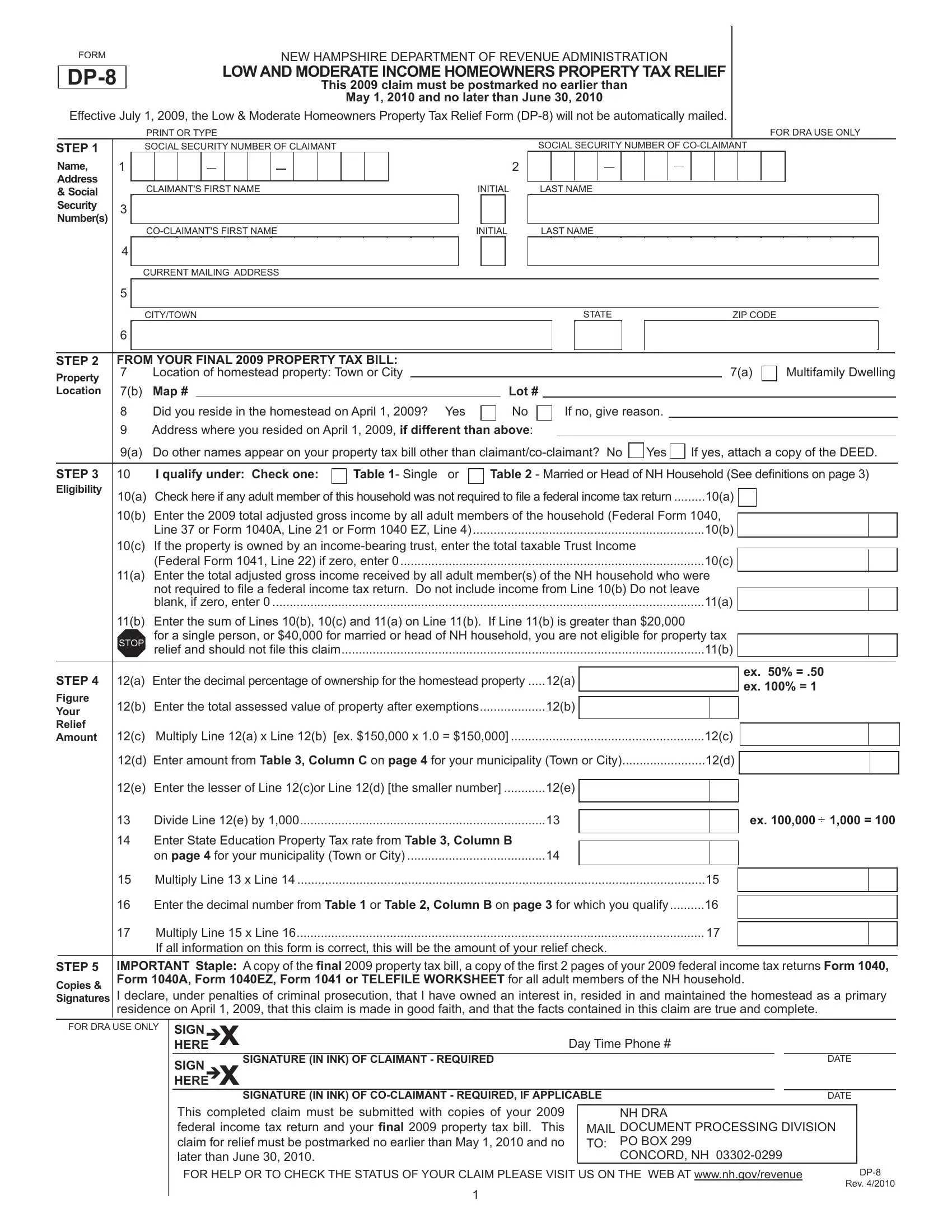

HOW DO I QUALIFY?

How do I qualify for Low & Moderate Income Homeowners Property Tax Relief? You must own a homestead subject to the state education property tax; reside in such homestead on April 1 of the year for which the claim for relief is made; have a total household income of (1) $20,000 or less if a single person or (2) $40,000 or less if married or head of a NH household.

