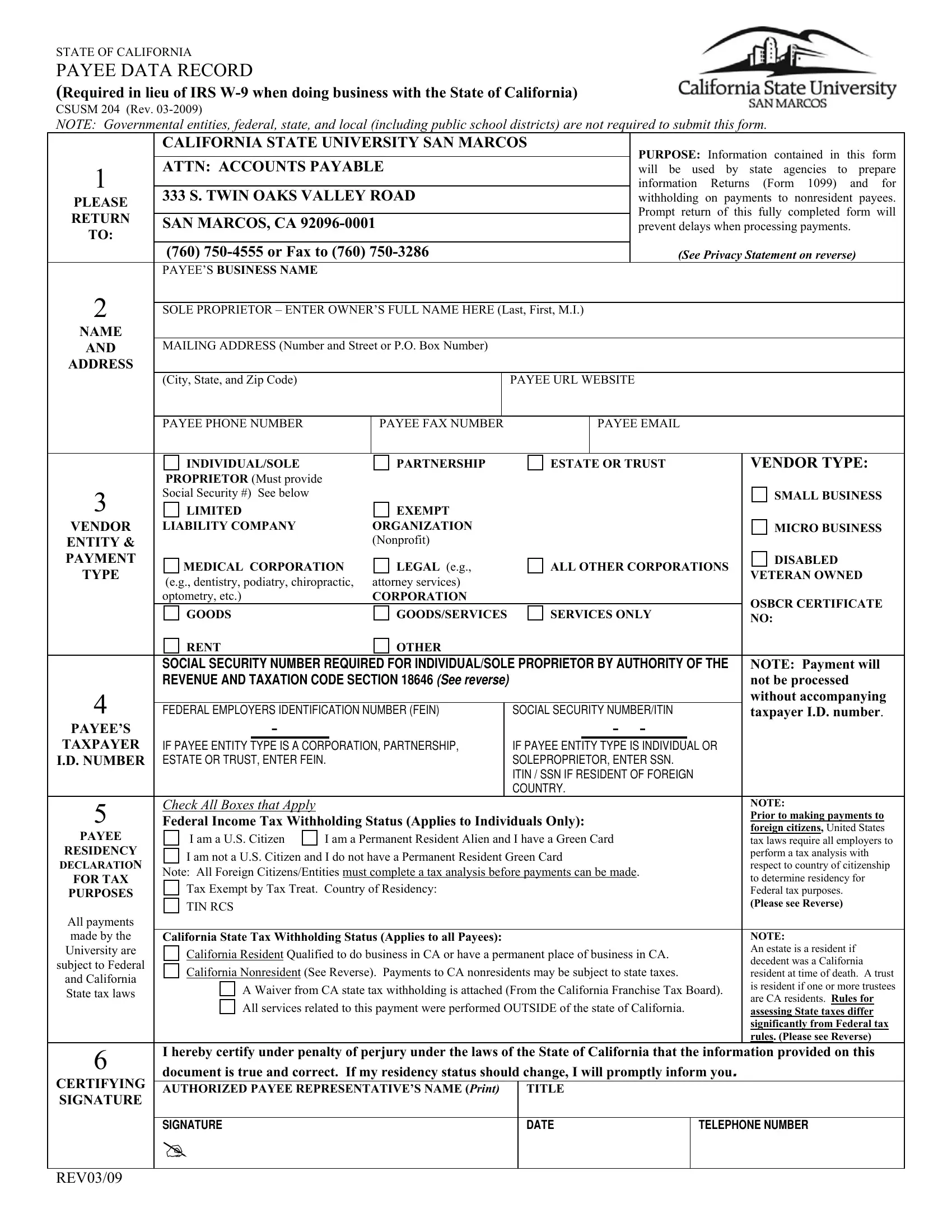

CSUSM 204 (Rev. 03-2009)

NOTE: Governmental entities, federal, state, and local (including public school districts) are not required to submit this form.

|

CALIFORNIA STATE UNIVERSITY SAN MARCOS |

PURPOSE: Information contained in this form |

|

|

|

|

|

|

|

|

|

|

|

|

ATTN: ACCOUNTS PAYABLE |

|

|

|

|

1 |

|

|

|

|

will be used by state agencies to prepare |

|

|

|

|

|

|

|

|

|

|

information Returns (Form 1099) and for |

333 S. TWIN OAKS VALLEY ROAD |

|

|

|

|

PLEASE |

|

|

|

|

withholding |

on payments to |

nonresident payees. |

|

|

|

|

|

|

|

|

|

|

Prompt return of |

this fully |

completed form will |

RETURN |

|

|

|

|

|

|

|

|

|

|

SAN MARCOS, CA 92096-0001 |

|

|

|

|

|

|

|

|

prevent delays when processing payments. |

TO: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(760) 750-4555 or Fax to (760) 750-3286 |

|

|

|

|

(See Privacy Statement on reverse) |

|

PAYEE’S BUSINESS NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SOLE PROPRIETOR – ENTER OWNER’S FULL NAME HERE (Last, First, M.I.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AND |

