When you wish to fill out st louis city tax form e 1r, you won't have to download and install any programs - simply use our PDF tool. Our tool is consistently developing to give the best user experience possible, and that is due to our commitment to continuous improvement and listening closely to user feedback. Here's what you would want to do to begin:

Step 1: First of all, open the pdf editor by pressing the "Get Form Button" above on this page.

Step 2: As you launch the file editor, you'll notice the document ready to be completed. Apart from filling out different fields, you could also perform other sorts of actions with the PDF, particularly putting on any textual content, changing the original text, adding illustrations or photos, placing your signature to the form, and a lot more.

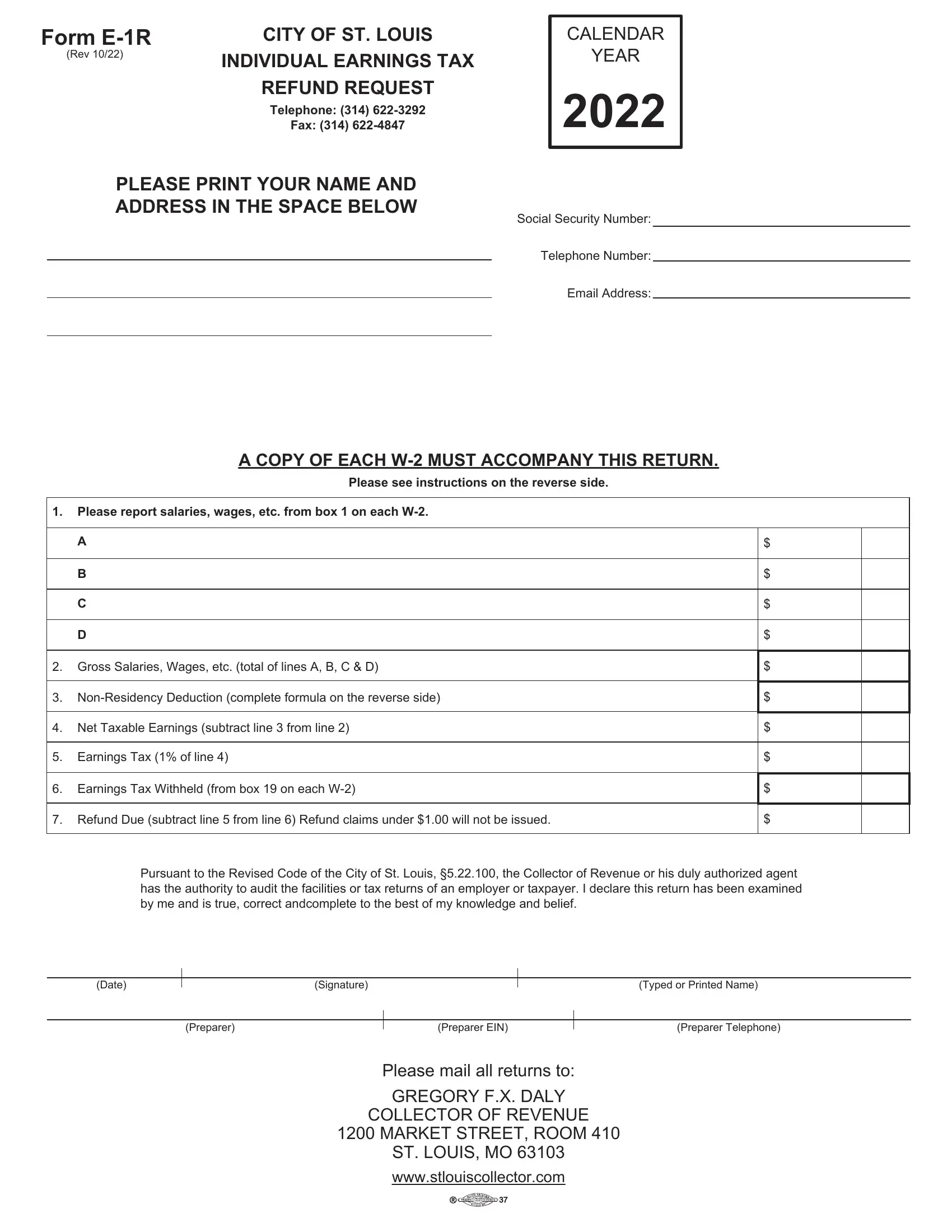

As for the blanks of this specific PDF, here is what you should consider:

1. While completing the st louis city tax form e 1r, make sure to complete all of the needed blank fields in its relevant part. This will help expedite the work, which allows your information to be handled quickly and appropriately.

