When it comes to managing taxes, understanding the obligations and potential penalties related to underpayment is crucial. The D-422 form issued by the North Carolina Department of Revenue serves as a vital tool for individuals to determine whether they are subject to penalties for underpaying their estimated taxes. Applicable to those who have either failed to pay or have paid insufficient quarterly taxes, this form lays out a straightforward method for calculating the necessary catch-up payments to avoid or reduce penalties. With special provisions for farmers and fishermen, who have a unique payment deadline, and instructions for those with varying annual income, the form is designed to guide taxpayers through the process of rectifying their tax payments. Whether opting for the short method for precise penalty calculation—applicable under specific conditions such as equal quarterly payments without delay—or the regular method for more complex situations, the form includes detailed line-by-line instructions to ensure clarity. The D-422 form underlines the importance of accurate tax calculation and timely payment, highlighting the potential financial repercussions of underpayment and providing pathways to compliance for North Carolina taxpayers.

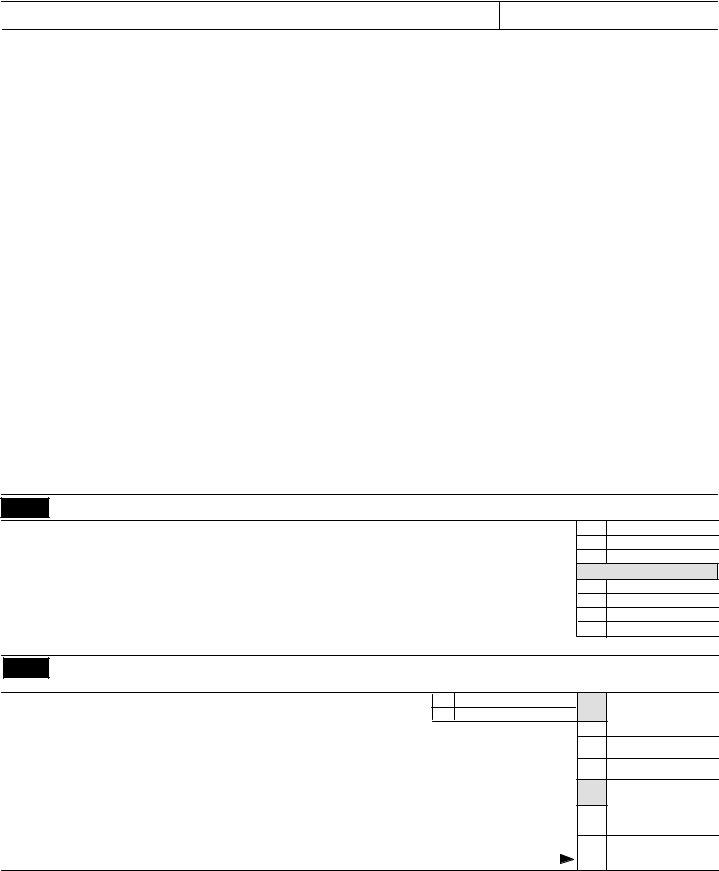

| Question | Answer |

|---|---|

| Form Name | Form D 422 North Carolina |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | d 422, UNDERPAYMENT, D--422, Annualized |

(Rev. |

|

1998 |

Form |

NORTH CAROLINA DEPARTMENT OF REVENUE |

|

UNDERPAYMENT OF ESTIMATED TAX BY INDIVIDUALS

Name(s) shown on tax return

Social Security Number

Instructions

Who Should Use This

NOTE: If you were not required to file a 1997 North Carolina income tax return, STOP HERE. You do not owe the penalty and you do not have to complete this form.

Short Method

You may use the short method only if:

. You made no estimated tax payments (or your only payments were withheld North Carolina income tax); OR

. You paid estimated tax in four equal amounts on the due dates.

NOTE: If you made estimated tax payments, the short method will give the precise penalty amount only if your payments were made exactly on the due dates. If any payment was made earlier than the due date, you may use the short method, but using it may cause you to pay a larger penalty than the regular method. If the payment is only a few days early, the difference will generally be small. Do Not use the short method if you made any of your payments late. Important: A farmer or fisherman cannot use the short method to

determine the penalty since the penalty for a farmer or fisherman is determined in the last quarter only.

Regular Method

Use the regular method to figure the penalty if you are not eligible to use the short method. To use the regular method, complete Part I below and Part III on the back.

Line 6

Line 7

If you were required to file a return for 1997 but have not filed, do not complete this line. Instead, enter the amount from line 4 on line 8.

