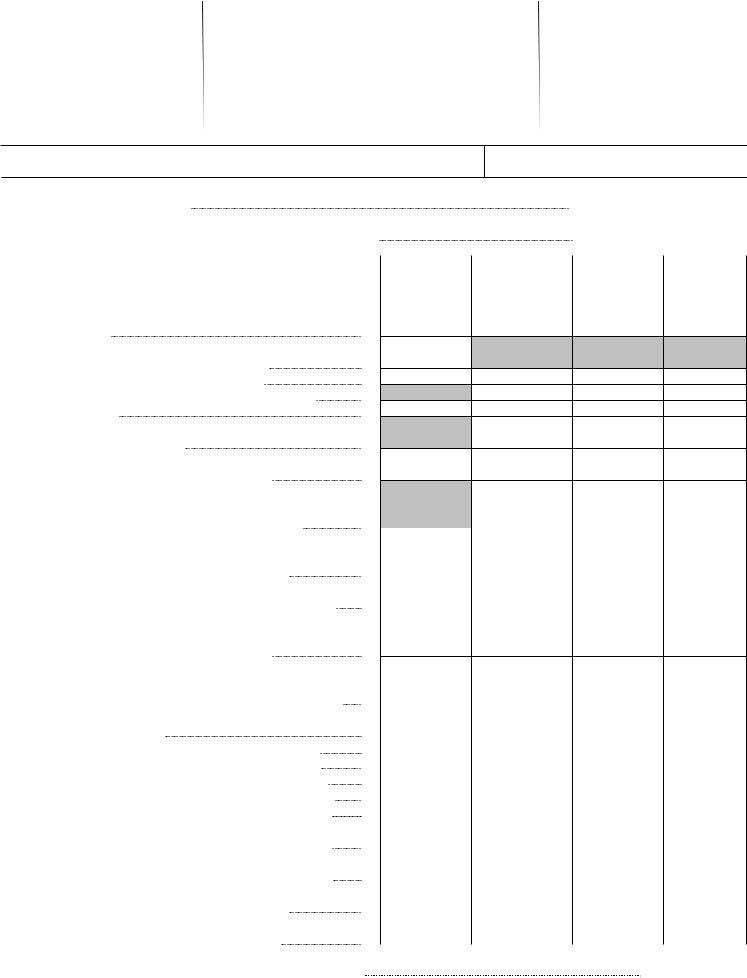

Michigan Department of Treasury (Rev.

SINGLE BUSINESS TAX

Penalty and Interest

Computation for Underpaid

Estimated Tax

This form is issued under authority of P.A. 228 of 1975.

See instruction booklet for filing guidelines.

1 Name

2 Federal Employer ID No. (FEIN) or TR No.

PART 1: ESTIMATED TAX REQUIRED FOR THE YEAR

3 |

Annual tax (from |

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|||||

4 |

Required estimate amount. Enter 85% of line 3. If your last year's tax was |

|

|

|

|

|

|||

|

less than $20,000, enter the smaller of last year's tax or 85% of line 3 |

|

4. |

|

|

|

|||

|

|

|

|

|

|||||

|

See SBT instruction booklet for exceptions |

|

|

|

|

|

|

|

|

|

|

A |

B |

|

|

C |

D |

||

|

to penalty and interest computation. |

|

|

|

|||||

|

|

|

|

|

|

|

|

||

5 |

ENTER YOUR PAYMENT DUE DATES |

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

6Divide amount on line 4 by 4 (or by the number of quarterly returns required). If you annualize, enter the amount from

worksheet, line 29

CAUTION: Complete lines 8 - 15 one column at a time.

7 Prior year overpayment used on quarterly return

8 Amount paid on quarterly return or SUW return

9 Enter amount, if any, from line 15 of the previous column 10 Add lines 7, 8 and 9

11 Add amounts on lines 13 and 14 of the previous column and enter the result here

12 Subtract line 11 from line 10. If zero or less, enter zero. For column A only, enter the amount from line 10

13Remaining underpayment from previous period.

