Handling PDF forms online is always super easy with this PDF editor. You can fill in Form Ct 75 here within minutes. The editor is constantly improved by our team, receiving powerful functions and turning out to be more versatile. Getting underway is easy! All you have to do is take the following easy steps down below:

Step 1: Hit the "Get Form" button at the top of this page to open our editor.

Step 2: As you open the PDF editor, you will see the form prepared to be filled in. Apart from filling out various blank fields, you can also do other actions with the Document, such as adding any words, modifying the initial textual content, adding illustrations or photos, putting your signature on the document, and much more.

This document will need specific details; to guarantee accuracy and reliability, remember to take into account the tips directly below:

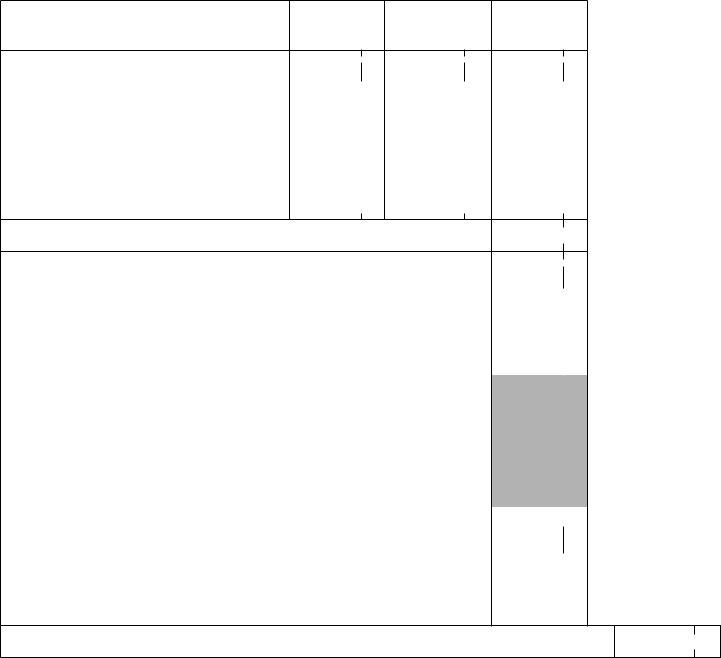

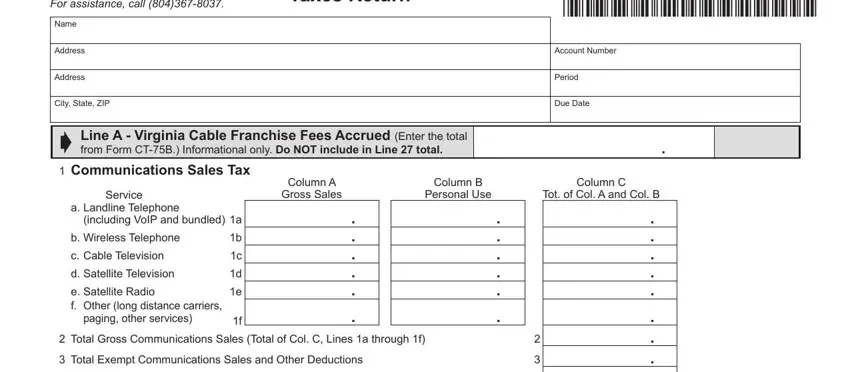

1. It is advisable to complete the Form Ct 75 accurately, thus be mindful while filling in the sections including these fields:

