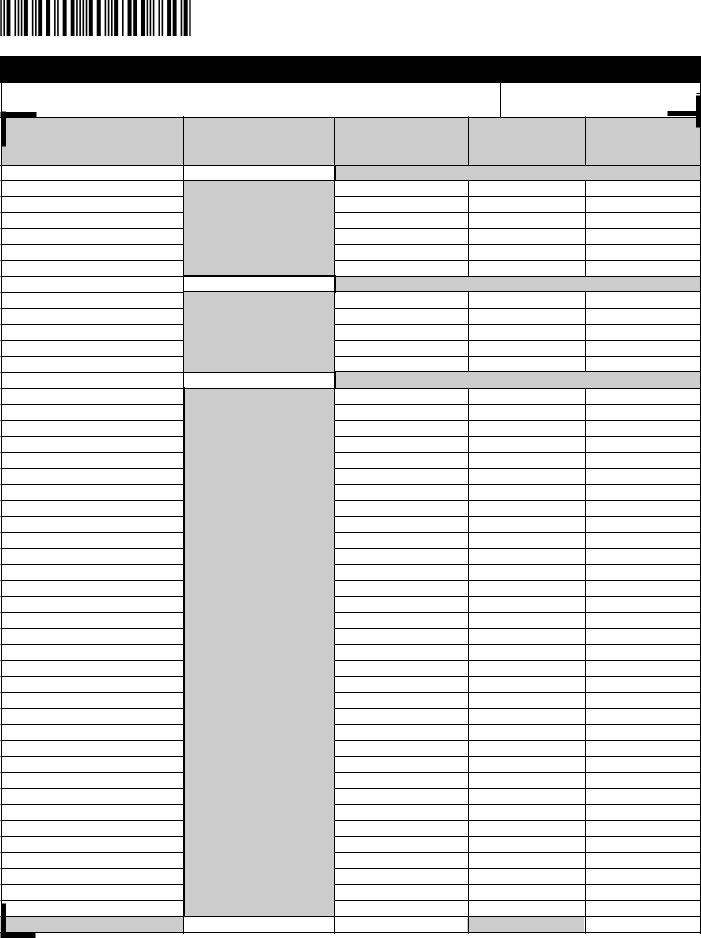

The DR-700016 form, also known as the Florida Communications Services Tax Return, plays a crucial role in the tax administration process for businesses involved in providing communications services within Florida. Required to be filed by these businesses, the form encapsulates a detailed declaration of taxes due on sales attributed to state and gross receipts portions of communications services tax, as well as taxes due on direct-to-home satellite services. It facilitates a comprehensive breakdown of taxes, inclusive of the local portion of the communications services tax specific to different jurisdictions across Florida. Additionally, the form allows for adjustments, multistate credits, and outlines the penalties and interests applicable for late filings or payments. Designed with precision to ensure accurate tax reporting and compliance, the form delineates specific guidelines for its completion, including the use of black ink for handwritten submissions and the necessity of attaching all applicable schedules and supporting documentation. It also functions as a declaration of the cessation of business, where applicable, marking the final tax return submission for a business. This documentation becomes a pivotal tool not only for tax calculation and payment but also serves as an official record under penalties of perjury, substantiating the truthfulness and accuracy of the information provided by the taxpayer. Moreover, the form addresses changes in business or payment information, advocating for updated records and facilitating electronic payment options, thereby streamlining the tax filing process in the digital age.