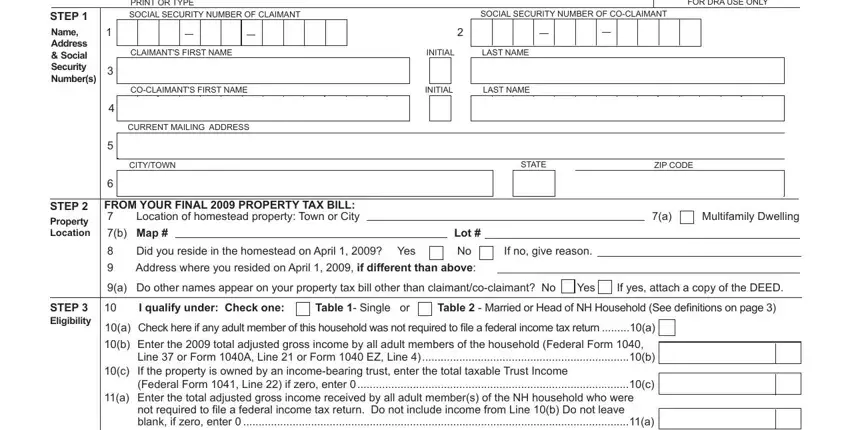

STEP 1: NAME, ADDRESS, & SOCIAL SECURITY NUMBERS Lines 1-2 Enter the claimant’s social security number and the social security number of the co-claimant. Attach a list of the name and social security number of every adult living in the claimant's household who is not a joint owner. Social Security Numbers are required pursuant to RSA 198:57, VII and authorized by 42 U.S.C. Section 405(c)(2)(C)(i). The failure to provide Social Security Numbers will result in a denial of a claim. All documents shall be kept confidential.

Line 3-4 Enter the name of the claimant and co-claimant who meet the residency and ownership criteria. If your name has changed on the final property tax bill due to marriage, civil union, divorce or other reason, please attach a statement explaining the change. If the homestead is held in a trust through which the claimant holds equitable title or beneficial interest for life in the homestead, please attach a copy of the trust. If your final property tax bill names someone other than you, or in addition to you, please attach a copy of the deed evidencing your ownership interest. If there are additional claimants please attach a list of their names and social security numbers.

Lines 5-6 Enter the claimant's current mailing address (please include PO Box if applicable).

STEP 2: PROPERTY LOCATION

FROM YOUR FINAL 2009 PROPERTY TAX BILL

Line 7 Enter the name of the municipality (Town, City or Unincorporated place) where the homestead property is located.

Line 7(a) Check the box if multifamily dwelling.

Line 7(b) Enter the map and lot number of the homestead property from the property tax bill that is the subject of your claim.

Line 8 Check only one box. Check yes if you resided in such homestead on April 1, 2009. Claimants on active duty in the US Armed Forces or temporarily away from the homestead but maintain the homestead as the primary domicile are eligible and should check yes. If you checked yes, proceed to the next line.

IF YOU CHECKED NO, YOU DO NOT QUALIFY FOR RELIEF. DO NOT FILE THIS CLAIM.

Line 9 Please enter the address where you resided on April 1, 2009 if different than the address listed in Step 1.

Line 9(a) If other names appear on your tax bill other than the claimant/ co-claimant, please check yes and attach a copy of the deed. This includes a homestead held by a trust. If not, check no.

STEP 3: ELIGIBILITY

Line 10 Check the table under which the claimant qualifies. If the claimant is a single person, the claimant qualifies under Table 1. If the claimant is a married person or head of a NH household, the claimant qualifies under Table 2.

Line 10(a) Check the box if any adult member of the NH household was not required to fi le a federal income tax return in 2009.

Line 10(b) Enter the sum of the total adjusted gross income from federal Form 1040, Line 37, or Form 1040A, Line 21 or Form 1040EZ, Line 4 or Telefile Worksheet of the claimant, co-claimant, and any other adult member of the NH household.

Line 10(c) If the homestead is in the name of an income-bearing trust, enter the 2009 total taxable income from federal Form 1041, Line 22.

If the trust's taxable income is zero, enter 0.

Line 11(a) Enter the total adjusted gross income of all adult members of the NH household who are not required to file a 2009 federal income

tax return. If you are not required to file a federal income tax return, then your social security income is not includable on this line.

Line 11(b) Enter the sum of Lines 10(b), 10(c) and 11(a). If you checked Table 1 on Line 10 and Line 11(b) is greater than $20,000, or if you checked Table 2 on Line 10 and Line 11(b) is greater than $40,000, STOP, you are not eligible for property tax relief and should not fi le this claim.