If the amount on line 12 is zero, subtract line 10 from

14 |

line 11 and enter the result here. Otherwise, enter zero |

13 |

|

|

|

|

|

|

|

|

|||

UNDERPAYMENT. If line 6 is greater than or equal to line 12, |

|

|

|

|

|

|

|

subtract line 12 from line 6 and enter it here. Then go |

|

|

|

|

|

15 |

to line 8 of the next column. Otherwise, go to line 15 |

14 |

|

|

|

|

|

|

|

|

|||

OVERPAYMENT. If line 12 is larger than line 6, subtract line 12 |

|

|

|

|

|

|

|

from line 6 and enter it here. Then go to line 9 of next column |

15 |

|

|

|

|

|

|

|

|

|

||

PART 2: FIGURING THE INTEREST |

|

|

|

|

|

|

|

A |

B |

C |

D |

||

16 TOTAL UNDERPAYMENT. Add lines 13 and 14

17Enter the due date for your next quarter or the date the tax was paid, whichever is earlier. In column D, enter the earlier

18 |

of the due date for your annual return or date the tax was paid |

17 |

|

|

|

|

|

|

|

|

|||

Number of days from the due date of your |

|

|

|

|

|

|

19 |

quarter to the date on line 17 |

18 |

|

|

|

|

|

|

|

|

|||

Number of days on line 18 after 4/30/98 and before 7/1/98 |

19 |

|

|

|

|

|

|

|

|

|

|||

20 |

Number of days on line 18 after 6/30/98 and before 1/1/99 |

20 |

|

|

|

|

|

|

|

|

|||

21 |

Number of days on line 18 after 12/31/98 and before 7/1/99 |

21 |

|

|

|

|

|

|

|

|

|||

22 |

Number of days on line 18 after 6/30/99 and before 1/1/2000 |

22 |

|

|

|

|

|

|

|

|

|||

23 |

Number of days on line 19 x 9.5% (.095) x amount on line16 |

23 |

|

|

|

|

|

|

|

|

|||

|

365 |

|

|

|

|

|

24 |

Number of days on line 20 x 9.5% (.095) x amount on line16 |

24 |

|

|

|

|

|

|

|

|

|||

|

365 |

|

|

|

|

|

25 |

Number of days on line 21 x 9.5% (.095) x amount on line16 |

25 |

|

|

|

|

|

|

|

|

|||

|

365 |

|

|

|

|

|

26 |

Number of days on line 22 x *% x amount on line16 |

26 |

|

|

|

|

|

|

|

|

|||

|

365 |

|

|

|

|

|

27 |

Underpayment of interest. Add lines 23 through 26 |

27 |

|

|

|

|

|

|

|

|

|||

28 |

Interest Due. Add line 27 columns A through D and enter the result here. |

|||||

|

If you have no penalty, enter on |

28. |

|

|

||

|

|

|

||||

|

*Interest rate will be set at 1% above the prime rate of interest for this period. |

|||||

www.treasury.state.mi.

Federal Employer Identification Number

PART 3: FIGURING THE PENALTY

Compute penalty only if paid quarterly return(s) were not filed. Do not compute penalty for any quarter in which a timely paid estimated return was filed or there is a credit available from prior quarterly returns. Treasury will review the estimates filed and, if necessary, bill you for the appropriate penalty.

29 |

Enter the amount from line 16 |

29 |

30 |

Penalty rate by quarter |

30 |

31 |

Multiply line 29 by line 30 |

31 |

32 |

Enter the portion of line 29, column D, that is carried |

|

|

forward from line 29A (see below*) |

32 |

33 |

Penalty correction percentage |

33 |

34 |

Multiply line 32, column D, by 10% |

34 |

35 |

Penalty. Subtract line 34 from line 31, if applicable |

35 |

36 |

Enter the amounts from line 31 or line 35, whichever applies |

36 |

37Total penalty. Add line 36, columns A through D

38Total penalty and interest. Add lines 28 and 37.

Enter here and on form

A |

B |

C |

|

D |

|

|

|

|

|

15% |

15% |

15% |

|

15% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37. |

|

|

|

|

38. |

|

*This adjustment is only necessary if a first quarter underpayment is not satisfied by payments made in the second, third or fourth quarters. To compute this line, total the amounts on line 8, columns B, C and D. If the total of these three amounts is greater than or equal to the amount on line 14, column A, then no adjustment is necessary. If line 14, column A is greater than the total of line 8, columns B, C and D, enter the difference on line 32 and compute the adjustment.

