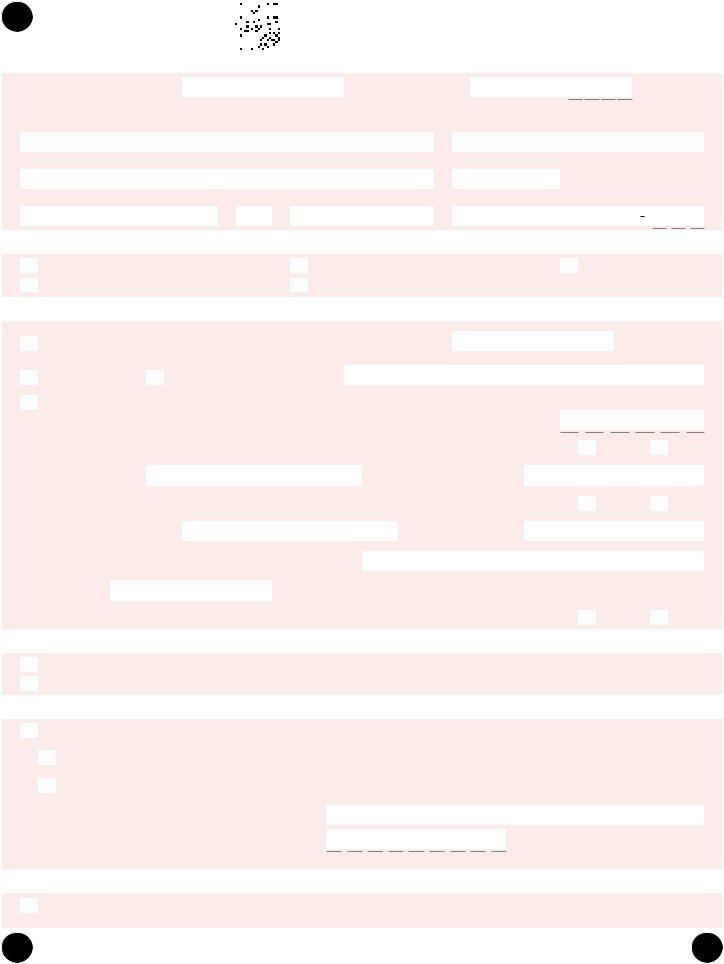

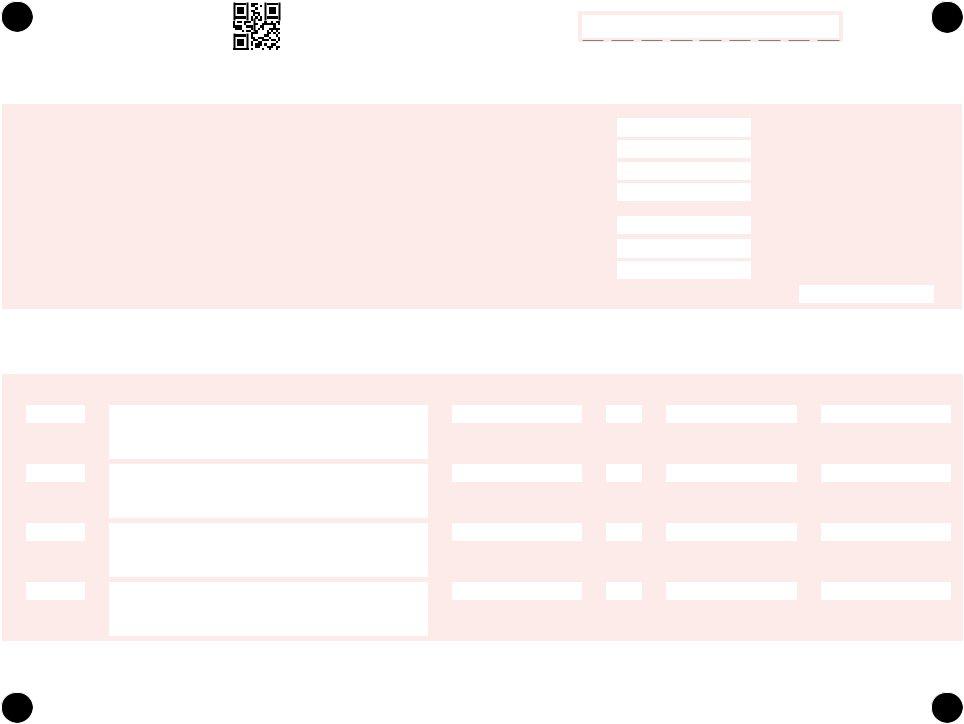

The Form CT-1065/CT-1120SI, issued by the Connecticut Department of Revenue Services, is specifically designed for pass-through entities operating within the state, encompassing limited liability partnerships (LLPs), limited partnerships (LPs), general partnerships (GPs), S corporations, and partnerships treated as such for tax purposes. This form, which must be submitted electronically, serves as the tax return for these entities, detailing income, expenses, and the distribution of earnings to members or partners. It provides multiple sections for different types of income and deductions, modifications specific to Connecticut tax law, allocations and apportionments of income, and comprehensive information about the entity’s members. The form emphasizes the requirement for precision by instructing that all entries should be in blue or black ink, and paper submissions are explicitly discouraged. Furthermore, it introduces options for entities to elect different bases for tax calculation, the possibility of combining reporting with other commonly-owned entities, and the option for electing composite income tax remittance on behalf of nonresident members. Moreover, it includes calculations for tax due, potential refunds, penalties, and interest for late submissions, underscoring its role as a critical document for both the state and the entities to ensure compliance and accurate tax reporting.

