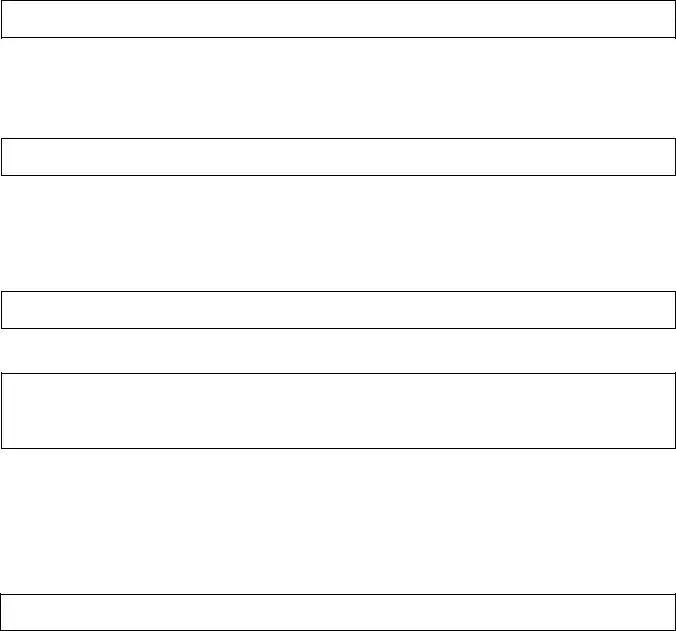

blank form e can be completed effortlessly. Simply make use of FormsPal PDF tool to do the job right away. The tool is consistently updated by our team, acquiring cool functions and becoming better. All it takes is several basic steps:

Step 1: Click on the orange "Get Form" button above. It's going to open our tool so you can start filling in your form.

Step 2: With our advanced PDF tool, you'll be able to do more than just fill in blank fields. Try all the features and make your documents seem great with custom textual content incorporated, or modify the original content to perfection - all supported by an ability to insert your personal graphics and sign the PDF off.

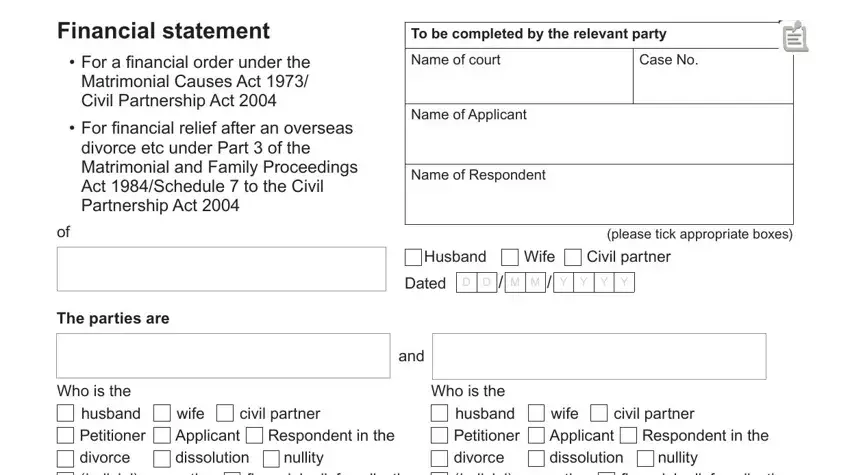

This form requires specific details to be typed in, hence you should definitely take the time to enter what is required:

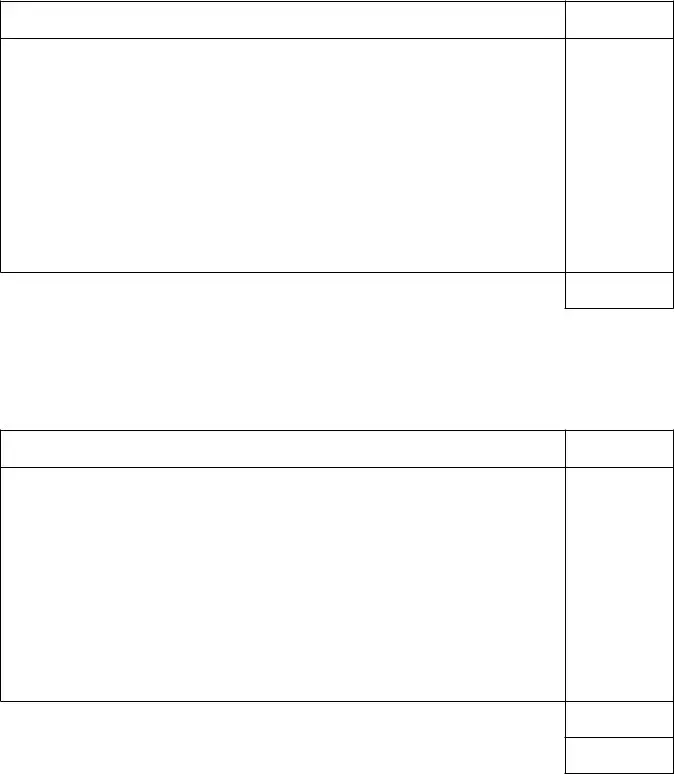

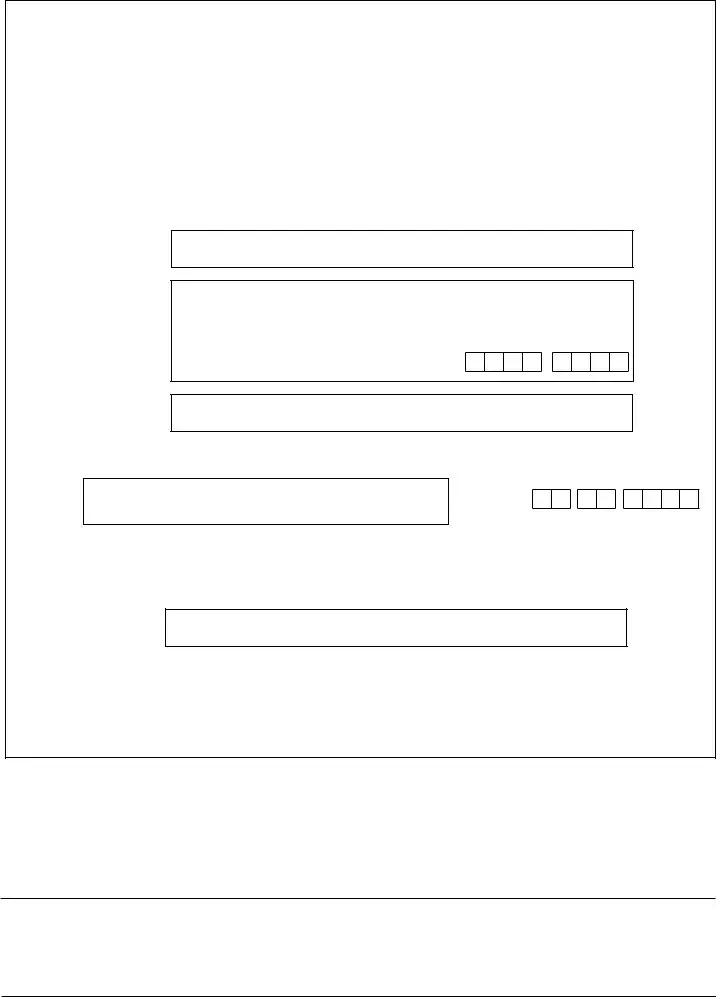

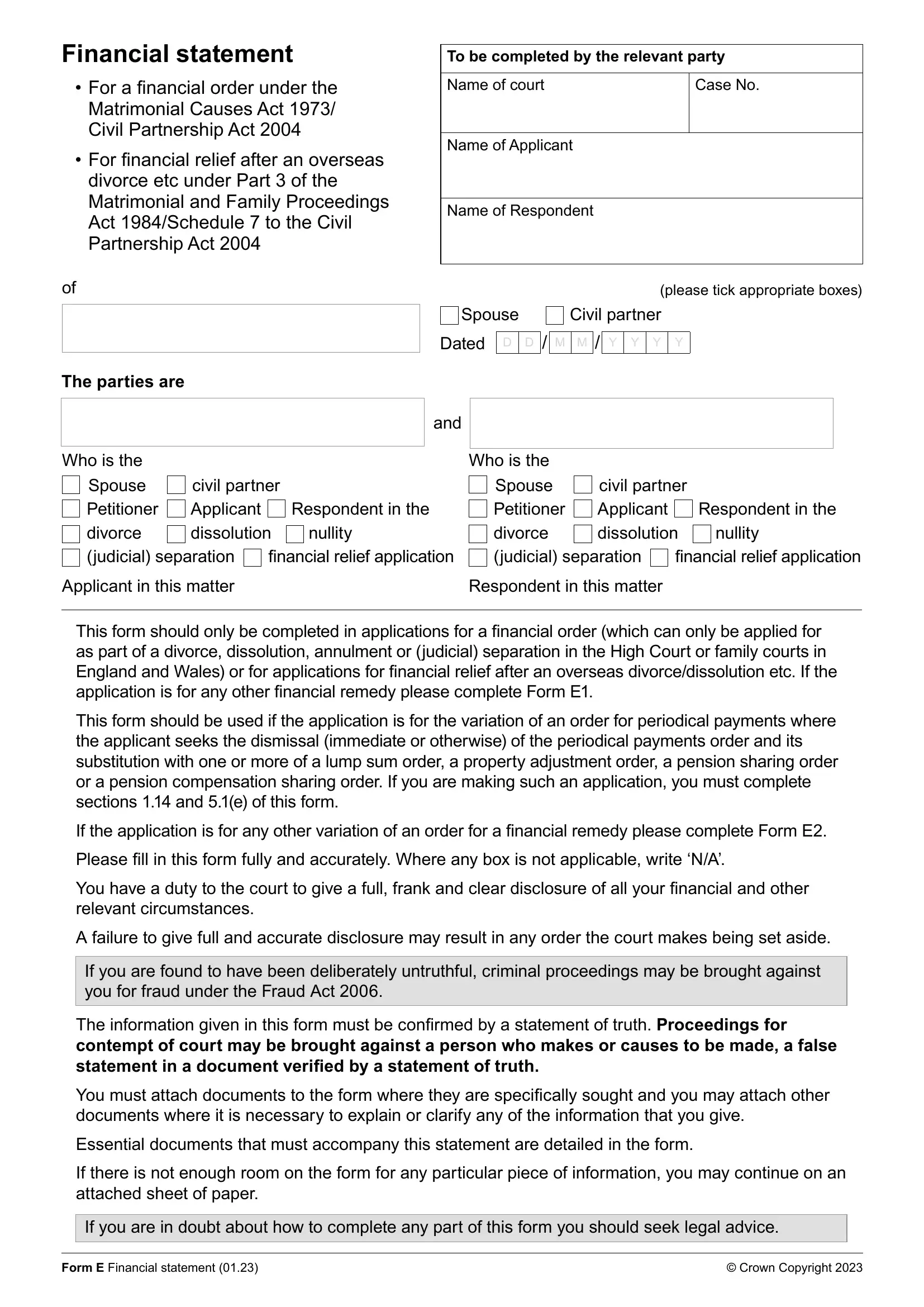

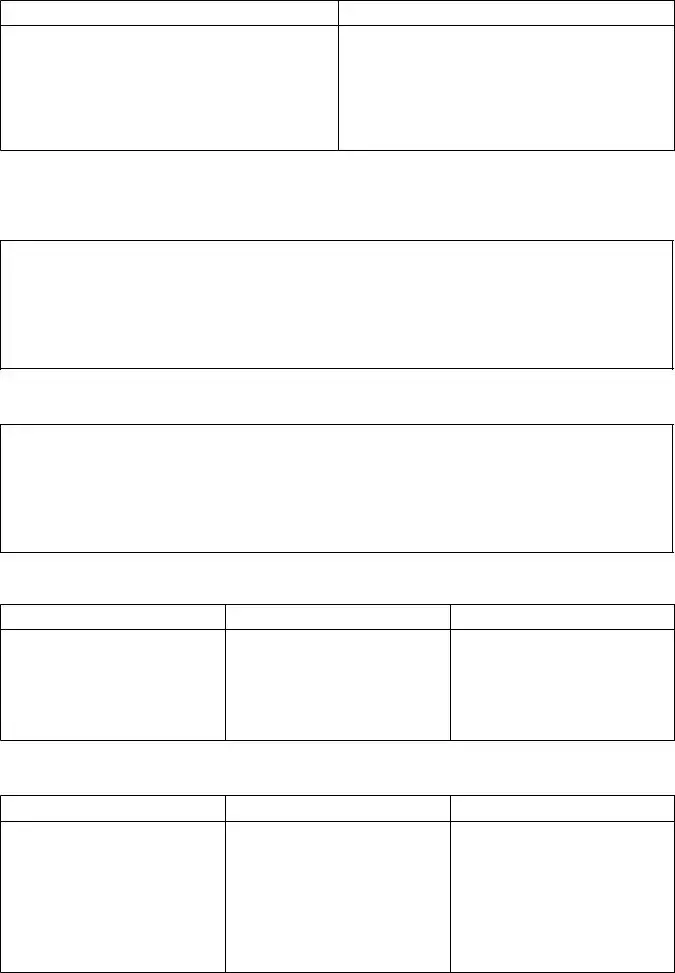