| Question | Answer |

|---|---|

| Form Name | Form Dr 700016 |

| Form Length | 24 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 6 min |

| Other names | dr700016_0111 700016 form |

|

|

|

|

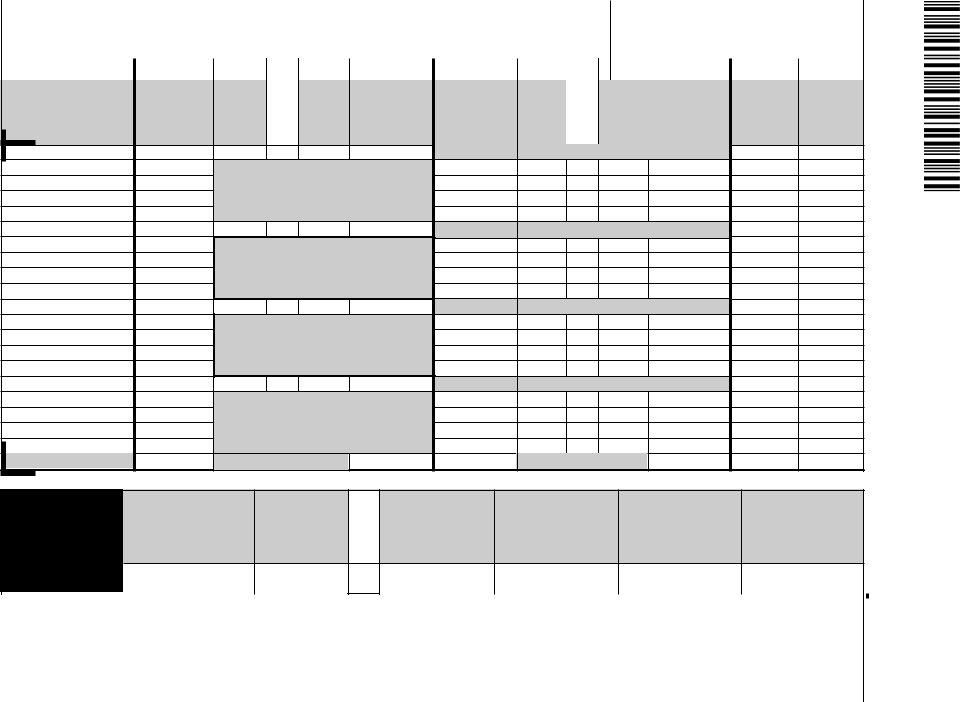

Florida Communications |

|

|

R. 01/11 |

|

|

Services tax Return |

|

|

|

|

|

|

|

|

|

|

Name |

|

|

Address |

|

|

|

|

|

|

|

|

BUSINeSS PARtNeR NUMBeR |

|

|

|

|

|

|

|

|

|

FeIN |

|

|

|

|

City/State/ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you are discontinuing your business |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and this is your inal return (see page 15). |

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RePoRtING PeRIoD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

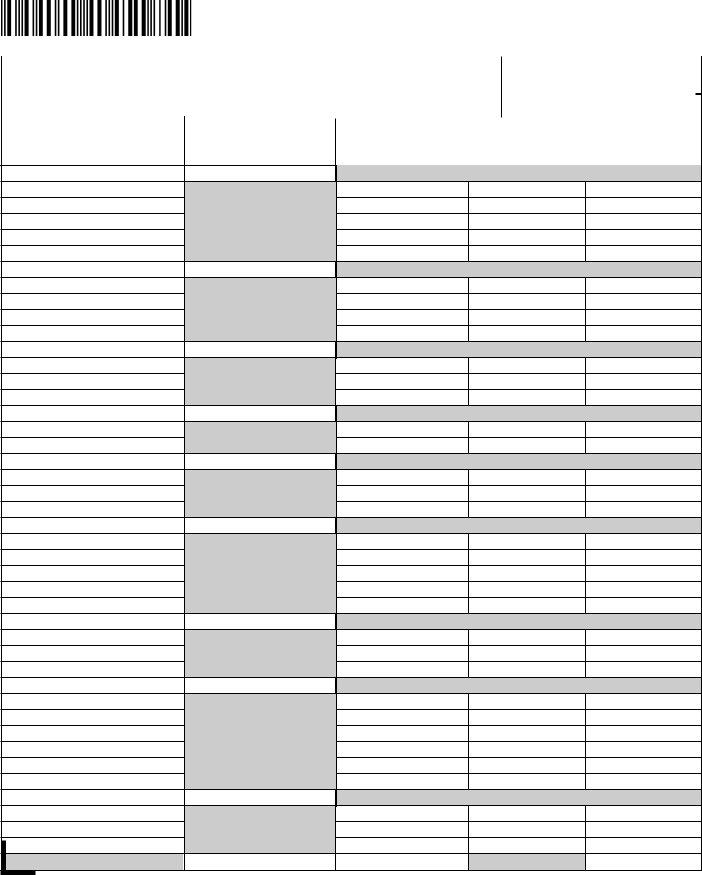

|

|

|

|

|

|

|

|

|

|

|

|

FROM: |

|

TO: |

|

|

|

Handwritten Example |

|

|

|

|

|

|

Typed Example |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|

0123456789 |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use black ink. |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

