At the heart of navigating post-retirement formalities for military retirees lies the crucial DD Form 2866. This form serves as a primary vehicle for retirees to communicate changes in their residential address and to adjust state tax withholding preferences, ensuring their financial and correspondence streams flow seamlessly to their new locales. Grounded in robust legal frameworks including Executive Order 9397, Public Law 92-425, and the statutes encapsulated in 10 U.S.C. 1401, the form stands as a testament to the structured approach towards managing the retiree's fiscal engagements with the state. The significance of completing the DD Form 2866 extends beyond mere administrative necessity; it represents the retiree's active management of their dues and benefits in compliance with federal regulations. The process, while voluntary, underscores the importance of accurate submissions — any lapse could disrupt the smooth receipt of payments or correspondence and possibly result in incorrect deductions from retired pay. Tailored to cater to the unique demands of military retirees, this form encapsulates sections dedicated to both address updates and state tax withholding adjustments, providing a comprehensive toolkit for retirees aiming to maintain their financial and residential arrangements up to date. Such meticulous record-keeping is facilitated further by the promise of privacy and the outlined circumstances under which this information may be shared with other governmental entities, highlighting a balance between administrative utility and individual privacy.

| Question | Answer |

|---|---|

| Form Name | Form Dd 2866 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | dfas address form, form dd 2866, dod form dd 2866, dfas form |

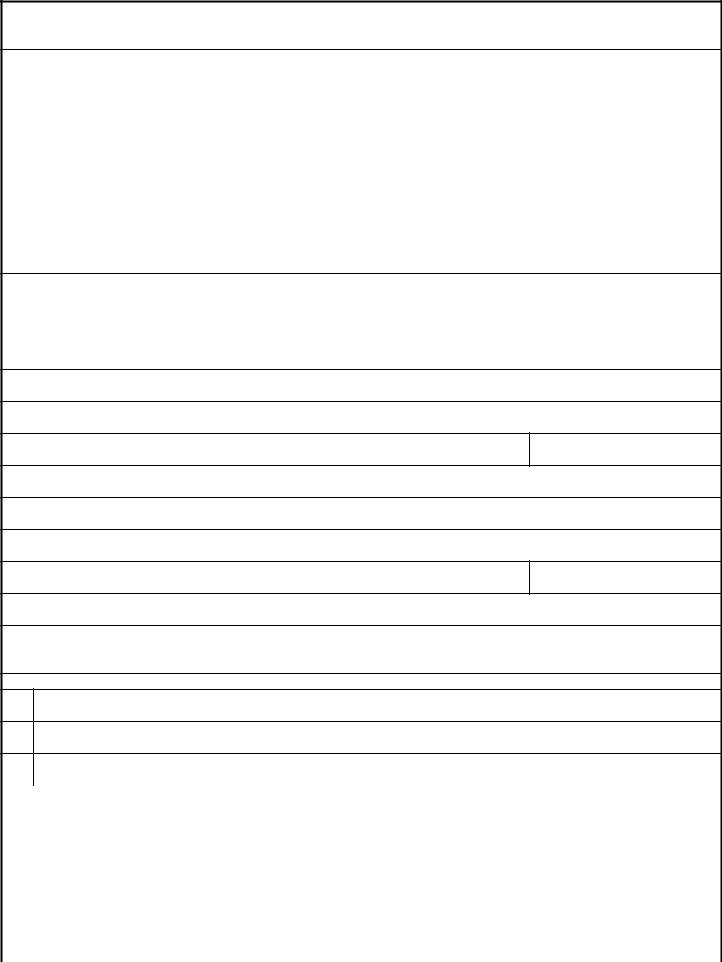

RETIREE CHANGE OF ADDRESS REQUEST/STATE TAX WITHHOLDING AUTHORIZATION

(Read Privacy Act Statement before completing this form.)

PRIVACY ACT STATEMENT

AUTHORITY: E.O. 9397; P.L.

PRINCIPAL PURPOSE(S): To change a member's address in the military retired pay system, and allow the member to start, stop, or change tax withholding information.

ROUTINE USE(S): The information on this form may be disclosed as generally permitted under 5 U.S.C. Section 552(a)(b) of the Privacy Act. It may also be disclosed outside of the Department of Defense to the Internal Revenue Service relating to an individual's claim for tax withholding, to the Department of Veterans Affairs (DVA) for establishment, changes, or discontinuing of DVA compensation to a retiree. In addition, other Federal, state, or local government agencies, which have identified a need to know, may obtain this information for the purpose(s) identified in the DoD Blanket Routine Uses as published in the Federal Register.

DISCLOSURE: Voluntary; however, failure to furnish the requested information could result in

PART I - CHANGE OF ADDRESS (Please print all information.)

1. MEMBER'S NAME (Last, First, Middle Initial) |

2. SSN |

|

|

3. NEW CORRESPONDENCE ADDRESS

a.OTHER ADDRESS INFORMATION (If applicable)

b.NUMBER AND STREET OR ROUTE

c. CITY AND STATE

d. ZIP CODE

4.NEW CHECK ADDRESS (Not to be used for a Financial Institution in the United States. If same as New Correspondence Address, enter "SAME" in block 4.a.)

a.BANK (If foreign), TRUSTEE ADDRESS INFORMATION, OR OTHER (If applicable)

b.NUMBER AND STREET OR ROUTE

c. CITY AND STATE

d. ZIP CODE

PART II - STATE INCOME TAX WITHHOLDING AUTHORIZATION (Please print all information.)

Deduction from military pay for state tax withholding is voluntary. Complete this form with or without a change of address if you wish to start, change, or terminate state tax withholding.

5.MARK (X) ONLY ONE BOX BELOW. THIS FORM MUST BE SIGNED AND DATED.

a.I wish to start state income tax withholding from my payments for the state and monthly amount indicated below.

The monthly amount must be in whole dollars and not less than $10.00.

b.I wish to change my state and/or monthly amount for state tax withholding purposes as indicated below.

c.I authorize that state income tax withholding deduction from my pay be terminated.

d. STATE |

e. WITHHOLDING AMOUNT |

|

$ |

|

|

f. SIGNATURE |

g. DATE SIGNED (YYYYMMDD) |

|

|

RETURN COMPLETED AND SIGNED FORM TO:

Defense Finance and Accounting Service

US Military Retirement Pay

P.O. Box 7130

London, KY

DD FORM 2866, NOV 2003 |

REPLACES DFAS CL FORM 5110/5. |

Adobe Professional 7.0 |