The New York State Department of Taxation and Finance introduces the DTF-619 form as a claim for the Qualified Emerging Technology Company (QETC) Facilities, Operations, and Training Credit, which aligns with Tax Law — Articles 9-A and 22. This document offers a pathway for corporations and individuals to apply for credits against their tax liabilities, provided their activities meet certain criteria centered around innovation and technological advancement within New York State. The form requires applicants to enter detailed information about their tax period, including the beginning and ending dates, alongside taxpayer identification numbers, making it essential for filing alongside corporate franchise tax returns or personal income tax returns as specified. It further guides filers through a series of schedules designed to affirm eligibility based on a company's location, sales, engagement in qualifying business activities related to emerging technologies, employment numbers, research and development activities, and gross revenues. Additionally, the form details the computation of credit component amounts relating to research and development property, qualified research expenses, and qualified high-technology training expenditures, which together ascertain the comprehensive credit claimable. Notably, it incorporates provisions for beneficiaries of estates or trusts and outlines the application of the QETC credit towards franchise taxes, providing a structured approach to applying for and calculating the tax credit, all underpinned by the necessity to contribute to the state’s technological advancement goals.

| Question | Answer |

|---|---|

| Form Name | Form Dtf 619 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | form dtf 160, dtf 619, need form dtf 719 c19, new york form dtf 619 |

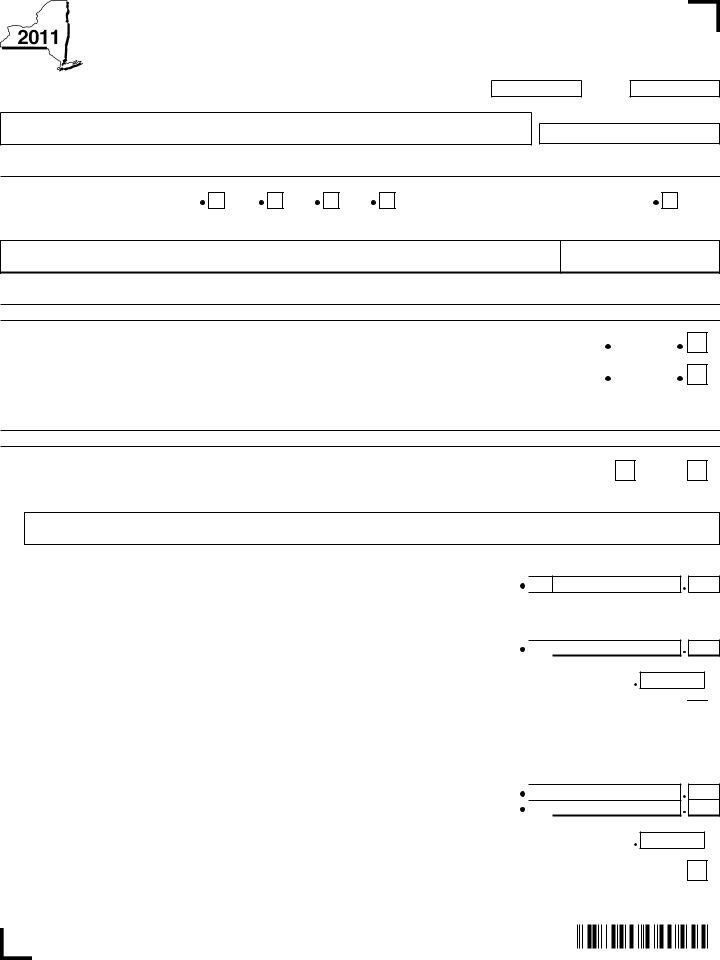

New York State Department of Taxation and Finance

Tax Law — Articles

All filers must enter tax period: beginning

Name(s) as shown on return

ending

Taxpayer identiication number

File this form with corporate franchise tax return Form

Mark an X in the box for the tax year for which you are claiming the qualiied emerging technology company (QETC) facilities, operations,

and training credit on this form: 1st |

2nd |

3rd |

4th |

or (only if relocating from incubator facility) 5th |

Line A — Partner in a partnership, S corporation shareholder, or beneiciary of an estate or trust.