M M D D Y |

|

Y Y Y |

|

M M D D |

|

|

Y Y Y Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

US Dollars |

|

|

|

|

|

|

|

Cents |

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

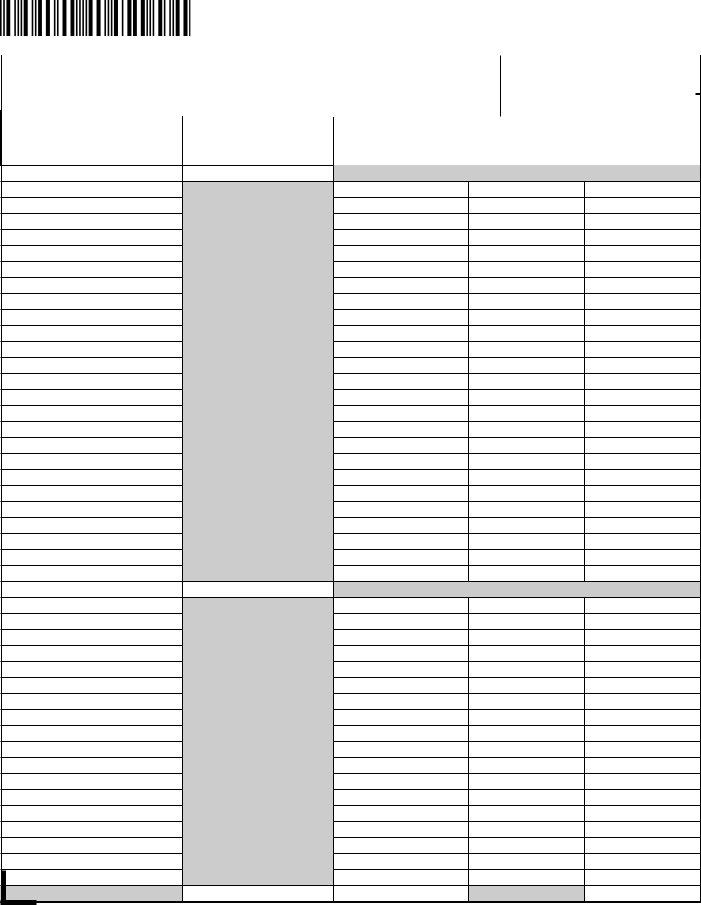

|

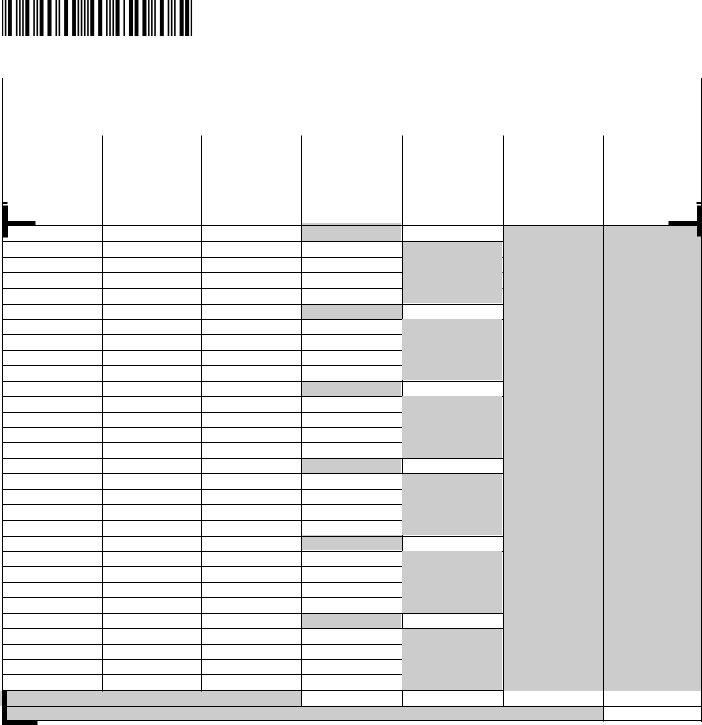

1. |

|

|

Tax due on sales subject to 6.65% state and .15% gross receipts portions |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

of communications services tax (from Summary of Schedule I, Line 3) |

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

2. |

|

|

Tax due on sales subject to 2.37% gross receipts portion of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

communications services tax (from Summary of Schedule I, Line 6) |

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

Tax due on sales subject to local portion of communications |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

services tax (from Summary of Schedule I, Line 7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

4. |

|

|

Tax due for |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

5. |

|

|

Total communications services tax (add Lines 1 through 4) |

5. |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

|

|

Collection allowance. Rate:________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

(If rate above is blank, check one) ❑ None applies ❑ .0025 ❑ .0075 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

7. |

|

|

Net communications services tax due (subtract Line 6 from Line 5) |

7. |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

|

Penalty |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

|

|

Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

10. |

|

Adjustments (from Schedule III, Column G and/or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Check here |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

Schedule IV, Column U) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if negative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

|

Multistate credits (from Schedule V) |

........................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

|

Amount due with return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AUthoRIZAtIoN |

|

Under penalties of perjury, I declare that I have read this return and that the facts stated in it are true [ss. 92.525(2), 202.27(5), and 837.06, Florida Statutes]. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type or print name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer (type or print name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact name (type or print name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact phone number |

|

|

|

|

|

|

|

|

|

|

|

Contact |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

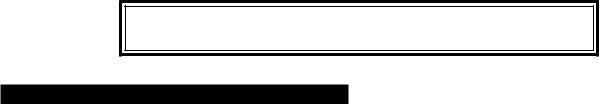

Payment Coupon |

|

|

Do Not DetACh |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

To ensure proper credit to your account, attach your check to |

|

|

|

|

|

|

|

|

|

|

|

R. 01/11 |

||||||||||||||||||||||

|

|

|

|

|

this payment coupon. Mail with tax return and all schedules. |

|

|

|

|

DoR USe oNLy |

|||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

Business Partner Number |

Reporting Period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

postmark or hand delivery date |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Check here if your address or business information |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

changed and enter changes below. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Business Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

New location address: ___________________________________________ |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

________________________________________________________________ |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

________________________________________________________________ |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Telephone number: (______)_______________________________________ |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

New mailing address: ____________________________________________ |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

________________________________________________________________ |

||||||||||||||||||||||||||||||||

|

|

|

Check here if payment was transmitted electronically. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

________________________________________________________________ |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Amount due |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Payment is due on the 1st and LAte |

|

|

|

|

|

|

from Line 12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

if postmarked or hand delivered after

9100 0 99999999 0063004031 7 3999999999 0000 2

R. 01/11

Page 2

Rule

Florida Administrative Code

effective 02/11

Where to send payments and returns

Make check payable to and send with return to:

FLORIDA DEPARTMENT OF REVENUE PO BOX 6520

TALLAHASSEE FL

File online via our Internet site at www.mylorida.com/dor

File electronically . . .

it’s easy!

