When using the online tool for PDF editing by FormsPal, you can fill out or alter ga cd14c right here and now. To make our editor better and easier to work with, we continuously come up with new features, taking into account feedback from our users. All it requires is just a few easy steps:

Step 1: Simply click the "Get Form Button" in the top section of this webpage to start up our pdf editing tool. This way, you will find everything that is necessary to work with your file.

Step 2: The tool will give you the capability to change your PDF document in many different ways. Transform it by including customized text, correct existing content, and place in a signature - all within a few mouse clicks!

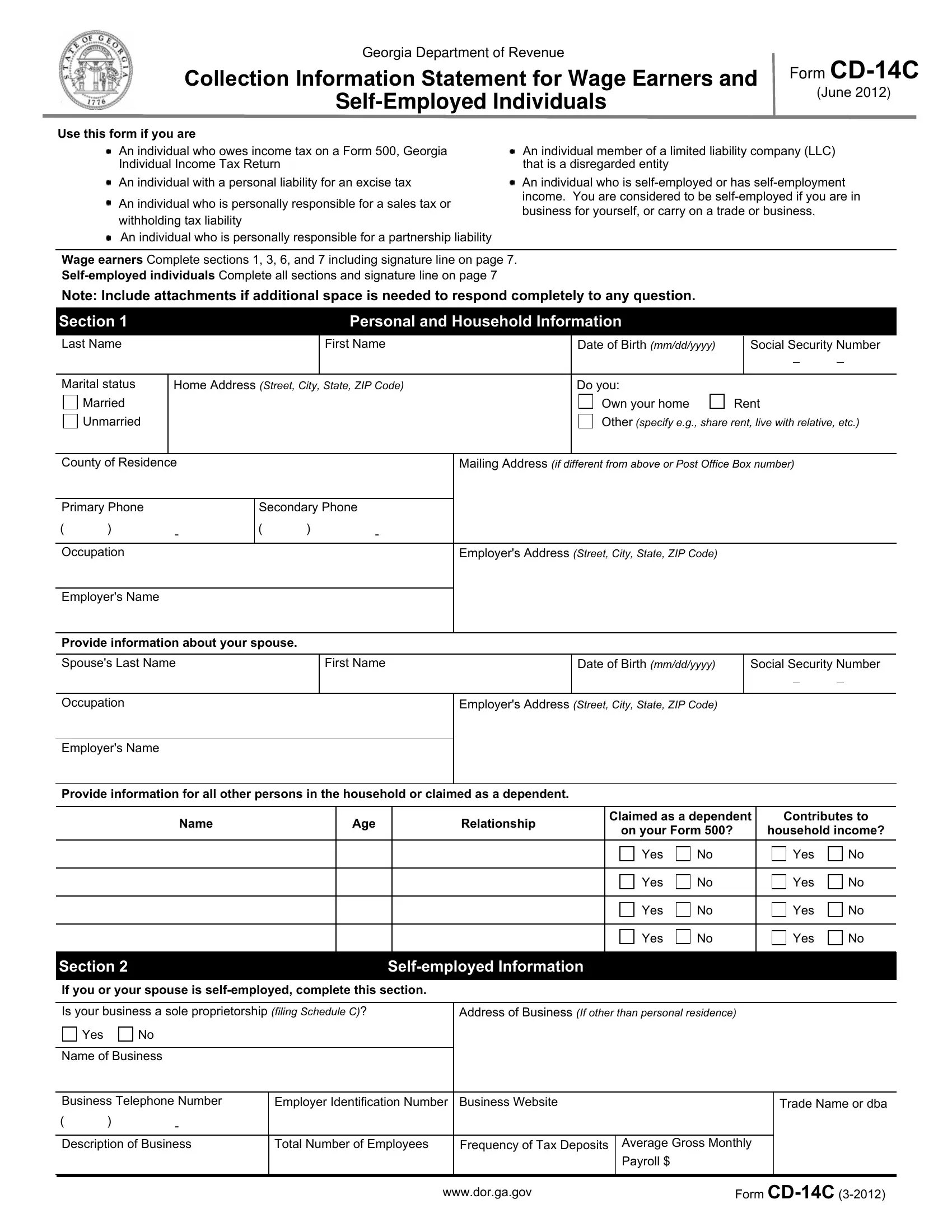

With regards to the blank fields of this specific PDF, this is what you should consider:

1. Start completing your ga cd14c with a selection of essential blanks. Collect all the important information and make sure not a single thing forgotten!

