Should you intend to fill out payable, it's not necessary to download and install any applications - simply try our PDF tool. In order to make our tool better and more convenient to work with, we consistently come up with new features, taking into account feedback coming from our users. Here is what you will have to do to begin:

Step 1: Just click the "Get Form Button" above on this site to launch our pdf editing tool. Here you will find everything that is required to work with your document.

Step 2: This editor helps you customize your PDF in a range of ways. Enhance it with your own text, adjust what is originally in the PDF, and include a signature - all when it's needed!

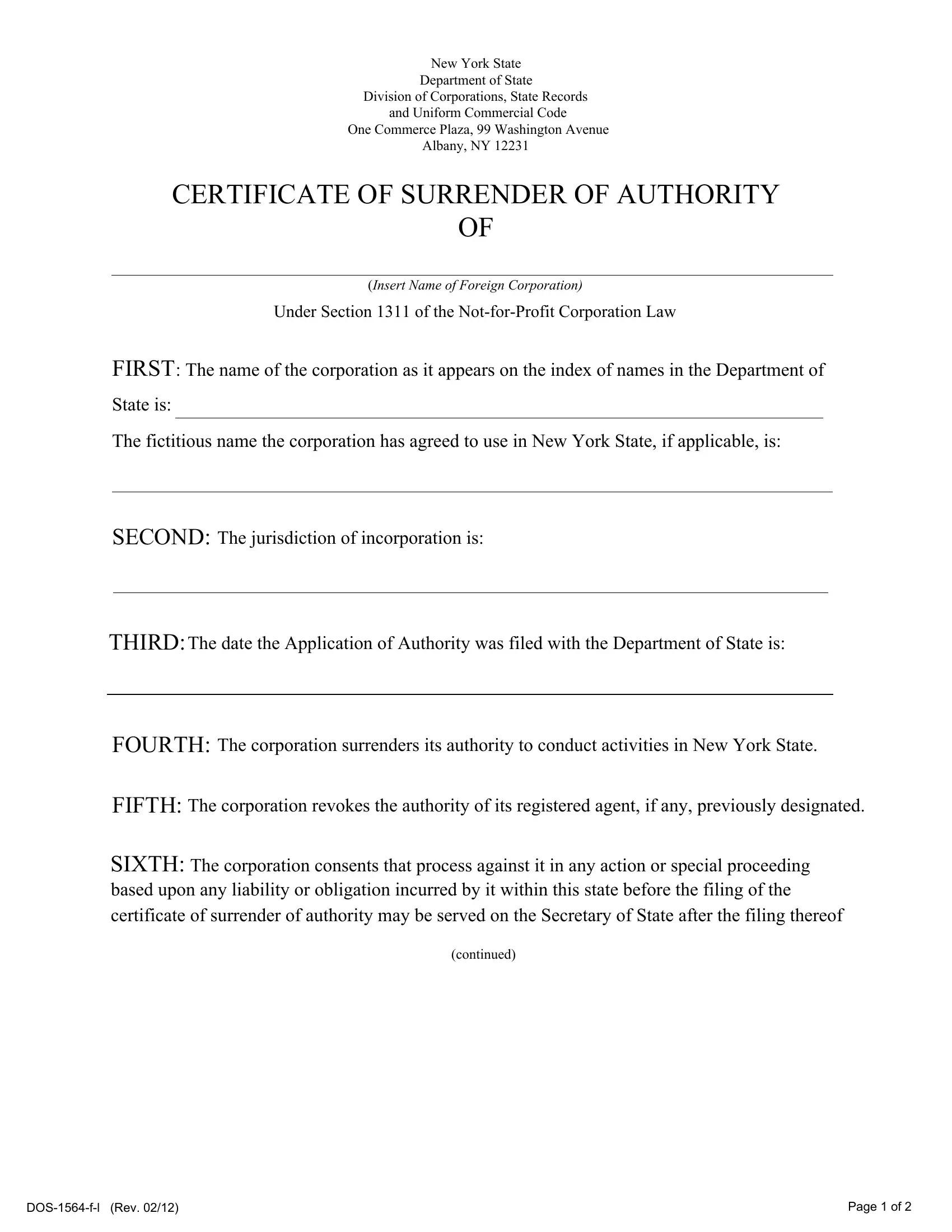

To be able to finalize this PDF form, make certain you type in the required information in every blank:

1. It's essential to complete the payable properly, thus be mindful when working with the sections including these particular fields:

2. Once this array of fields is filled out, go on to enter the suitable details in all these - THIRD The date the Application of, FOURTH The corporation surrenders, FIFTH The corporation revokes the, SIXTH The corporation consents, and continued.

Always be extremely careful when filling out FOURTH The corporation surrenders and FIFTH The corporation revokes the, as this is the section in which most users make some mistakes.

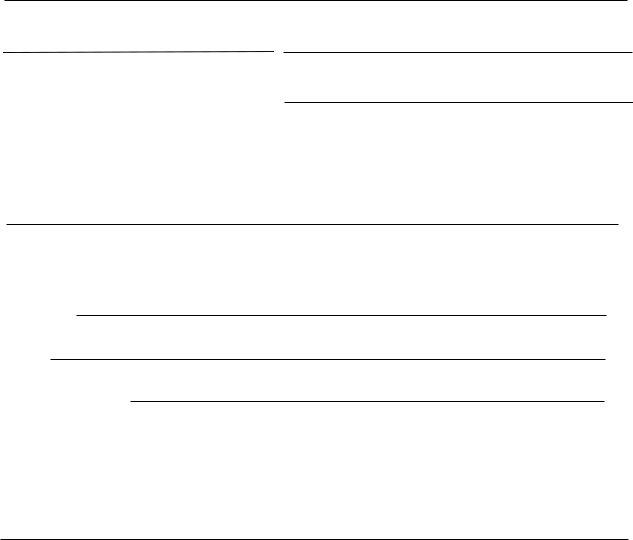

3. In this particular step, examine in the manner set forth in, Signature, Name of Signer, Title of Signer, CERTIFICATE OF SURRENDER OF, Insert Name of Foreign Corporation, Under Section of the NotforProfit, and Filers Name. All these should be filled out with utmost awareness of detail.

4. This next section requires some additional information. Ensure you complete all the necessary fields - Address, City State and Zip Code, NOTES The name of the corporation, and For Office Use Only - to proceed further in your process!

Step 3: Make sure your information is correct and then click on "Done" to proceed further. Try a 7-day free trial subscription at FormsPal and acquire direct access to payable - download or modify from your personal account page. FormsPal ensures your data privacy by having a protected method that never records or shares any type of private data used in the PDF. Rest assured knowing your docs are kept safe every time you work with our service!