The Department maintains a free and secure Internet site to ile and pay communications services tax. To enroll, go to the Department’s Internet site at:

www.mylorida.com/dor

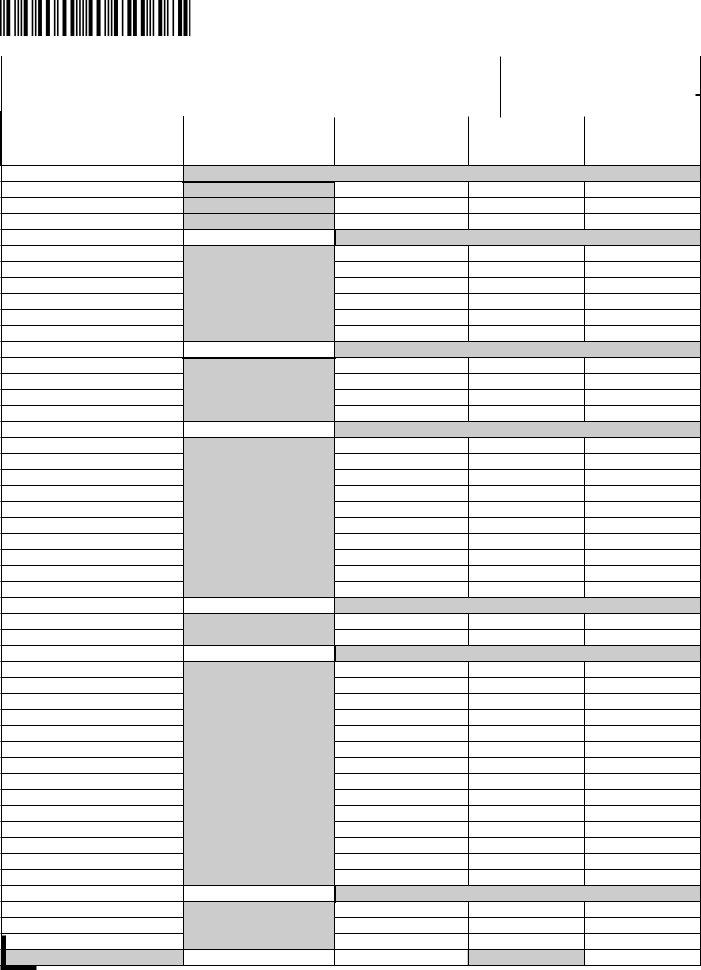

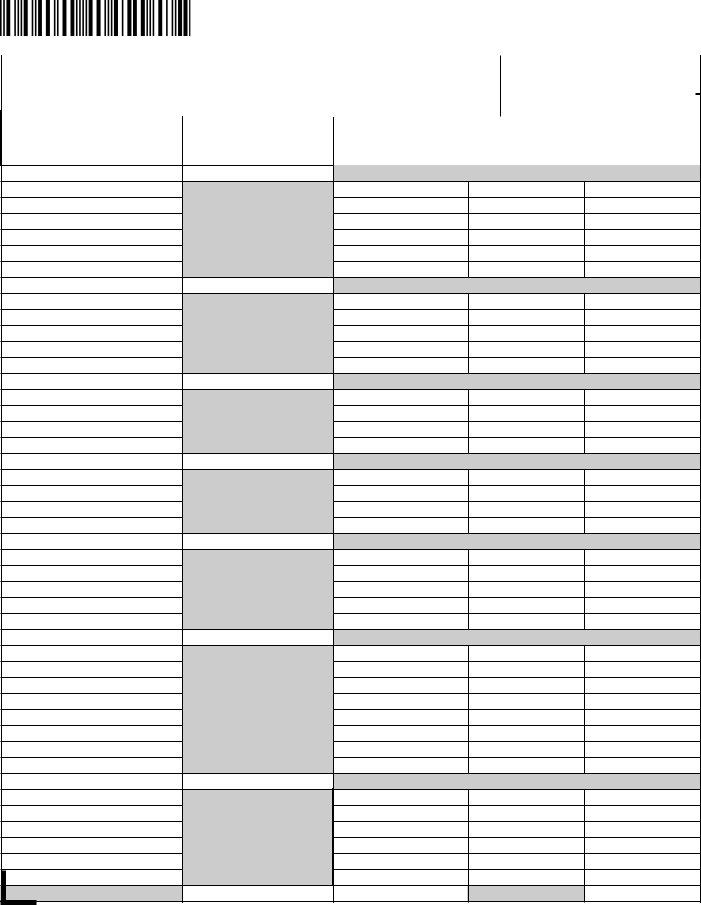

Complete Columns B, C, and E for all jurisdictions in which you provide or use communications services. Attach Schedule I and all other supporting schedules to the tax return.