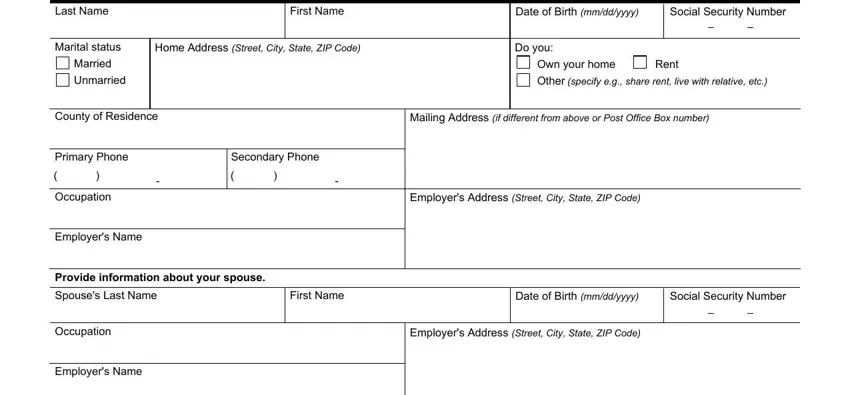

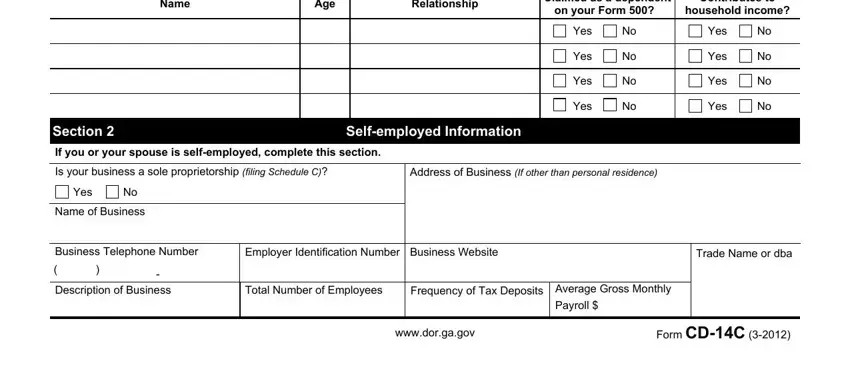

2. Once your current task is complete, take the next step – fill out all of these fields - Name, Age, Relationship, Claimed as a dependent, Contributes to, on your Form, household income, Yes, Yes, Yes, Yes, Yes, Yes, Yes, and Yes with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

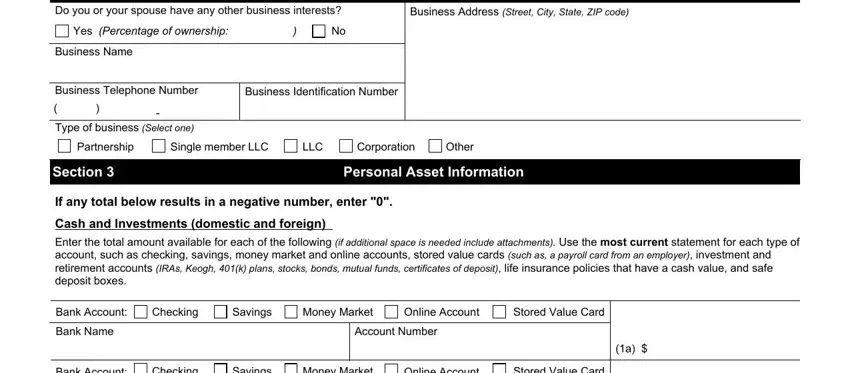

3. This third part is straightforward - fill in all the blanks in Section Do you or your spouse, Yes Percentage of ownership, Business Address Street City State, Business Name, Business Telephone Number Type of, Business Identification Number, Partnership, Single member LLC, LLC, Corporation, Other, Section, Personal Asset Information, If any total below results in a, and Cash and Investments domestic and in order to complete this part.

Be extremely careful while filling out Section and If any total below results in a, as this is where a lot of people make mistakes.

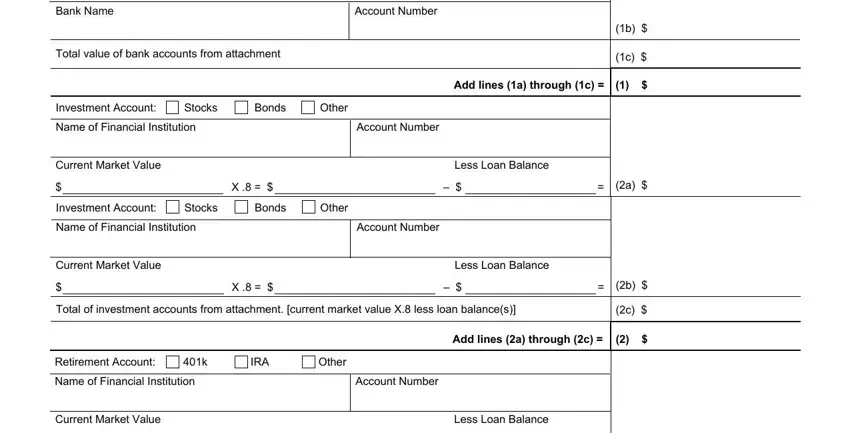

4. This specific section arrives with the next few blanks to complete: Account Number, Bank Account Bank Name, Total value of bank accounts from, Investment Account Name of, Stocks Bonds Other, Account Number, Current Market Value, Less Loan Balance, Add lines a through c, Investment Account Name of, Stocks, Bonds, Other, Account Number, and Current Market Value.

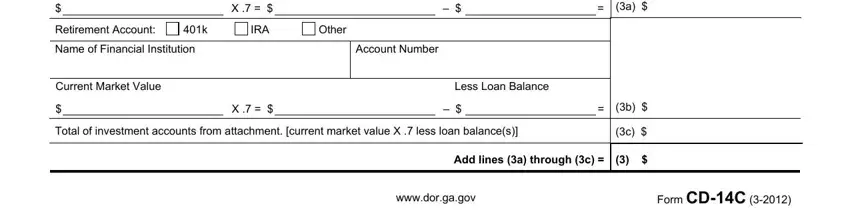

5. As a final point, the following last section is precisely what you'll have to finish prior to finalizing the document. The fields under consideration are the next: Retirement Account Name of, IRA, Other, Account Number, Current Market Value, Less Loan Balance, Total of investment accounts from, wwwdorgagov, Form CDC, and Add lines a through c.

Step 3: Spell-check the information you have inserted in the blanks and then press the "Done" button. After getting a7-day free trial account at FormsPal, you'll be able to download ga cd14c or email it immediately. The form will also be accessible via your personal account with your each edit. FormsPal is dedicated to the confidentiality of our users; we ensure that all personal information used in our tool is kept secure.