Line 16

Line 17

. You are considered to have paid any

withheld State income tax evenly over the period you worked during the year unless you can show otherwise. If you worked all year, divide the total amount withheld by 4, and enter the result in each column.

. Include your estimated tax paid for each

payment period. Also include any 1997 overpayment of tax which you elected to apply to your 1998 estimated tax. If you file your return and pay the tax due by January 31, 1999, include on line 17, column (d), the amount of tax you pay with your return.

Line 23

Line 25

Line 27

(c) and 90 in column (d).

Part I

Required Annual Payment

1. |

1998 tax from Form |

|

. . . . |

. . . . . . . . . . . . . . . . . . . . . |

2. |

Tax credits from 1998 Form |

|

. . . . |

. . . . . . . . . . . . . . . . . . . . . |

3. |

Subtract line 2 from line 1 |

|

. . . . |

. . . . . . . . . . . . . . . . . . . . . |

4. |

Multiply line 3 by 90% (.90) or 66 2/3% (.6667) for farmers and commercial fishermen |

|

4. |

|

|

|

|||

5. |

Withholding taxes from 1998, Form |

|

. . . . |

. . . . . . . . . . . . . . . . . . . . . |

6. |

Subtract line 5 from line 3. If less than $1,000, stop here; do not complete or file this form. You do not owe the penalty . . . . |

|||

7. |

Enter your 1997 tax (amount from line 12 less tax credit(s) claimed on line 15) |

|

. . . . |

. . . . . . . . . . . . . . . . . . . . . |

8. |

Required annual payment. Enter the smaller of line 4 or line 7 |

|

. . . . |

. . . . . . . . . . . . . . . . . . . . . |

|

Note: If line 5 is equal to or more than line 8, stop here. You do not owe the penalty. |

|

|

|

1.

2.

3.

5.

6.

7.

8.

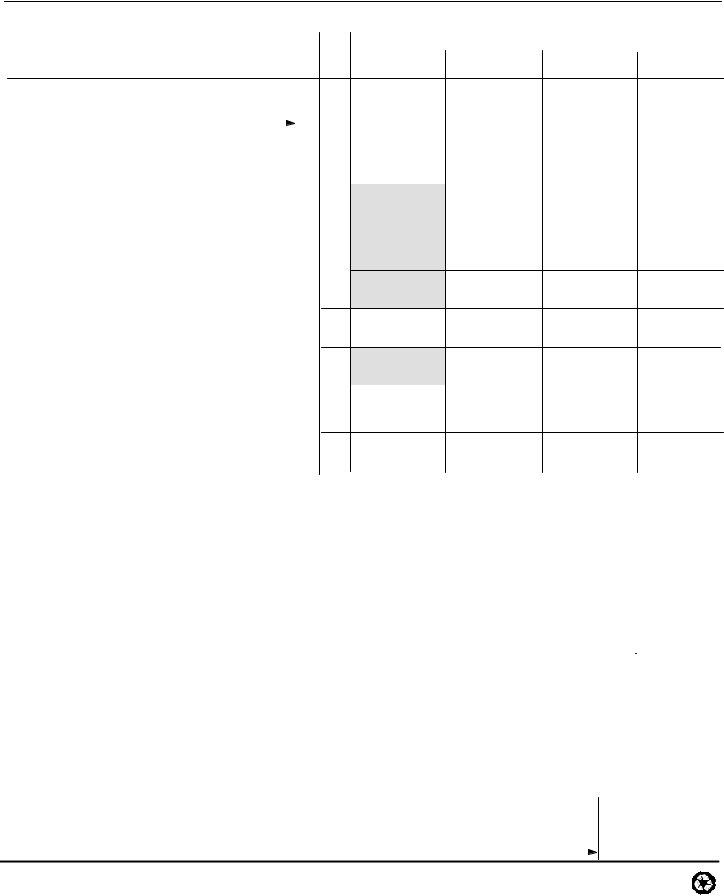

Part II

Short Method

9. |

Enter the amount, if any, from line 5 above |

9. |

|

|

|||

10. |

Enter the total amount, if any, of estimated tax payments you made |

10. |

|

|

|||

11. |

Add lines 9 and 10 |

11. |

|||||

12. |

Total underpayment for year. Subtract line 11 from line 8. (If zero or less, stop here; you do not owe |

