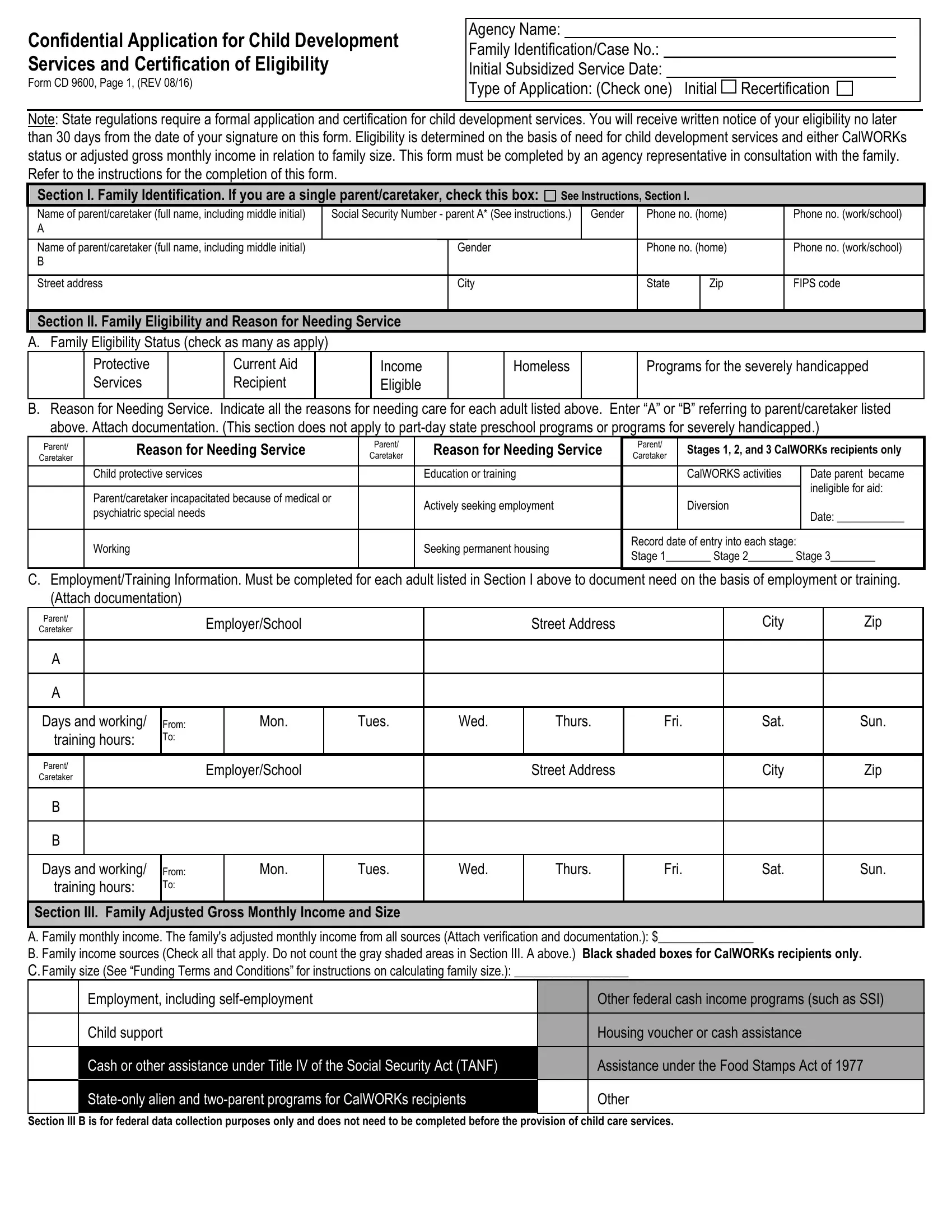

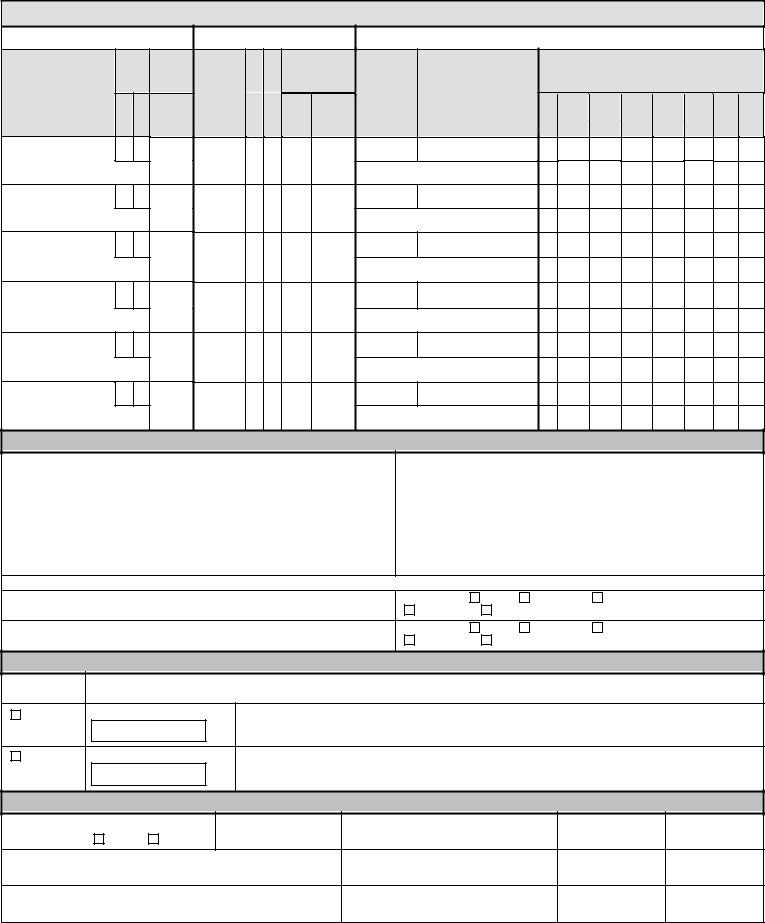

Social Security Number (SSN) Collection Consent

Form CD 9600A, the Child Care Data Collection/Privacy Notice and Consent Form, must be completed and signed by all heads of households in all CDE- funded programs. If the head of household gives consent to use their SSN, the SSN should be inserted on the CD 9600. If the head of household does not give consent, leave the SSN space blank on the CD 9600. In "family of one" situations the SSN will not be collected; therefore, completion of the CD 9600A is not required. When completed, attach the CD 9600A to the CD 9600.

*The social security number is to be listed only for heads of households who have given consent on form CD 9600A. In all cases, a CD 9600A must be completed and signed by the head of household and attached to the CD 9600. In "family of one" situations, no SSN is required and no CD 9600A will be completed.

Agency Name: Insert the name of the agency providing or funding child care services in this space.

Family Identification/Case Number: This is an optional field and can be used if the agency assigns an identification or case number to each family.

Initial Subsidized Service Date: This is the earliest month and year that the child(ren), as listed on this CD 9600, first started receiving subsidized child care services from your agency. Every CD 9600 must have a month and year entered in this field. This information is for data reporting purposes. If there is a break of three months or more, enter the month child care resumed. If there is a break of less than three months (vacation, for example), enter the original date assistance began, not the date it resumed.

Type of Application: Check the box after "Initial" if this is the first application taken by the agency named on this CD 9600. Check the box after "Recertification" if this is the second or later application taken by the agency listed on this CD 9600.

Section I. Family Identification

Note: If family size includes more than two adults, complete Sections I, II, and III of a second CD 9600 and attach it to the complete CD 9600. You may also use a second CD 9600 to record additional employers or training institutions for the parents listed under A and B in Section I.

If the child lives with only one parent/caretaker who is legally/financially responsible for the child, check the box on the line next to Section I.

