If you wish to fill out Form Dr 501Sc, you won't need to download and install any applications - just use our PDF editor. In order to make our editor better and more convenient to use, we constantly implement new features, bearing in mind suggestions from our users. In case you are looking to start, here is what you will need to do:

Step 1: Click the orange "Get Form" button above. It'll open up our pdf tool so you can begin filling in your form.

Step 2: Using our online PDF editor, you may do more than just complete blanks. Try all the functions and make your forms seem sublime with customized textual content added, or optimize the file's original content to excellence - all that comes with an ability to insert any graphics and sign the document off.

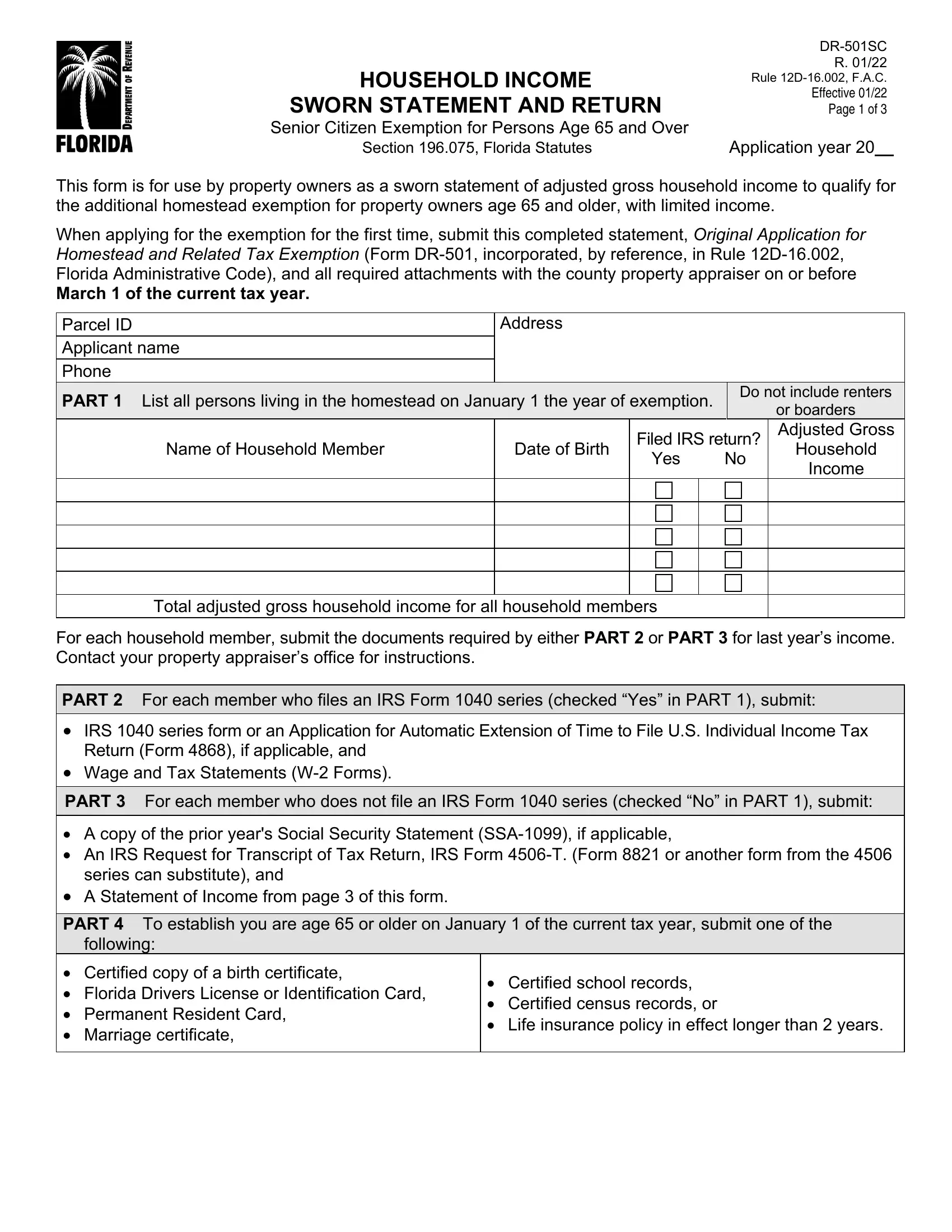

This PDF doc will need you to enter some specific information; to guarantee correctness, be sure to take into account the following steps:

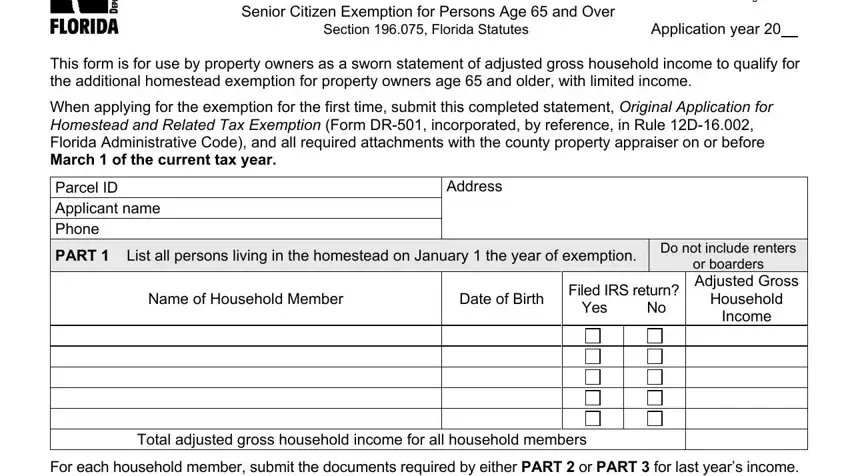

1. Start filling out the Form Dr 501Sc with a number of necessary fields. Get all the information you need and make sure not a single thing omitted!

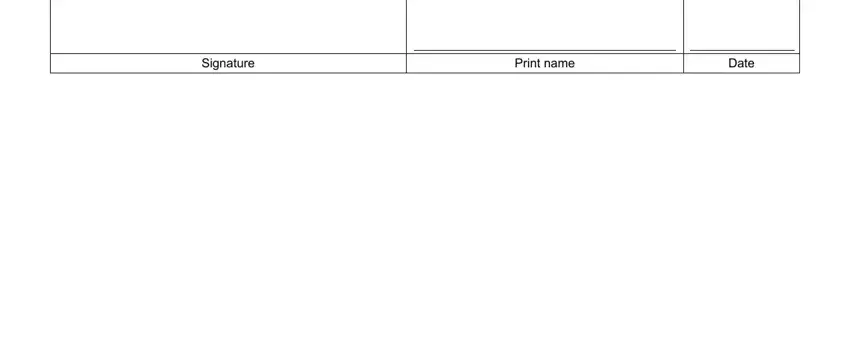

2. The subsequent step is usually to submit the following blanks: Signature, Print name, and Date.

People who use this document generally get some things incorrect while filling out Signature in this part. You should definitely double-check everything you type in right here.

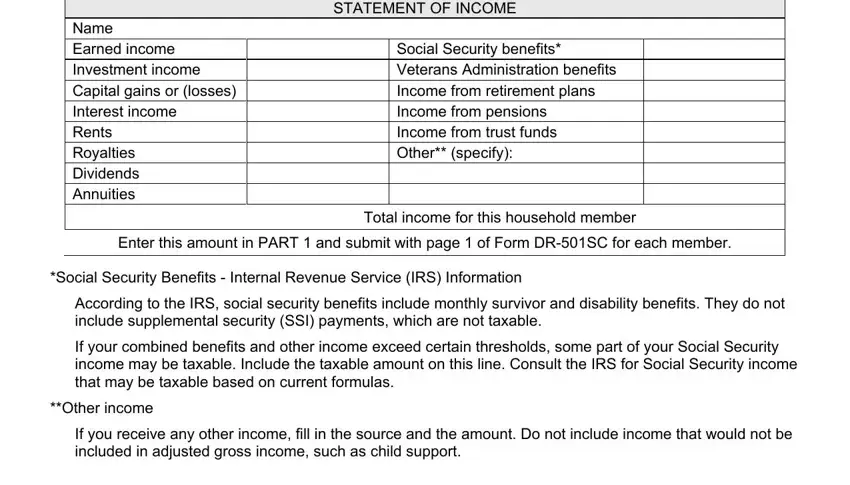

3. The third stage is straightforward - complete all of the fields in Name Earned income Investment, STATEMENT OF INCOME, Social Security benefits Veterans, Enter this amount in PART and, Total income for this household, Social Security Benefits Internal, According to the IRS social, If your combined benefits and, Other income, and If you receive any other income in order to complete this segment.

Step 3: Right after you have looked once more at the information you given, click on "Done" to finalize your form. Make a 7-day free trial option at FormsPal and acquire direct access to Form Dr 501Sc - downloadable, emailable, and editable from your FormsPal cabinet. At FormsPal.com, we strive to be sure that your information is stored private.