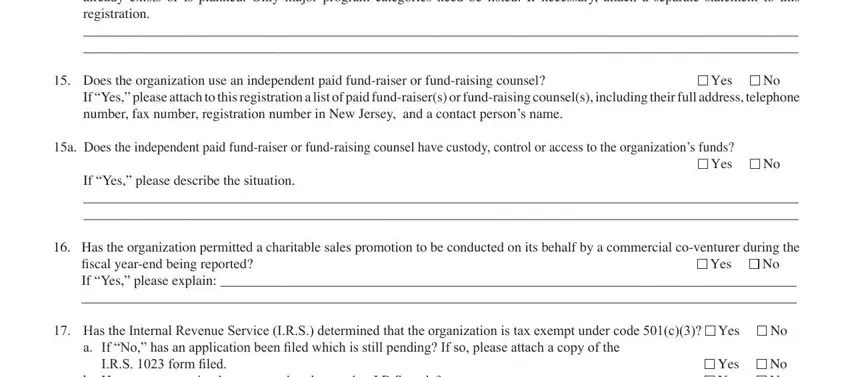

18. Has the organization ever had its authority to conduct charitable activities denied, suspended, or revoked in any jurisdiction or has the

organization ever entered into any voluntary agreement of discontinuance with any governmental entity?

Yes

Yes

No

No

If “Yes,” attach to this registration a copy of the denial, suspension, revocation or voluntary agreement of discontinuance. If the

document does not explain the reasons for the denial, suspension or revocation, attach to this registration an explanation on a separate sheet of paper.

19.Has the organization voluntarily entered into an assurance of voluntary compliance or similar order or agreement (including, but not limited to, a settlement of an administrative investigation or proceeding, with or without an admission of liability) with any

jurisdiction, state or federal agency or oficer? |

Yes |

No |

If “Yes,” please attach to this registration the relevant document.

20.Has the organization or any of its present oficers, directors, executive personnel or trustees ever been found to have engaged in unlawful practices in the solicitation of contributions or administration of charitable assets or been enjoined from soliciting

contributions, or are such proceedings pending in this or any other jurisdiction? |

Yes |

No |

If “Yes,” attach to this registration photocopies of any and all written documentation (such as a court order, administrative order, judgment, formal notice, written assurance or other document) which show the inal disposition of the matter.

21. Has the organization or any of its present oficers, directors, trustees or principal salaried executive staff employees ever been convicted of any criminal offense committed in connection with the performance of activities regulated under this act or any criminal or civil offense involving untruthfulness or dishonesty or any criminal offense relating adversely to the registrant’s

itness to perform activities regulated by this Act? A plea of |

guilty, non vult, nolo contendere or any similar disposition |

of alleged criminal activity shall be deemed a conviction. |

Yes |

No |

22.Has the organization or any of its oficers, directors, trustees or principal salaried executive staff employees been adjudged liable in any administrative or civil action involving theft, fraud, or deceptive business practices? For purposes of this question a judgment of liability in an administrative or civil action shall include, but is not limited to, any inding or admission that the individual engaged

in an unlawful practice in relation to the solicitation of contributions or the administration of charitable assets. |

Yes |

No |

If “Yes,” identify the individual(s) below and attach to this registration a copy of any order, judgment or other documents indicating the inal disposition of the matter.

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

23.Provide the following information for each oficer, director, trustee and the ive most-highly compensated executive staff employees:

Name |

Business address |

Telephone number |

Title |

Salary |

|

|

(include area code) |

|

|

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

Yes

Yes

No

No