how to form 310 can be filled in online without any problem. Just make use of FormsPal PDF editor to perform the job in a timely fashion. To keep our tool on the cutting edge of efficiency, we strive to put into operation user-driven capabilities and enhancements on a regular basis. We are at all times looking for suggestions - play a pivotal part in revampimg PDF editing. For anyone who is seeking to get started, this is what it takes:

Step 1: Click the "Get Form" button at the top of this webpage to get into our editor.

Step 2: Once you launch the tool, you will notice the document ready to be completed. Other than filling in different blank fields, you might also perform some other actions with the Document, namely putting on custom text, modifying the original textual content, adding images, signing the document, and much more.

Pay close attention when completing this pdf. Make sure all necessary areas are done correctly.

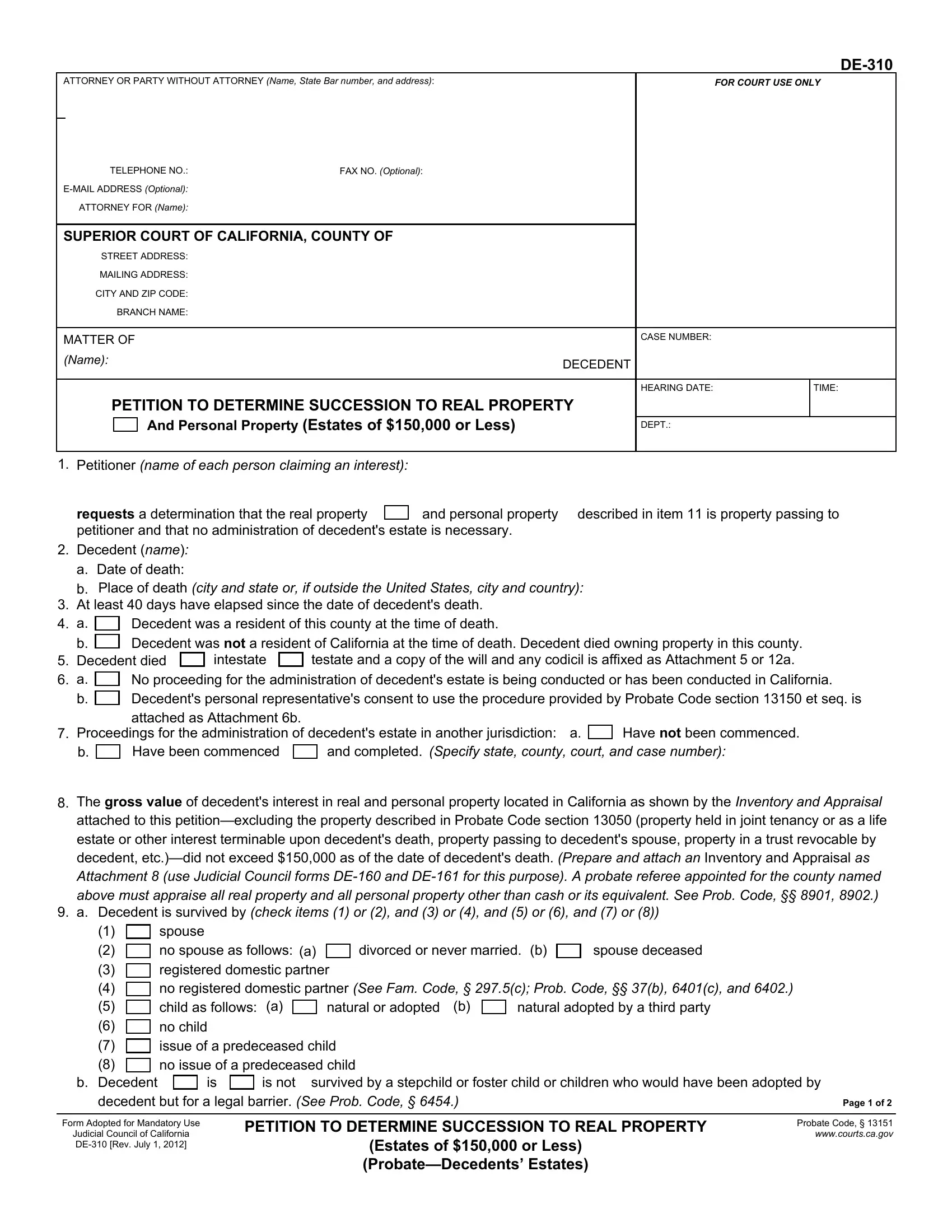

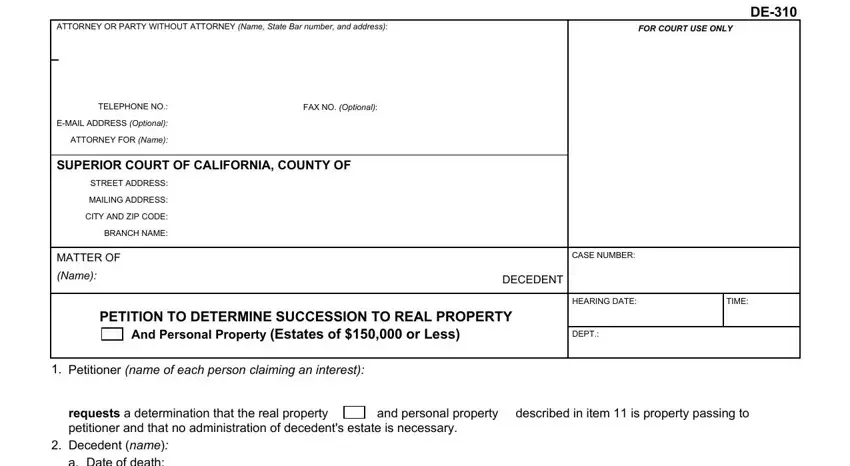

1. The how to form 310 needs particular details to be typed in. Make sure the subsequent blanks are complete:

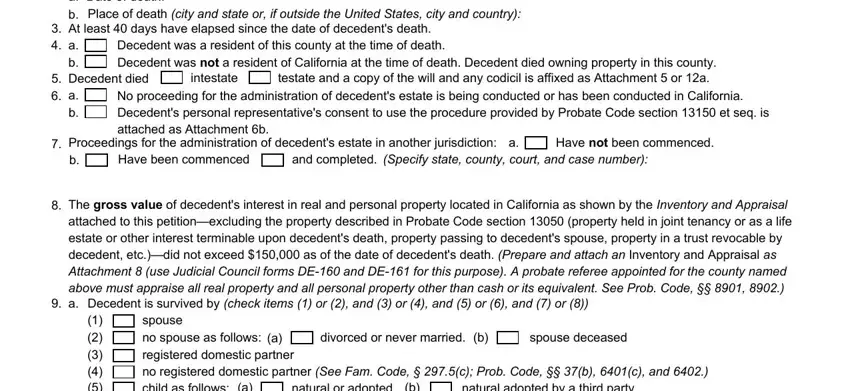

