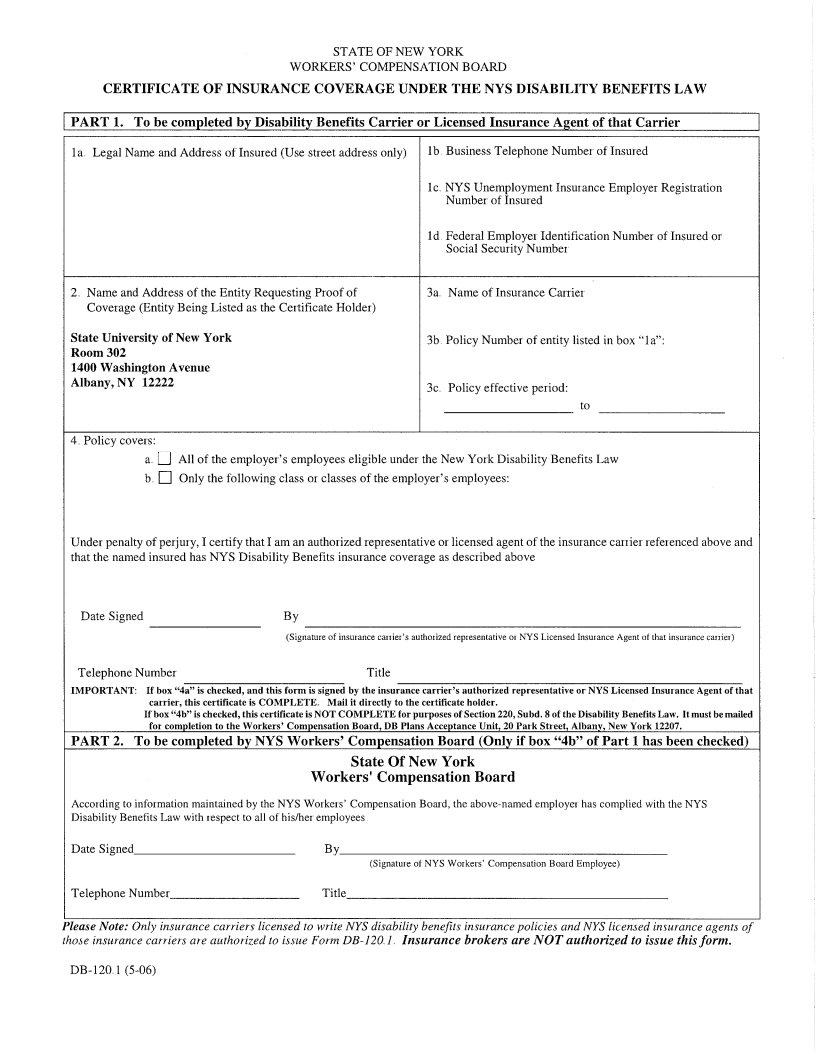

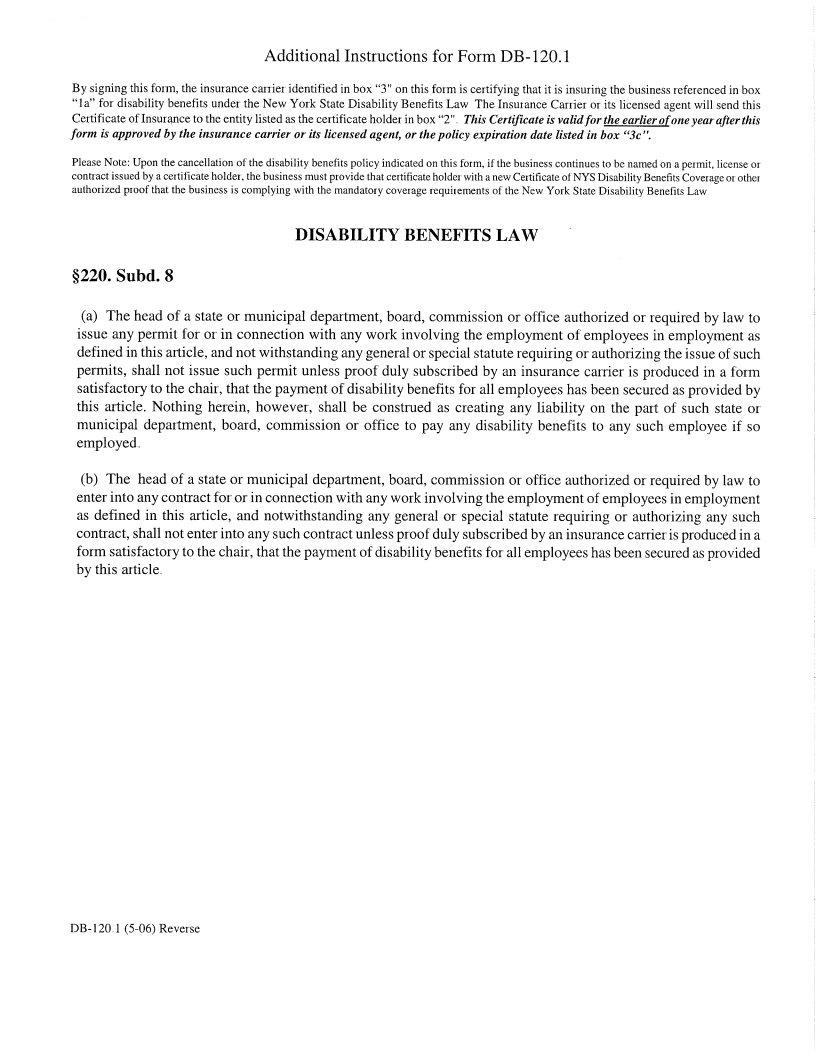

In navigating the requirements set forth by New York State law for employers, understanding and utilizing the DB-120.1 form becomes crucial. This form serves as a testament to the fact that a business has procured disability benefits insurance for its employees through a verified New York State disability benefits insurance carrier or an authorized agent of that carrier. Mandatory for any business employing individuals in New York State for over 30 days within a calendar year, the DB-120.1 form underscores an employer's compliance with the state's disability benefits coverage mandate. The form is provided by either the insurance carrier directly or by a licensed New York State insurance agent acting on the carrier’s behalf. Its primary purpose is to furnish undeniable proof that the employer has secured the necessary insurance to safeguard employees against financial hardships stemming from off-the-job injuries or illnesses. Crucially, this form is required before the issuance of any permits or the execution of contracts, signifying its importance in the regulatory framework governing New York State employers. For entities like The Research Foundation of the State University of New York, which operate within this jurisdiction, ensuring that their disability benefits insurance carrier is highly rated and maintains that rating throughout the policy term is not just about regulatory compliance—it's also about trust and reliability in providing for employees' well-being during challenging times.

| Question | Answer |

|---|---|

| Form Name | Form Db 120 1 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | db120 1 pdf, db 120 1 form, db 120 1 certificate, certificate nys disability |

|

Acceptable proof that the business listed |

|

What is the |

has secured from a NYS disability benefits |

|

insurance carrier or an insurance agent of |

||

|

||

|

that carrier disability benefits insurance. |

|

|

The |

|

|

the NYS statutory disability benefits |

|

|

insurance carrier, or a licensed NYS |

|

Who provides the |

insurance agent of that carrier. The form |

|

|

can be obtained by contacting the Bureau |

|

|

of Compliance |

|

|

(certificates@wcb.state.ny.us). |

|

|

To establish proof that a business has |

|

Why it is needed? |

secured disability benefits insurance |

|

|

coverage for all its employees. |

|

|

Prior to any permit being issued or any |

|

When is it needed? |

contract, including purchase orders, being |

|

|

entered into for work |

|

Who is the certificate holder? |

The Research Foundation of the State |

|

University of New York |

||

|

||

Who are the additional insureds? |

N/A |

New York State requires employers to provide disability benefits coverage to employees for an

The Workers' Compensation Law requires employers to post Form

The insurance carrier must be rated at least

The next page provides a sample of a