| Question | Answer |

|---|---|

| Form Name | Form Ct 1065 Ct 1120Si |

| Form Length | 9 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min 15 sec |

| Other names | Connecticuts New Pass-Through Entity TaxWelcome to the Connecticut Department of Revenue Services ...Connecticut Department of Revenue ServicesTaxpayer Service Center - Form CT-1065/CT-1120SI |

Department of Revenue Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

|||||||||||||||||||||

State of Connecticut |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

(Rev. 12/20) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Connecticut |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

10651120SI 1220W 01 9999 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Return |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

Complete this return and all attachments in blue or black ink only. Do not use staples. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

Enter income year beginning |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and ending |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

M M - D D - Y Y Y Y |

M M - D D - |

|||||||||||||||||||||||||||||||||||||||||||||||||

2020

Y Y Y Y

|

Name of |

Federal Employer Identification Number (FEIN) |

|||||||||||||||||

|

This return MUST be filed electronically! |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number and street |

PO Box |

|||||||||||||||||

DO NOT MAIL paper tax return to DRS.

City, town, or post office |

State |

ZIP code |

Connecticut Tax Registration Number |

||||||||||||||||||||

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of PE:

|

Limited liability partnership (LLP) |

|

Limited partnership (LP) |

|

General partnership (GP) |

|

S corporation |

|

Partnership (LLC treated as a partnership) |

|

|

A. Return type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Final return (out of business in Connecticut) |

Date of dissolution: |

|

|

|

|

||||||||||||||||

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M M - D D - Y Y Y Y |

||||||||||||||||||

|

Amended return |

Short period return |

Explanation: |

|||||||||||||||||||

B.Change of address. See instructions.

C.Enter the

D. (a) Did this PE transfer a controlling interest in an entity that owns, directly or indirectly, CT real property? |

|

|

|

|

|

Yes |

|

|

No |

||||||||||||||||||||||||||||

If Yes, enter: Entity name |

|

|

|

|

|

|

|

|

|

|

|

|

Federal Employer ID Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

(b) If this PE directly or indirectly owns CT real property, was a controlling interest of this PE transferred? |

|

|

|

|

|

Yes |

|

|

No |

||||||||||||||||||||||||||||

If Yes, enter: Transferor name |

|

|

|

|

|

|

|

|

|

|

|

|

FEIN / SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

(c) If the answer to either (a) or (b) is Yes, enter: Transferee(s) name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Date of transfer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, and attach a list of addresses for all Connecticut real property transferred. |

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M M - D |

|

D - Y Y Y Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

E. Did this PE elect out of the new federal centralized partnership audit regime enacted by the Bipartisan Budget Act of 2015? |

|

|

Yes |

|

|

No |

|||||||||||||||||||||||||||||||

Select a Filing Method, Required. Select one. See instructions.

Standard Base (default). Complete Form

Alternative Base (election). Complete Form

Combined Election, Optional. See instructions.

PE elects to calculate its tax as a combined group with other

PE is the Designated Combined Reporting PE. Complete Schedule

PE’s income is reported on Schedule

Complete this return, except enter zero (“0”) on Part I, Schedule A, Line 1.

Designated Combined Reporting PE’s name: |

|

Designated Combined Reporting PE’s FEIN: |

|

Each PE must file its own return and select the same filing base (standard or alternative) as the other members of the combined group.

Nonresident Composite Income Tax Remittance Election, Optional. See instructions.

PE elects to remit income tax on behalf of its nonresident members. If election is made, complete Form