R.01/11 Page 3

|

|

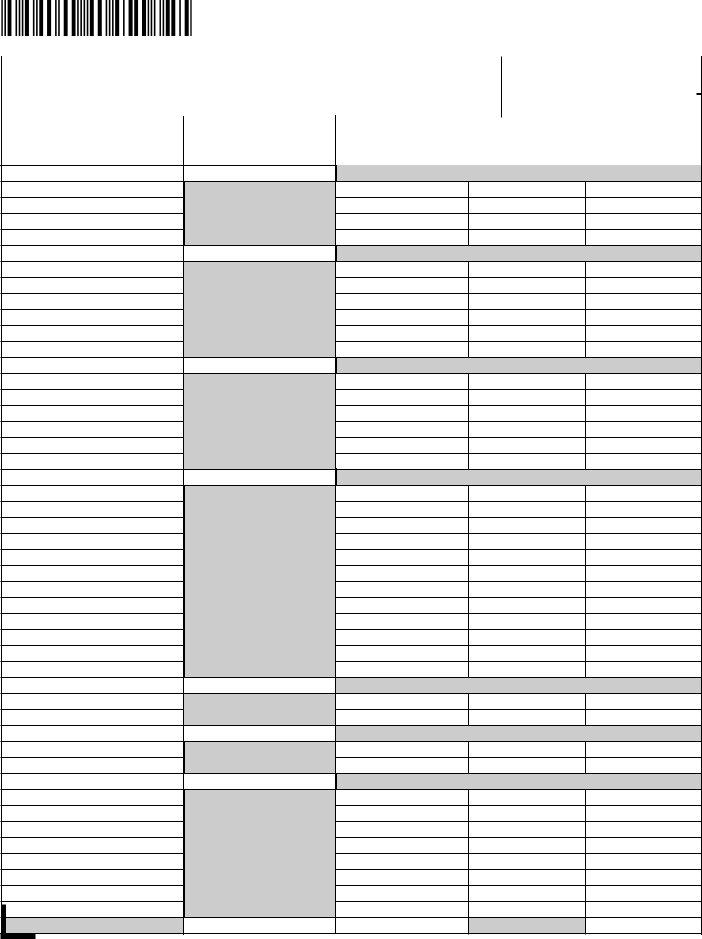

Schedule I - State, Gross Receipts, and Local taxes Due |

|

|

|

|||||

Business name |

|

|

|

Business partner number |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Local jurisdiction |

B. taxable sales subject to |

C. taxable sales subject |

D. Local tax rate |

|

e. Local tax due |

|

||

|

|

|||||||||

|

|

|

6.65% state tax and .15% |

to 2.37% gross receipts |

|

|

|

|

|

|

|

|

|

gross receipts tax |

tax and local tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALACHUA |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0710 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Alachua |

|

|

0.0542 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Archer |

|

|

0.0542 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Gainesville |

|

|

0.0577 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Hawthorne |

|

|

0.0542 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

High Springs |

|

|

0.0542 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

La Crosse |

|

|

0.0362 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Micanopy |

|

|

0.0530 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Newberry |

|

|

0.0542 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Waldo |

|

|

0.0542 |

|

|

|

|

||

|

BAKER |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0234 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Glen St. Mary |

|

|

0.0580 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Macclenny |

|

|

0.0652 |

|

|

|

|

||

|

BAY |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0214 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Callaway |

|

|

0.0552 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Lynn Haven |

|

|

0.0552 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Mexico Beach |

|

|

0.0318 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Panama City |

|

|

0.0552 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Panama City Beach |

|

|

0.0552 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Parker |

|

|

0.0552 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Springield |

|

|

0.0552 |

|

|

|

|

||

|

BRADFORD |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0124 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Brooker |

|

|

0.0360 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Hampton |

|

|

0.0280 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Lawtey |

|

|

0.0170 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Starke |

|

|

0.0582 |

|

|

|

|

||

|

BREVARD |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0522 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Cape Canaveral |

|

|

0.0522 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Cocoa |

|

|

0.0522 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Cocoa Beach |

|

|

0.0522 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.0522 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Indialantic |

|

|

0.0620 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Indian Harbour Beach |

|

|

0.0522 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Malabar |

|

|

0.0522 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Melbourne |

|

|

0.0593 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Melbourne Beach |

|

|

0.0522 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Melbourne Village |

|

|

0.0522 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Palm Bay |

|

|

0.0522 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Palm Shores |

|

|

0.0480 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Rockledge |

|

|

0.0522 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Satellite Beach |

|

|

0.0522 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Titusville |

|

|

0.0542 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

West Melbourne |

|

|

0.0552 |

|

|

|

|

||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

PAGe totAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete Columns B, C, and E for all jurisdictions in which you provide or use communications services. Attach Schedule I and all other supporting schedules to the tax return.

