NOTICE

Effective January 1, 2009, the licensing of Tobacco Retailers, Vending Machine Operators and Samplers was transferred to the NH Liquor Commission, Bureau of Enforcement and Licensing (Chapter 341 of the Laws of 2008). If you wish to obtain a Retail Tobacco License, Tobacco Vending Machine License, or a Tobacco Sampling License after December 31, 2008, visit www.nh.gov/liquor/licensing_information.shtml, or contact them at (603) 271-3521. The Liquor Commission's Bureau of Enforcement and Licensing is located at Horseshoe Pond Place, 10 Commercial Street, PO Box 1795, Concord, NH 03302-1795.

It is the responsibility of all Tobacco Tax License holders to read, understand, and comply with the laws and rules relating to Tobacco Tax as set forth in RSA 78 and N.H. Admin Rule Rev. 700. Special attention should be given to laws regarding the purchase and sale of tobacco products under RSAs 78:12; 78:12-a, 78:14, and 78:16. Please be advised that failure to comply with provisions of RSA 78 may result in criminal charges as provided in RSA 21-J:39. RSA 78 and N.H. Admin Rule, Rev 700 can be found at www.nh.gov/revenue. For additional information, visit our website to access TIR 2008-012.

All Manufacturers and Wholesalers selling cigarettes to consumers (whether directly, or through a distributor, retailer or similar intermediary or intermediaries) in the State of New Hampshire must register with the Attorney General’s Office for purposes of the Master Settlement Agreement as outlined in RSA 541-C. Please contact the Attorney General’s Office at (603) 271-3641 or visit their website at www.doj.

nh.gov/consumer/tobacco for more information.

TERM OF LICENSE

Licenses expire on June 30 of each even-numbered year.

WHAT IS IT

Pursuant to RSA 78:7, a tax is imposed upon the retail consumer of tobacco products. Under RSA 78:2, a Tobacco Tax License shall be obtained by those listed in "WHO PAYS IT" below before engaging in the business of selling or distributing tobacco products in this state.

WHO PAYS IT

"Manufacturer" - any person engaged in the business of importing, exporting, producing, or manufacturing tobacco products who sells his product only to licensed wholesalers.

"Sub-jobber" - any person doing business in this state who buys stamped tobacco products from a licensed wholesaler and who sells all of his tobacco products to other licensed sub-jobbers, vending machine operators, and retailers.

"Wholesaler" - any person doing business in this state who shall purchase all of his unstamped tobacco products directly from a licensed manufacturer, and who shall sell all of his products to licensed wholesalers, sub-jobbers, vending machine operators, retailers, and those persons exempted from the Tobacco Tax under RSA 78:7-b.

WHEN IS IT DUE

Completed Applications for Tobacco Tax License, Form DP-31, must be filed prior to making any NH tobacco product sales and must be renewed pursuant to RSA 78:4 on or before July 1st of every even-numbered year thereafter.

NO SALES

If you are not selling tobacco products, please return the application with a notation to that effect.

FORMS

For additional copies of this form or for a fi ll-in version of this form visit us on the web at www.nh.gov/revenue or to request a form by mail call (603) 271-2192.

NEED HELP?

For assistance please call Customer Service at (603) 271-2191.

ADA COMPLIANCE

Individuals who need auxiliary aids for effective communications in programs and services of the New Hampshire Department of Revenue Administration are invited to make their needs and preferences known. Individuals with hearing or speech impairments may call TDD Access: Relay NH 1-800-735-2964.

