Using PDF files online is actually quite easy with this PDF tool. Anyone can fill out EZ here without trouble. To keep our editor on the cutting edge of practicality, we strive to implement user-oriented capabilities and improvements on a regular basis. We're always grateful for any suggestions - assist us with reshaping how you work with PDF files. To get started on your journey, consider these basic steps:

Step 1: Access the PDF form inside our editor by clicking on the "Get Form Button" above on this webpage.

Step 2: Using this online PDF tool, you're able to accomplish more than simply fill out blank fields. Express yourself and make your docs appear sublime with custom text added, or adjust the original content to excellence - all comes with an ability to add any kind of photos and sign the document off.

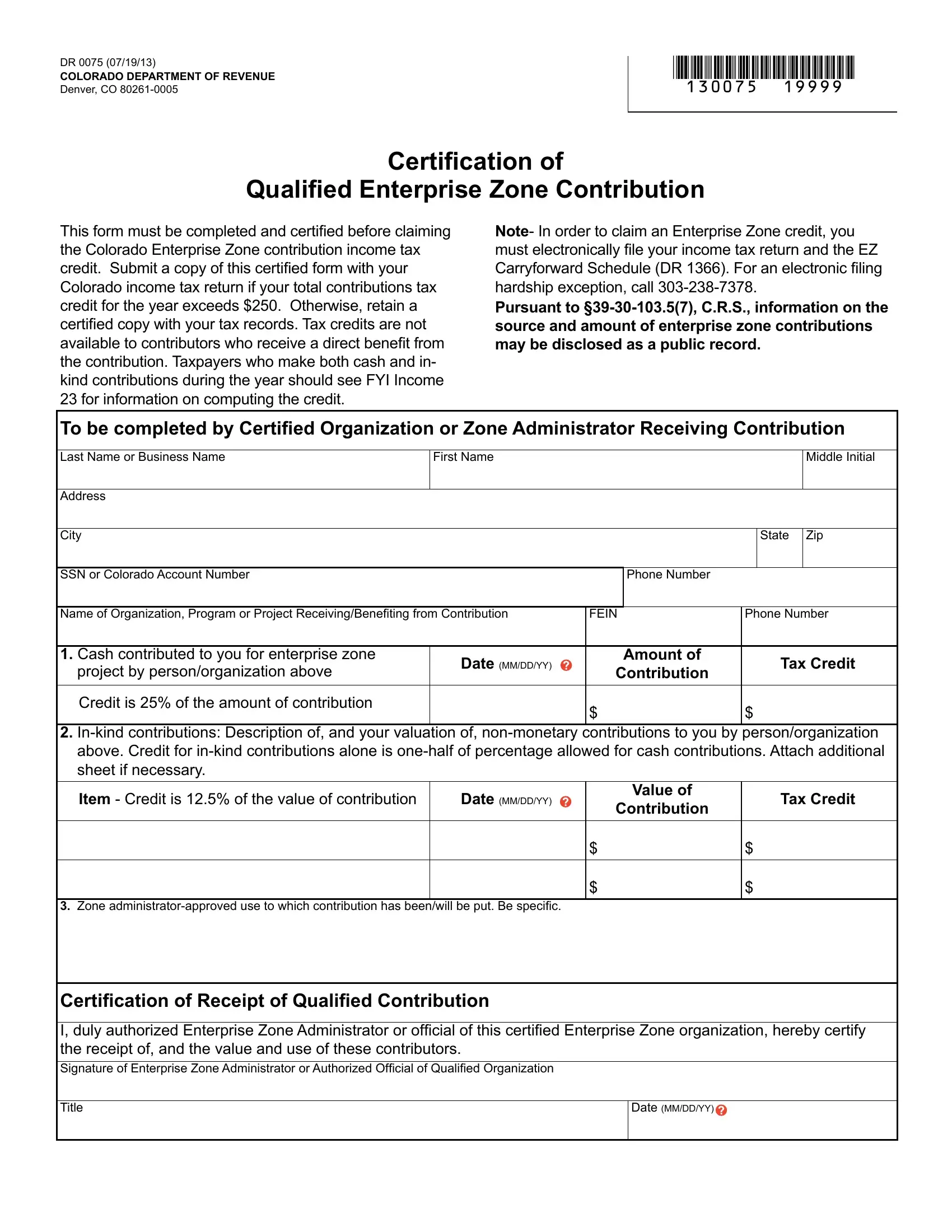

This document requires specific data to be typed in, hence make sure you take the time to fill in what is required:

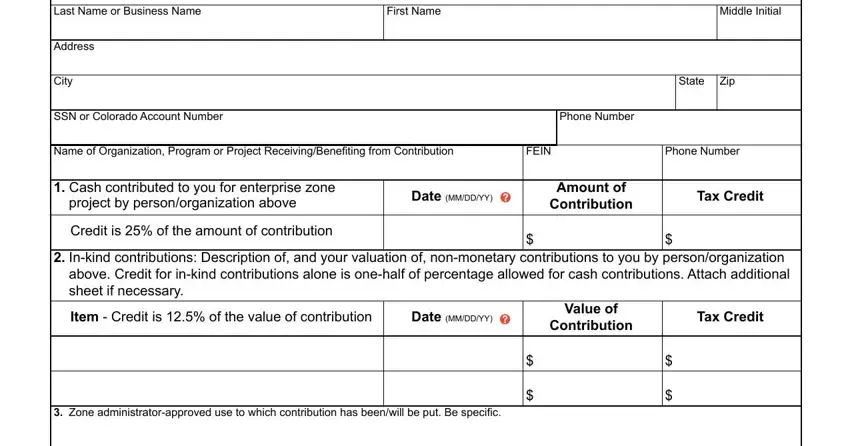

1. The EZ involves certain information to be inserted. Ensure that the following blanks are completed:

2. Immediately after this selection of blank fields is filled out, go to enter the applicable information in all these: Title, and Date MMDDYY.

It is easy to make an error when completing your Title, for that reason ensure that you take a second look before you'll submit it.

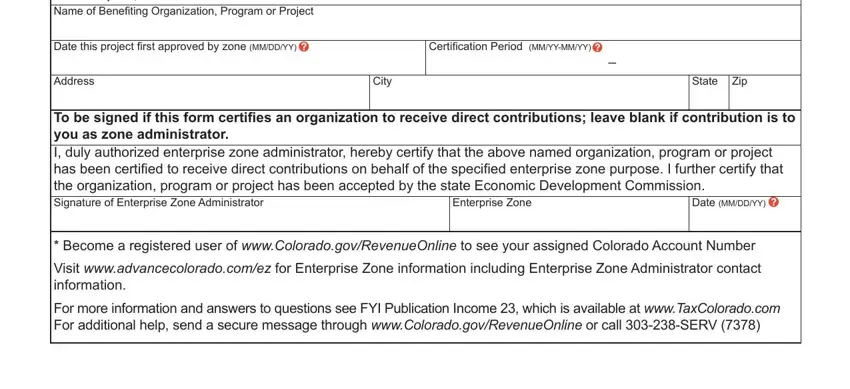

3. In this part, have a look at Certiication of, Date this project irst approved by, Certiication Period MMYYMMYY, Address, City, State, Zip, To be signed if this form certiies, Enterprise Zone, Date MMDDYY, and Become a registered user of. Every one of these need to be filled out with greatest awareness of detail.

Step 3: Spell-check all the information you have typed into the blanks and hit the "Done" button. Obtain the EZ when you join for a free trial. Immediately access the form inside your FormsPal account, along with any edits and changes being automatically synced! With FormsPal, it is simple to fill out documents without needing to be concerned about data leaks or data entries being shared. Our secure system ensures that your personal details are stored safely.