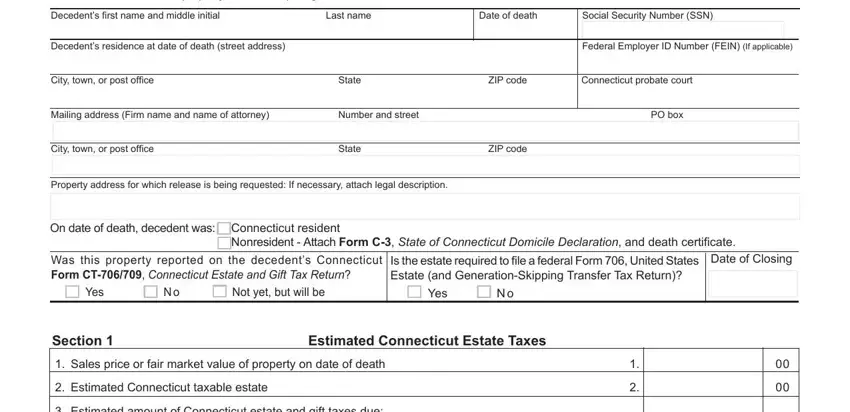

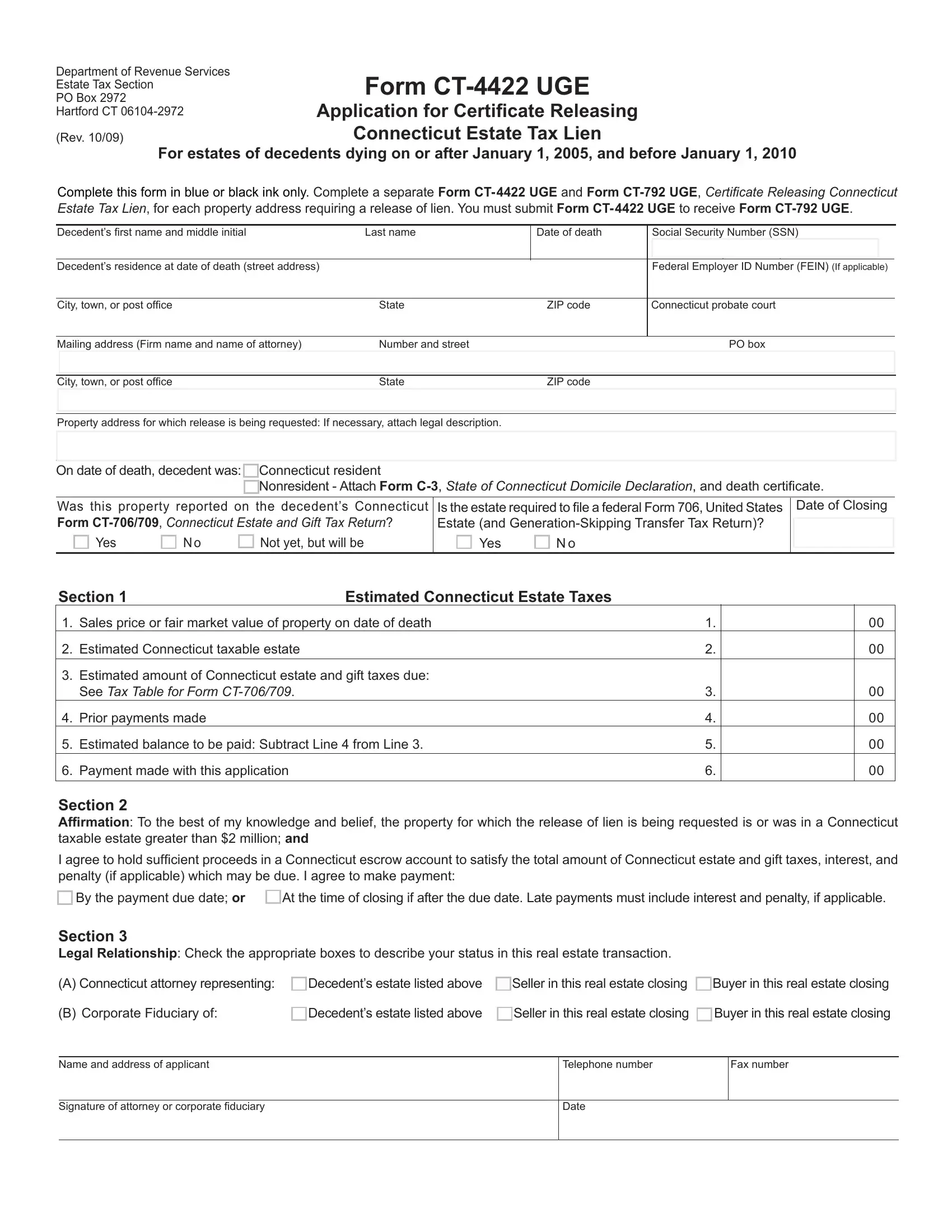

Complete the form in blue or black ink only.

Purpose

Use Form CT-4422 UGE, Application for Certiicate Releasing CONNECTICUT ESTATE TAX LIEN, to request the release of a lien on

Connecticut real property includible in the decedent’s Connecticut taxable estate.

What Is the Connecticut Taxable Estate

The Connecticut taxable estate is;

•The sum of the decedent’s gross estate, as valued for federal estate tax purposes less allowable federal estate tax deductions (other than the federal estate tax deduction for state death taxes paid); plus

•The aggregate amount of Connecticut taxable gifts made by the decedent in his or her lifetime during all calendar years beginning on or after January 1, 2005.

