When using the online tool for PDF editing by FormsPal, you can easily complete or edit 0104ad colorado 2017 form fillable here. In order to make our editor better and simpler to utilize, we continuously develop new features, taking into consideration suggestions coming from our users. To get the ball rolling, consider these basic steps:

Step 1: First, access the pdf tool by pressing the "Get Form Button" above on this site.

Step 2: The editor grants the capability to modify PDF files in a range of ways. Improve it with any text, correct original content, and put in a signature - all when it's needed!

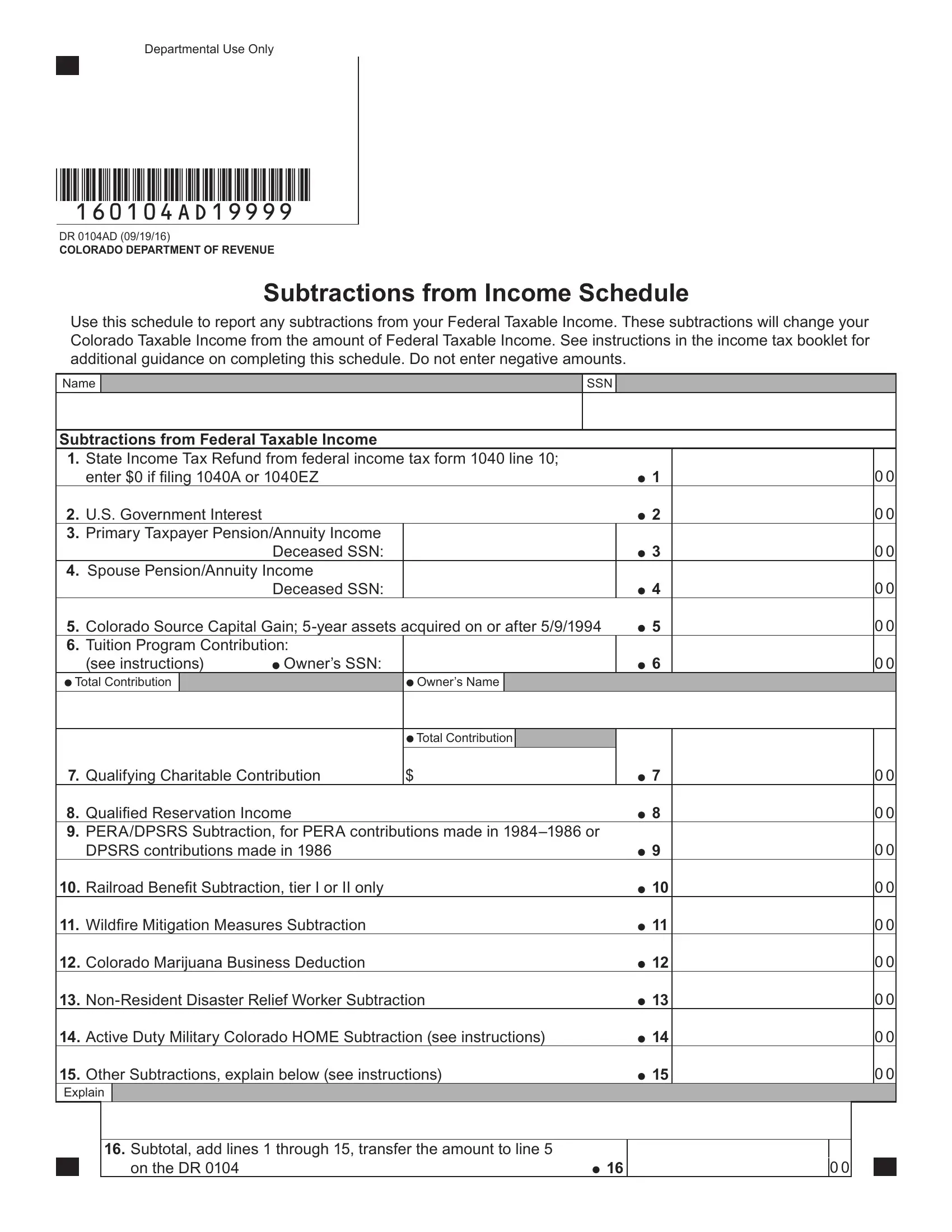

This document will require particular info to be entered, thus be sure you take whatever time to type in what is required:

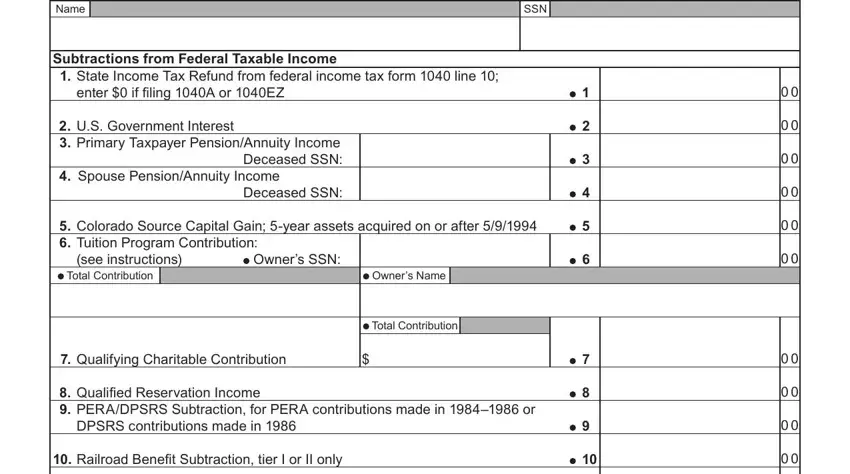

1. It's vital to fill out the 0104ad colorado 2017 form fillable properly, thus be attentive while working with the sections comprising these fields:

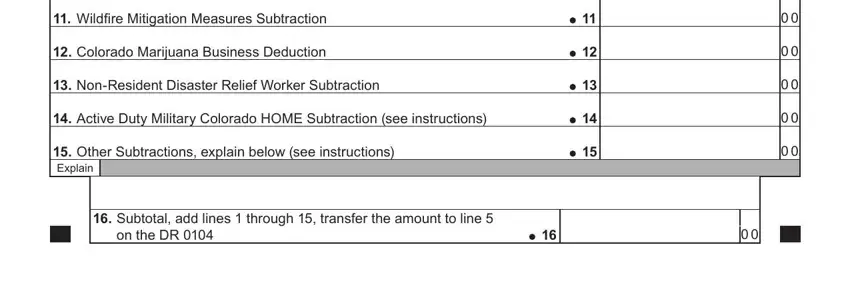

2. Once this part is finished, you're ready include the essential specifics in Wildire Mitigation Measures, Colorado Marijuana Business, NonResident Disaster Relief, Active Duty Military Colorado, Other Subtractions explain below, Subtotal add lines through, and on the DR so that you can move on to the 3rd part.

Be really careful when filling in Other Subtractions explain below and Subtotal add lines through, because this is the section where many people make errors.

Step 3: After double-checking the entries, press "Done" and you're good to go! Download your 0104ad colorado 2017 form fillable after you subscribe to a free trial. Readily use the pdf document in your FormsPal account page, with any modifications and changes being all kept! FormsPal ensures your information privacy by having a protected method that never records or shares any type of personal data involved. Be assured knowing your paperwork are kept safe when you use our services!