Form

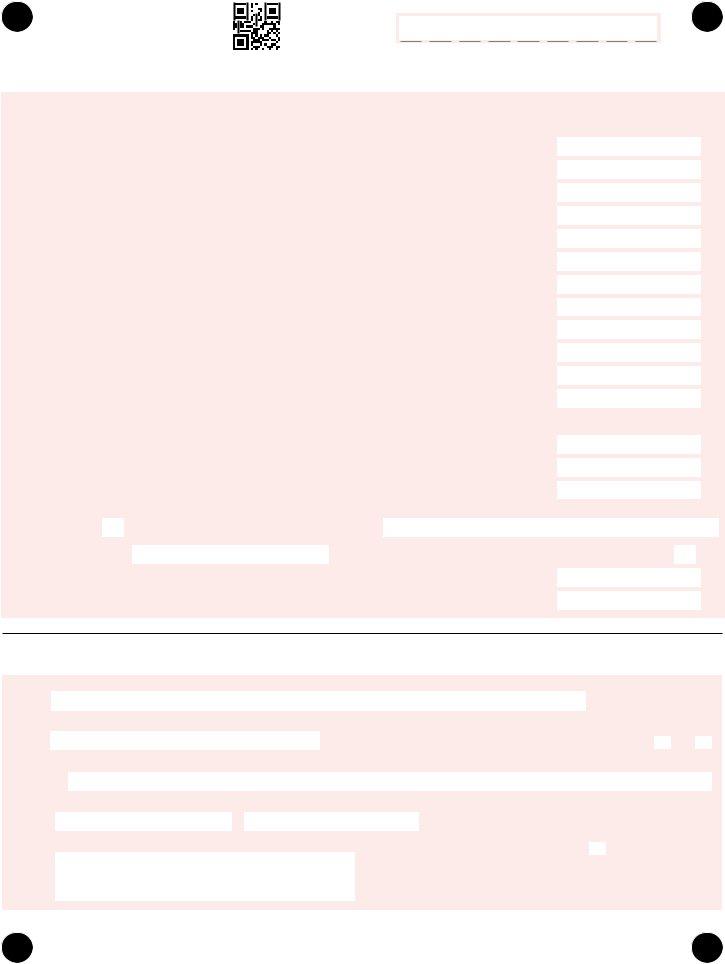

Page 2 of 9

10651120SI 1220W 02 9999

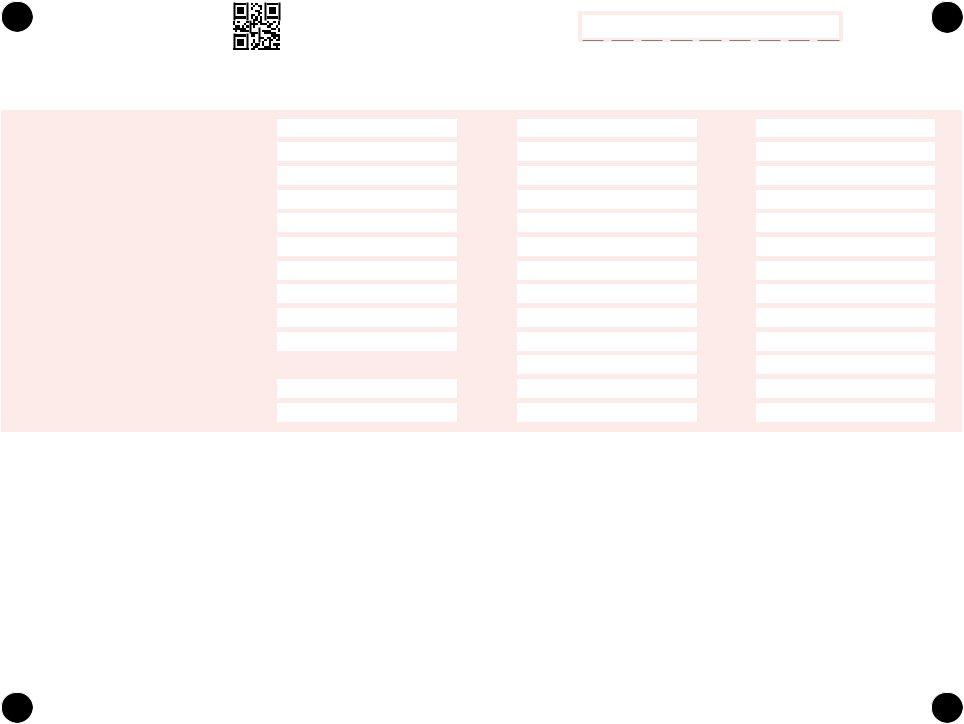

Part I, Schedule A – Computation of Amount Due

1. |

PE Income/(Loss) Subject to Tax |

|

|

||

|

Standard Base Filers: Enter amount from Part I, Schedule B, Line 20, Column D. |

|

|

||

|

Alternative Base Filers: Enter the amount from Schedule |

|

|

||

|

Combined Filers: See instructions. |

1. |

|

||

2a. |

PE Tax due: Multiply Line 1 by 6.99% (.0699). If Line 1 is zero or less, enter zero (“0”). |

2a. |

|

||

2b. |

Elective Composite Income Tax Remittance from Schedule |

2b. |

|

||

2. |

Total tax due: Add Line 2a and Line 2b. |

2. |

|

||

3a. |

2020 estimated payments |

3a. |

|

||

3b. |

Payment made with Form |

3b. |

|

||

3c. |

Overpayment from prior year applied to 2020. |

3c. |

|

||

3. |

Payments: Enter the total of Lines 3a, 3b and 3c. |

3. |

|

||

4. |

Balance due/(overpaid): Subtract Line 3 from Line 2. |

4. |

|

||

5a. |

If late, enter penalty. See instructions. |

5a. |

|

||

5b. |

If late, enter interest. Multiply the amount on Line 4 by 1% (.01). Multiply the result by |

5b. |

|||

|

the number of months or fraction of a month late. |

||||

|

|

|

|||

5c. |

Interest on underpayment of estimated tax: See instructions. |

5c. |

|

||

|

|

|

|

||

|

5d. If annualizing estimated payments, check here: |

|

|

|

|

|

|

|

|

|

|

5. |

Total penalty and interest: Enter the total of Lines 5a, 5b and 5c. |

5. |

|||

6a. |

Amount to be applied to 2021 estimated PE Tax |

6a. |

|

||

6b. |

Amount to be refunded |

6b. |

|

||

For faster refund, use direct deposit by completing Lines 6c, 6d, and 6e.