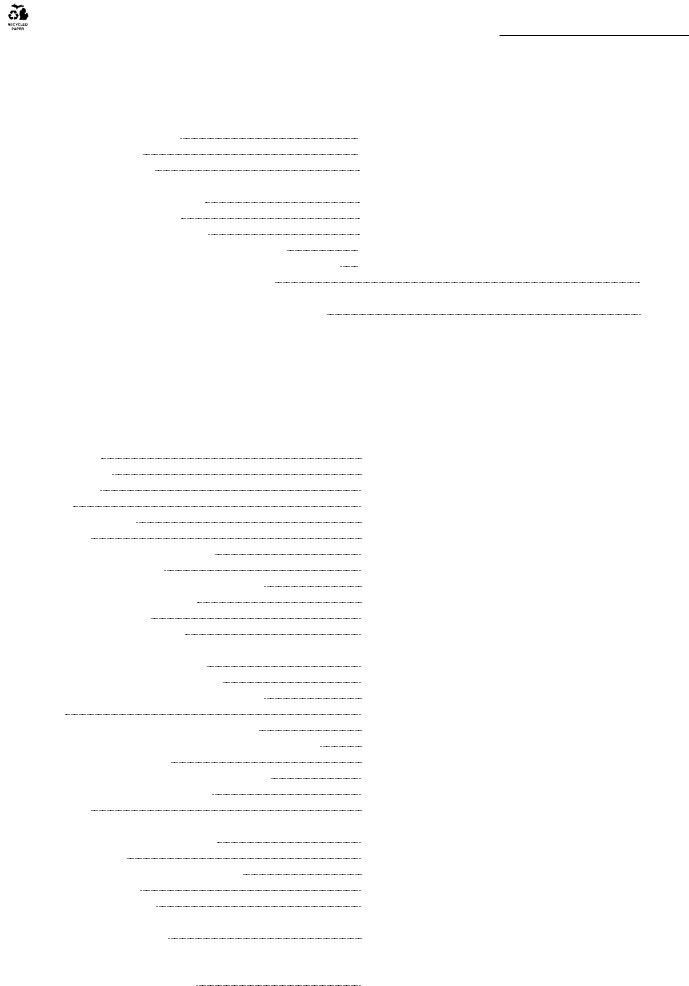

Annualization Worksheet |

|

|

|

|

|

|

|

A |

B |

C |

D |

||

Complete this worksheet if your liability is not |

|

|||||

|

First 3 |

First 6 |

First 9 |

Full 12 |

||

evenly distributed throughout the year. |

|

|||||

|

Months |

Months |

Months |

Months |

||

|

|

|

||||

1 |

Gross receipts |

1 |

|

|

|

|

2 |

Business income |

2 |

|

|

|

|

3 |

Compensation |

3 |

|

|

|

|

4 |

Additions |

4 |

|

|

|

|

5 |

Add lines 2 through 4 |

5 |

|

|

|

|

6 |

Subtractions |

6 |

|

|

|

|

7 |

Tax base. Subtract line 6 from line 5 |

7 |

|

|

|

|

8 |

Apportionment percentage |

8 |

|

|

|

|

9 |

Apportioned tax base. Multiply line 7 by line 8 |

9 |

|

|

|

|

10 |

Net capital acquisition deduction |

10 |

|

|

|

|

11 |

Business loss deduction |

11 |

|

|

|

|

12 |

Statutory deduction if available |

12 |

|

|

|

|

13 |

Adjusted tax base. Subtract lines 10, 11 and 12 |

|

|

|

|

|

|

from line 7 or 9, whichever applies |

13 |

|

|

|

|

14 |

Reductions to tax base from |

14 |

|

|

|

|

15 |

Taxable amount. Subtract line 14 from line 13 |

15 |

|

|

|

|

16 |

Tax rate |

16 |

2.3% |

2.3% |

2.3% |

2.3% |

17 |

Tax before credits. Multiply line 15 by line 16 |

17 |

|

|

|

|

18 |

Standard small business credit from |

18 |

|

|

|

|

19 |

Subtract line 18 from line 17 |

19 |

|

|

|

|

20 |

Alternate tax from |

20 |

|

|

|

|

21 |

21 |

|

|

|

|

|

22 |

Other credits |

22 |

|

|

|

|

23 |

Net tax liability. Subtract lines 21 and 22 |

|

|

|

|

|

|

from line 19 or 20, whichever applies |

23 |

|

|

|

|

24 |

Annualization ratios |

24 |

4 |

2 |

1.3333 |

1 |

25 |

Annualized tax. Mutliply line 23 by line 24 |

25 |

|

|

|

|

26 |

Applicable percentage |

26 |

21.25% |

42.5% |

63.75% |

85% |

27 |

Multiply line 25 by line 26 |

27 |

|

|

|

|

28 |

Enter the combined amounts of line 29 |

|

|

|

|

|

|

from all preceding columns |

28 |

|

|

|

|

29. ESTIMATE REQUIREMENTS BY QUARTER |

|

|

|

|

|

|

|

Subtract line 28 from line 27. If less than zero, enter |

|

|

|

|

|

|

Enter here and on |

29. |

|

|

|

|

NOTE: Totals on line 29 must equal 85% of the current year tax liability on page 1, line 3.