R.01/11 Page 4

|

|

Schedule I - State, Gross Receipts, and Local taxes Due |

|

|

|

|||||

Business name |

|

|

|

Business partner number |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Local jurisdiction |

B. taxable sales subject to |

C. taxable sales subject |

D. Local tax rate |

|

e. Local tax due |

|

||

|

|

|||||||||

|

|

|

6.65% state tax and .15% |

to 2.37% gross receipts |

|

|

|

|

|

|

|

|

|

gross receipts tax |

tax and local tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BROWARD |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0522 |

|

|

|

|

||

|

Coconut Creek |

|

|

0.0522 |

|

|

|

|

||

|

Cooper City |

|

|

0.0480 |

|

|

|

|

||

|

Coral Springs |

|

|

0.0522 |

|

|

|

|

||

|

Dania Beach |

|

|

0.0532 |

|

|

|

|

||

|

Davie |

|

|

0.0520 |

|

|

|

|

||

|

Deerield Beach |

|

|

0.0522 |

|

|

|

|

||

|

Fort Lauderdale |

|

|

0.0522 |

|

|

|

|

||

|

Hallandale Beach |

|

|

0.0522 |

|

|

|

|

||

|

Hillsboro Beach |

|

|

0.0120 |

|

|

|

|

||

|

Hollywood |

|

|

0.0522 |

|

|

|

|

||

|

Lauderdale Lakes |

|

|

0.0532 |

|

|

|

|

||

|

|

|

0.0522 |

|

|

|

|

|||

|

Lauderhill |

|

|

0.0522 |

|

|

|

|

||

|

Lazy Lake |

|

|

0.0060 |

|

|

|

|

||

|

Lighthouse Point |

|

|

0.0622 |

|

|

|

|

||

|

Margate |

|

|

0.0532 |

|

|

|

|

||

|

Miramar |

|

|

0.0522 |

|

|

|

|

||

|

North Lauderdale |

|

|

0.0522 |

|

|

|

|

||

|

Oakland Park |

|

|

0.0542 |

|

|

|

|

||

|

Parkland |

|

|

0.0522 |

|

|

|

|

||

|

Pembroke Park |

|

|

0.0522 |

|

|

|

|

||

|

Pembroke Pines |

|

|

0.0542 |

|

|

|

|

||

|

Plantation |

|

|

0.0522 |

|

|

|

|

||

|

Pompano Beach |

|

|

0.0522 |

|

|

|

|

||

|

Sea Ranch Lakes |

|

|

0.0522 |

|

|

|

|

||

|

Southwest Ranches |

|

|

0.0522 |

|

|

|

|

||

|

Sunrise |

|

|

0.0522 |

|

|

|

|

||

|

Tamarac |

|

|

0.0522 |

|

|

|

|

||

|

West Park |

|

|

0.0522 |

|

|

|

|

||

|

Weston |

|

|

0.0522 |

|

|

|

|

||

|

Wilton Manors |

|

|

0.0562 |

|

|

|

|

||

|

CALHOUN |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0264 |

|

|

|

|

||

|

Altha |

|

|

0.0602 |

|

|

|

|

||

|

Blountstown |

|

|

0.0602 |

|

|

|

|

||

|

CHARLOTTE |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0582 |

|

|

|

|

||

|

Punta Gorda |

|

|

0.0582 |

|

|

|

|

||

|

CITRUS |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0224 |

|

|

|

|

||

|

Crystal River |

|

|

0.0522 |

|

|

|

|

||

|

Inverness |

|

|

0.0532 |

|

|

|

|

||

|

|

|

|

|

|

|

||||

|

PAGe totAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

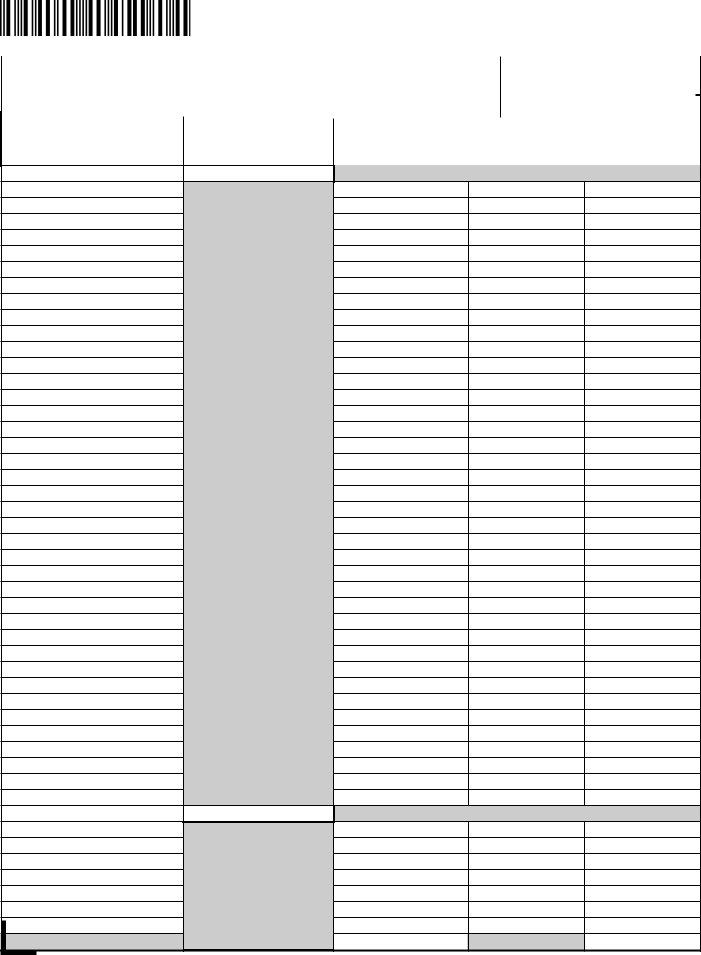

Complete Columns B, C, and E for all jurisdictions in which you provide or use communications services. Attach Schedule I and all other supporting schedules to the tax return.

