In today's digital age, the importance of timely and accurate wage reporting cannot be overstated for both employers and the state's revenue services. The State of Connecticut Department of Revenue Services has streamlined this critical process with the Form CT-6559, Submitter Report for Form W-2 Magnetic Media Filing. This essential document serves as a bridge between employers and the state, ensuring that employee wage information is accurately and efficiently processed. Designed for use in conjunction with Form CT-W3, Connecticut's Annual Reconciliation of Withholding, Form CT-6559 details every aspect necessary for the magnetic media reporting of W-2 information. It captures a range of crucial data, from the type of file (original or replacement) and the calendar year of the submission to the specific media type used for the submission (cartridge, diskette, or CD-ROM). Furthermore, it intricately outlines the submitter's details, including their Connecticut Tax Registration and Federal Employer Identification Numbers, ensuring a transparent and traceable reporting process. To add to its comprehensiveness, the form requires detailed contact information and concludes with declarations that must be signed under the penalty of law, underscoring the seriousness and legal implications of the filing process. Additionally, providing a summary for each employer included in the magnetic media file showcases the form's role in facilitating detailed, organized, and systematic wage reporting to the Connecticut Department of Revenue Services.

| Question | Answer |

|---|---|

| Form Name | Form Ct 6559 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | ct 6559 state of ct w2 fillable form |

Department of Revenue Services

State of Connecticut

PO Box 2930

Hartford CT

(Rev. 10/04)

Forms

Form

Submitter Report

for Form

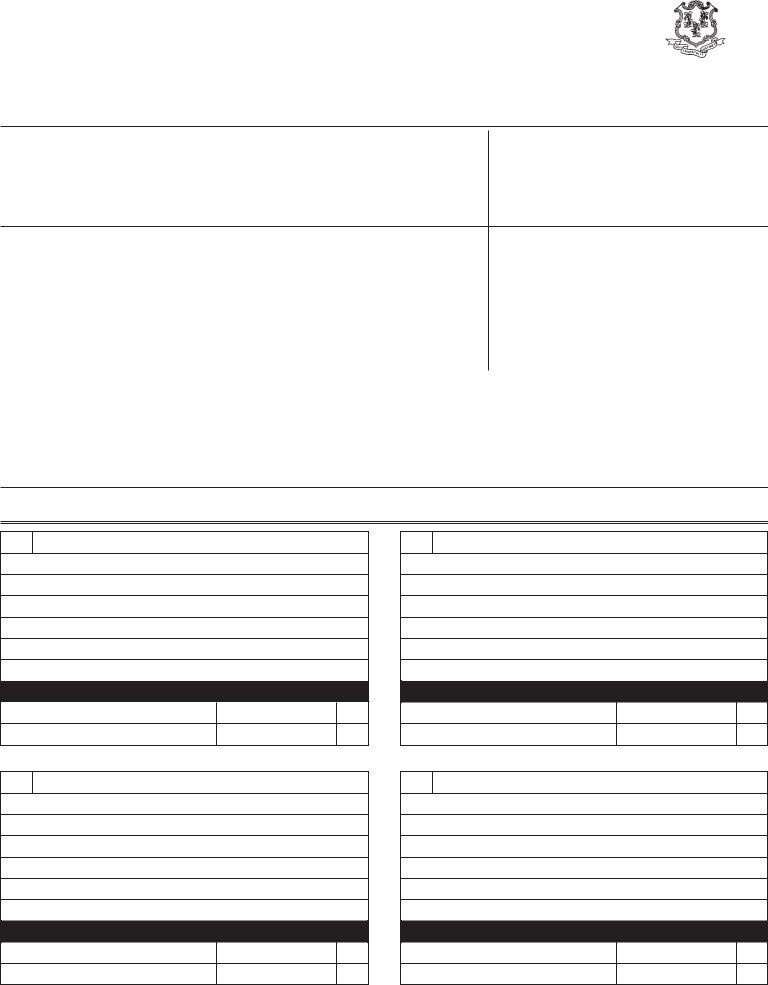

1. |

Type of file represented by this transmittal |

2. Calendar year for which media is submitted |

3. |

Submitter’s Connecticut Tax Registration Number |

|

|

Original |

Replacement |

|

|

|

|

|

|

|

|

|

4. |

Name and address of submitter (Include street, PO box, city, state, and ZIP code) |

