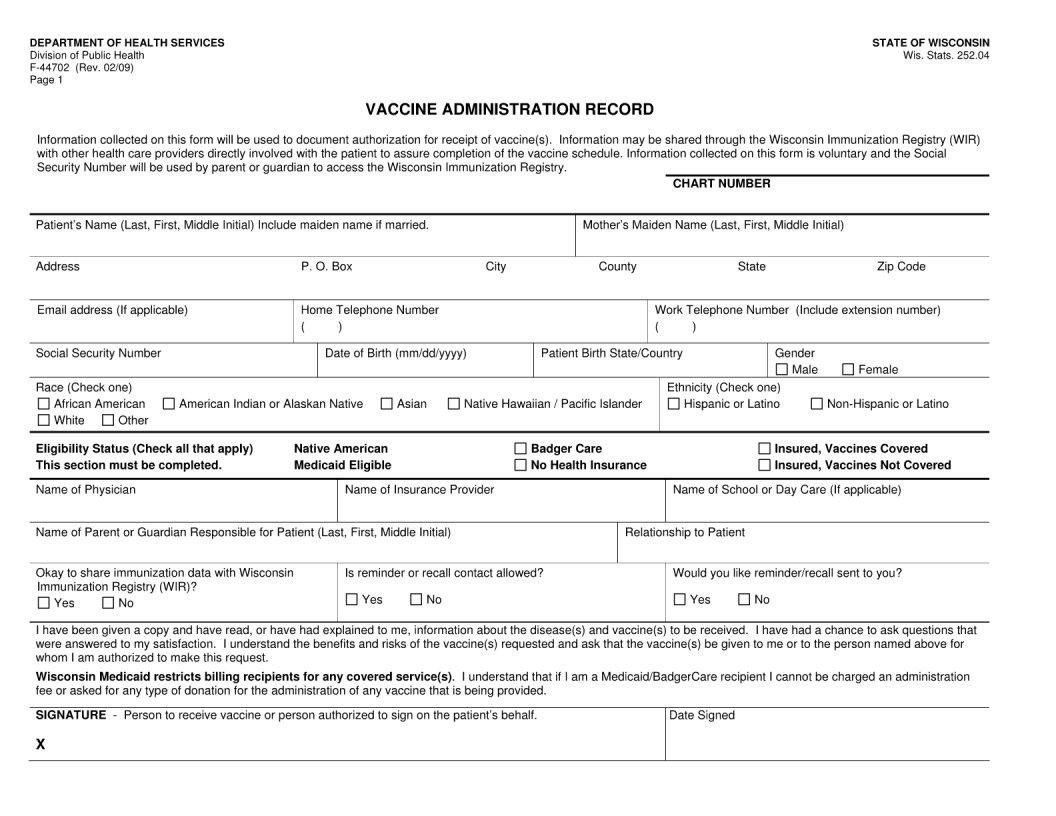

If you are a small business owner, you may be wondering what Form F 44702 is and whether or not you need to file it. This article will provide an overview of Form F 44702 and discuss whether or not your small business is required to file it. Form F 44702 is the Annual Federal Unemployment (FUTA) Tax Return for Small Businesses. All businesses with employees are required to file this form, regardless of size. The deadline for filing Form F 44702 is January 31st of the following year. If you are a small business owner, it is important to understand and comply with all applicable tax requirements. Failure to file Form F 44702 can result in significant penalties and interest charges. For more information on Form F 44702, contact the IRS or your tax professional.

| Question | Answer |

|---|---|

| Form Name | Form F 44702 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

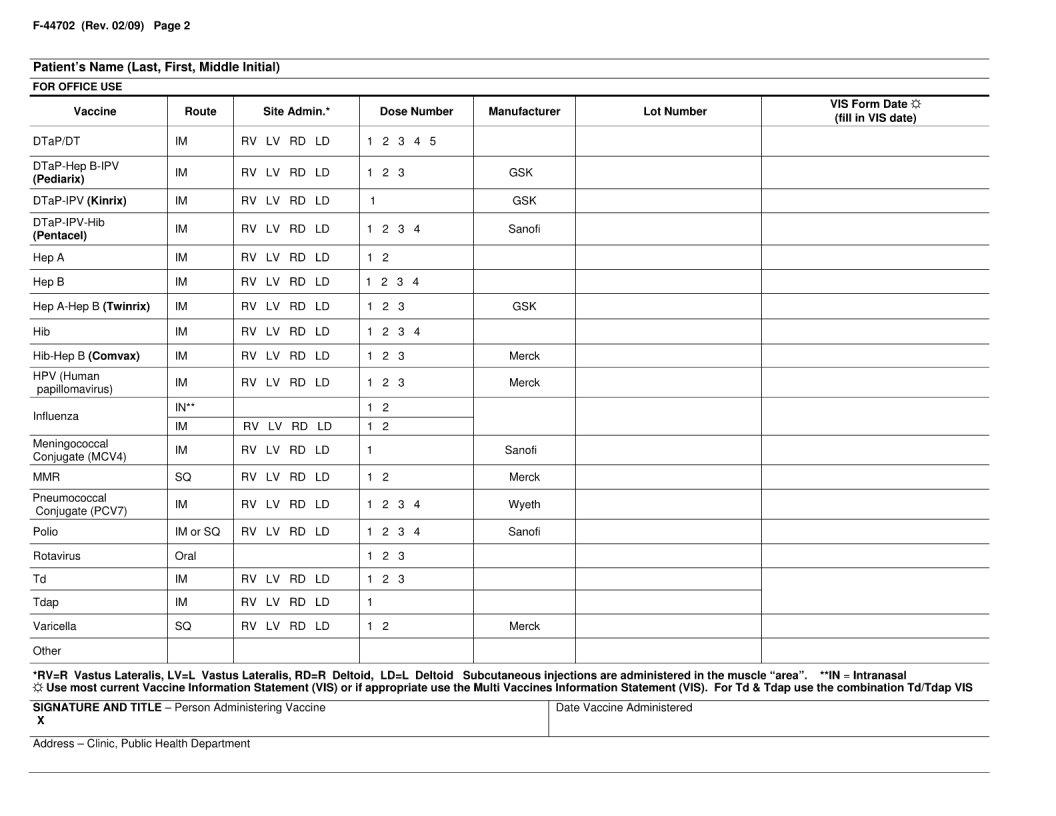

| Other names | HPV, DTaP, Td, WISCONSIN |