Who Must File

A Connecticut attorney or corporate iduciary who, for the property description and address cited, represents any of the following:

•Decedent’s estate;

•Buyer at the real estate closing; or

•Seller at the real estate closing.

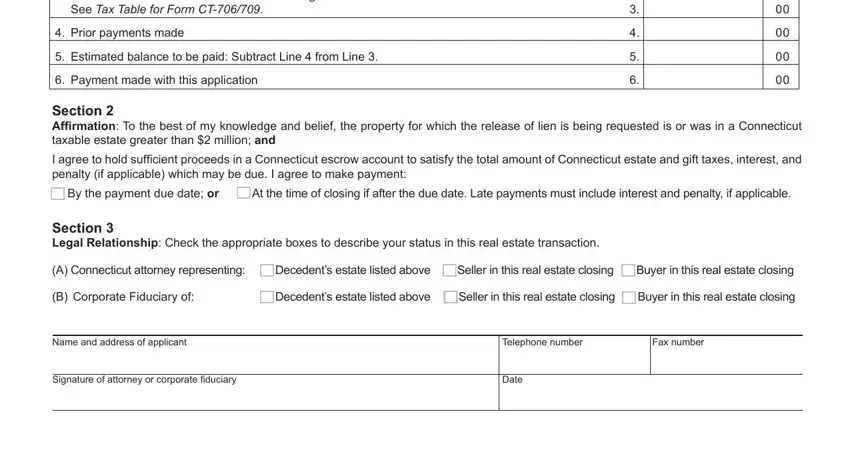

By signing Form CT-4422 UGE, the attorney or corporate iduciary making the request for release agrees to pay any tax, interest, or penalty due by the payment due date or at the time of closing.

Rounding Off to Whole Dollars

You must round off cents to the nearest whole dollar on your return and schedules. If you do not round, the Department of Revenue Services (DRS) will disregard the cents. Round down to the next lowest dollar all amounts that include 1 through 49 cents. Round up to the next highest dollar all amounts that include 50 through 99 cents. However, if you need to add two or more amounts to compute the amount to enter on a line, include cents and round off only the total.

Example: Add two amounts ($1.29 + $3.21) to compute the total ($4.50) to enter on a line. $4.50 is rounded to $5.00 and entered on a line.

How to Request the Release of a Lien From DRS on a Taxable Estate

A Connecticut taxable estate must ile Form CT-4422 UGE and Form

CT-792 UGE, Certiicate Releasing Connecticut Estate Tax Lien, with the DRS to request the release of a lien.

Form CT-4422 UGE will be considered incomplete if an afirmation box agreeing to payment is not checked.

To calculate the amount of tax, interest, and penalty due, if applicable, see instructions for Form CT-706/709, CONNECTICUT

ESTATE AND GIFT TAX RETURN.

A separate Form CT-4422 UGE must be iled for each property address requiring a release of lien. Form CT-4422 UGE must be accompanied by Form CT-792 UGE. Nonresident estates must

also attach Form C-3, State of Connecticut Domicile Declaration, and a death certiicate.

How to Request the Release of a Lien From Probate Court on a Nontaxable Estate

Where the amount of a decedent’s Connecticut taxable estate is $2 million or less, any certiicate of release of estate tax lien will be issued by the probate court having jurisdiction of the estate. For more information, contact the Probate Court.

If DRS issues a release of lien per your request, based on an estimated taxable estate of greater than $2 million, and you ile

anontaxable Form CT-706 NT, CONNECTICUT ESTATE TAX RETURN

(for Nontaxable Estates), with the Probate Court, the request for release of lien is invalid. You must contact the Probate Court for a valid release of lien.

Property Address

Describe the property in enough detail so the property can be easily identiied. If necessary, attach the legal description.

Estate Tax

An estate must ile Form CT-706/709 if the decedent’s Connecticut taxable estate exceeds $2 million. Form CT-706/709 must be iled by both estates of Connecticut residents and by estates of

nonresidents who owned real or tangible personal property located in Connecticut.

The Connecticut estate and gift tax return must be iled with DRS and a copy iled with the Probate Court for the district in which the decedent was a Connecticut resident or if the decedent was a nonresident of Connecticut, a copy with the probate court for

the district in which the decedent owned real property or tangible

personal property in Connecticut.

When to File for Estate Tax

Form CT-706/709 for Connecticut estate tax is due within six months after the date of the decedent’s death unless an extension of time to ile is requested. Use Form CT-706/709 EXT, Application for Estate and Gift Tax Return Filing Extension and for Estate Tax Payment Extension, to apply for an extension of time to ile.

Payment of the estate tax is due within six months after the date of the decedent’s death unless an extension of time to pay has been granted.

Where to File

You may ile your completed Form CT-4422 UGE by fax, mail, or in person at the DRS main ofice.

Fax: 860-297-5775

Mail: Department of Revenue Services

Estate Tax Section

PO Box 2972

Hartford CT 06104-2972

In person: 25 Sigourney, Hartford CT

Make your check or money order payable to: Commissioner of Revenue Services. To ensure payment is applied to your account, write “2009 Form CT-4422” and the SSN, optional, on the front of your check. Be sure to sign your check and paper clip it to the front of your return. Do not send cash. DRS may submit your check to your bank electronically.

How to Get Help

Call the Estate Tax Section, Monday through Friday, 8:30 a.m. through 4:30 p.m., at 860-297-5737.

Forms and Publications

Visit the DRS website at www.ct.gov/DRS to download and print Connecticut tax forms and publications.