A.Information on parent/caretaker A. For the first adult living in the same household as the child(ren), complete all items in Section I, including address information. For the purposes of these instructions

and the certification of eligibility, a parent/caretaker shall be a person who has responsibility for the child. Thus, “parent/caretaker” could refer, for example, to a biological parent, a stepparent, a grandparent, a foster or adoptive parent, or a legal guardian. For SSN information, see above.

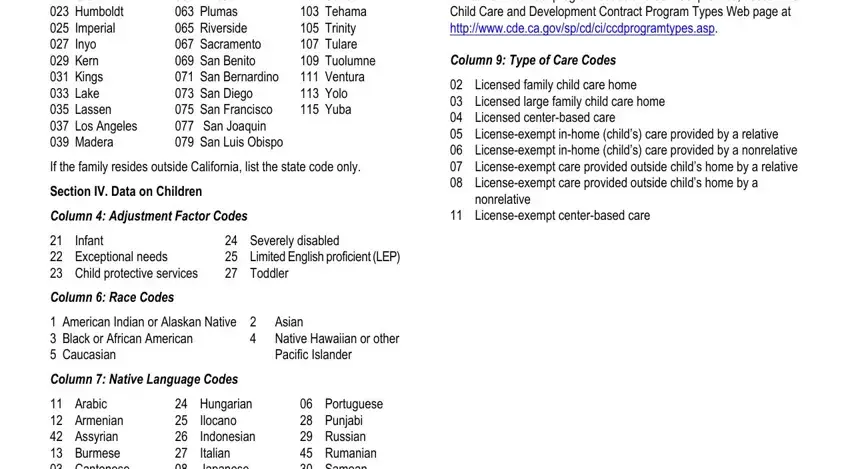

FIPS Code. See the “FIPS Codes” section on page three of these instructions to determine the FIPS Code that identifies the state and county where the parent/caretaker lives.

B. Information on parent/caretaker B. If a second parent/caretaker lives in the same household as the child and is included in the calculation of family size, complete all items in Section I B.

Section II. Family Eligibility and Reason for Needing Service

A.Family eligibility status. Check all eligibility categories for which the family qualifies.

B.Reason for needing service. For each parent/caretaker or other adult included in the family size, note with an “A” or “B” all of the reasons for needing services and attach the appropriate documentation. Identify the main reason for needing service with an asterisk if there is more than one reason. Do not complete this section for part-day state preschool or severally handicapped.

CalWORKs recipients only: This box is to be completed for all CalWORKs recipients receiving services in Stages I, 2, or 3.

If a parent/caretaker is completing CalWORKs activities, enter “A” and/or “B” in the box labeled “CalWORKs Activities."

If a parent/caretaker has received a diversion payment, enter “A” and/or “B” in the box labeled “Diversion.”

In the box labeled “Record date of entry into each stage,” enter the initial date of entry into each stage.

For Stage I or II families no longer eligible for CalWORKs aid,

enter the date the parent became ineligible for aid in the box labeled “Date parent became ineligible for aid.”

C.Employment/training information. For each parent/caretaker, enter the name and address of the employer or the institution of training or education, as appropriate. Do not complete this section for part-day state preschool or programs for severally handicapped.

Days and working/training hours. Note the beginning and ending hours for each day that the parent is employed or in a training program.

Section III. Family Adjusted Gross Monthly Income and Size

A.Family monthly income. Enter the family’s total adjusted gross monthly income from all sources. All income must be verified.

B.Family income sources. Check each box to identify all sources of family income. These include sources of income that are not counted for eligibility determinations.

The black shaded boxes are to be completed for CalWORKs recipients only. County welfare departments will identify whether a CalWORKs recipient is receiving CalWORKs benefits under the State-only alien program or the state-only two-parent program. These two programs count toward Temporary Assistance to Needy Families Maintenance of Effort.

The gray shaded boxes are not to be counted in the family’s total adjusted monthly income.