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

6c. |

Checking |

Savings |

|

|

|

|

|

6e. Account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6d. |

Routing number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6f. Will this refund go to a bank account outside the U.S.? |

|

|

Yes |

|||||||||||||||||||||||||||||||||

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|||||||||||||||||||||||||||||||||||

Total to be credited or refunded: Enter the total of Line 6a and Line 6b. |

6. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

7. |

Total amount due: Add Line 4 and Line 5. If the result is zero or less, leave this line blank. |

7. |

|

.00 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

DECLARATION: I declare under the penalty of law that I have examined this return and, to the best of my knowledge and belief, it is true, complete, and correct.

I understand the penalty for willfully delivering a false return or document to the Department of Revenue Services (DRS) is a fine of not more than $5,000, imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Sign

Here

Keep a copy of this return for your records.

Signature of general partner or corporate officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date (MMDDYYYY) |

||||||||||||||||||||||||||||||

This return MUST be filed electronically! |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Title |

|

Telephone number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

May DRS contact the preparer Yes |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

DO NOT MAIL paper |

|

|

return to DRS. |

|

|

|

|

|

|

|

|

No |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Email address of general partner or corporate officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

shown below about this return? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid preparer’s name (print) |

Paid preparer’s signature |

Date (MMDDYYYY) |

Preparer’s PTIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name and address |

|

|

|

Check if |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Firm’s FEIN |

|

|

|

|

|

|

|

|

|

|

|

Telephone number |

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please note that each form is year specific. To prevent any delay in processing your return,

the correct year’s form must be submitted to DRS.