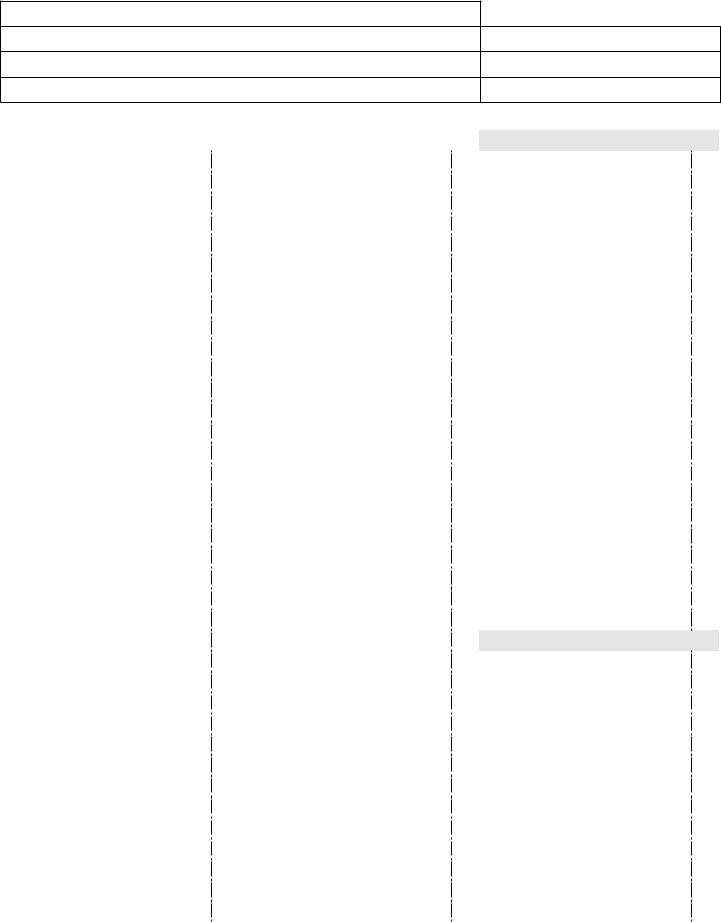

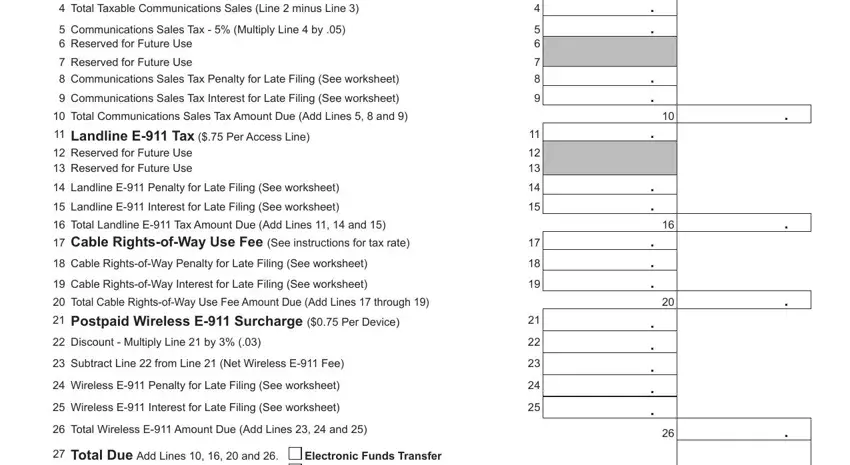

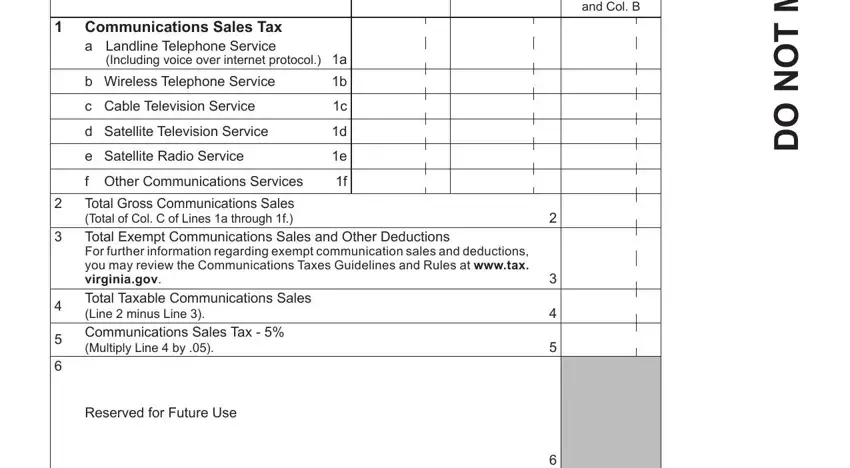

2. Soon after the previous part is completed, go to enter the suitable details in all these - Total Taxable Communications, Communications Sales Tax, Reserved for Future Use, Communications Sales Tax Penalty, Communications Sales Tax Interest, Total Communications Sales Tax, Landline E Penalty for Late, Landline E Interest for Late, Total Landline E Tax Amount Due, Cable RightsofWay Penalty for, Cable RightsofWay Interest for, Total Cable RightsofWay Use Fee, Discount Multiply Line by, Subtract Line from Line Net, and Wireless E Penalty for Late.

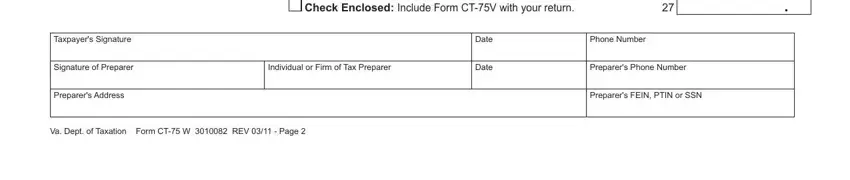

3. Throughout this stage, have a look at Taxpayers Signature, Check Enclosed Include Form CTV, Signature of Preparer, Individual or Firm of Tax Preparer, Preparers Address, Va Dept of Taxation Form CT W REV, Date, Date, Phone Number, Preparers Phone Number, and Preparers FEIN PTIN or SSN. Each of these need to be filled out with utmost precision.

