Navigating the complexities of homeownership and the benefits it can bring, especially in the realm of tax advantages, is a critical aspect for homeowners in understanding the multifaceted financial landscape. At the heart of these benefits, particularly for homeowners who have experienced damage to their homestead as a result of a natural disaster, is the Directive 501Rvsh form. This vital document serves as an application for reassessment of property tax values in the wake of devastating events, offering a financial respite for those significantly impacted. The aim of the form is to ensure that property taxes reflect the true value of the property after it has sustained damage, providing a mechanism for relief and support to homeowners during their time of need. It represents a crucial step in the recovery process after a natural disaster, underscoring the importance of accurate property assessments and the role of government in assisting its citizens through challenging times. Through this lens, the Dr 501Rvsh form embodies not just a procedure for tax adjustment, but a lifeline for affected homeowners striving to rebuild their lives and homes. Understanding its provisions, eligibility criteria, and the application process is essential for anyone looking to navigate the aftermath of a natural disaster with the goal of ensuring their financial responsibilities are aligned with their property's current condition.

| Question | Answer |

|---|---|

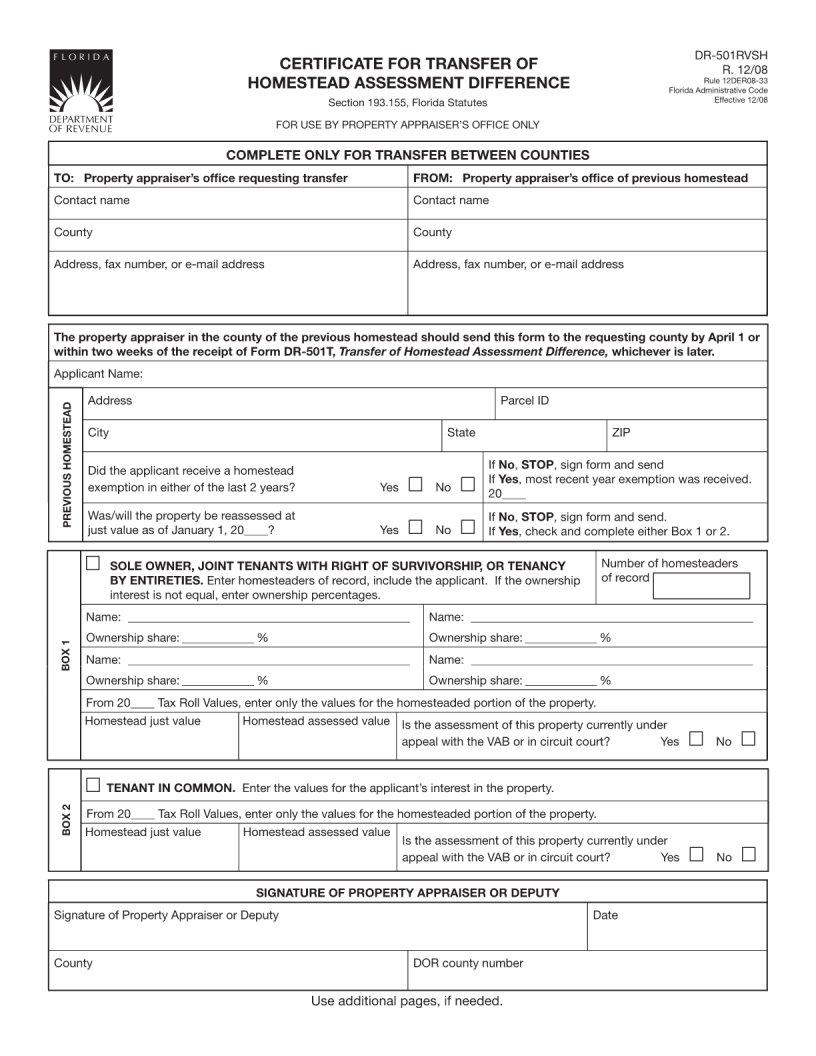

| Form Name | Form Dr 501Rvsh |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | 12Der08-33, VAb, TenAncy, dr 501 rvsh fillable |