Allegany can be filled in online without any problem. Simply try FormsPal PDF tool to do the job quickly. The editor is consistently updated by our team, acquiring new awesome functions and turning out to be better. It just takes a couple of simple steps:

Step 1: Click on the orange "Get Form" button above. It will open our pdf tool so you can begin completing your form.

Step 2: Once you open the editor, you will find the form made ready to be completed. Besides filling out various blanks, you may also perform other things with the file, namely putting on any words, editing the initial textual content, adding illustrations or photos, putting your signature on the form, and much more.

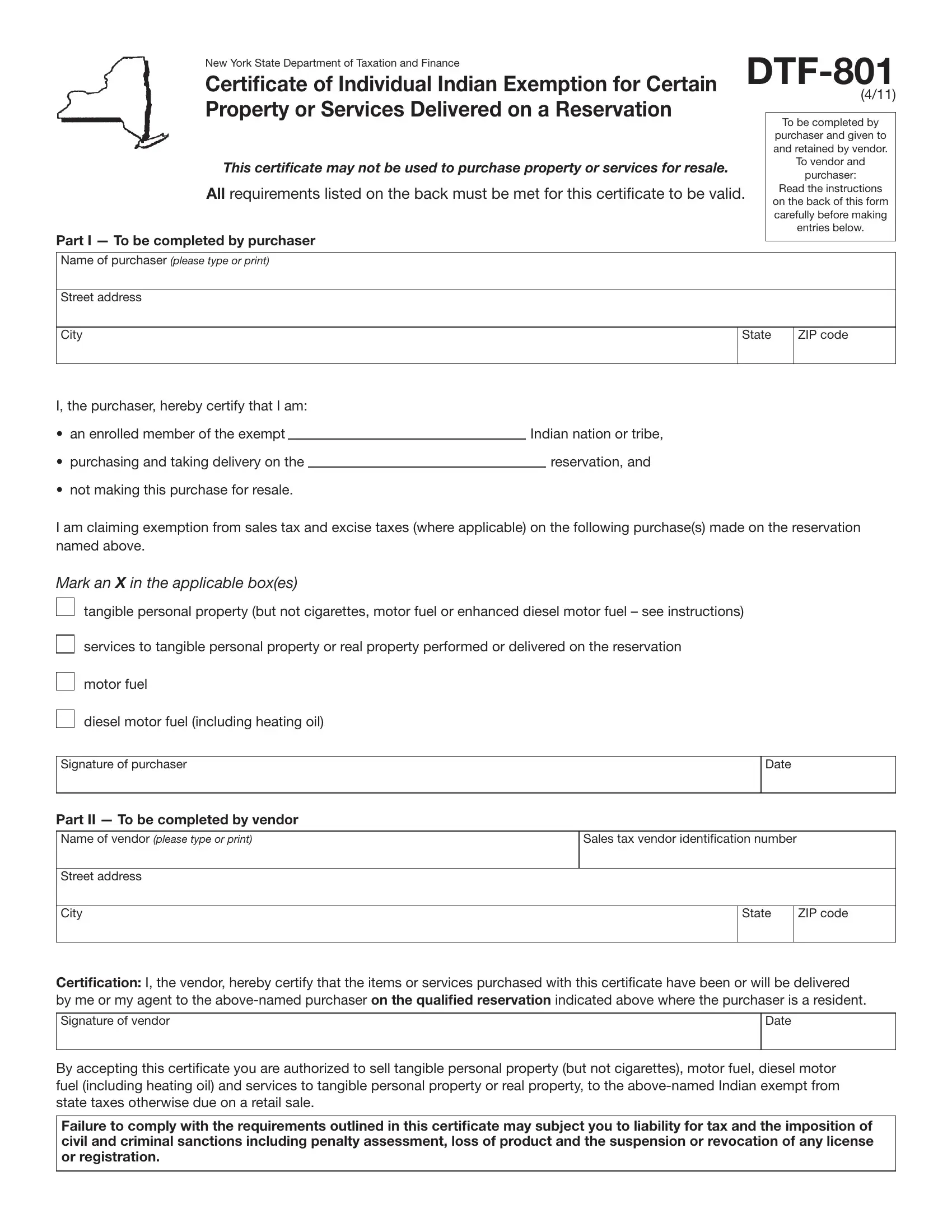

This document will require specific details; in order to ensure consistency, please pay attention to the tips hereunder:

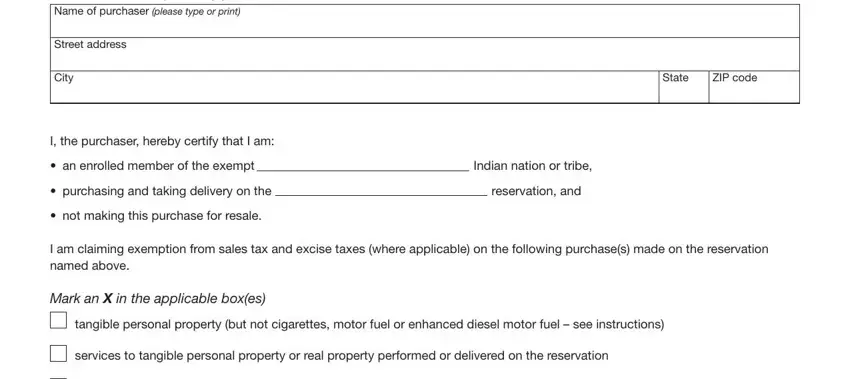

1. Begin completing the Allegany with a group of essential fields. Gather all the information you need and make certain there's nothing neglected!

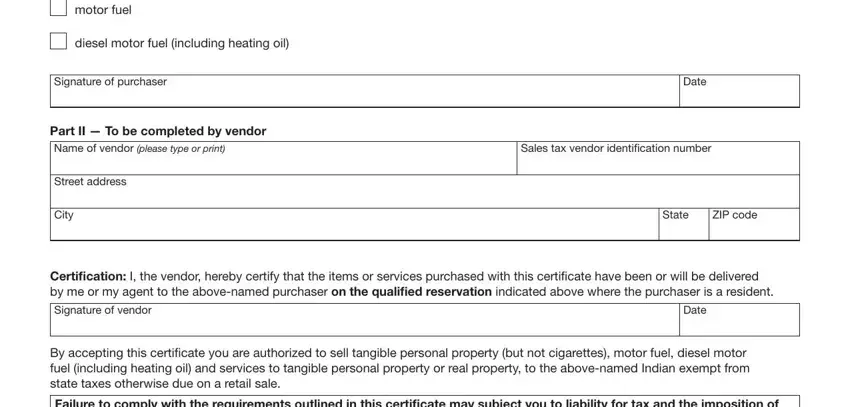

2. Right after filling in this step, head on to the subsequent step and fill in the necessary details in all these fields - motor fuel, diesel motor fuel including, Signature of purchaser, Date, Part II To be completed by vendor, Name of vendor please type or print, Sales tax vendor identiication, Street address, City, State, ZIP code, Certification I the vendor hereby, Signature of vendor, Date, and By accepting this certiicate you.

When it comes to Street address and ZIP code, be sure that you take a second look in this current part. Both of these are certainly the most important ones in this PDF.

Step 3: Make certain the information is accurate and click on "Done" to complete the process. Join us today and easily get access to Allegany, available for download. All changes made by you are saved , which means you can edit the pdf at a later time as required. FormsPal offers protected document editing with no personal data record-keeping or any sort of sharing. Rest assured that your details are safe here!