12. |

|||||

|

the penalty) |

||||||

|

|

||||||

13. |

Multiply line 12 by .0575 and enter the result |

|

|

|

13. |

||

14. |

. |

If the amount on line 12 was paid on or after 4/15/99, enter |

|

|

|

||

|

. |

If paid before 4/15/99, make the following computation to find the amount to enter on line 14. |

|

||||

|

Amount on |

|

Number of days paid before |

|

|

|

|

|

|

X |

X |

.00022 |

14. |

||

|

|

line 12 |

4/15/99 |

||||

|

|

|

|

|

|

||

15. |

PENALTY. Subtract line 14 from line 13. |

Enter the result here and on line 17b of your income tax return, |

|

||||

|

Form |

15. |

|||||

|

|

|

|

|

|

|

|

Form

Page 2

|

Part III |

Regular Method |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section A |

|

|

Payment Due Dates |

|

||

|

|

(a) |

(b) |

(c) |

(d) |

||

|

|

|

|

4/15/98 |

6/15/98 |

9/15/98 |

1/15/99 |

16.Divide line 8 by 4 and enter the result in each column. Exception: If you use the annualized income

|

ment method, complete Form |

|

16. |

|

|

||||

17. |

Income Installment Worksheet) and check this box. |

|

|

|

|

|

|||

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

Estimated tax paid and tax withheld. For column (a) only, |

|

|

|

|

|

||||

|

|

|

|

|

|

||||

|

enter the amount from line 17 on line 21. (If line 17 is |

|

|

|

|

|

|||

|

equal to or more than line 16 for each payment period, |

17. |

|

|

|||||

|

. . . .stop here; you do not owe the penalty.) |

|

|

||||||

|

|

|

|||||||

|

Complete lines 18 through 24 of one column before |

|

|

|

|

|

|||

|

going to the next column. |

|

|

|

|

|

|||

18. |

Enter amount, if any, from line 24 of previous colum . . . . |

18. |

|

|

|||||

|

|

19. |

|

|

|||||

19. |

Add lines 17 and 18 |

|

|

||||||

20. |

Add amounts on lines 22 and 23 of the previous column |

|

|

and enter the result |

20. |

21.Subtract line 20 from line 19 and enter the result. If zero

or less, enter zero. (For column (a) only, enter the |

|

amount from line 17) |

21. |

22.Remaining underpayment from previous period. If the

amount on line 21 is |

||

and enter the result. Otherwise, enter |

. . . . 22. |

|

23. Underpayment. If line 16 is larger than or equal |

to |

|

line 21, subtract line 21 from line 16 and enter the |

||

result. Enter 0 on line 18 of the next column and go to |

||

line 19. Otherwise, go to line 24 |

. . . . 23. |

|

24.Overpayment. If line 21 is larger than line 16, subtract

|

|

line 16 from line 21 and enter the result. Then go to |

|

|

|

|

|

|

|||||

|

|

line 18 of next column. . |

. . . . . . . . . . . . . . . . . . . . |

. . . . |

. . . . 24. |

|

|

|

|

||||

|

Section B Figure the Penalty (Complete lines 25 through 28 of one column before going to the next |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

April 15, 1998 December 31, 1998 |

|

|

|

|

|

|

|

||||

|

|

|

|

|

4/15/98 |

6/15/98 |

9/15/98 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

25. Number of days after the date shown above line 25 through |

|

Days: |

Days: |

Days: |

|

|||||||

|

|

the date the amount on line 23 was paid or |

12/31/98, |

|

|

|

|

|

|||||

|

|

whichever is earlier. |

. . . . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . |

25. |

|

|

|

|

|||

|

26. |

Underpayment |

X |

|

Number of days |

X |

.09 |

|

|

|

|

|

|

|

|

on line 23 |

|

on line 25 |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

(see instructions) |

|

365 |

|

|

|

26. |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

January 1, 1999 |

April 15, 1999 |

|

|

|

|

|

|

|

|||

|

|

|

|

|

12/31/98 |

12/31/98 |

12/31/98 |

1/15/99 |

|||||

|

|

|

|

|

|

|

|

|

|

||||

|

27. Number of days after the date shown above line 27 through |

|

Days: |

Days: |

Days: |

Days: |

|||||||

|

|

the date the amount on line 23 was paid or |

4/15/99, |

|

|

|

|

|

|||||

|

|

whichever is earlier. |

. . . . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . |

27. |

|

|

|

|

|||

|

28. |

Underpayment |

X |

|

Number of days |

X |

.08 |

|

|

|

|

|

|

|

|

on line 23 |

|

on line 27 |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

(see instructions) |

|

365 |

|

|

|

28. |

$ |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|||||

29.Penalty (add amounts on line 26 and 28). Enter here and on line 17b of your individual income tax return,

Form

29.