It is possible to work with Cms 1 Mn Form easily by using our online PDF tool. To keep our editor on the forefront of efficiency, we work to integrate user-oriented capabilities and enhancements regularly. We are routinely grateful for any feedback - play a vital part in reshaping how you work with PDF forms. To get the process started, consider these easy steps:

Step 1: Open the PDF doc in our tool by hitting the "Get Form Button" at the top of this webpage.

Step 2: After you start the PDF editor, you will get the document made ready to be completed. Besides filling out various blanks, it's also possible to perform various other things with the PDF, namely writing your own words, changing the initial text, inserting graphics, placing your signature to the PDF, and more.

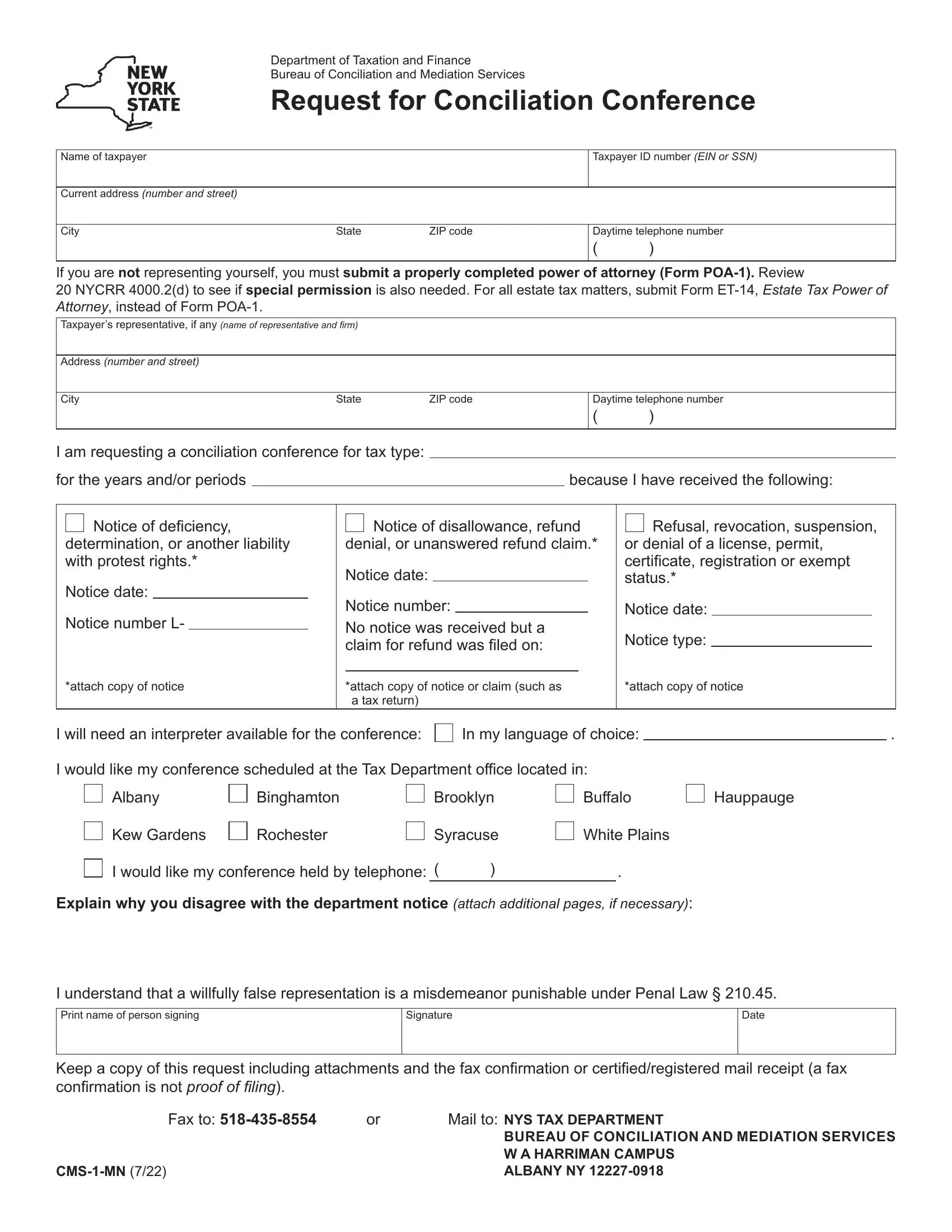

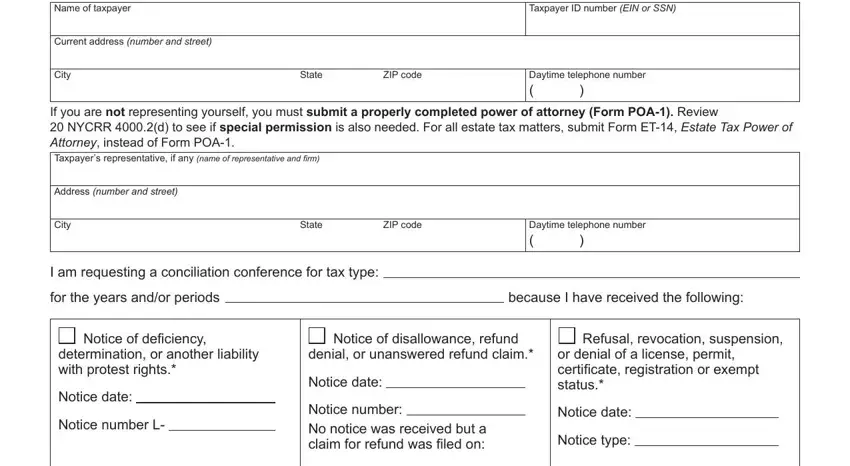

This document will involve specific information; in order to guarantee accuracy, take the time to take into account the next recommendations:

1. While filling out the Cms 1 Mn Form, be sure to include all essential fields within the relevant part. This will help facilitate the process, enabling your information to be processed quickly and appropriately.