1. For starters, once completing the blank form e, start with the page that has the subsequent fields:

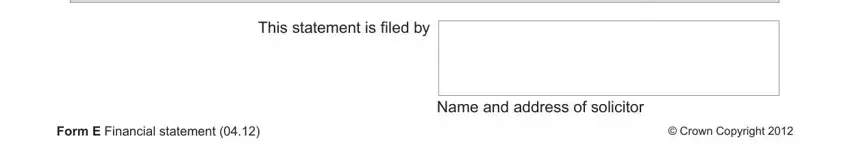

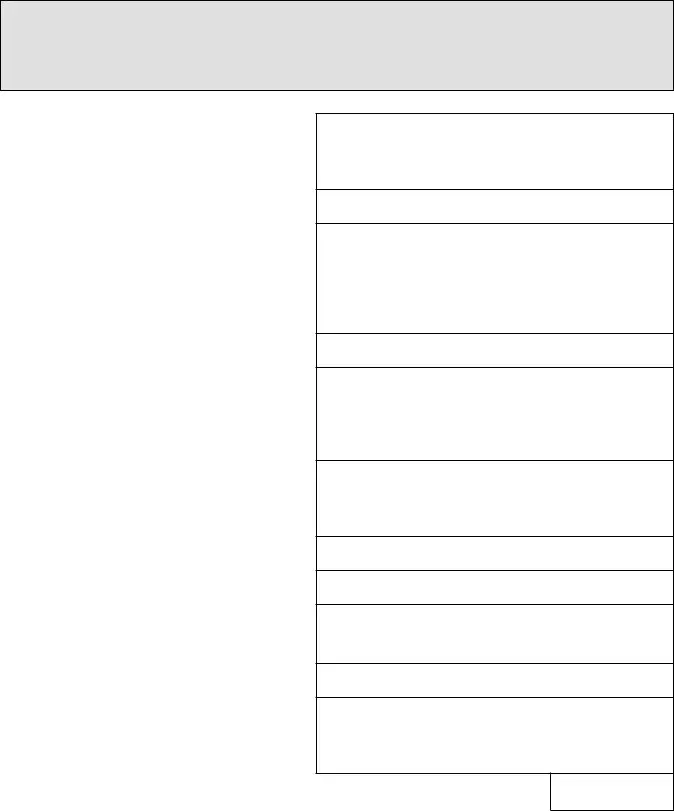

2. Once this section is filled out, go to type in the suitable information in all these: This statement is iled by, Form E Financial statement, Crown Copyright, and Name and address of solicitor.