LINE BY LINE INSTRUCTIONS

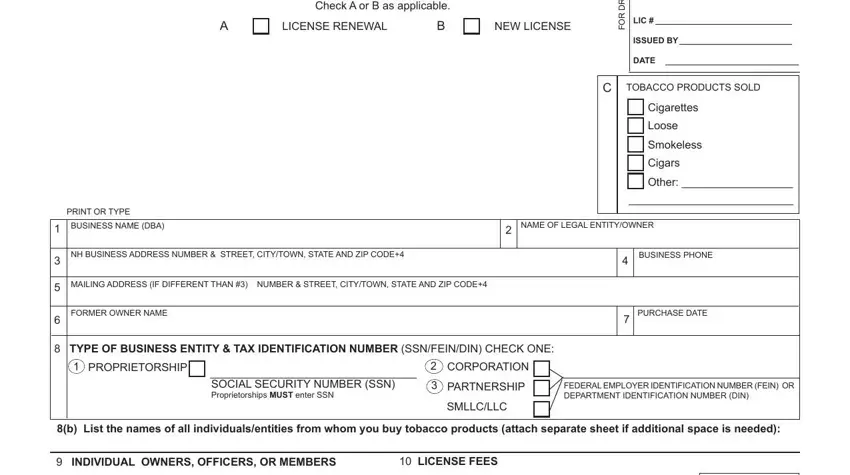

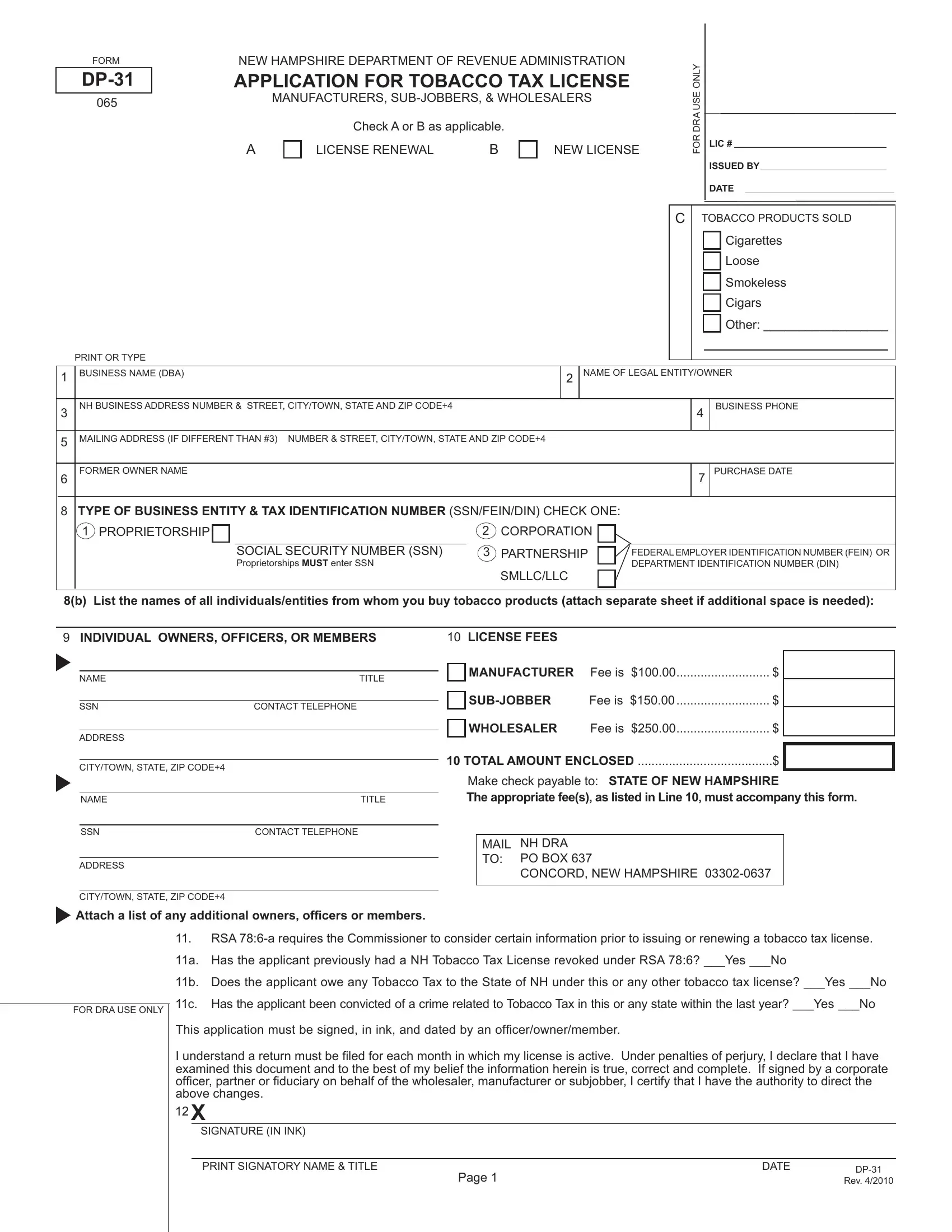

A or B: Indicate whether this is a Tobacco Tax License Renewal or a New License by checking Box A or Box B. Note that if your name, physical location, or tax identification number has changed since your last license was issued, you must apply for a new license number and notify the NH DRA to inactivate the last license.

C:Check all that apply. Indicate the type(s) of tobacco products sold by your business entity. If "other" provide a brief description.

LINE 1: Enter the "doing business as" name (DBA), or locally known

as....

LINE 2: Enter the name of the "legal" entity/owner - proprietor, corporate or partnership name.