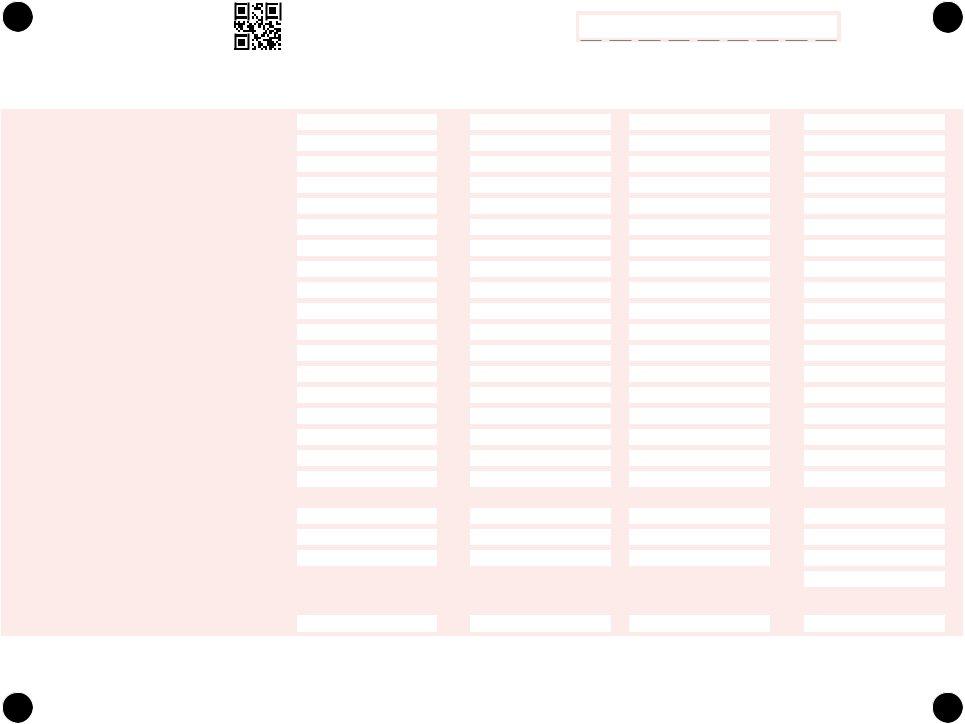

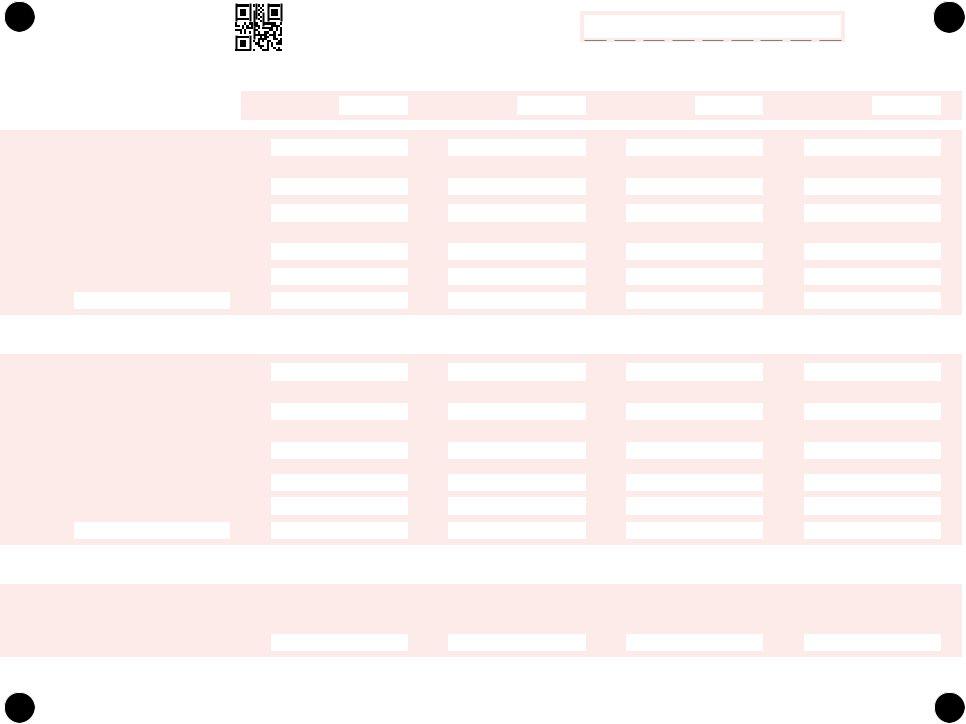

Form

Page 3 of 9

10651120SI 1220W 03 9999

Part I, Schedule B – Computation of PE’s |

Column A |

|

Own Connecticut Source Income/(Loss) |

||

Amounts Reported by this PE on |

||

|

||

|

Federal Schedule K |

|

Column C |

Column D |

|

|

PE’s Connecticut Source Income/ |

||

|

PE’s Income/(Loss) From Its |

||

Column B |

(Loss) From Its OwnActivities |

||

Own Activities |

(Apportioned or allocated from |

||

|

|||

Amounts From Subsidiary PE(s) |

(Column A minus Column B) |

Column C. See instructions.) |

1. |

Ordinary business income (loss) |

1. |

|

.00 |

.00 |

.00 |

2. |

Net rental real estate income (loss) |

2. |

|

.00 |

.00 |

.00 |

3. |

Other net rental income (loss) |

3. |

|

.00 |

.00 |

.00 |

4. |

Guaranteed payments |

4. |

|

.00 |

.00 |

.00 |

5. |

Interest income |

5. |

|

.00 |

.00 |

.00 |

6a. |

Ordinary dividends |

6a. |

|

.00 |

.00 |

.00 |

7. |

Royalties |

7. |

|

.00 |

.00 |

.00 |

8. |

Net |

8. |

|

.00 |

.00 |

.00 |

9a. |

Net |

9a. |

|

.00 |

.00 |

.00 |

10. |

Net section 1231 gain (loss) |

10. |

|

.00 |

.00 |

.00 |

11. |

Other income (loss): Attach statement. |

11. |

|

.00 |

.00 |

.00 |

11a. |

Subtotal: Add Lines 1 through 11. |

11a. |

|

.00 |

.00 |

.00 |

12. |

Section 179 deduction |

12. |

|

.00 |

.00 |

.00 |

13. |

Other deductions: Attach statement. |

13. |

|

.00 |

.00 |

.00 |

13a. |

Subtotal: Add Line 12 and Line 13. |

13a. |

|

.00 |

.00 |

.00 |

14. |

Total: Subtract Line 13a from Line 11a. |

14. |

|

.00 |

.00 |

.00 |

15. |

Subtractions from Part I, Schedule C, Line 12a |

15. |

|

.00 |

.00 |

.00 |

16. |

Subtotal: Subtract Line 15 from Line 14. |

16. |

|

.00 |

.00 |

.00 |

17a. |

Connecticut PE tax payments deducted in |

|

|

|

|

|

|

calculating income/(loss) for federal purposes 17a. |

.00 |

.00 |

.00 |

||

17b. |

Additions from Part I, Schedule C, Line 6a 17b. |

.00 |

.00 |

.00 |

||

18. |

Subtotal: Add Lines 16, 17a, and 17b. |

18. |

|

.00 |

.00 |

.00 |

19. |

Net operating loss deduction. Enter as a positive number. See instructions. .................................................................................................................................. 19. |

|||||

20.Total: Enter the amount from Line 18 for Columns A, B, and C. Subtract Line 19