2. Soon after this section is filled out, go on to enter the relevant information in these: requests a determination that the, intestate, Decedent was a resident of this, testate and a copy of the will and, No proceeding for the, Proceedings for the administration, Have been commenced, and completed, Specify state county court and, Have not been commenced, The gross value of decedents, divorced or never married, Decedent is survived by check, spouse no spouse as follows, and natural adopted by a third party.

Always be extremely careful while completing Decedent was a resident of this and divorced or never married, because this is the part in which many people make a few mistakes.

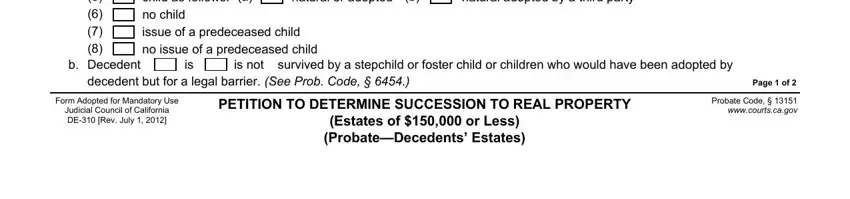

3. This third stage is going to be straightforward - fill in all the blanks in Decedent is survived by check, spouse no spouse as follows, natural adopted by a third party, natural or adopted, is not survived by a stepchild or, Form Adopted for Mandatory Use, Judicial Council of California DE, PETITION TO DETERMINE SUCCESSION, Estates of or Less, Page of, and Probate Code wwwcourtscagov in order to complete this part.