If you are single and your total household income is greater

STOP than $20,000 you are not eligible. If you are a married person or head of a NH household and the total household income

is greater than $40,000 you are not eligible.

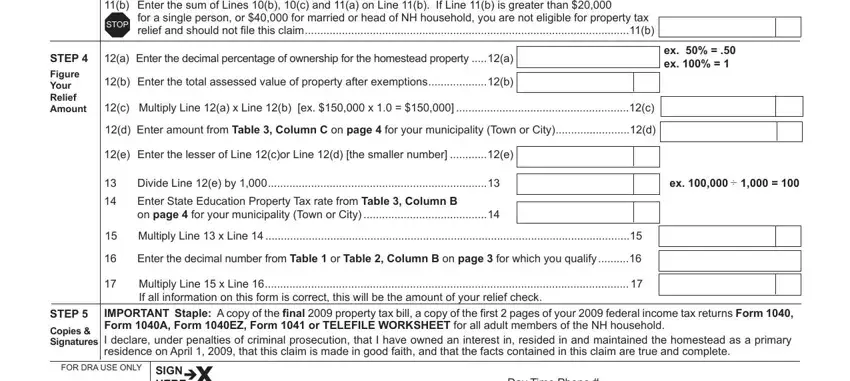

STEP 4: FIGURE YOUR RELIEF AMOUNT

Line 12(a) Enter the decimal percentage of ownership for the homestead property. Owners of multi-unit dwellings or a homestead that is not occupied by all owners must enter only the claimant's proportionate share of the homestead. For example, an owner of a duplex who resides in one-half of the homestead would enter .50; the owner who resides in a homestead, but owns only one-third of the homestead property would enter .3333.

Line 12(b) Enter the total assessed value from the final 2009 property tax bill of your homestead after deducting any applicable exemption(s) granted by your municipality, such as an elderly exemption or an exemption for the blind. Do not include property listed on the tax bill that is assessed under current use.

Line 12(c) Multiply Line 12(a) x Line 12(b).

Line 12(d) Enter the number for your municipality (Town or City) from Table 3, Column C on page 4. This is the equalized value of property for your Town or City.

Line 12(e) Enter the lesser (smaller) of Line 12(c) or Line 12(d).

Line 13 Divide Line 12(e) by 1,000.

Line 14 Enter the State Education Property Tax rate from Table 3, Column B, page 4.

Line 15 Multiply Line 13 by Line 14.

Line 16 Go to page 3. Find your income range in Column A from Table 1 or Table 2 and then enter on Line 16 the decimal number found

in Column B next to your income range.

Line 17 Multiply Line 15 by Line 16. You should receive a relief check in approximately 4 months.

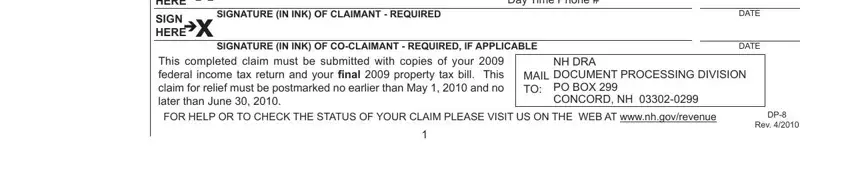

STEP 5: COPIES & SIGNATURE(S)

Under penalties of criminal prosecution, the claimant and co-claimant, if applicable, must sign and date the claim to declare (1) ownership and residence of the homestead property, and telephone number (2) that the claim is made in good faith, and (3) that the facts contained in the claim are true. Only one claim may be fi led for a single homestead.

ATTACHMENTS

This completed claim must be submitted with copies of your 2009 federal income tax returns, the final 2009 property tax bill, a copy of your trust document if property is held by a trust and any explanatory statements, if necessary. This claim for relief must be postmarked no earlier than

May 1, 2010 and no later than June 30, 2010.

NEED HELP?

Call the Low and Moderate Income Homeowners Property Tax Relief Assistance at (603) 271-2191. For more information or to check the status of your claim, visit us on the web at www.nh.gov/revenue. Hearing or speech impaired individuals may call TDD Access: Relay NH 1-800- 735-2964.

APPEALS

If your claim for relief is denied or adjusted, you have the right to appeal the decision in writing, postmarked within 30 days of the Notice of Relief or Letter of Rejection to the Board of Tax and Land Appeals, Johnson Hall, 107 Pleasant Street, Concord, NH 03301.