Business name

Taxpayer identiication number

Schedule A — QETC eligibility requirements (All the questions in Schedule A pertain to the tax year for which you are claiming the credit.)

Part 1 — Location and sales (Mark an X in the appropriate boxes.)

1 |

Is the company located in New York State? |

Yes |

|

No |

2 |

Are the total annual product sales of the company $10,000,000 or less? |

Yes |

|

No |

|

||||

|

If you answered Yes to questions 1 and 2, continue with Part 2. |

|

|

|

|

If you answered No to either question 1 or 2, stop. You cannot claim this credit for the current tax year. |

|

|

|

Part 2 — QETC business activities

Primary products and services

3Does the company develop or create products or services that are classiied as emerging technologies?.. Yes

No

If Yes, enter in the box below a description of the company’s emerging technology products or services, and continue with line 4.

If No, stop. You cannot claim this credit.

4Enter the gross receipts or sales from all the company’s products or services included

on your federal return |

4. |

|

|

If line 4 is zero, skip lines 5 through 7 and continue with line 8. If line 4 is greater than zero, continue with line 5.

5Enter the gross receipts or sales from the company’s emerging technology products or

|

services described on line 3 included on your federal return |

5. |

|

|

|

|

6 |

Divide line 5 by line 4 ( round the result to the fourth decimal place ) |

|

|

|

|

|

|

|

|||||

|

|

6. |

|

|

||

|

|

|

|

|

|

|

7 |

Is the percentage on line 6 greater than 50%? |

|

|

|

Yes |

|

|

If Yes, continue with Schedule B. |

|

|

|

|

|

|

If No, and line 4 is greater than zero, stop. You cannot claim this credit. |

|

|

|

|

|

8Enter the total expenditures attributable to the development or creation of emerging