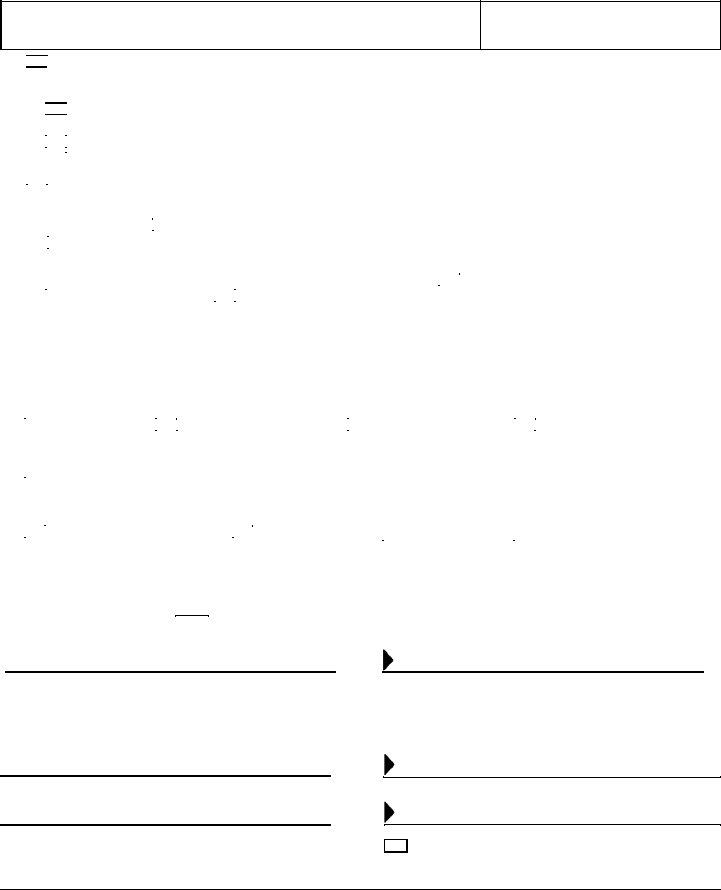

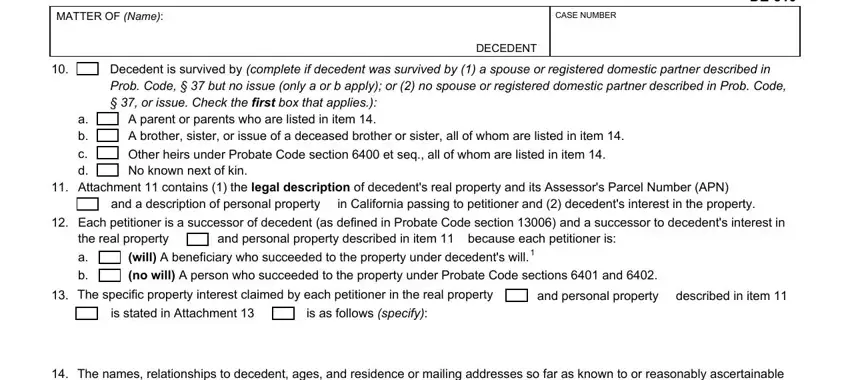

4. Filling in MATTER OF Name, CASE NUMBER, DECEDENT, Decedent is survived by complete, a b c d Attachment contains the, and a description of personal, Each petitioner is a successor of, and personal property described in, a b, will A beneficiary who succeeded, The specific property interest, and personal property described in, is stated in Attachment, is as follows specify, and The names relationships to is paramount in the fourth part - ensure to don't rush and take a close look at each and every empty field!

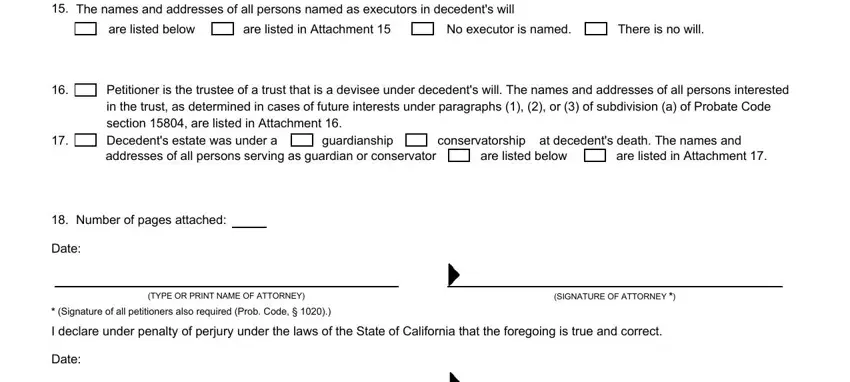

5. Finally, the following final portion is precisely what you will need to complete prior to submitting the PDF. The blank fields at issue are the next: The names and addresses of all, are listed below, are listed in Attachment, No executor is named, There is no will, Petitioner is the trustee of a, conservatorship at decedents death, guardianship, are listed below, are listed in Attachment, Number of pages attached, Date, Signature of all petitioners also, TYPE OR PRINT NAME OF ATTORNEY, and SIGNATURE OF ATTORNEY.

Step 3: Immediately after going through the fields, press "Done" and you are good to go! Make a free trial option with us and obtain immediate access to how to form 310 - with all adjustments preserved and available from your personal account. FormsPal offers safe form tools without personal information record-keeping or any kind of sharing. Feel at ease knowing that your information is secure here!