The CT-247 Form plays a pivotal role for not-for-profit organizations seeking exemption from New York State's corporation franchise taxes, mandated by the taxation laws within Article 9-A. This form is a detailed application that requires organizations to provide comprehensive information about their operations, legal status, and compliance with federal tax exemption standards under the Internal Revenue Code (IRC) section 501. Designed to streamline the exemption process, the CT-247 form includes sections for organizational details such as the organization's name, address, Employer Identification Number (EIN), and the specifics of its not-for-profit status, including whether it issues capital stock, its net earnings distribution, and its engagement in unrelated business activities within New York State. Additionally, it delves into the organization's federal tax exemption status, requiring proof of exemption and detailing the nature of operations and property held within the state. This form not only serves as an application for tax exemption but also as a certification of the organization's adherence to both state and federal regulations governing not-for-profit entities. The importance of accurately completing this form cannot be overstated, as it affects the organization's financial obligations and compliance with tax laws. The process of filing, including necessary documents and addressing changes in tax status, underscores the commitment of not-for-profit organizations to transparency and accountability, ensuring they are recognized correctly under New York State law.

| Question | Answer |

|---|---|

| Form Name | Form Ct 247 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | form ct 247, you 247 ct247, form any exemption form, ct247 |

|

|

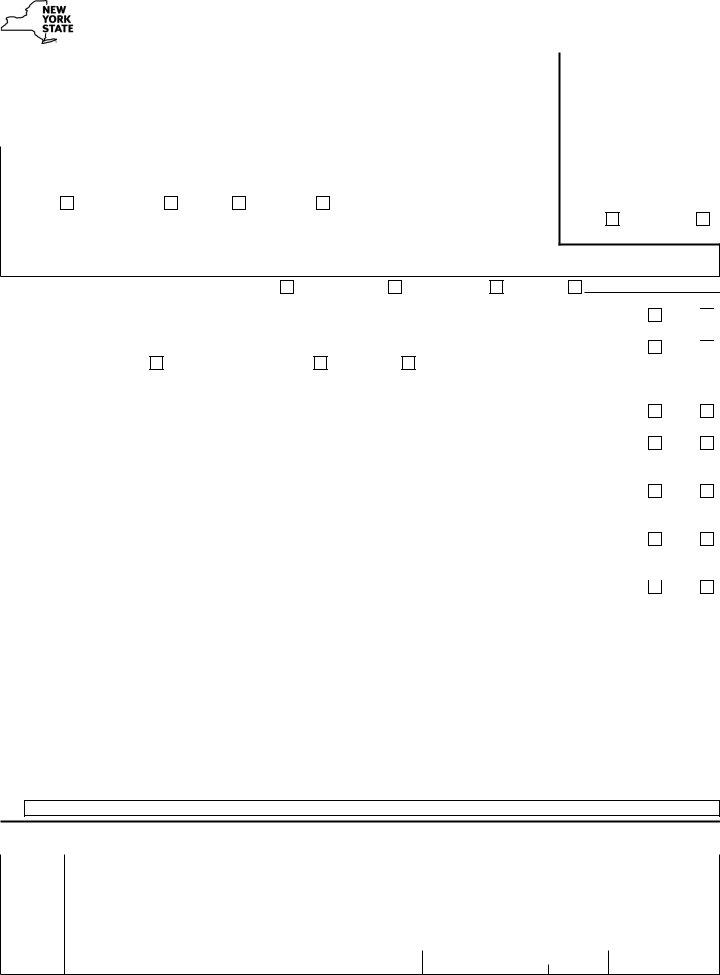

Department of Taxation and Finance |

|

|

|

|

|

|

|||

|

|

Application for Exemption from Corporation Franchise |

|||||||||

|

|

Taxes by a |

|

|

|

(12/20) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Mailingname addressand |

Legal name of corporation |

|

|

|

Employer identification number (EIN) |

For office use only |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Mailing name (if different from legal name) |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||||

|

c/o |

|

|

|

|

|

|

|

|

|

|

|

Number and street or PO box |

|

City |

|

|

State |

ZIP code |

|

|

||

|

|

|

|

|

|

|

|

||||

NYS |

principal business activity |

|

|

|

Date tax exemption claimed from |

|

For audit use only |

||||

|

|

|

|

|

|

|

|||||

Form of organization (mark an X in the appropriate box) |

|

Business/officer telephone number |

|

|

|||||||

Corporation |

Association |

Trust |

Other |

( |

) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Taxable |

Exempt |

Date of formation |

|

|

State or country of incorporation |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

Indicate exact name of the law under which the entity was formed (general corporation,

Federal return filed (mark an X in one): |

Form 990 |

Form 990‑T |

Form 1120 |

Other: |

||||

For lines 1 through 7, mark an X in the YES or NO box |

|

|

|

|

||||

1 |

Is the entity organized and operated as a |

|

Yes |

|||||

2 |

Is the entity authorized to issue capital stock? (If Yes, also mark an X in the appropriate box below.) |