|

technology products or services included on your federal return |

8. |

|

|

|

|

9 |

Enter the total expenditures included on your federal return |

9. |

|

|

|

|

10 |

Divide line 8 by line 9 (round the result to the fourth decimal place) |

|

|

|

|

|

|

|

|

|

|||

|

|

10. |

|

|

||

|

|

|

|

|

|

|

11 |

Is the percentage on line 10 greater than 50%? |

|

|

|

Yes |

|

|

If Yes, continue with Schedule B. If No, stop. You cannot claim this credit. |

|

|

|

|

|

%

No

%

No

6191110094

|

Please file this original scannable |

61901110094 |

form with the Tax Department. |

Page 2 of 4

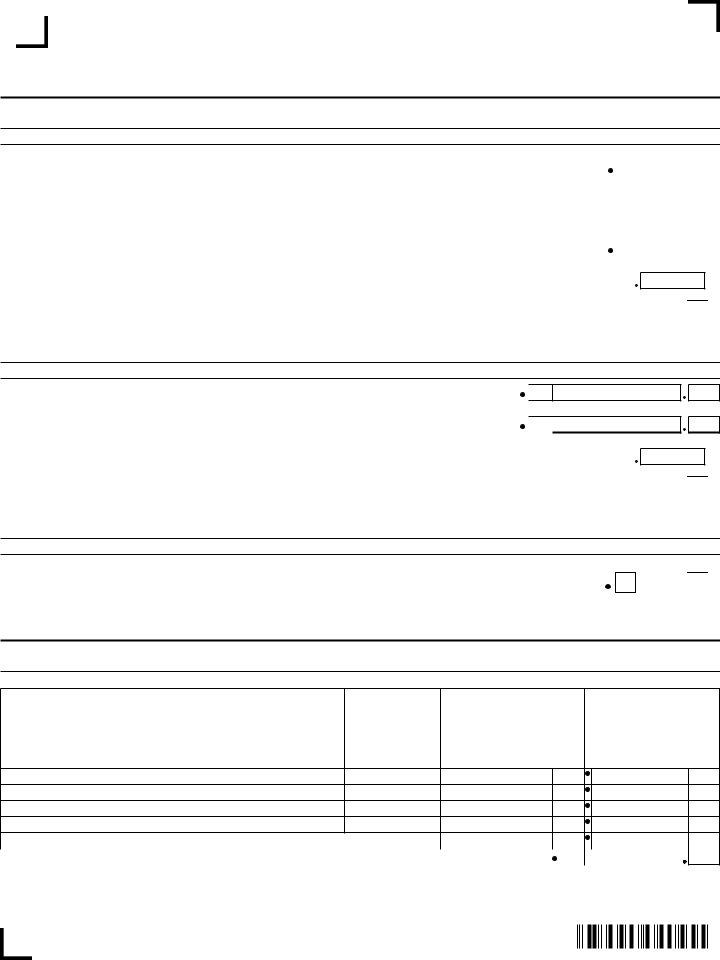

Schedule B — Credit eligibility requirements

Part 1 — Employment

12 |

Number of |

....... |

12. |

|

|

|

|

13 |

Is the number of employees on line 12 one hundred (100) or less? |

Yes |

|

|

No |

|

|

|

|

|

|

||||

|

If Yes, continue with line 14. |

|

|

|

|

|

|

|

If No, stop. You are not eligible to claim this credit. |

|

|

|

|

|

|

14 |

Number of employees on line 12 who are employed in New York State |

14. |

|

|

|

||

15 |

Divide line 14 by line 12 ( round the result to the fourth decimal place ) |

15. |

|

|

|

|

|

|

|

16 |

Does the percentage on line 15 equal or exceed 75%? |

|

Yes |

|

|

If Yes, continue with line 17. |

|

|

|

|

If No, stop. You are not eligible to claim this credit. |

|

|

|

%

No

Part 2 — Research and development activities

17 Enter the amount of research and development funds |

17. |

18Enter the amount of net sales for the current tax year reported on your federal return. ( If you

have any amount of R&D funds, but zero net sales, mark the Yes box on line 20. ) |

18. |

19Research and development funds percentage ( divide line 17 by line 18; round the result to the

fourth decimal place ) |

19. |

|

|

|

|

|

|

20 Does the percentage on line 19 equal or exceed 6%? |

|

Yes |

|

If Yes, continue with line 21. |

|

|

|

If No, stop. You are not eligible to claim this credit. |

|

|

|

%

No

Part 3 — Gross revenues

21For tax year 2010, were your gross revenues, along with the gross revenues of afiliates and related

members, $20,000,000 or less? |

Yes |

If Yes, continue with Schedule C. |

|

If No, stop. You are not eligible to claim this credit. |

|

No

Schedule C — Computation of credit component amounts

Part 1 — Research and development property credit component

A

Description of property,

expense, or fee

(list each and attach schedule if needed )

B

Date placed

in service

(

C

Cost, basis, expense,

or fee

D

Credit

( column C × 18% (.18 ))

Totals from attached schedule, if needed ...............................................................

