In case you want to fill out SSN, you won't have to download any software - simply give a try to our online PDF editor. The editor is continually maintained by us, receiving awesome functions and turning out to be greater. This is what you'll want to do to get going:

Step 1: Click on the orange "Get Form" button above. It is going to open our pdf editor so you could start completing your form.

Step 2: As soon as you access the editor, you'll see the document prepared to be filled out. Apart from filling out different fields, you could also do many other things with the file, particularly putting on any text, modifying the initial text, adding images, placing your signature to the PDF, and a lot more.

Completing this form calls for attention to detail. Make certain all required fields are filled in properly.

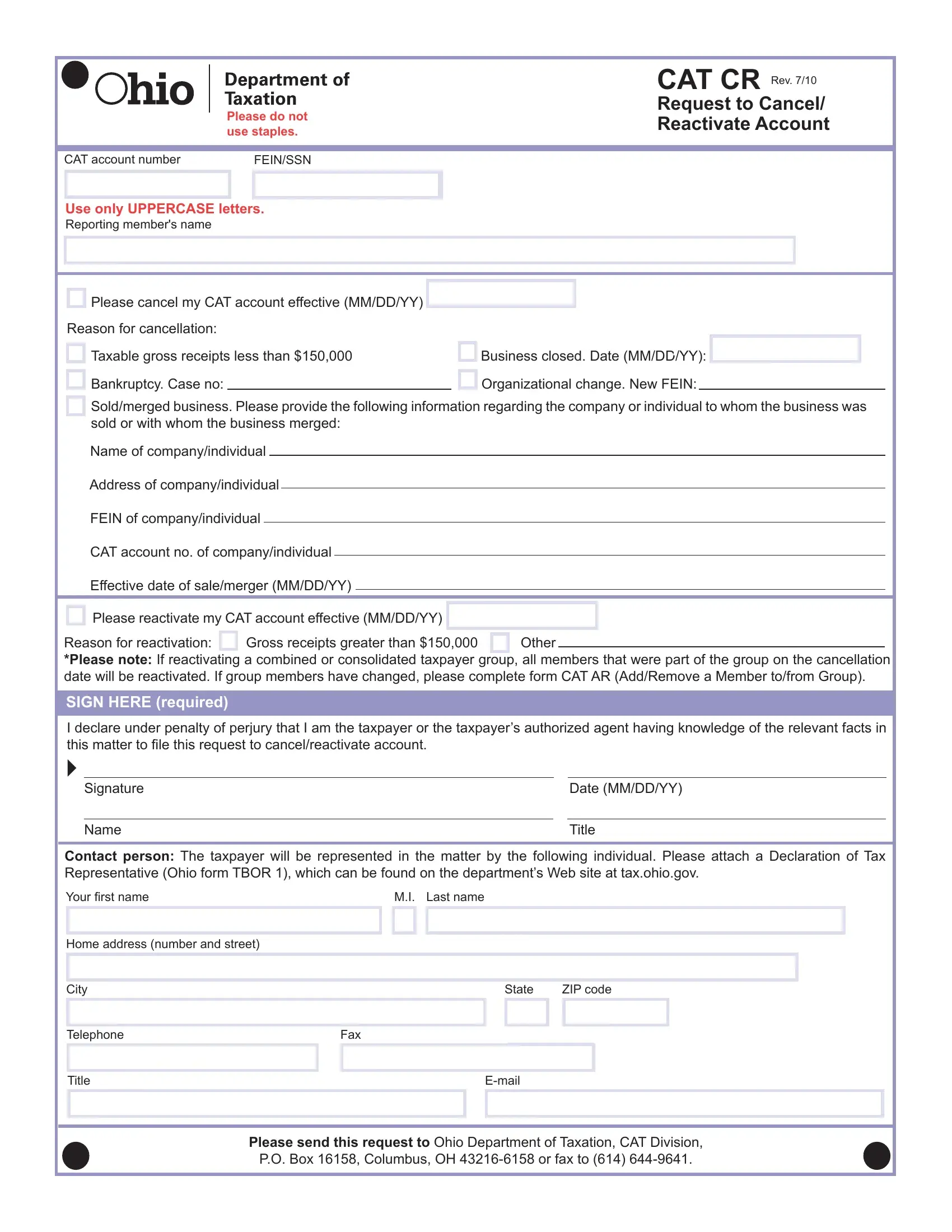

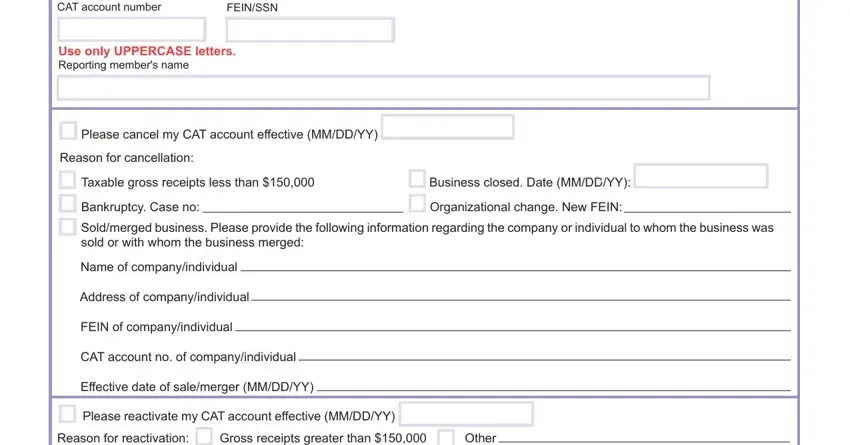

1. It is recommended to complete the SSN correctly, thus pay close attention while working with the parts comprising all these blanks:

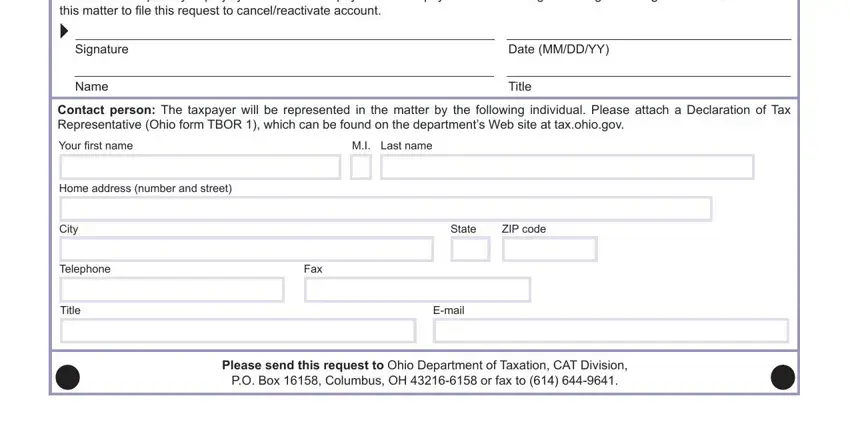

2. Soon after filling in the previous section, head on to the subsequent part and fill in the necessary particulars in these fields - I declare under penalty of perjury, Signature, Name, Date MMDDYY, Title, Contact person The taxpayer will, Your fi rst name, Last name, Home address number and street, CCity, Telephone, Title, State, ZIP code, and Fax.

People who work with this PDF frequently make some mistakes when completing Your fi rst name in this area. You need to revise everything you type in right here.

Step 3: Proofread all the details you've entered into the form fields and press the "Done" button. Find the SSN as soon as you sign up at FormsPal for a 7-day free trial. Conveniently view the pdf inside your FormsPal cabinet, together with any modifications and changes all synced! Whenever you work with FormsPal, you can certainly complete documents without stressing about data breaches or entries being distributed. Our protected system ensures that your private information is kept safe.