from Line 18 for Column D. |

20. |

.00 |

.00 |

.00 |

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Form

Page 4 of 9

10651120SI 1220W 04 9999

Part I, Schedule C - PE’s Connecticut

Modifications

|

Column B |

Column C |

Column D |

|

PE’s Connecticut Source |

||

Column A |

Modifications Reported on |

PE’s Net Modifications |

Net Modifications |

Schedule CT |

(Column A minus |

(Apportioned or allocated from |

|

Total Modifications |

Subsidiary PE(s) |

Column B) |

Column C. See instructions.) |

1. |

Interest on state and local government obligations |

1. |

|

.00 |

.00 |

.00 |

.00 |

|

other than Connecticut |

||||||

2. |

Mutual fund |

|

|

|

|

|

|

|

2. |

|

.00 |

.00 |

.00 |

.00 |

|

|

obligations |

||||||

3. |

Certain deductions relating to income exempt from |

3. |

|

.00 |

.00 |

.00 |

.00 |

|

Connecticut income tax |

||||||

|

|

|

|

|

|

|

|

4. |

Section 168(k) federal bonus depreciation allowed |

4. |

|

.00 |

.00 |

.00 |

.00 |

|

for property placed in service during this year |

||||||

5. |

80% of Section 179 federal deduction |

5. |

|

.00 |

.00 |

.00 |

.00 |

6. |

Other: Attach statement. |

6. |

|

.00 |

.00 |

.00 |

.00 |

6a. Total additions: Add Lines 1 through 6. |

6a. |

|

.00 |

.00 |

.00 |

.00 |

|

7. |

Interest on U.S. government obligations |

7. |

|

.00 |

.00 |

.00 |

.00 |

8. |

Exempt dividends from certain qualifying mutual |

8. |

|

.00 |

.00 |

.00 |

.00 |

|

funds derived from U.S. government obligations |

||||||

9. |

Certain expenses related to income exempt from |

9. |

|

.00 |

.00 |

.00 |

.00 |

|

federal income tax but subject to Connecticut tax |

||||||

10. |

25% of Section 168(k) federal bonus depreciation |

10. |

|

.00 |

.00 |

.00 |

.00 |

|

added back in preceding three years |

||||||

11. |

25% of Section 179 federal deduction |

11. |

|

.00 |

.00 |

.00 |

.00 |

|

added back in preceding two years |

||||||

12. Other: Attach statement. |

12. |

|

.00 |

.00 |

.00 |

.00 |

|

12a.Total subtractions: Add Lines 7 through 12. |

12a. |

|

.00 |

.00 |

.00 |

.00 |

|

Part I, Schedule D - Subsidiary PE Information (Attach supplemental attachment(s), if needed) |

|

|

||

Only a parent PE must complete this schedule |

|

Column A |

Column B |

Column C |

|

|

|||

|

|

Amount Reported |

Amount From |

PE Tax Credit Reported |

Name of Subsidiary PE |

FEIN |

on Federal |

Connecticut Sources |

on Schedule CT |

1. .00 .00 .00

2. .00 .00 .00

3. .00 .00 .00

4. .00 .00 .00

5. .00 .00 .00

6. |

Subtotal(s) from supplemental attachment(s) |

6. |

|

.00 |

|

.00 |

|

.00 |

7. |

Total: Add Lines 1 through 6. |

7. |

|

.00 |

|

.00 |

|

.00 |

The amount reported on Line 7, Column C should be allocated among the members in Part IX, Column C. Do not report this amount on Part I, Schedule A.