22 Research and development property credit component amount ( add column D amounts ) |

22. |

|

|

6192110094

|

Please file this original scannable |

61902110094 |

form with the Tax Department. |

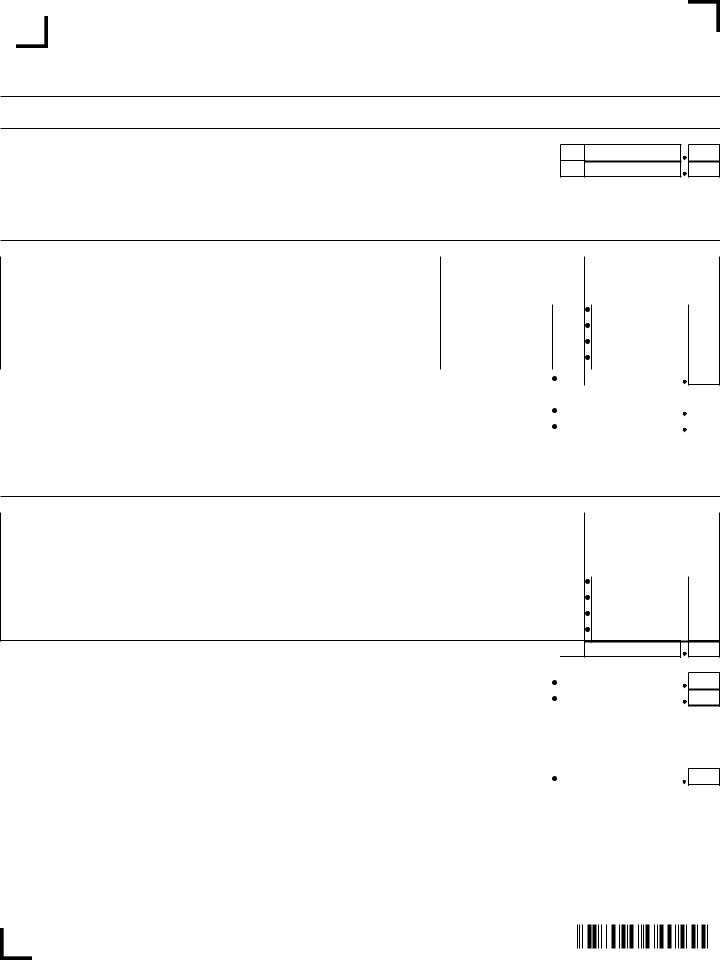

Schedule C (continued)

23 Beneficiary: Enter your share of the estate’s or trust’s research and development property

credit component ...........................................................................................................................

24 Total research and development property credit component ( add lines 22 and 23) .............................

Fiduciaries: Include the line 24 amount on the Total line of Schedule D, column C, and continue with Part 2.

All others: Continue with Part 2.

23.

24.

Part 2 — Qualified research expenses credit component

A |

B |

C |

D |

Description of |

Date paid or |

Cost |

Credit |

expense |

incurred |

|

( column C × 9% ( .09 )) |

|

( |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals from attached schedule, if needed ..............................................................

25 |

Qualiied research expenses credit component amount ( add column D amounts ) |

25. |

|

|

|

26 |

Beneficiary: Enter your share of the estate’s or trust’s qualiied research expenses credit |

|

|

|

|

|

component |

26. |

|

|

|

27 |

Total qualiied research expenses credit component ( add lines 25 and 26 ) |

27. |

|

|

|

Fiduciaries: Include the line 27 amount on the Total line of Schedule D, column D, and continue with Part 3.

All others: Continue with Part 3.

Part 3 — Qualified

A |

B |

C |

D |

E |

F |

Employee name |

Social security |

Description of qualiied |

Date paid or |

Amount of |

Credit ( enter the |

|

number |

incurred |

expense |

lesser of column E |

|

|

|

training expense |

( |

|

or $4,000 ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total from attached schedule, if needed............................................................................................................

28 Qualiied

29Beneficiary: Enter your share of the estate’s or trust’s qualiied

|

expenditures credit component |

29. |

|

30 |

Total qualiied |

30. |

|

|

Fiduciaries: Include the line 30 amount on the Total line of Schedule D, column E, and |