R.01/11 Page 5

|

|

Schedule I - State, Gross Receipts, and Local taxes Due |

|

|

|

|

||||

Business name |

|

|

Business partner number |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Local jurisdiction |

B. taxable sales subject to |

C. taxable sales subject |

D. Local tax rate |

|

e. Local tax due |

|

|

|

|

|

|

||||||||

|

|

|

6.65% state tax and .15% |

to 2.37% gross receipts |

|

|

|

|

|

|

|

|

|

gross receipts tax |

tax and local tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CLAY |

|

Unincorporated area |

0.0652 |

Green Cove Springs |

0.0582 |

Keystone Heights |

0.0582 |

Orange Park |

0.0582 |

Penney Farms |

0.0582 |

COLLIER |

|

Unincorporated area |

0.0210 |

Everglades City |

0.0390 |

Marco Island |

0.0522 |

Naples |

0.0522 |

COLUMBIA |

|

Unincorporated area |

0.0190 |

Fort White |

0.0120 |

Lake City |

0.0582 |

DESOTO |

|

Unincorporated area |

0.0294 |

Arcadia |

0.0582 |

DIXIE |

|

Unincorporated area |

0.0234 |

Cross City |

0.0300 |

Horseshoe Beach |

0.0670 |

DUVAL |

|

Atlantic Beach |

0.0582 |

Baldwin |

0.0682 |

Jacksonville Beach |

0.0582 |

Jax Duval (City of Jacksonville) |

0.0582 |

Neptune Beach |

0.0582 |

ESCAMBIA |

|

Unincorporated area |

0.0274 |

Century |

0.0300 |

Pensacola |

0.0612 |

FLAGLER |

|

Unincorporated area |

0.0254 |

Beverly Beach |

0.0580 |

Bunnell |

0.0645 |

Flagler Beach |

0.0580 |

Marineland |

0.0110 |

Palm Coast |

0.0592 |

FRANKLIN |

|

Unincorporated area |

0.0150 |

Apalachicola |

0.0420 |

Carrabelle |

0.0642 |

PAGe totAL |

|

Complete Columns B, C, and E for all jurisdictions in which you provide or use communications services. Attach Schedule I and all other supporting schedules to the tax return.

R.01/11 Page 6

|

|

Schedule I - State, Gross Receipts, and Local taxes Due |

|

|

|

|||||

Business name |

|

|

|

Business partner number |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Local jurisdiction |

B. taxable sales subject to |

C. taxable sales subject |

D. Local tax rate |

|

e. Local tax due |

|

||

|

|

|

6.65% state tax and .15% |

to 2.37% gross receipts |

|

|

|

|

|

|

|

|

|

gross receipts tax |

tax and local tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GADSDEN |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0264 |

|

|

|

|

||

|

Chattahoochee |

|

|

0.0602 |

|

|

|

|

||

|

Greensboro |

|

|

0.0592 |

|

|

|

|

||

|

Gretna |

|

|

0.0482 |

|

|

|

|

||

|

Havana |

|

|

0.0602 |

|

|

|

|

||

|

Midway |

|

|

0.0450 |

|

|

|

|

||

|

Quincy |

|

|

0.0602 |

|

|

|

|

||

|

GILCHRIST |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0234 |

|

|

|

|

||

|

Bell |

|

|

0.0500 |

|

|

|

|

||

|

Fanning Springs |

|

|

0.0612 |

|

|

|

|

||

|

Trenton |

|

|

0.0572 |

|

|

|

|

||

|

GLADES |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0244 |

|

|

|

|

||

|

Moore Haven |

|

|

0.0180 |

|

|

|

|

||

|

GULF |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0234 |

|

|

|

|

||

|

Port St. Joe |

|

|

0.0572 |

|

|

|

|

||

|

Wewahitchka |

|

|

0.0572 |

|

|

|

|

||

|

HAMILTON |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0090 |

|

|

|

|

||

|

Jasper |

|

|

0.0540 |

|

|

|

|

||

|

Jennings |

|

|

0.0570 |

|

|

|

|

||

|

White Springs |

|

|

0.0560 |

|

|

|

|

||

|

HARDEE |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0184 |

|

|

|

|

||

|

Bowling Green |

|

|

0.0382 |

|

|

|

|

||

|

Wauchula |

|

|

0.0560 |

|

|

|

|

||

|

Zolfo Springs |

|

|

0.0282 |

|

|

|

|

||

|

HENDRY |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0244 |

|

|

|

|

||

|

Clewiston |

|

|

0.0582 |

|

|

|

|

||

|

La Belle |

|

|

0.0482 |

|

|

|

|

||

|

HERNANDO |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0170 |

|

|

|

|

||

|

Brooksville |

|

|

0.0552 |

|

|

|

|

||

|

Weeki Wachee |

|

|

0.0040 |

|

|

|

|

||

|

HIGHLANDS |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

0.0244 |

|

|

|

|

||

|

Avon Park |

|

|

0.0582 |

|

|

|

|

||

|

Lake Placid |

|

|

0.0582 |

|

|

|

|

||

|

Sebring |

|

|

0.0582 |

|

|

|

|

||

|

|

|

|

|

|

|

||||

|

PAGe totAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete Columns B, C, and E for all jurisdictions in which you provide or use communications services. Attach Schedule I and all other supporting schedules to the tax return.