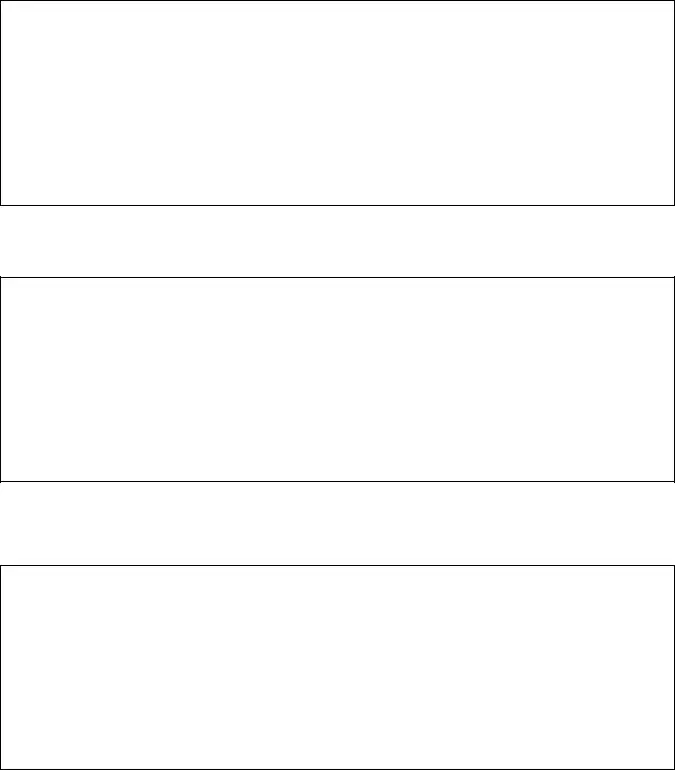

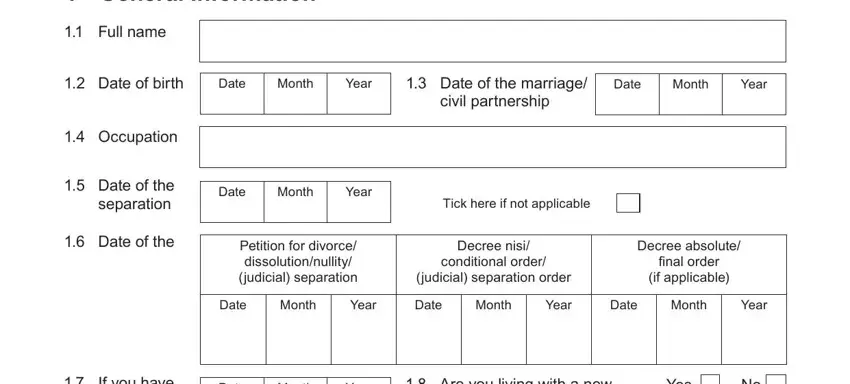

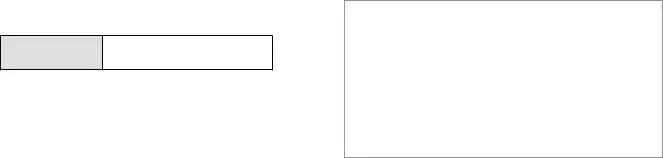

3. The next part is going to be simple - complete every one of the form fields in General Information, Full name, Date of birth, Date, Month, Year, Date of the marriage, civil partnership, Date, Month, Year, Date, Month, Year, and Tick here if not applicable in order to complete this part.

Those who work with this form often make some errors when completing Month in this part. You should double-check everything you enter here.