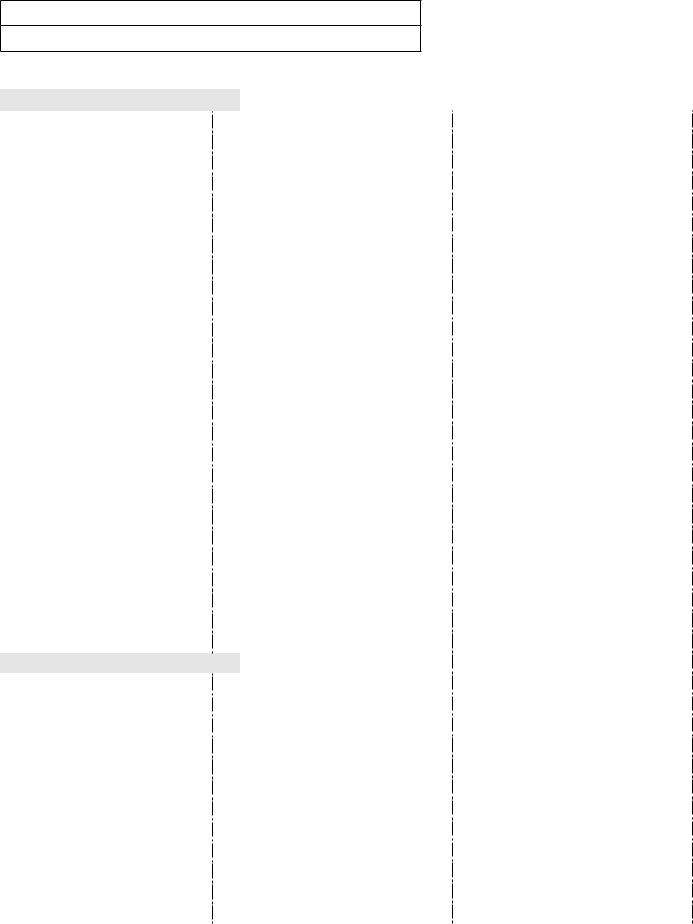

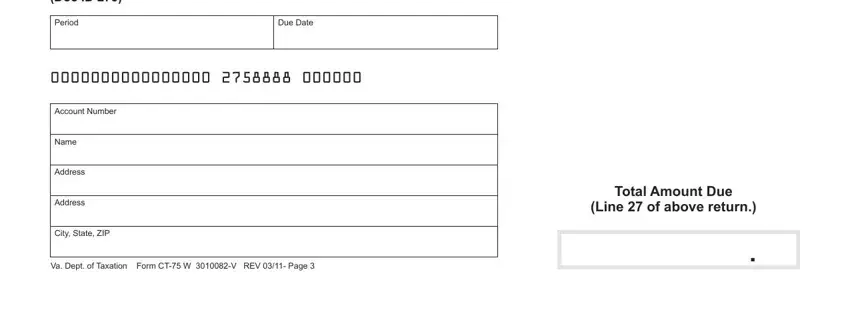

4. You're ready to proceed to the next part! Here you will get all of these Form CTV Virginia Communications, Period, Due Date, Account Number, Name, Address, Address, City State ZIP, Va Dept of Taxation Form CT W V, Total Amount Due, and Line of above return blanks to do.

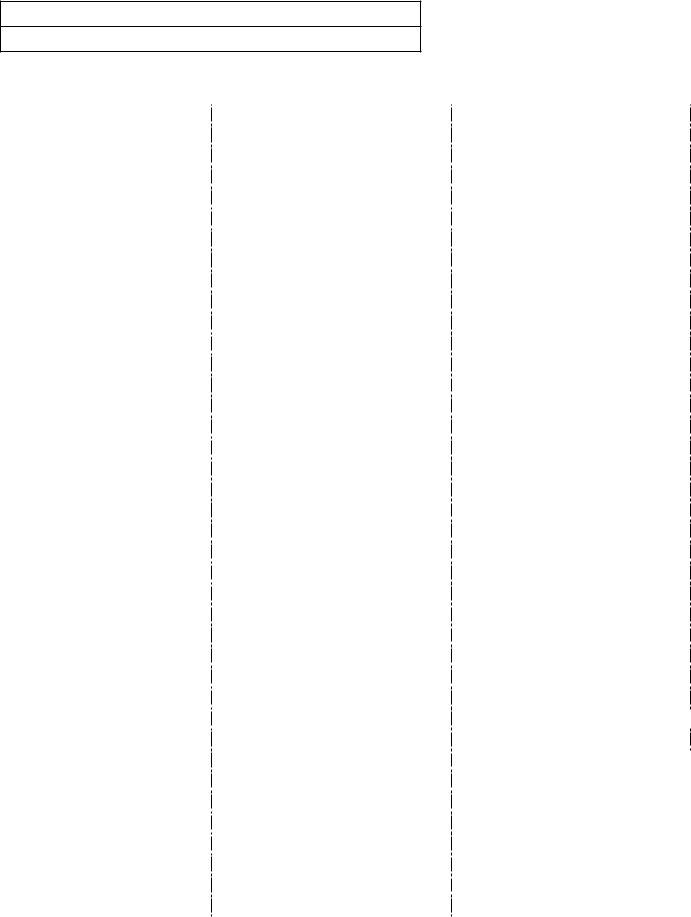

5. This document needs to be finalized by going through this segment. Here there can be found an extensive listing of form fields that need accurate information for your form submission to be faultless: L A m T O N O D, and Col B, Communications Sales Tax a, Including voice over internet, b Wireless Telephone Service, c Cable Television Service, d Satellite Television Service, e Satellite Radio Service, f Other Communications Services, Total Gross Communications Sales, and Reserved for Future Use.

When it comes to and Col B and d Satellite Television Service, be sure that you do everything properly in this section. Both of these are thought to be the key ones in the file.

Step 3: After rereading the entries, hit "Done" and you're done and dusted! Join FormsPal now and easily obtain Form Ct 75, all set for downloading. All adjustments you make are kept , meaning you can edit the form later on as required. Whenever you work with FormsPal, you'll be able to fill out documents without stressing about database leaks or entries being distributed. Our protected software ensures that your personal information is maintained safely.