R.01/11 Page 7

|

|

Schedule I - State, Gross Receipts, and Local taxes Due |

|

|

|

||||

Business name |

|

|

Business partner number |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Local jurisdiction |

B. taxable sales subject to |

C. taxable sales subject |

D. Local tax rate |

|

e. Local tax due |

|

|

|

|

||||||||

|

|

|

6.65% state tax and .15% |

to 2.37% gross receipts |

|

|

|

|

|

|

|

|

gross receipts tax |

tax and local tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HILLSBOROUGH |

|

Unincorporated area |

0.0460 |

Plant City |

0.0632 |

Tampa |

0.0582 |

Temple Terrace |

0.0600 |

HOLMES |

|

Unincorporated area |

0.0244 |

Bonifay |

0.0642 |

Esto |

0.0140 |

Noma |

0.0070 |

Ponce De Leon |

0.0330 |

Westville |

0.0150 |

INDIAN RIVER |

|

Unincorporated area |

0.0244 |

Fellsmere |

0.0582 |

Indian River Shores |

0.0582 |

Orchid |

0.0270 |

Sebastian |

0.0582 |

Vero Beach |

0.0572 |

JACKSON |

|

Unincorporated area |

0.0254 |

Alford |

0.0220 |

Bascom |

0.0202 |

Campbellton |

0.0592 |

Cottondale |

0.0592 |

Graceville |

0.0592 |

Grand Ridge |

0.0592 |

Greenwood |

0.0592 |

Jacob City |

0.0592 |

Malone |

0.0592 |

Marianna |

0.0592 |

Sneads |

0.0400 |

JEFFERSON |

|

Unincorporated area |

0.0164 |

Monticello |

0.0500 |

LAFAYETTE |

|

Unincorporated area |

0.0234 |

Mayo |

0.0250 |

LAKE |

|

Unincorporated area |

0.0254 |

Astatula |

0.0500 |

Clermont |

0.0582 |

Eustis |

0.0582 |

Fruitland Park |

0.0582 |

Groveland |

0.0582 |

0.0582 |

|

Lady Lake |

0.0582 |

PAGe totAL |

|

Complete Columns B, C, and E for all jurisdictions in which you provide or use communications services. Attach Schedule I and all other supporting schedules to the tax return.

R.01/11 Page 8

|

|

Schedule I - State, Gross Receipts, and Local taxes Due |

|

|

|

|||||

Business name |

|

|

Business partner number |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Local jurisdiction |

B. taxable sales subject to |

C. taxable sales subject |

D. Local tax rate |

|

e. Local tax due |

|

||

|

|

|||||||||

|

|

|

|

6.65% state tax and .15% |

to 2.37% gross receipts |

|

|

|

|

|

|

|

|

|

gross receipts tax |

tax and local tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAKE - continued |

|

|

|

|

|

|

|

||

|

Leesburg |

|

|

0.0582 |

|

|

|

|

||

|

Mascotte |

|

|

0.0582 |

|

|

|

|

||

|

Minneola |

|

|

0.0582 |

|

|

|

|

||

|

Montverde |

|

|

0.0570 |

|

|

|

|

||

|

Mount Dora |

|

|

0.0582 |

|

|

|

|

||

|

Tavares |

|

|

0.0592 |

|

|

|

|

||

|

Umatilla |

|

|

0.0582 |

|

|

|

|

||

|

LEE |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

|

0.0361 |

|

|

|

|

|

|

Bonita Springs |

|

|

0.0182 |

|

|

|

|

||

|

Cape Coral |

|

|

0.0522 |

|

|

|

|

||

|

Fort Myers |

|

|

0.0522 |

|

|

|

|

||

|

Fort Myers Beach |

|

|

0.0522 |

|

|

|

|

||

|

Sanibel |

|

|

0.0522 |

|

|

|

|

||

|

LEON |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

|

0.0602 |

|

|

|

|

|

|

Tallahassee |

|

|

0.0690 |

|

|

|

|

||

|

LEVY |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

|

0.0234 |

|

|

|

|

|

|

Bronson |

|

|

0.0300 |

|

|

|

|

||

|

Cedar Key |

|

|

0.0260 |

|

|

|

|

||

|

Chieland |

|

|

0.0572 |

|

|

|

|

||

|

Fanning Springs |

|

|

0.0612 |

|

|

|

|

||

|

Inglis |

|

|

0.0572 |

|

|

|

|

||

|

Otter Creek |

|

|

0.0120 |

|

|

|

|

||

|

Williston |

|

|

0.0572 |

|

|

|

|

||

|

Yankeetown |

|

|

0.0622 |

|

|

|

|

||

|

LIBERTY |

|

|

|

|

|

|

|

|

|

|

Unincorporated area |

|

|

|

0.0120 |

|

|

|

|

|

|

Bristol |

|

|

0.0582 |

|

|

|

|

||

|

MADISON |

|

|

|

|

|

|

|

|

|