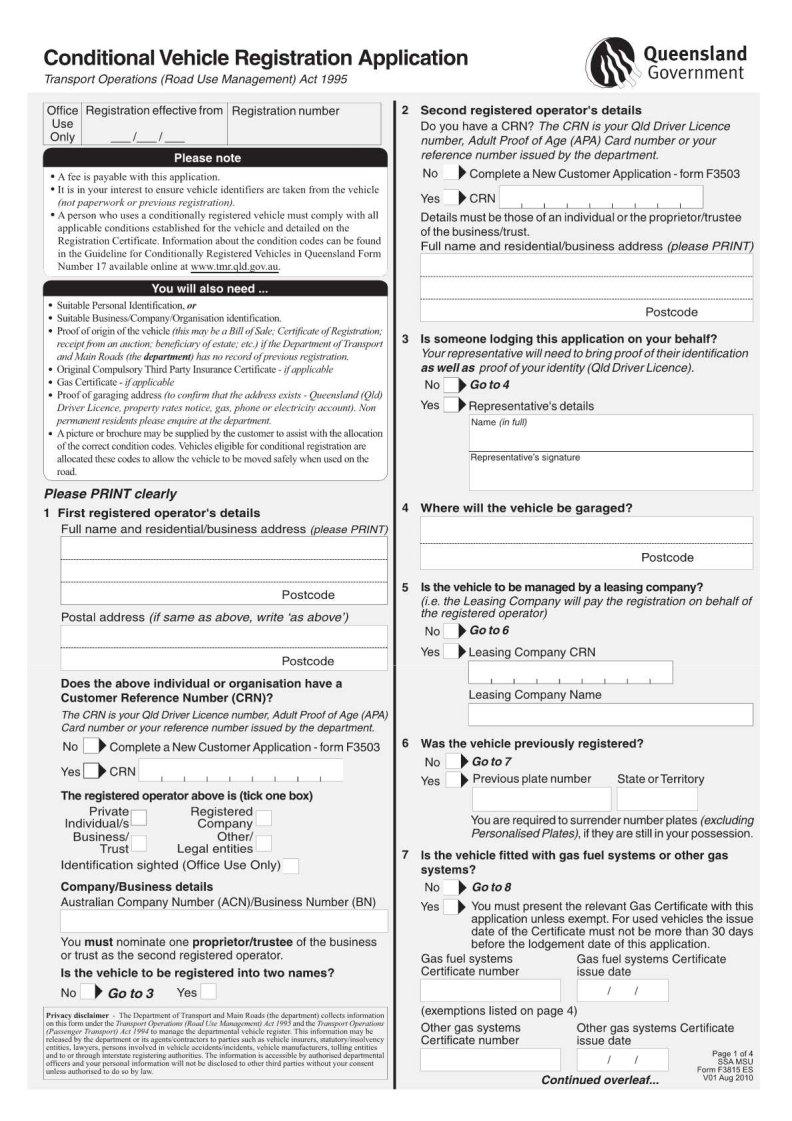

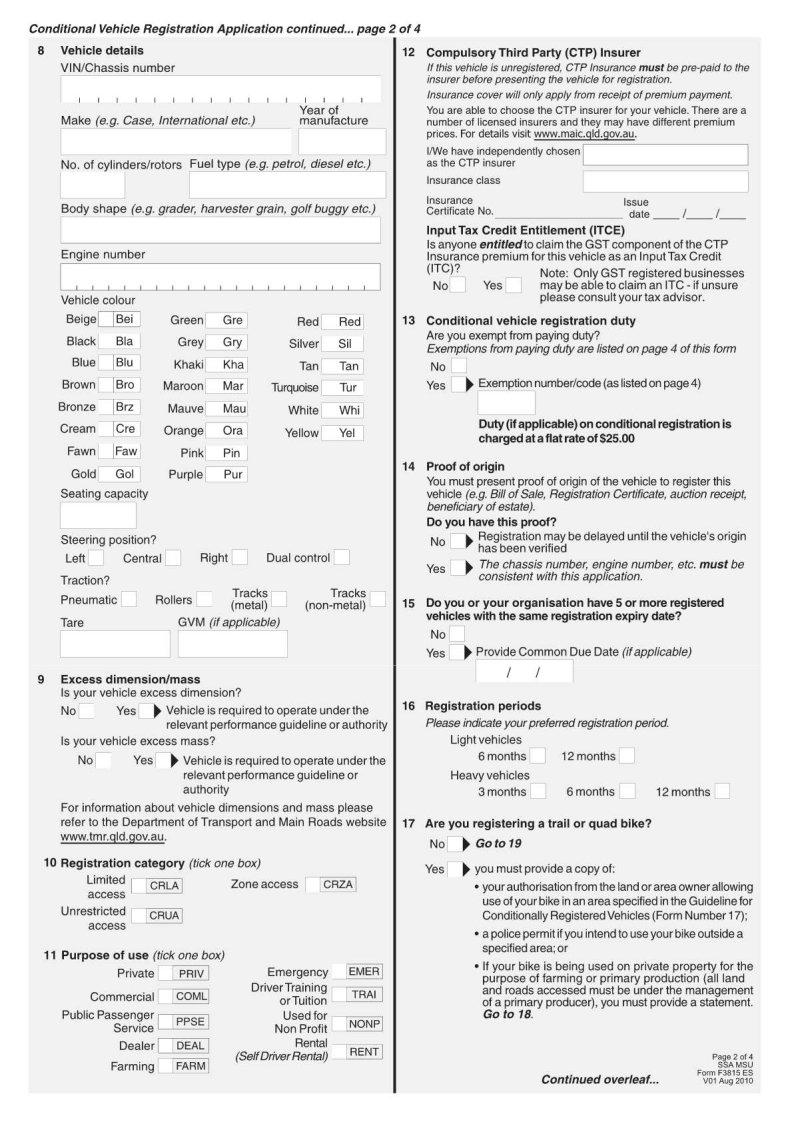

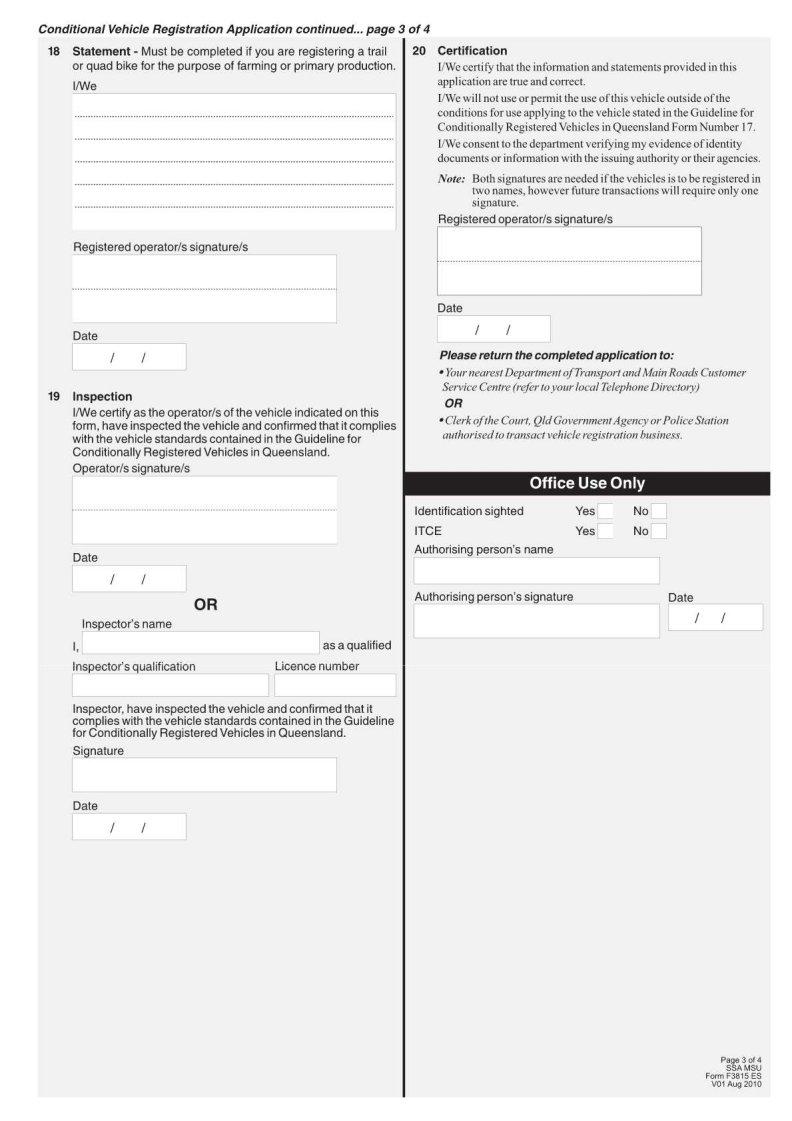

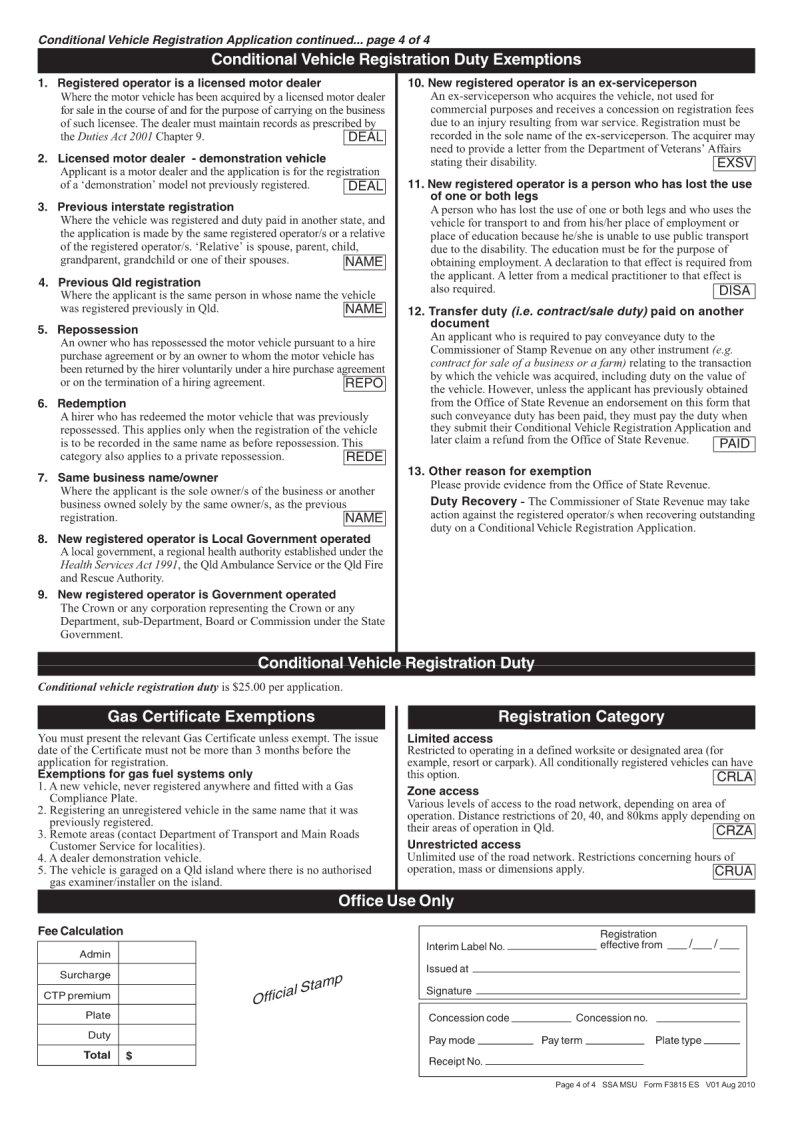

The intricacies of navigating tax documents can often leave individuals feeling overwhelmed, particularly when they encounter less familiar forms such as the F3851 Es. This important tax document plays a critical role in the financial management of individuals and entities alike, encompassing a range of information integral for accurate tax reporting and compliance. While the form itself may not be as widely recognized as other tax documents, its significance cannot be understated, serving as a vital link in the chain of financial accountability and transparency. The F3851 Es form serves multiple purposes, including the reporting of specific types of income, deductions, or tax credits that are not covered by more common forms. Its completion is essential for those who find themselves required to submit this document, as it directly influences tax calculations and can impact the overall tax liability. Understanding the key components, deadlines, and submission processes associated with the F3851 Es form is crucial for timely and accurate tax filing, underscoring the importance of gaining a comprehensive grasp of this document.

| Question | Answer |

|---|---|

| Form Name | Form F3851 Es |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | F3815_ES conditional automobile bill of sale example form |