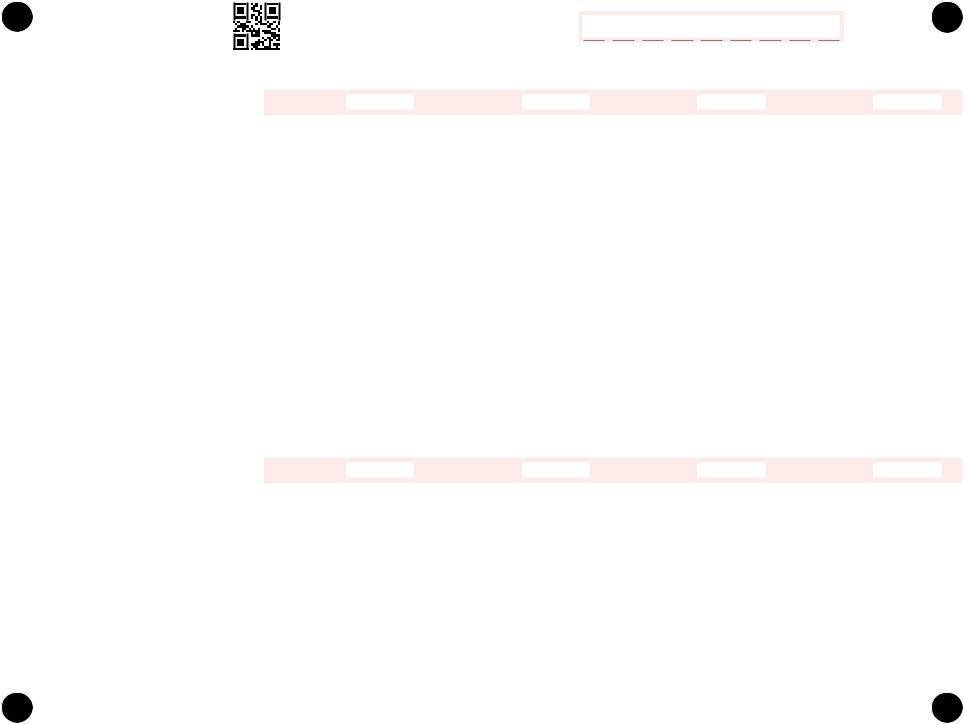

Form

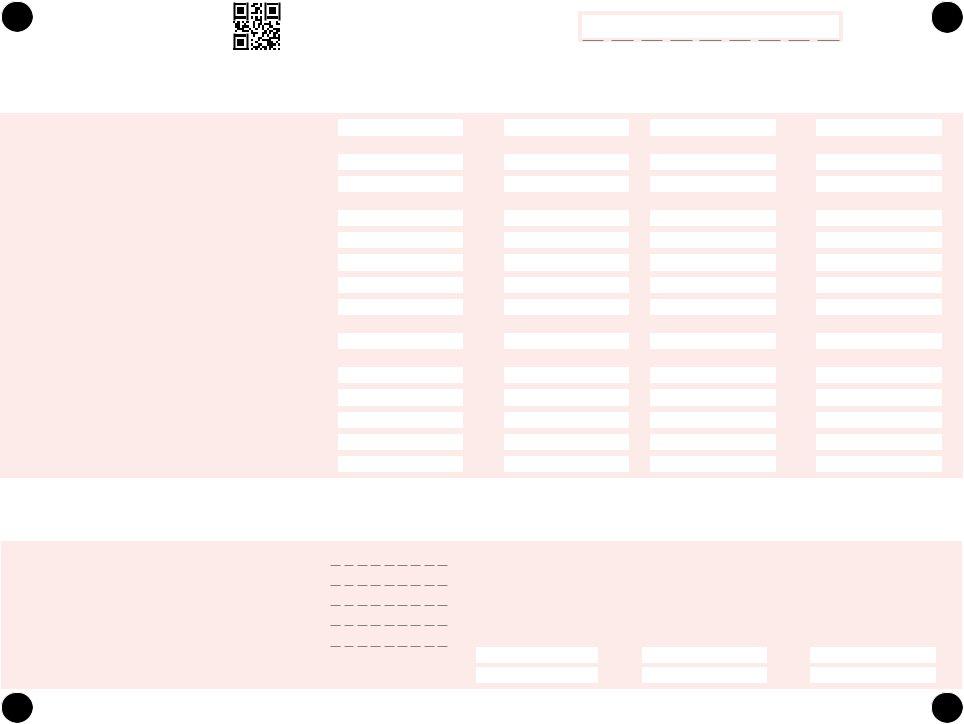

Page 5 of 9

10651120SI 1220W 05 9999

Part II – Allocation and Apportionment of Income (See instructions.) |

Column A |

Column B |

|

If the PE carries on business only within Connecticut, enter 1.000000 (100%) on Line 8 and leave the other lines blank. |

|||

Connecticut |

Everywhere |

||

|

1. Gross receipts from the sale or disposition of tangible personal property held for sale in the ordinary course of trade or business

2. Gross receipts from services

3. Gross receipts from the rental, lease or license of tangible personal property

4. Gross receipts from the rental, lease or license of intangible property

5.Gross receipts from the sale or disposition of intangible property held for sale in the ordinary course of trade or business

6.Other receipts

7.Total: Add Lines 1 through 6 in Column A and Column B.

8.Apportionment fraction: Divide Line 7, Column A, by Line 7, Column B, and carry to six decimal places.

Part III – Member Information (Attach supplemental attachment(s), if needed.)

See instructions for order in which to list and for member type codes.

|

Member |

Name, Address, City, State, and ZIP Code |

|

FEIN or SSN |

Member |

|

# |

|

|

||

|

|

|

Type Code |

||

|

|

|

|

|

|

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

8. |

. |

Distributive Share % |

|

Capital Ownership % |

Enter as a decimal. |

|

Enter as a decimal. |

. |

|

. |

|

|

|

|

|

. |

|

. |

|

|

|

|

|

. |

|

. |

|

|

|

|

|

. |

|

. |

Form

Page 6 of 9

10651120SI 1220W 06 9999

Part IV – PE’s Total Connecticut |

|

Column A |

|

Source Income/(Loss) |

|

Connecticut Source Portion of PE |

|

|

|

|

Income/(Loss) From PE’s Own Activities |

1. |

Ordinary business income (loss) |

1. |

.00 |

2. |

Net rental real estate income (loss) |

2. |

.00 |

3. |

Other net rental income (loss) |

3. |

.00 |

4. |

Guaranteed payments |

4. |

.00 |

5. |

Interest income |

5. |

.00 |

6a. |

Ordinary dividends |

6a. |

.00 |

7. |

Royalties |

7. |

.00 |

8. |

Net |

8. |

.00 |

9a. |

Net |

9a. |

.00 |

10. |

Net section 1231 gain (loss) |

10. |

.00 |

11.Other income (loss): Attach statement. 11. .00

12. |

Section 179 deduction |

12. |

.00 |

13. |

Other deductions: Attach statement. |

13. |

.00 |

|

Column C |

Column B |

PE’s Total Connecticut |

Connecticut Source Portion of Subsidiary |

Source Income/(Loss) |

PE Income/(Loss) |

(Column A plus Column B) |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

.00 |

Column A: Report amounts from Part I, Schedule B, Column D. Include modification from Part I, Schedule C, Column D where applicable. See instructions.

Column B: Report this information from Part II of the Schedule CT

Form

Page 7 of 9

10651120SI 1220W 07 9999

Part V – Member’s Total Share of Connecticut Modifications (Attach supplemental attachment(s), if needed.)

Additions: |

|

Member #: |

Enter all amounts as positive numbers. |

|

|

1. Interest on state and local government |

1. |

|

obligations other than Connecticut |

||

2.Mutual fund

municipal government obligations |

2. |

|

3. Certain deductions relating to income |

3. |

|

exempt from Connecticut income tax |

4.Section 168(k) federal bonus depreciation allowed for property

|

placed in service during this year |

4. |

|

5. |

80% of Section 179 federal deduction |

5. |

|

6. |

Other |

6. |

|

|

Specify: |

Subtractions: Enter all amounts as positive numbers.