MAILING ADDRESS (Number and Street or P.O. Box Number) |

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(City, State, and Zip Code) |

|

|

|

|

PAYEE URL WEBSITE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYEE PHONE NUMBER |

|

|

PAYEE FAX NUMBER |

|

|

|

PAYEE EMAIL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INDIVIDUAL/SOLE |

|

|

PARTNERSHIP |

|

ESTATE OR TRUST |

|

|

VENDOR TYPE: |

|

PROPRIETOR (Must provide |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Social Security #) See below |

|

|

|

|

|

|

|

|

|

|

|

|

|

SMALL BUSINESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIMITED |

|

|

EXEMPT |

|

|

|

|

|

|

|

|

|

|

|

VENDOR |

LIABILITY COMPANY |

|

|

ORGANIZATION |

|

|

|

|

|

|

|

|

|

MICRO BUSINESS |

ENTITY & |

|

|

|

|

(Nonprofit) |

|

|

|

|

|

|

|

|

|

|

|

PAYMENT |

MEDICAL CORPORATION |

LEGAL (e.g., |

|

ALL OTHER CORPORATIONS |

|

DISABLED |

TYPE |

|

|

VETERAN OWNED |

(e.g., dentistry, podiatry, chiropractic, |

attorney services) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

optometry, etc.) |

|

|

CORPORATION |

|

|

|

|

|

|

|

|

|

OSBCR CERTIFICATE |

|

GOODS |

|

|

GOODS/SERVICES |

|

SERVICES ONLY |

|

|

|

|

|

|

|

|

NO: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RENT |

|

|

OTHER |

|

|

|

|

|

|

|

|

|

|

|

|

SOCIAL SECURITY NUMBER REQUIRED FOR INDIVIDUAL/SOLE PROPRIETOR BY AUTHORITY OF THE |

|

NOTE: Payment will |

|

REVENUE AND TAXATION CODE SECTION 18646 (SEE REVERSE) |

|

|

|

|

|

|

|

|

|

not be processed |

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

without accompanying |

FEDERAL EMPLOYERS IDENTIFICATION NUMBER (FEIN) |

|

SOCIAL SECURITY NUMBER/ITIN |

|

|

taxpayer I.D. number. |

PAYEE’S |

|

- |

|

|

|

|

|

- - |

|

|

|

|

|

|

TAXPAYER |

IF PAYEE ENTITY TYPE IS A CORPORATION, PARTNERSHIP, |

|

IF PAYEE ENTITY TYPE IS INDIVIDUAL OR |

|

|

|

I.D. NUMBER |

ESTATE OR TRUST, ENTER FEIN. |

|

|

SOLEPROPRIETOR, ENTER SSN. |

|

|

|

|

|

|

|

|

|

|

|

ITIN / SSN IF RESIDENT OF FOREIGN |

|

|

|

|

|

|

|

|

|

|

|

COUNTRY. |

|

|

|

|

5 |

Check All Boxes that Apply |

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTE: |

|

Federal Income Tax Withholding Status (Applies to Individuals Only): |

|

|

Prior to making payments to |

|

|

foreign citizens, United States |

PAYEE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I am a U.S. Citizen |

I am a Permanent Resident Alien and I have a Green Card |

|

|

tax laws require all employers to |

RESIDENCY |

I am not a U.S. Citizen and I do not have a Permanent Resident Green Card |

|

|

perform a tax analysis with |

DECLARATION |

|

|

respect to country of citizenship |

Note: All Foreign Citizens/Entities must complete a tax analysis before payments can be made. |

|

|

FOR TAX |

|

|

to determine residency for |

Tax Exempt by Tax Treat. Country of Residency: |

|

|

|

|

|

|

|

|

|

PURPOSES |

|

|

|

|

|

|

|

|

|

Federal tax purposes. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Please see Reverse) |

|

TIN RCS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All payments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

made by the |

California State Tax Withholding Status (Applies to all Payees): |

|

|

|

|

|

|

|

|

|

NOTE: |

|

University are |

California Resident Qualified to do business in CA or have a permanent place of business in CA. |

|

|

An estate is a resident if |

subject to Federal |

|

|

decedent was a California |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

California Nonresident (See Reverse). Payments to CA nonresidents may be subject to state taxes. |

|

|

resident at time of death. A trust |

and California |

|

|

A Waiver from CA state tax withholding is attached (From the California Franchise Tax Board). |

|

is resident if one or more trustees |

State tax laws |

|

|

are CA residents. Rules for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All services related to this payment were performed OUTSIDE of the state of California. |

|

|

|

|

|

assessing State taxes differ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

significantly from Federal tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

rules. (Please see Reverse) |

6 |

I hereby certify under penalty of perjury under the laws of the State of California that the information provided on this |

document is true and correct. If my residency status should change, I will promptly inform you. |

|

CERTIFYING |

|

AUTHORIZED PAYEE REPRESENTATIVE’S NAME (Print) |

|

TITLE |

|

|

|

|

SIGNATURE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

|

|

|

DATE |

|

TELEPHONE NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|