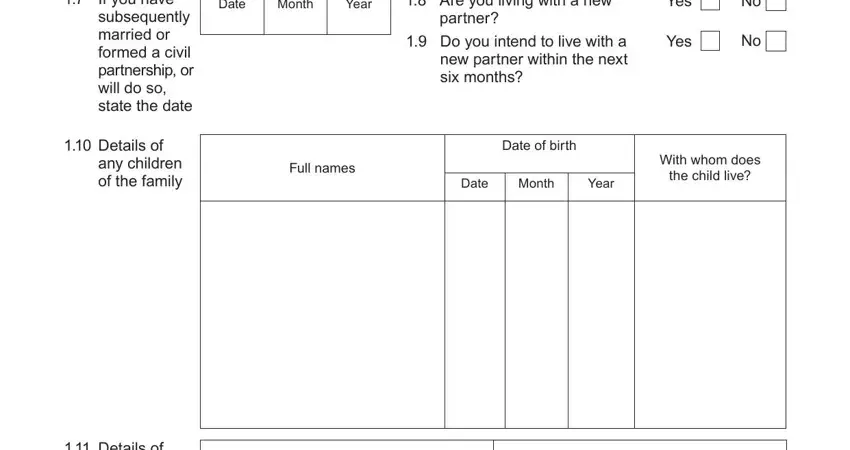

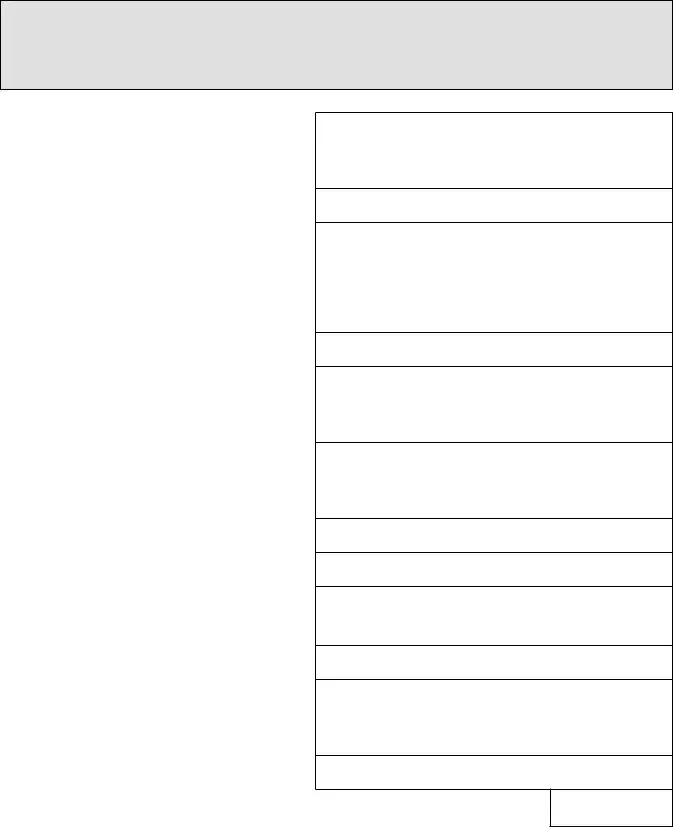

4. The subsequent paragraph requires your details in the subsequent parts: Date, Month, Year, Are you living with a new, partner, Do you intend to live with a new, Yes, Yes, Full names, Date of birth, Date, Month, Year, With whom does, and the child live. It is important to fill in all needed info to move onward.

