In the complex interplay of economic redevelopment and environmental restoration, the New York State Department of Taxation and Finance's Form DTF-70 emerges as a pivotal tool for developers involved in revitalizing brownfield sites. This form is specifically designed for those tackle the challenge of redeveloping properties burdened by environmental contamination, providing a structured way to report the economic impact of their efforts. Developers, defined broadly as taxpayers engaged in a Brownfield Cleanup Agreement with the Department of Environmental Conservation, are tasked with the annual responsibility of detailing both state and local taxes generated directly from their redevelopment activities. Moreover, the form serves as a comprehensive report, encompassing the contributions of all businesses and employees within a given project, even when multiple developers are involved, ensuring a unified submission. Beyond just tax information, the form delves into site-specific details such as location, developmental changes, and the percentage of the site located within Environmental Zones or Brownfield Opportunity Areas, offering nuanced insights into the redevelopment process. The submission deadline, set within a year after a Brownfield Cleanup Agreement's execution and annually thereafter, underscores the ongoing commitment these developers must uphold in their transformative work. Form DTF-70, thus, not only facilitates a crucial aspect of financial reporting to state authorities but also stands as a testament to the broader goals of environmental stewardship and economic revitalization within New York State.

| Question | Answer |

|---|---|

| Form Name | Form Dtf 70 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | COC, Remediation, NYS, novation agreement |

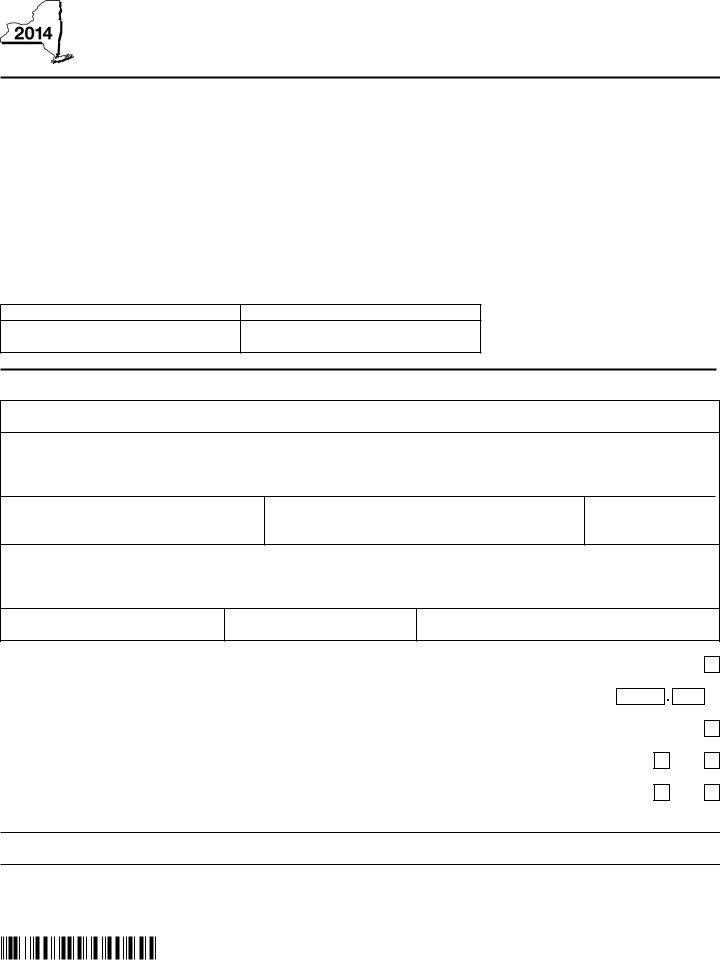

New York State Department of Taxation and Finance

Brownield Redevelopment Report

Developers of brownield sites are required to ile an annual report with the Tax Department. The report must include the amounts of state and local taxes generated by the activities of the businesses and employees operating on the brownield site. If the actual amounts are unavailable, a developer may provide estimates. The department implemented the reporting requirement using Form

Developers are generally deined as taxpayers who have executed a Brownield Cleanup Agreement (BCA) with the Department of Environmental Conservation (DEC) and have been issued or are expected to be issued a Certiicate of Completion (COC), or taxpayers that have purchased or acquired a qualiied site for which a COC has been issued from an unrelated party.

A developer must compile the required information from any

lessees and other developers and combine the information with its own to produce one report for the qualiied site. In cases where there are multiple developers on the same site, the report must be completed by only one of the developers, but it must contain information for all activity on the site by all developers

and lessees.

The report is irst due within one year after the execution of the BCA and for 11 years thereafter. The annual reporting period covers all activity occurring on the site from December 1 through November 30 of the following year. The report is due by December 31 of each year. If a developer would like to request an alternate reporting period, the request should be submitted to

the address below.

Starting date of report

Ending date of report

Part 1 – Site identifying information

Name of developer completing report

Names of all other developers (submit additional sheets if necessary)

Division of Environmental Remediation site number |

Site name |

Site location – include street address, municipality, and county |

|

DEC region

Date BCA executed

Date COC issued

Date COC sold or transferred (if applicable)

A. Mark an X in the box if the site is located in an |

|

||

|

If you marked the box, enter the percent of the qualiied site located within an |

|

|

B. Mark an X in the box if the site is located in a Brownield Opportunity Area |

|

||

C. |

Will the site be used/is the site used primarily for manufacturing activities? |

Yes |

No |

D. |

Has the use of the property changed since the last report? (If Yes, list new use below) |

Yes |

No |

%

Send your report or request to: NYS TAX DEPARTMENT

|

OTPA – BROWNFIELD REPORTING UNIT |

|

W A HARRIMAN CAMPUS |

670001140094 |

ALBANY NY 12227 |

|

|

Has any new development occurred on the property since the last report? (If Yes, describe below) |

Yes |

No

Part 2 - Tax information

For each applicable tax article or type below, list the actual or estimated amount of tax generated by the activities of the businesses and employees operating on the brownield site. If the businesses were subject to the tax, but did not generate tax revenue, enter 0. If the

businesses were not subject to the tax, enter N/A. |

Actual or Estimated |

Amount |

||||

|

|

(mark an X in one) |

|

|||

|

|

|

|

|

|

|

State taxes |

|

|

|

|

|

|

Article 9 - Corporation Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Article |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Article 11 - Tax on Mortgages |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Article 13 - Tax on Unrelated Business Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Article 22 - Personal Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Article 28 - Sales and Compensating Use Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Article 29 - Taxes Authorized for Cities, Counties and School Districts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Article 30 - City Personal Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Article 31 - Real Estate Transfer Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Article 32 - Franchise Tax on Banking Corporations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Article 33 - Franchise Tax on Insurance Corporations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Article |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Article |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Local taxes |

|

|

|

|

|

|

Any Real Property Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York City Unincorporated Business Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York City Business Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York City Real Property Transfer Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York City Mortgage Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

670002140094