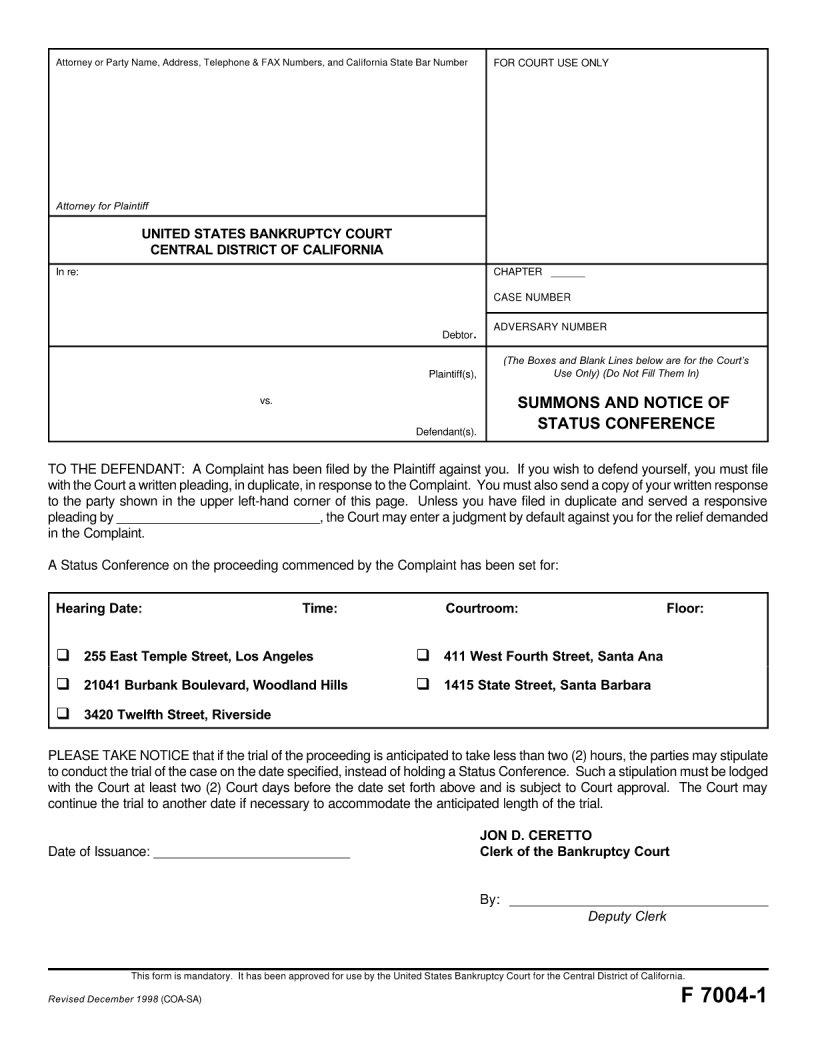

Navigating the labyrinth of tax documentation is a daunting task for many, yet understanding each form's purpose can ease this burden significantly. Among these, the F 7004 1 form plays a crucial role for businesses and organizations across the United States. This document is not just another piece of paperwork; it serves as a lifeline for entities that find themselves in need of additional time to prepare their income tax returns. With its ability to extend the filing deadline, it provides a cushion that can be critically important in ensuring that financial details are thoroughly and accurately reported. The form is tailored to a variety of entities, including corporations, partnerships, and trusts, each of which faces distinct filing requirements and deadlines. Through the F 7004 1 form, the Internal Revenue Service offers a pathway for these entities to request additional time, demonstrating the flexibility of the tax system to accommodate the diverse needs of the business landscape. As such, a comprehensive understanding of this form is not only beneficial but essential for anyone involved in the preparation of taxes for businesses and organizations, ensuring compliance and facilitating a smoother financial management process.

| Question | Answer |

|---|---|

| Form Name | Form F 7004 1 |

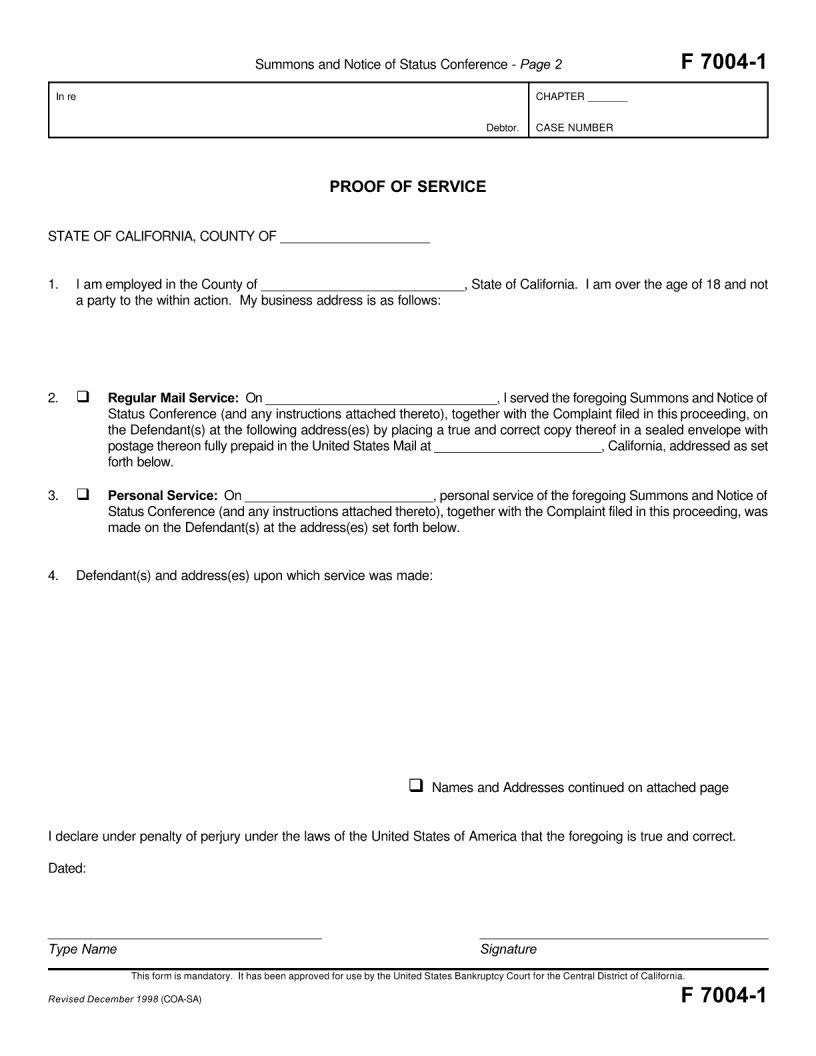

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | F7004 1 f7004 1 form |