7. Interest on U.S. government |

7. |

obligations |

8.Exempt dividends from certain qualifying mutual funds derived from

U.S. government obligations |

8. |

9.Certain expenses related to income exempt from federal income tax but

|

subject to Connecticut tax |

9. |

|

10. |

25% of Section 168(k) federal bonus |

|

|

|

depreciation added back in preceding |

10. |

|

|

three years |

||

11. |

25% of Section 179 federal deduction |

11. |

|

|

added back in preceding two years |

||

12. Other |

12. |

|

|

|

Specify: |

||

Member #: Member #: Member #:

.00 |

.00 |

.00 |

.00 |

|||

.00 |

.00 |

.00 |

.00 |

|||

.00 |

|

.00 |

|

.00 |

|

.00 |

.00 |

|

.00 |

|

.00 |

|

.00 |

.00 |

|

.00 |

|

.00 |

|

.00 |

.00 |

|

.00 |

|

.00 |

|

.00 |

.00 |

.00 |

.00 |

.00 |

|||

.00 |

.00 |

.00 |

.00 |

|||

.00 |

|

.00 |

|

.00 |

|

.00 |

.00 |

|

.00 |

|

.00 |

|

.00 |

.00 |

|

.00 |

|

.00 |

|

.00 |

.00 |

|

.00 |

|

.00 |

|

.00 |

Additional Information Required to be Reported to Nonresident, Noncorporate Members and PE Members

13.Member’s portion of Connecticut PE tax payments deducted in calculating income/(loss) for federal purposes: Enter the member’s distributive share of the amount reported on Part I, Schedule B,

Line 17a, Column A. |

13. |

.00 |

.00 |

.00 |

.00 |

Form

Page 8 of 9

10651120SI 1220W 08 9999

Part VI – Member’s Total Connecticut Source Income/(Loss). (Attach supplemental attachment(s), if needed.)

Enter member’s distributive share of Connecticut |

Member #: |

|

Member #: |

|

Member #: |

|

Member #: |

|

||||||

source items from Part IV, Column C. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Ordinary business income (loss) |

1. |

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|||||||

2. |

Net rental real estate income (loss) |

2. |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||

3. |

Other net rental income (loss) |

3. |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||

4. |

Guaranteed payments |

4. |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||

5. |

Interest income |

5. |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||

6a. |

Ordinary dividends |

6a. |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||

7. |

Royalties |

7. |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||

8. |

Net |

8. |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||

9a. |

Net |

9a. |

|

.00 |

|

.00 |

|

.00 |

|

.00 |

||||

|

|

|

|

|

|

|

|

|||||||

10. |

Net section 1231 gain (loss) |

10. |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||

11. |

Other income (loss): Attach statement. 11. |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||

12. |

Section 179 deduction |

12. |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||

13. |

Other deductions: Attach statement. |

13. |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part VII – Connecticut Income Tax Credit Summary |

|

|

|

|

|

|

|

|

|

|

||||

(Attach supplemental attachment(s), if needed.) |

|

Member #: |

|

Member #: |

|

Member #: |

|

Member #: |

|

|||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Reserved for future use |

1. |

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Reserved for future use |

2. |

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Angel investor tax credit |

3. |

|

.00 |

|

.00 |

|

.00 |

|

.00 |

||||

|

|

|

|

|

|

|

|

|||||||

4. |

Insurance reinvestment fund tax credit |

4. |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||

5. |

Total credits: Add Line 3 and Line 4. |

5. |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

.00 |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form

Page 9 of 9

10651120SI 1220W 09 9999

Do not complete Part VIII or Part IX if the PE has made the election to calculate its tax as a combined group on Page 1.

Part VIII – Direct PE Tax Credit Calculation.

1. |

Enter the amount of tax from Part I, Schedule A, Line 2a. |

1. |

|

.00 |

2. |

Total Direct PE Tax Credit Available to Members: Multiply Line 1 by 87.5% (.875). If Line 1 is zero, |

|

|

|

|

enter zero (“0”). |

2. |

|

.00 |

Part IX – Allocation of PE Tax Credit to Members. (Attach supplemental attachment(s), if needed.)

Column C

Column D |

|

Column A |

Column B |

|

Member # |

Direct PE Tax Credit |

1. |

|

1. |

2. |

|

2. |

3. |

|

3. |

4. |

|

4. |

5. |

|

5. |

6. |

|

6. |

7. |

|

7. |

8. |

|

8. |

9. |

|

9. |

10. Subtotal(s) from supplemental |

|

|

|

attachment(s) |

10. |

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Indirect PE Tax Credit From

Subsidiary PE(s)

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

|

Total PE Tax Credit |

|

(Column B plus Column C) |

|

.00 |

|

.00 |

|

.00 |

|

.00 |

|

.00 |

|

.00 |

|

.00 |

|

.00 |

|

.00 |

|

.00 |

11. Total |

11. |

.00 |

|

.00 |

|

.00 |