Navigating the landscape of child care assistance can be complex, but the DOH-3688 form plays a crucial role in simplifying this process for many families. Aimed at child care centers, this crucial document serves as an income eligibility form, making it a cornerstone for assessing whether a family qualifies for free or reduced-price support. By considering household income and specific assistance programs such as Food Stamps, Temporary Assistance to Needy Families (TANF), or the Food Distribution Program on Indian Reservations (FDPIR), the form ensures a comprehensive evaluation of financial need. Furthermore, it accommodates considerations for foster children, highlighting its inclusive approach. Completion requires detailed income information from all household members, fostering transparency and accuracy in the pursuit of aid. Essential signatures from both applying families and child care center staff underscore the collaborative effort to secure necessary federal funds, aiming to support child development through accessible care options. Through careful instruction and sensitive design, the DOH-3688 form embodies the collective effort to prioritize children's welfare and family support in the context of child care services.

| Question | Answer |

|---|---|

| Form Name | Form Doh 3688 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | xx, Privatization, 2012, ACS |

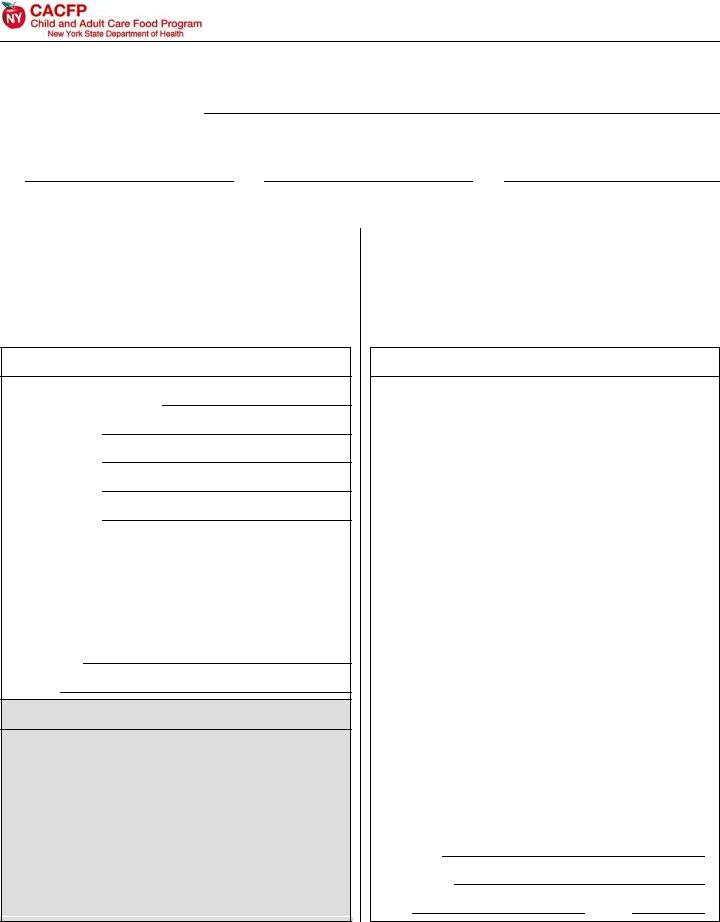

INCOME ELIGIBILITY FORM for Child Care Centers

See INSTRUCTIONS on reverse.

CHILD CARE CENTER NAME:

Print the name of the child(ren) enrolled in this child care center:

1.2.

DIRECTIONS:

Complete SECTION A if anyone in your household:

1.Receives Food Stamps

2.Receives Temporary Assistance to Needy Families (TANF)

3.Participates in the Food Distribution Program on Indian Reservations (FDPIR) OR

4.If any of the children enrolled in this child care center are foster children

SECTION A

Food Stamp Case Number

TANF Number

FDPIR Number

Names of

Foster Children

An adult household member must sign the application before it can be approved. After reading the following statement and the statement on the back, sign below.

I certify that the above information is true. I understand that the center will get Federal funds based on the information I give.