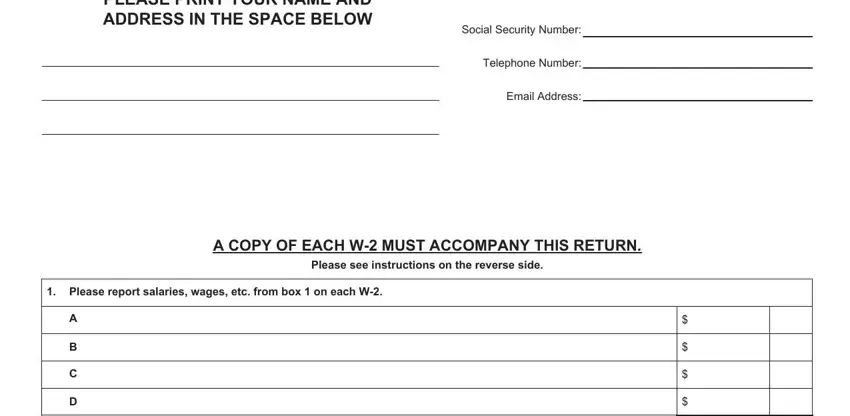

2. The subsequent step would be to fill out the next few fields: Gross Salaries Wages etc total of, NonResidency Deduction complete, Net Taxable Earnings subtract, Earnings Tax of line, Earnings Tax Withheld from box, Refund Due subtract line from, Pursuant to the Revised Code of, Date, Signature, Typed or Printed Name, Preparer, Preparer EIN, and Preparer Telephone.

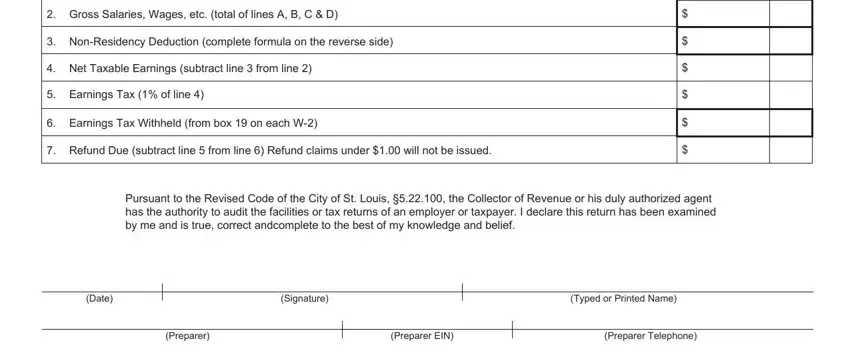

3. This next step is all about In order to claim a nonresidency, This is to certify the below, days including vacation, This is to certify the below, whole days, Address of work location must be, The standard work year is days If, I certify to the best of my, Please complete the following, THE AREA BELOW FOR POST OFFICE USE, Employee Name, Company Name, Company Address, Company Phone Number, and Printed Name of SupervisorManager - type in all of these fields.

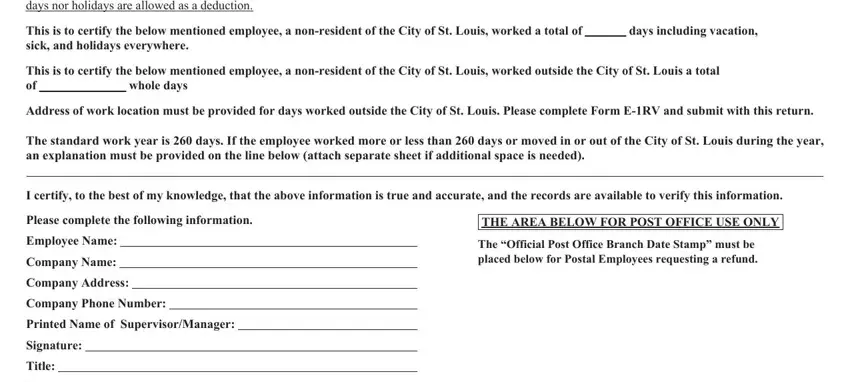

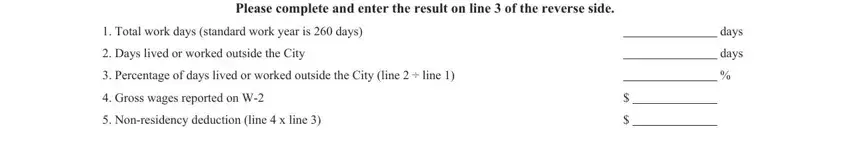

4. All set to start working on this fourth portion! Here you'll have these Please complete and enter the, Total work days standard work, Days lived or worked outside the, Percentage of days lived or, Gross wages reported on W, Nonresidency deduction line x, days, and days form blanks to fill out.

In terms of Percentage of days lived or and days, make sure you review things in this section. The two of these are considered the key fields in this form.

Step 3: Glance through everything you've inserted in the blanks and then hit the "Done" button. Join FormsPal right now and easily obtain st louis city tax form e 1r, all set for downloading. Every single edit made is handily kept , helping you to edit the file at a later point if required. FormsPal is committed to the confidentiality of our users; we make sure all personal data used in our editor continues to be secure.