5. |

Submitter’s Federal Employer Identification Number |

||

6. Name and address of person to contact about this magnetic media file |

7. Contact telephone number (include area code) |

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

8. |

Type of media submitted |

|

|

|

9. |

Total number of media in shipment |

|

|

Cartridge |

Diskette |

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

Total number of employers |

|

|

11. Total number of employees |

12. |

Submitter’s magnetic media inventory numbers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In general, the employer must sign the declaration; however, an authorized agent of the employer may sign if all conditions stated on the back are met.

Declaration: I declare under the penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Signature |

Title |

Date |

13.Employer Summary of Form

Street Address

City |

State |

ZIP |

Connecticut Tax Registration Number

Federal Employer ID Number

Number of

Form

Total Connecticut Wages Reported

Connecticut Tax Withheld From Wages

13.Employer Summary of Form

Street Address

City |

State |

ZIP |

Connecticut Tax Registration Number

Federal Employer ID Number

Number of

Form

Total Connecticut Wages Reported

Connecticut Tax Withheld From Wages

13.Employer Summary of Form

Street Address

City |

State |

ZIP |

Connecticut Tax Registration Number

Federal Employer ID Number

Number of

Form

Total Connecticut Wages Reported

Connecticut Tax Withheld From Wages

13.Employer Summary of Form

Street Address

City |

State |

ZIP |

Connecticut Tax Registration Number

Federal Employer ID Number

Number of

Form

Total Connecticut Wages Reported

Connecticut Tax Withheld From Wages

Instructions

Use Form

Block 3: Enter the

Block 5: Enter the

Block 10: Enter the total number of employers covered by this submittal . Form

Block 11: Enter the total number of employees (as entered on the code RF final record).

Block 12: Enter the inventory number for each cartridge, diskette, or CD - ROM in this file . The inventory number is any type of number assigned by the submitter to the cartridge, diskette, or

Block 13: Complete Block 13, Employer Summary of Form

Substitute Forms

Mailing Address: Prepare Form

Department of Revenue Services

State of Connecticut

PO Box 2930

Hartford CT

If a PO Box cannot be used, send to:

Department of Revenue Services

State of Connecticut

Attn: Processing II, 15th Floor

25 Sigourney Street

Hartford CT

Declaration Instructions

A submitter, service bureau, paying agent, or disbursing agent (agent) may sign Form

1.The agent has the authority to sign the form under an agency agreement (oral, written, or implied) that is valid under state law; and

2.The agent signs the form and adds the caption “For: (Name of the payer or other person required to file).”

If an authorized agent signs the declaration on the employer’s behalf, this does not relieve the employer of the responsibility for filing a correct, complete, and timely Form

Forms and Publications

Forms and publications are available anytime at:

•Internet: Preview and download forms and publications from the DRS Web site at www.ct.gov/DRS

•DRS

•Telephone: Call

Option 2; or the Forms Unit at

Magnetic Media Specifications for

Cartridge Requirements

•3480 or 3490 cartridge

•512 byte fixed length records

Cartridge Recommendation

•45 records per block (23,040)

•EBCDIC character set

Character Set - Check one

ASCII |

|

EBCDIC |

Diskette Requirements |

|

|

|

• PC compatible |

|

• Formatted as Data |

|

• 512 byte fixed length records |

• 512 byte fixed length records |

||

• 3 1/2 inch (720K, 1.44M densities) |

|

|

|

Character Set - Check one |

Character Set - Check one |

|

|

ASCII |

ASCII |

||

EBCDIC |

EBCDIC |

||