Signature:

Date:

FOR SPONSOR USE ONLY

Sponsor Agreement Number ____________

Total Household Members ____________

(including foster children, if applicable)

Total Income $____________ |

|

|

Free _______ |

Reduced _______ |

Paid _______ |

Date Determined _____ / _____ / _____

Signature of

Center Staff________________________________________

3.

Complete SECTION B if no one in your household receives Food Stamps, TANF, FDPIR or if none of the children enrolled in the child care center is a foster child.

SECTION B

List all household members below. Include yourself and all adults and children NOT listed above, even if they do not receive income. Then list all income received last month in your household in the column to the right. Gross income includes: earnings from work, pensions, retirement, Social Security, child support, foster child's personal income and any other sources of income.

|

Name of Household Members |

|

Monthly Gross Income |

||

|

|

|

|

|

|

1. |

|

|

$ |

|

|

2. |

|

|

$ |

|

|

3. |

|

|

$ |

|

|

4. |

|

|

$ |

|

|

5. |

|

|

$ |

|

|

6. |

|

|

$ |

|

|

|

|

|

|

|

|

An adult household member must sign the application before it can be approved. After reading the following statement and the statement on the back, sign below.

I certify that the above information is true and that all income is reported. I understand that the center will get Federal funds based on the information I give.

Signature:

Print Name:

SS#

PAGE 1 OF 2 |

Privacy Act Statement: The Richard B. Russell National School Lunch Act requires the information on this form. You do not have to give the information, but if you do not, we cannot approve the participant for free or

INSTRUCTIONS FOR COMPLETING

Definition of Income

Income means income before deductions for income taxes, social security taxes, insurance premiums, charitable contributions, and bonds, etc. It includes the following: (1) monetary compensation for services, including wages, salary, commissions or fees; (2) net income from

Definition of Household

Household means family as defined in Section 226.2. Family means a group of related or

Instructions for Parents or Guardians:

Write in the name of the child care center in the space provided.

Print the name of each child in your household who attends this child care center.

Section A: If anyone in your household receives Food Stamps, Temporary Assistance for Needy Families (TANF) or participates in the Food Distribution Program on Indian Reservations (FDPIR), complete Section A only. Write down the Food Stamp, TANF or FDPIR number (do not use your ACS or DSS child care subsidy number). Then sign and date the form and return it to the day care center.

Foster children: If your household includes a foster child who is in child care, write in the names of the foster children.

Section B: Complete this section if you did not complete Section A. Write in your name and the names of all other adults and children living in the household, including unrelated people, even if they do not have any income. Do not include the children in child care who are listed at the top of the form.

Enter the amount of income each person received last month, before taxes or anything else was taken out. Refer to the Definition of Income and the Definition of Household, above. If any amount last month was more or less than the usual, write in that person’s usual income.

The last four digits of the Social Security Number of the adult signing the certification is required. If you do not have a Social Security Number, write none. The form must be signed by an adult member of the household.

Instructions for Centers and Sponsors:

The For Sponsor Use Only section is to be completed, signed and dated by center or sponsor staff. The sponsor/center representative must review the income eligibility form and ensure that it is completed as indicated in the instructions above. Then indicate the following:

The Sponsor Agreement Number.

Total Household Members – This item does not have to be completed if the parent completed Section A. Add those indicated in Section B (if completed) to the children enrolled in child care and the number of foster children, if applicable.

Total Income – This item does not need to be completed if the parent completed Section A. Indicate the total monthly income as calculated from Section B. If the parent chooses not to disclose income, the form must be categorized as paid.

Free, Reduced or Paid – Compare the total household income and the total number of household members with the current year’s Income Eligibility Guidelines

Incomplete forms (missing signatures, income information, or Food Stamp, TANF or FDPIR numbers) are categorized in the paid category.

The income eligibility form is valid until the last day of the month one calendar year from the date it is signed by the household member. For example, a form signed on May 12, 2011 is valid until May 31, 2012.

PAGE 2 OF 2 |