LINE 3: Enter the physical location in New Hampshire.

LINE 4: Enter the telephone number of the New Hampshire business location.

LINE 5: Enter the mailing address if different than the physical address listed on Line 3.

LINE 6: Enter the name of the previous owner of the business. If this is a new business please indicate "First Owner".

LINE 7: Enter the date the business was purchased.

LINE 8: Check the box indicating the business entity of the licensee and enter the appropriate tax identification number on the line that corresponds with the business entity type. Enter a Federal Identification Number (FEIN) or a Department Identification Number (DIN), unique to the business entity.

LINE 8b: List the names of all entities from which you buy tobacco products. Attach a list if additional space is needed.

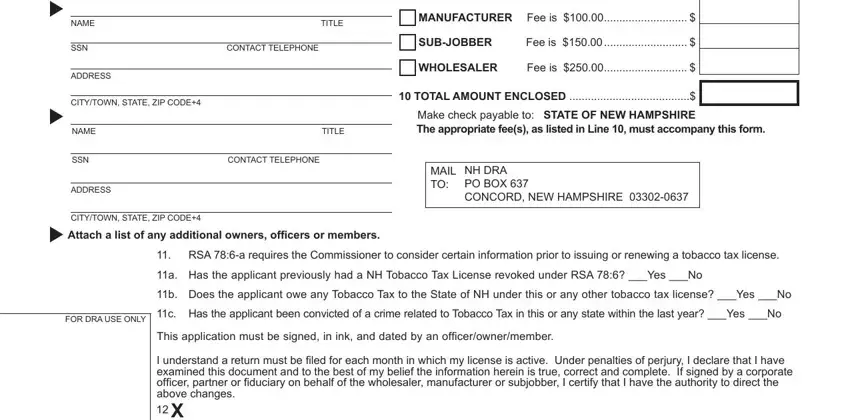

LINE 9: List each individual owner or officer of the business, their title, social security number, a contact telephone number, and address. If more than two owners or offi cers, attach a separate list.

LINE 10: Check appropriate boxes indicating the type(s) of Tobacco Tax License and calculate the total license fees. Enter the sum of all applicable fees. Make check payable to State of New Hampshire.

LINE 11: Complete Lines 11(a) through 11(c) by indicating "yes" or "no" for each question.

LINE 12: Enter the signature (in ink) of owner or authorized representative, their title and date.

As a Licensed Tobacco Manufacturer, Wholesaler or Sub-jobber, the NH Code of Administrative Rules requires that you provide the following reports to the NHDRA:

1.Rev 1009.02 Manufacturer’s Report: On or before the 30th day following the end of each month, every manufacturer shall send the Department’s Audit Division a written report of unstamped cigarettes and gratis cigarettes transported into this state.

2.Rev 1009.03 Form AU-201, Non-Resident Wholesaler's Cigarette Tax Report: Every non-resident wholesaler shall complete and file with the Department’s Audit Division Form AU-201, “Non-resident Wholesaler's Cigarette Tax Report”, on or before the 30th day following the end of their regular accounting quarter.

3.Rev 1009.04 Form AU-202, Resident Wholesaler's Cigarette Tax Report: Every resident wholesaler shall complete and file with the Department Form AU-202, “Resident Wholesaler's Cigarette Tax Report”, on or before the 30th day following the end of their regular accounting quarter.

4.Rev 1009.05 Form CD-15, Cigarette Stamp Order: Form CD-15, “Cigarette Stamp Order”, accompanied by payment be filed by New Hampshire licensed wholesalers to purchase tobacco tax stamps through the Department.

5.Rev 1009.06 Form CD-18, Tobacco Tax Credit Bond: Form CD-18, “Tobacco Tax Credit Bond”, shall be completed and filed by wholesalers licensed in New Hampshire to establish a charge account with the Department.

6.Rev 1009.07 Form CD-92, Notice of Intent to Ship Return of Damaged or Obsolete Cigarettes to Manufacturer: A wholesaler shall complete and fi le Form CD-92, “Notice of Intent to Ship Return of Damaged or Obsolete Cigarettes to Manufacturer”, to notify the Department’s Collection Division, at least 5 days prior to shipping, of the wholesaler’s intent to return damaged or obsolete packages of cigarettes to the Department.

7.Rev 1009.09 Form DP-151, Smokeless Tobacco Tax Return: Form DP-151, “Smokeless Tobacco Tax Return”, shall be completed and fi led with the Department by all licensed wholesalers complying with the fi ling requirements of RSA 78:12,II by the 15th day following the end of the reporting period.