.............................. |

Yes |

|||||

|

Title holding company |

Collective investment |

Other: |

|

|

|

||

|

|

|

|

|||||

|

List shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No

No

3 |

Does any part of the net earnings of the organization benefit any officer, director, or member? |

Yes |

No |

||

4 |

Does the entity meet the qualifications for exemption from federal income tax? (See General information) |

Yes |

No |

||

|

If No, stop. You do not qualify as an exempt organization. |

|

|

|

|

5 |

Did the entity apply for federal exemption? |

Yes |

No |

||

|

If Yes, indicate date of exemption |

|

. Attach a copy of your federal exemption letter. |

|

|

|

|

|

|

||

6 |

Is the entity engaged in an unrelated business activity at a location in New York State (NYS)? |

Yes |

No |

||

7Is the entity operating as a trust under Internal Revenue Code (IRC) section 401(a) and exempt from federal

..................................................................................................................income tax under IRC section 501(a)? |

Yes |

|

No |

8List location and type of activity for each office and other places of business (attach separate sheet if necessary).

|

Location |

Nature of activity |

|

9 |

|

|

|

|

|

|

|

List officers, employees, agents, and representatives in NYS and briefly describe their duties (attach separate sheet if necessary). |

|||

|

Name |

Title |

Duties |

|

|

|

|

|

|

|

|

10 List type and use of real property owned in NYS (attach separate sheet if necessary). |

|

||

|

Type |

How used |

|

|

|

|

|

|

|

|

|

11 Describe any NYS activities not shown above (attach separate sheet if necessary).

Certification: I certify that this application and any attachments are to the best of my knowledge and belief true, correct, and complete.

Willfully filing a false application is a misdemeanor punishable under the Tax Law.

Authorized |

Printed name of authorized person |

|

Signature of authorized person |

|

|

Official title |

|

|||||

person |

E‑mail address of authorized person |

|

|

|

Telephone number |

|

|

Date |

|

|||

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid |

Firm’s name (or yours if |

|

|

Firm’s EIN |

|

|

|

|

Preparer’s PTIN or SSN |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

preparer |

|

|

|

|

|

|

|

|

||||

Signature of individual preparing this application |

Address |

|

City |

|

State |

ZIP code |

||||||

use |

|

|

|

|

|

|

|

|

|

|

|

|

only |

|

|

|

|

|

|

|

|

|

|||

E‑mail address of individual preparing this application |

|

Preparer’s NYTPRIN |

|

or |

Excl. code Date |

|

||||||

(see instr.)

Page 2 of 2

Instructions

General information

Certain

(Article

Generally, a corporation or an organization treated as a

corporation must meet all of the following requirements to be tax exempt:

•It must be organized and operated as a

•It must not have stock, shares, or certificates for stock or for shares.

holding companies as described in Internal Revenue

Code (IRC) section 501(c)(2), and collective investment entities as described in IRC section 501(c)(25), are exempt from tax under Article

information, see TSB‑M‑87(9)C, Exemption for Title

Holding Companies (THC) and Collective Investment

Entities (CIE).

•No part of its net earnings may benefit any officer, director, or member.

•It must be exempt from federal income taxation under IRC section 501, subsection (a).

If the organization meets all of the above requirements, it will be presumed to be exempt from tax under Tax Law Article

An organization whose tax exempt status has been

revoked and later restored by the Internal Revenue

Service (IRS), must file a new application on

Form CT‑247. The new application must be approved before any

activities.

Organizations required to file federal Form 1120 may be taxable under Article

When filing Form

corporation’s articles of incorporation, and its bylaws.

Promptly report any changes in the corporation’s federal tax status to the NYS Tax Department.

Any exemption granted by the filing of Form

Any inquiry on the taxable status of an organization must be in writing, signed by an officer of the organization, and mailed to the address under How to file.

Refund of franchise taxes

If the organization paid franchise taxes in error, request a refund by filing an amended return. A housing

development fund company must submit proof that it was organized under Private Housing Finance Law Article 11.

How to file

Fax to:

Or mail to: NYS Tax Department, Corporation Tax Account Resolution, W A Harriman Campus, Albany NY

Private delivery services

See Publication 55, Designated Private Delivery Services.

Signature

The application must be certified by the president, vice

president, treasurer, assistant treasurer, chief accounting

officer, or other officer authorized by the taxpayer

corporation.

The application of an association, publicly traded partnership, or business conducted by a trustee or trustees must be signed by a person authorized to act for the association, publicly traded partnership, or business.

If an outside individual or firm prepared the application,

all applicable entries in the paid preparer section must be completed, including identification numbers (see Paid preparer identification numbers in Form CT‑1). Failure

to sign the application will delay the processing of any refunds and may result in penalties.

Need help? and Privacy notification

See Form CT‑1, Supplement to Corporation Tax Instructions.