YYYY can be completed very easily. Just use FormsPal PDF tool to get the job done promptly. Our tool is constantly evolving to deliver the very best user experience attainable, and that's thanks to our commitment to constant improvement and listening closely to comments from users. Getting underway is effortless! All that you should do is follow these basic steps below:

Step 1: Hit the "Get Form" button above. It is going to open up our tool so that you could begin filling out your form.

Step 2: When you start the PDF editor, you'll see the document prepared to be filled out. In addition to filling out various blanks, you may also do other sorts of things with the PDF, such as putting on any words, modifying the original textual content, adding illustrations or photos, affixing your signature to the document, and a lot more.

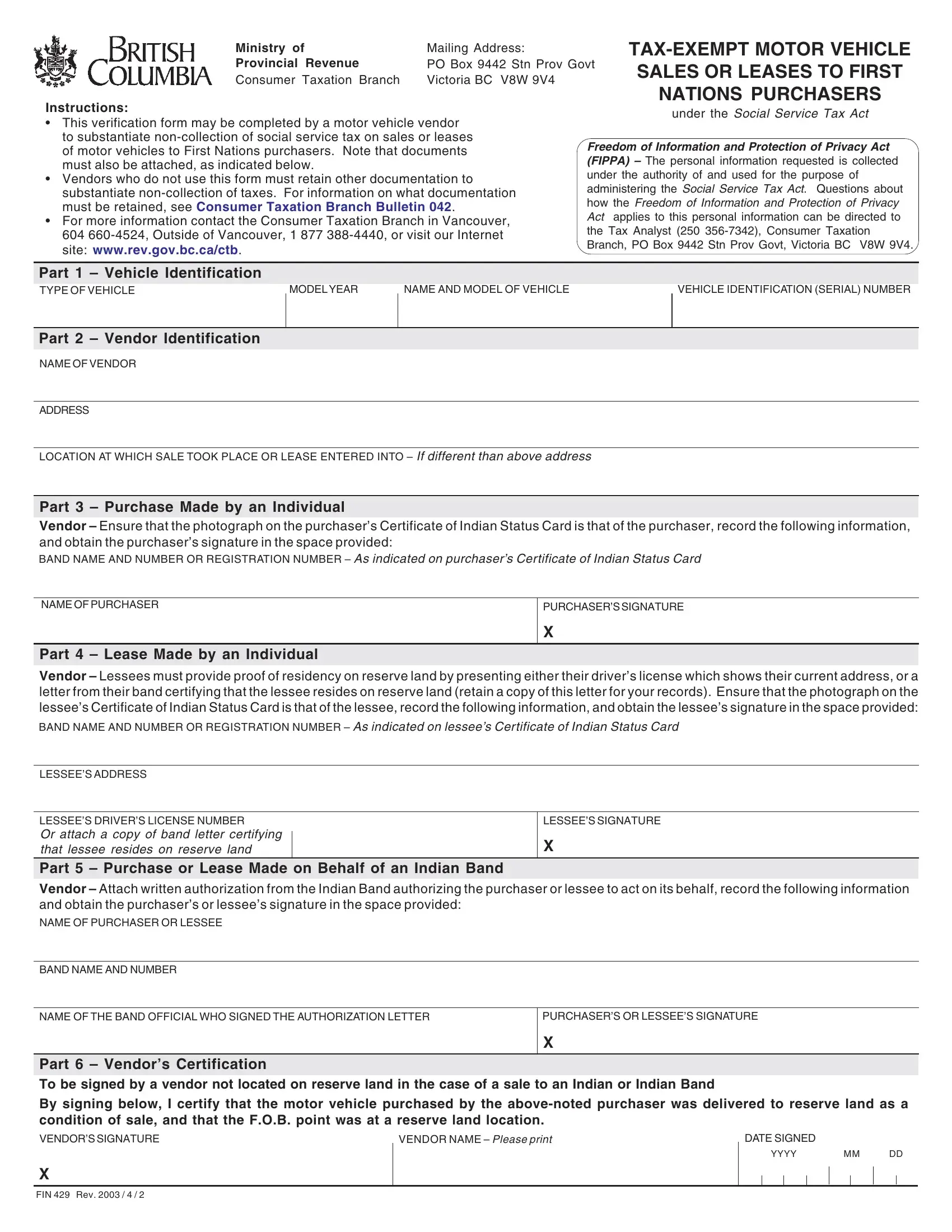

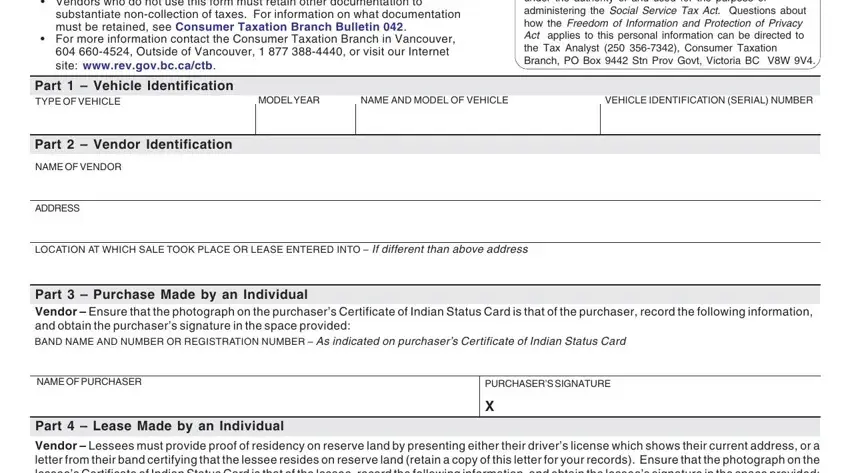

This document will need particular info to be typed in, so ensure that you take whatever time to fill in precisely what is expected:

1. Whenever completing the YYYY, be sure to include all necessary fields within the associated form section. It will help to speed up the process, enabling your details to be processed efficiently and correctly.

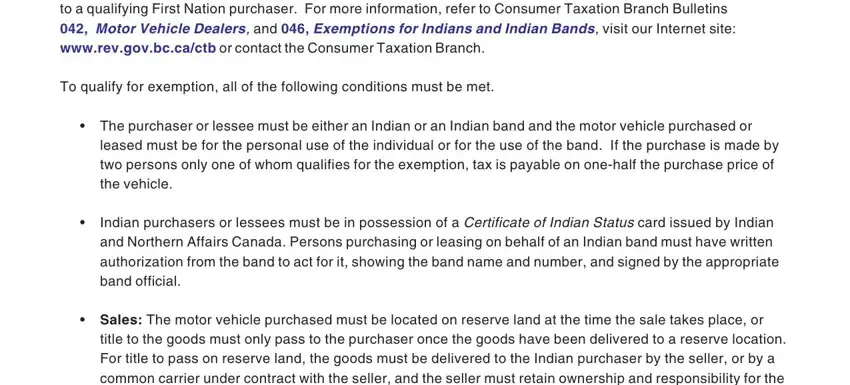

2. Once your current task is complete, take the next step – fill out all of these fields - This form may be used to, To qualify for exemption all of, cid The purchaser or lessee must, leased must be for the personal, cid, Indian purchasers or lessees must, cid Sales The motor vehicle, and title to the goods must only pass with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

People often make errors when filling in cid in this part. Be sure you reread everything you enter right here.

Step 3: Ensure your details are accurate and press "Done" to finish the project. Make a free trial account at FormsPal and obtain direct access to YYYY - which you are able to then work with as you want in your personal account page. When you work with FormsPal, you'll be able to complete forms without needing to be concerned about personal data breaches or records being distributed. Our secure platform makes sure that your private data is stored safely.