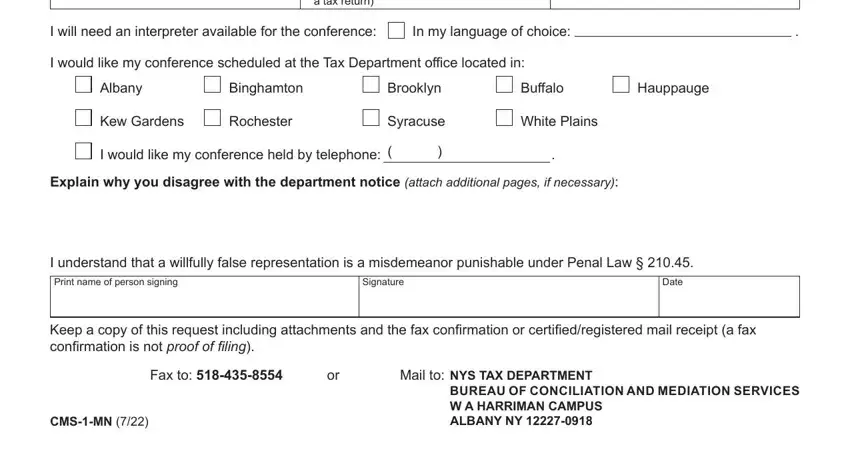

2. Just after the previous selection of fields is completed, go on to type in the applicable details in these - attach copy of notice or claim, I will need an interpreter, In my language of choice, I would like my conference, Binghamton, Brooklyn, Albany, Buffalo, Hauppauge, Kew Gardens, Rochester, Syracuse, White Plains, I would like my conference held by, and Explain why you disagree with the.

Lots of people often make errors while filling out Binghamton in this area. Be sure to revise what you type in right here.

Step 3: Prior to moving on, double-check that all form fields were filled in as intended. Once you think it's all good, click “Done." Sign up with us today and immediately obtain Cms 1 Mn Form, set for downloading. All adjustments made by you are kept , making it possible to change the file at a later stage anytime. When you use FormsPal, you're able to complete documents without being concerned about personal data breaches or entries getting shared. Our protected software makes sure that your private data is maintained safely.