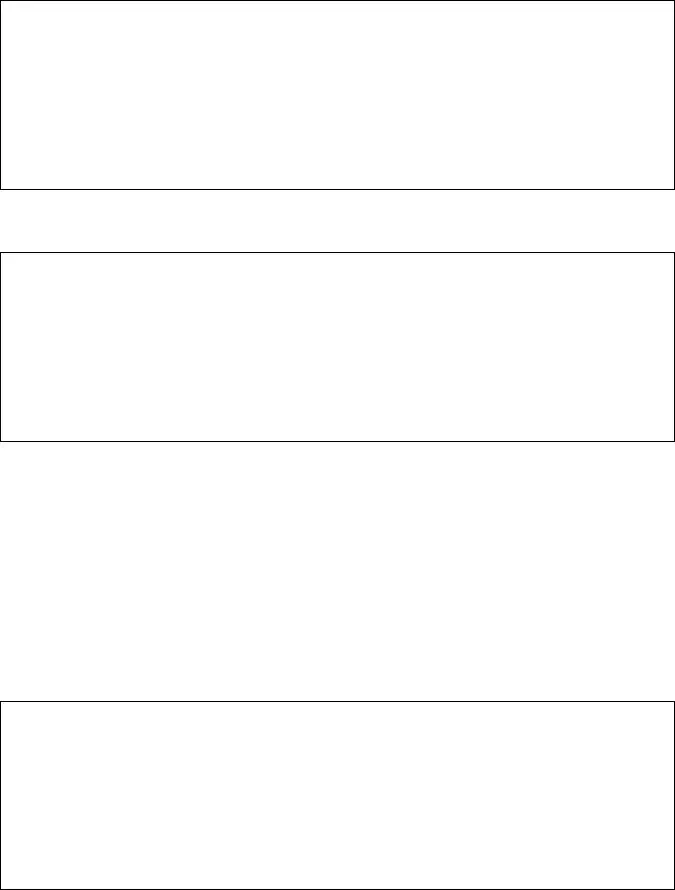

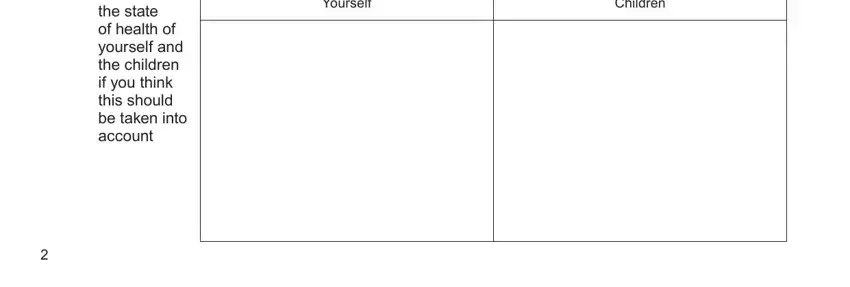

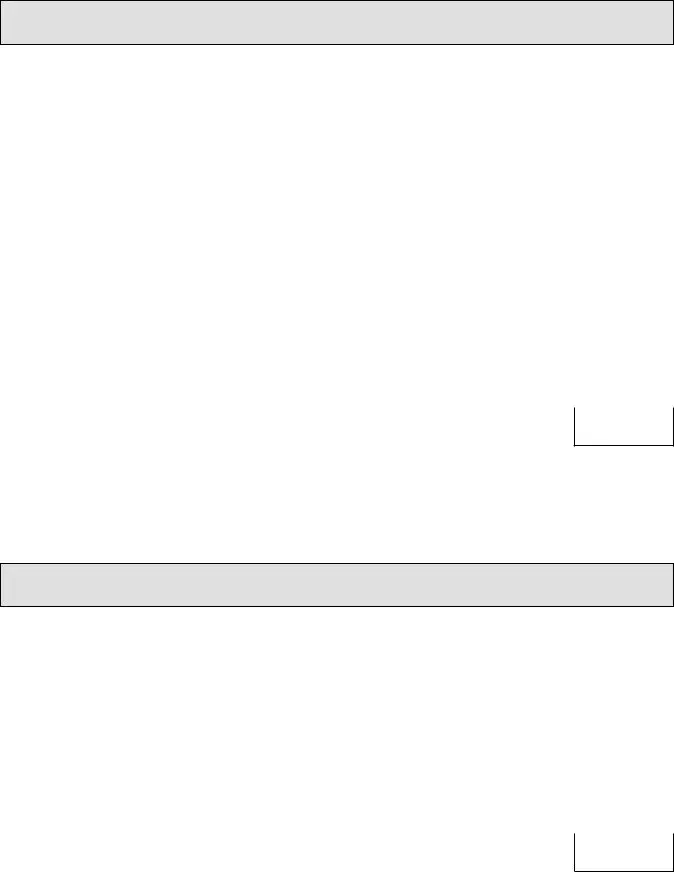

5. The very last notch to finish this document is critical. Ensure that you fill in the appropriate blanks, which includes Yourself, Children, and Details of the state of health of, before finalizing. Neglecting to do it may contribute to a flawed and probably invalid document!

Step 3: Reread the details you've entered into the blanks and click on the "Done" button. Go for a 7-day free trial plan at FormsPal and gain instant access to blank form e - accessible inside your FormsPal account page. If you use FormsPal, you can certainly fill out documents without worrying about information incidents or entries being distributed. Our protected software ensures that your private information is kept safe.

Spouse

Spouse

Civil partner

Civil partner

Sole trader

Sole trader Partner in a partnership with others

Partner in a partnership with others

Shareholder in a limited company

Shareholder in a limited company

No

No

No

No