|

|

|

continue with line 31. |

|

|

|

All others: Continue with line 31. |

|

|

31 |

Total credit component amount ( add lines 24, 27, and 30 ) |

|

|

31. |

|

||

|

Fiduciaries: Complete Schedule D. |

|

|

|

All others: Enter the line 31 amount on line 32. |

|

|

6193110094

|

Please file this original scannable |

61903110094 |

form with the Tax Department. |

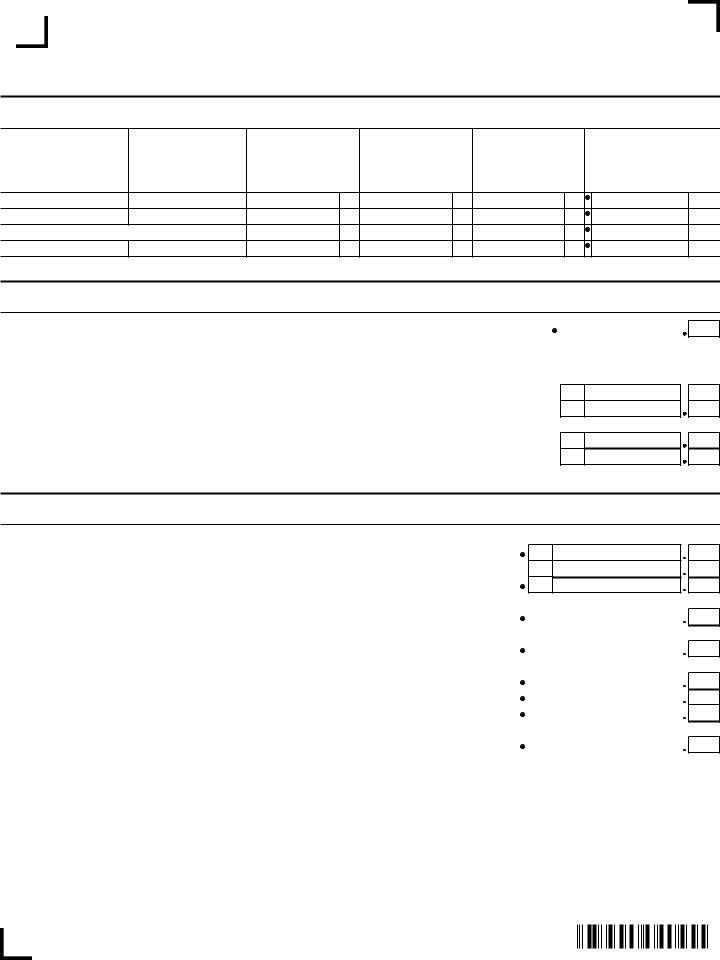

Page 4 of 4

Schedule D — Beneficiary’s and fiduciary’s share of credit

A |

B |

C |

D |

E |

F |

Beneiciary’s name |

Identifying |

Share of research |

Share of qualiied |

Share of qualiied |

Total credit |

( same as Form |

number |

and development |

research expenses |

( add columns C, D, and E ) |

|

Schedule C ) |

|

property |

credit component |

training expenditures |

|

|

|

credit component |

|

credit component |

|

Total

Totals from attached schedule, if needed

Fiduciary

Schedule E — Credit limitation

32 Total credit component amounts |

32. |

|

Fiduciaries: Enter the amount from the Fiduciary line of Schedule D, column F.

All others: Enter the line 31 amount.

33 Credit limitation .....................................................................................................................................

34 Available credit after limitation ( enter the amount from line 32 or line 33, whichever is less )........................

35 Partners and S corporation shareholders: Enter your share of the partnership’s or

S corporation’s credit ( see instructions )..............................................................................................

36 Total available credit ( add lines 34 and 35; see instructions ) .....................................................................

33.2 5 0 0 0 0

34.

35.

36.

0 0

Schedule F — Application of the QETC facilities, operations, and training credit (Article

37Enter your franchise tax from Form

recapture of credits |

37. |

38Tax credits claimed before the QETC facilities, operations, and training credit ( see instructions ) 38.

39 Subtract line 38 from line 37 |

39. |

40Enter the higher of the tax on the minimum taxable income base or the

tax ( from Form |

40. |

|

41QETC facilities, operations, and training credit limitation ( subtract line 40 from line 39; if line 40

is greater than line 39, enter 0 on line 40 ) |

41. |

|

42QETC facilities, operations, and training credit to be used this period ( enter the amount from

|

line 36 or line 41, whichever is less; see instructions ) |

42. |

|

43 |

Unused QETC facilities, operations, and training credit ( subtract line 42 from line 36; see instr. )... |

43. |

|

44 |

Amount of unused credit to be refunded ( see instructions ) |

44. |

|

45Amount of unused credit to be applied as an overpayment to next period ( subtract line 44

from line 43; see instructions ) |

45. |

|

6194110094

|

Please file this original scannable |

61904110094 |

form with the Tax Department. |